How Prediction Markets Turn News Into Real-Time Probabilities: The Future of Election and Sports Forecasting

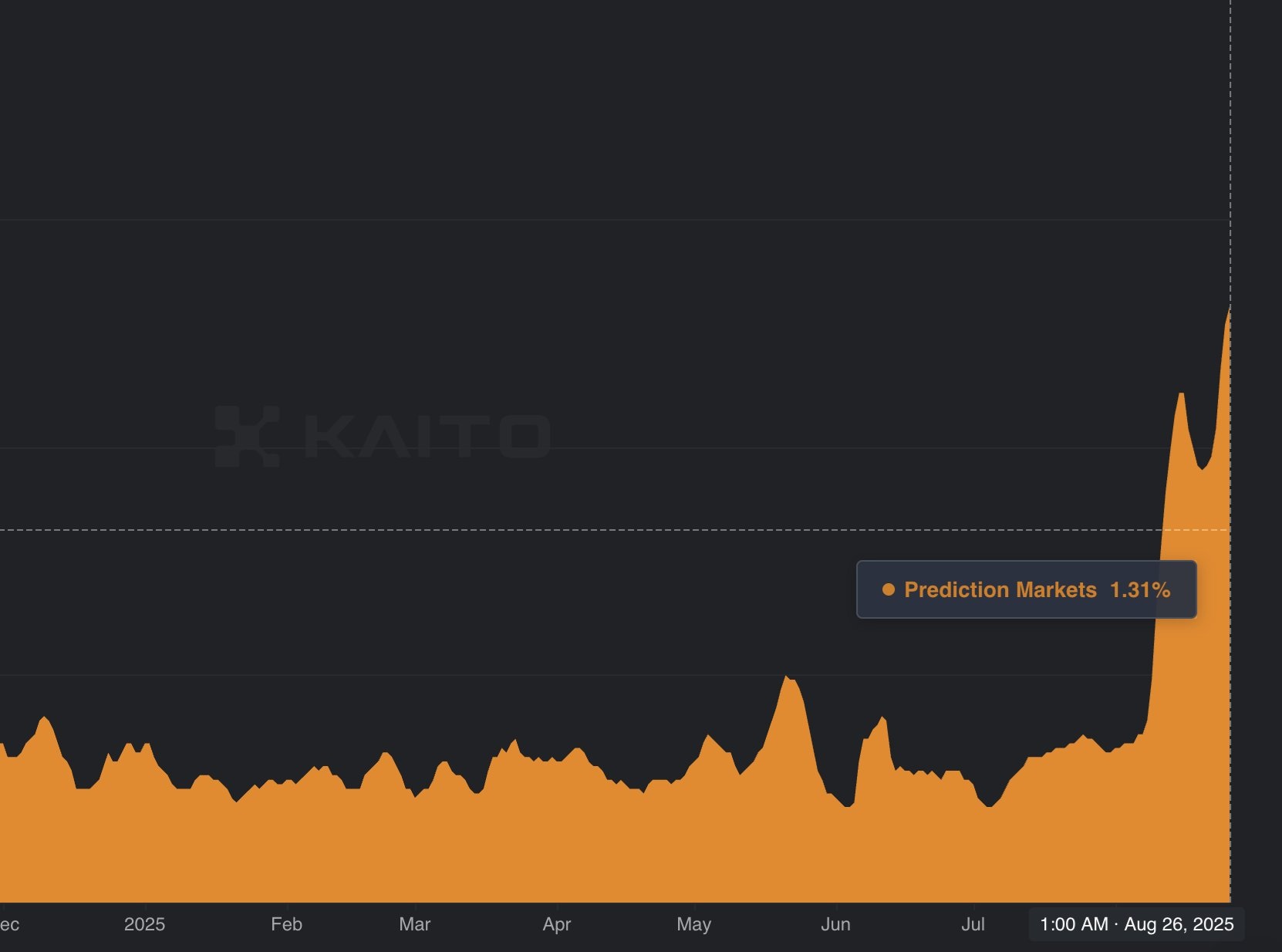

Every headline, poll, or game-changing moment in sports and politics sparks a wave of speculation. But how do you capture the true probability of an event as news breaks? Prediction markets have emerged as the answer, transforming raw news into actionable, real-time probabilities. These markets are no longer niche corners of the internet; they are at the forefront of event forecasting blockchain and decentralized betting innovation.

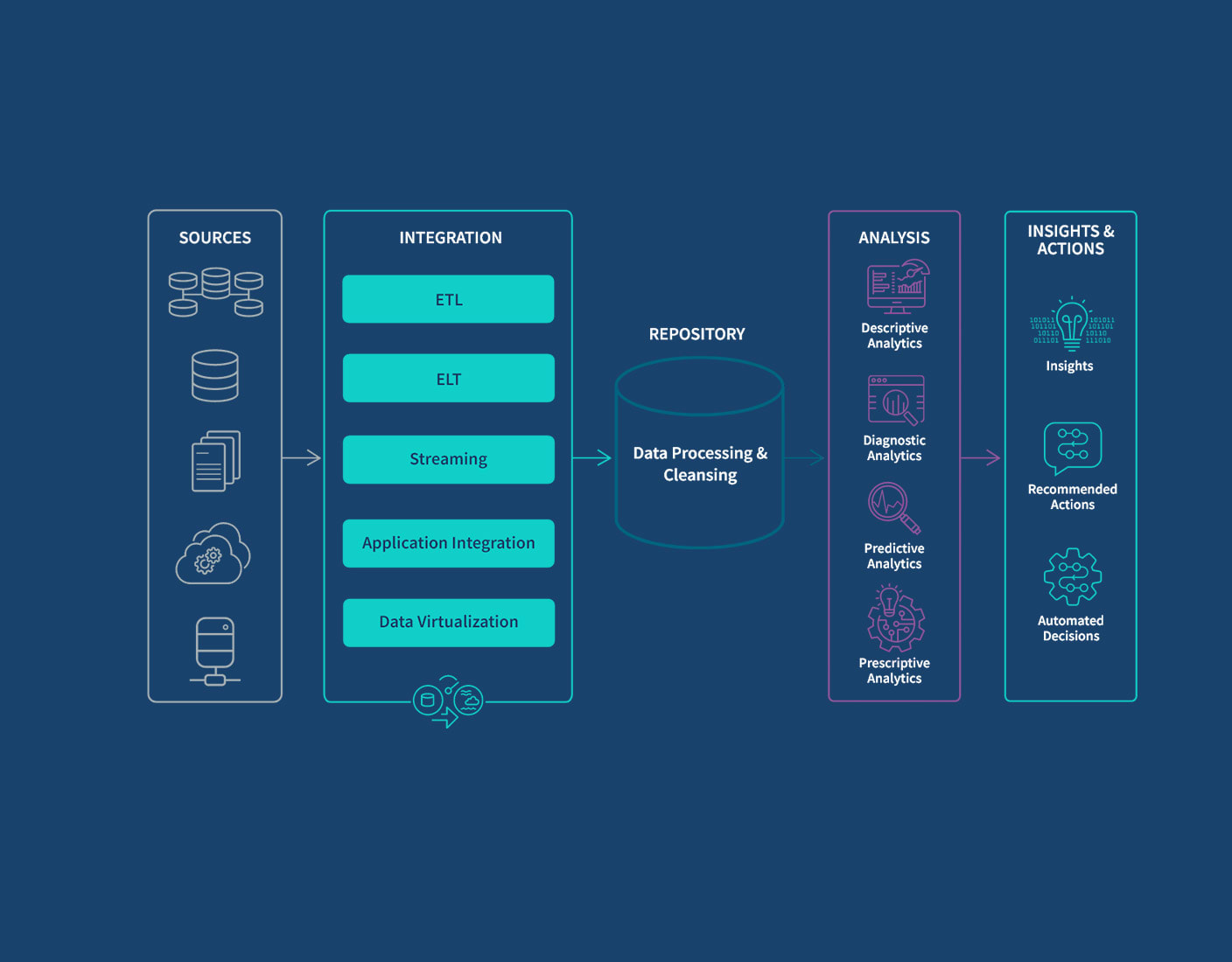

How Prediction Markets Convert News Into Odds

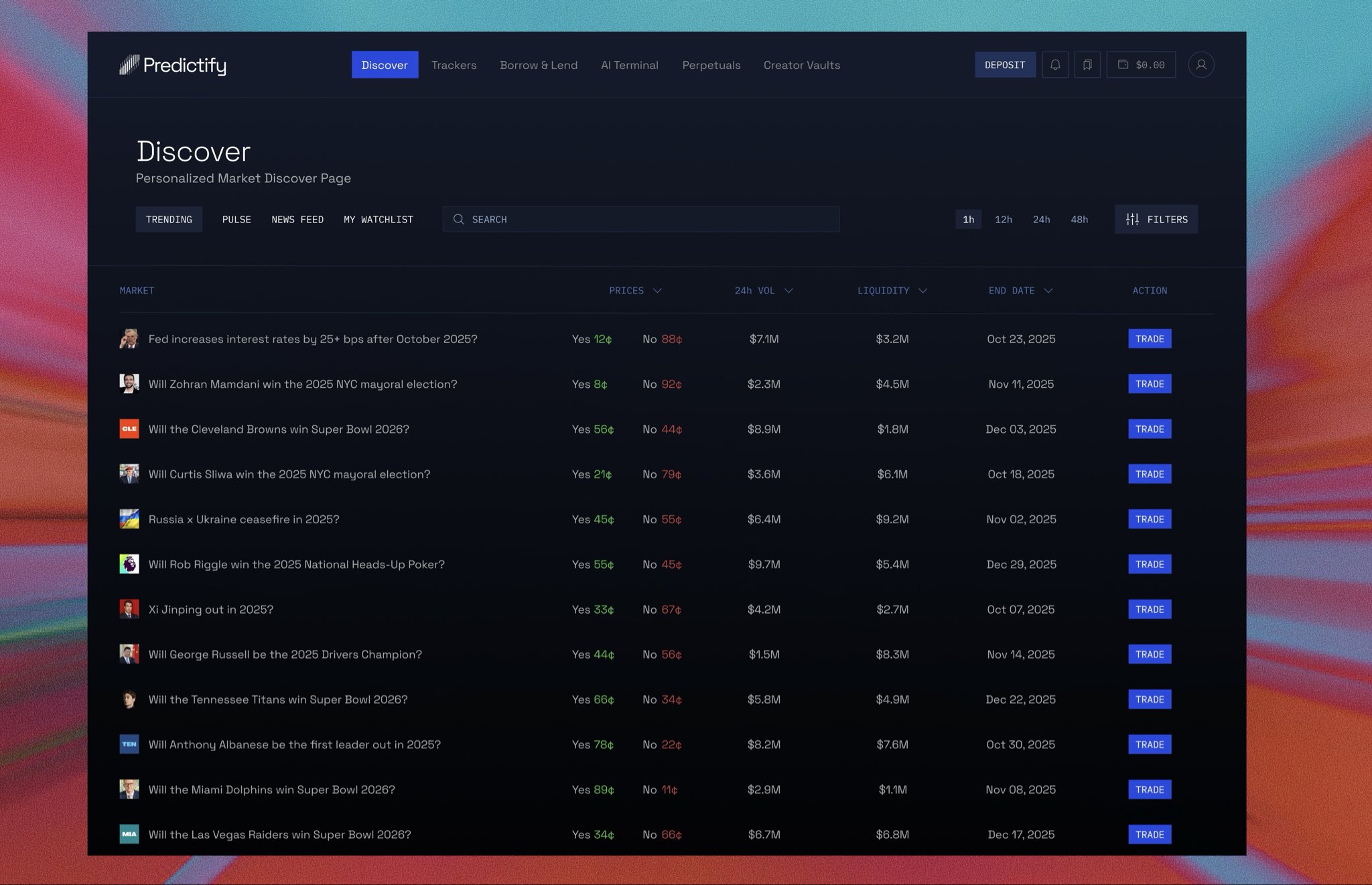

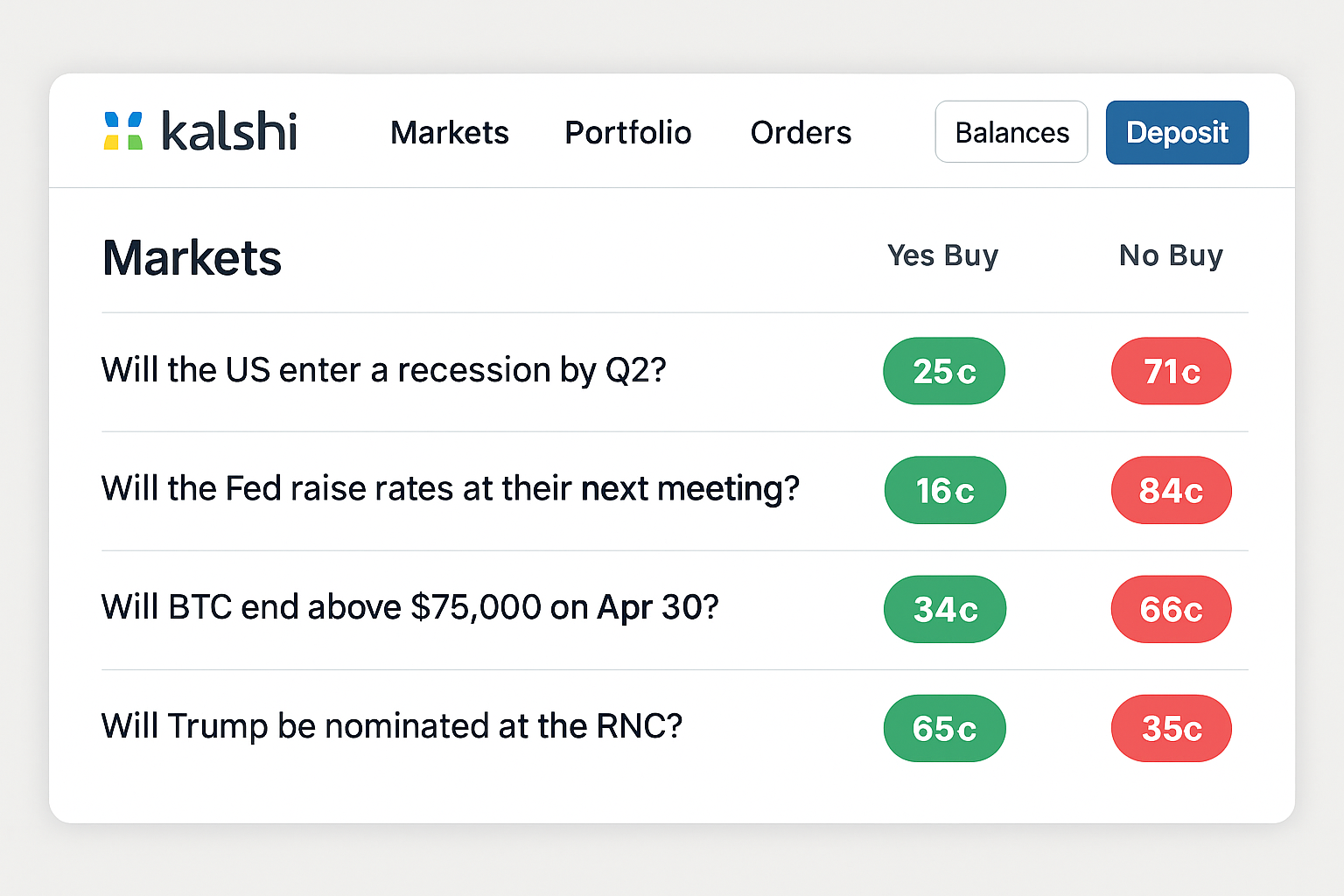

Prediction markets let users buy and sell contracts tied to future outcomes: who will win an election, which team will take the championship, or whether a policy will pass. The price of each contract reflects the market’s consensus probability for that event. For example, if a contract on “Team A wins” trades at $0.72, the market estimates a 72% chance of victory.

The power of these platforms lies in their ability to aggregate information. As traders react to breaking news, like injury reports or new polling data, prices update instantly. This creates a living forecast that adapts faster than traditional punditry or polling averages.

The Blockchain Edge: Transparency and Speed

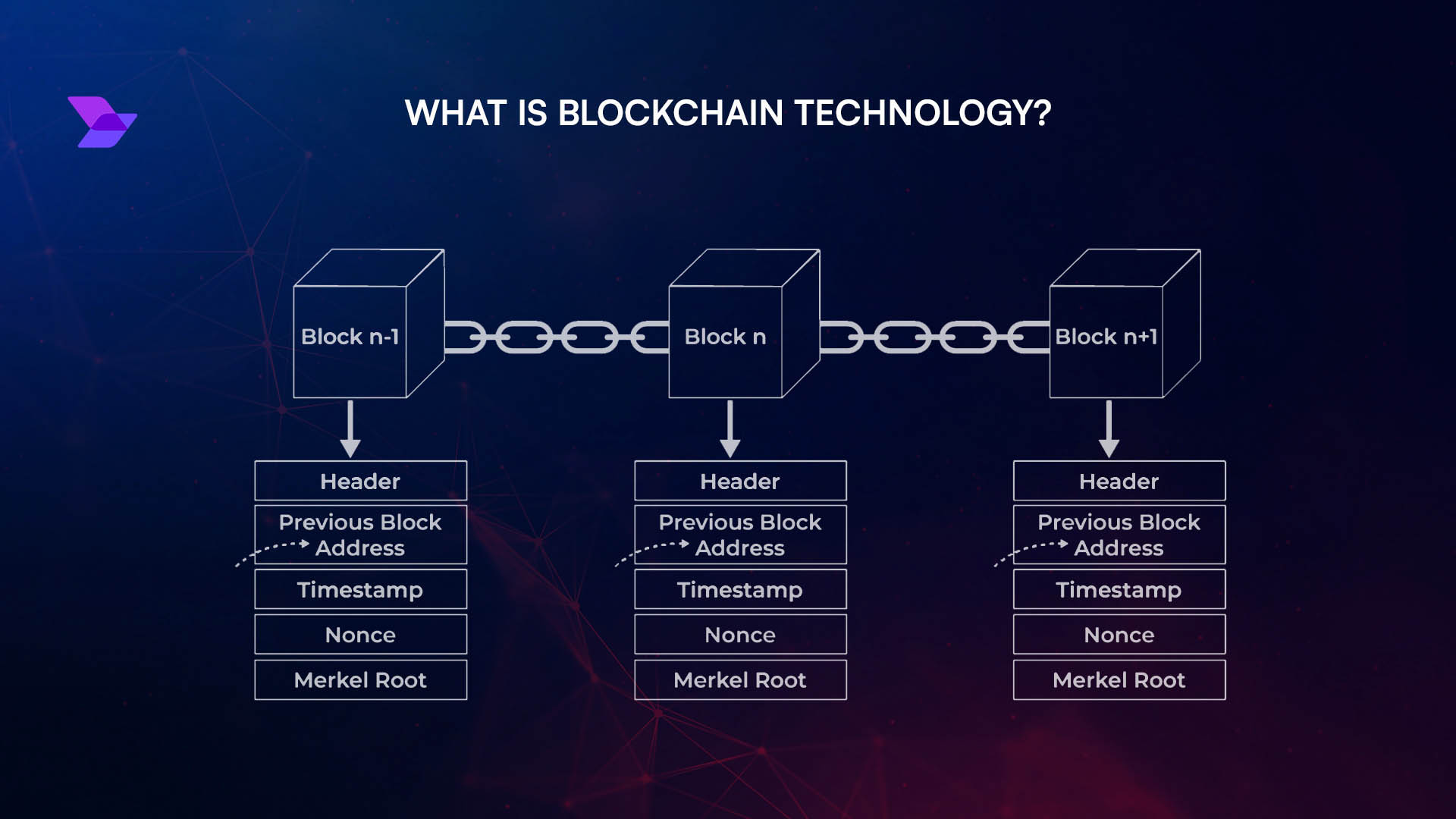

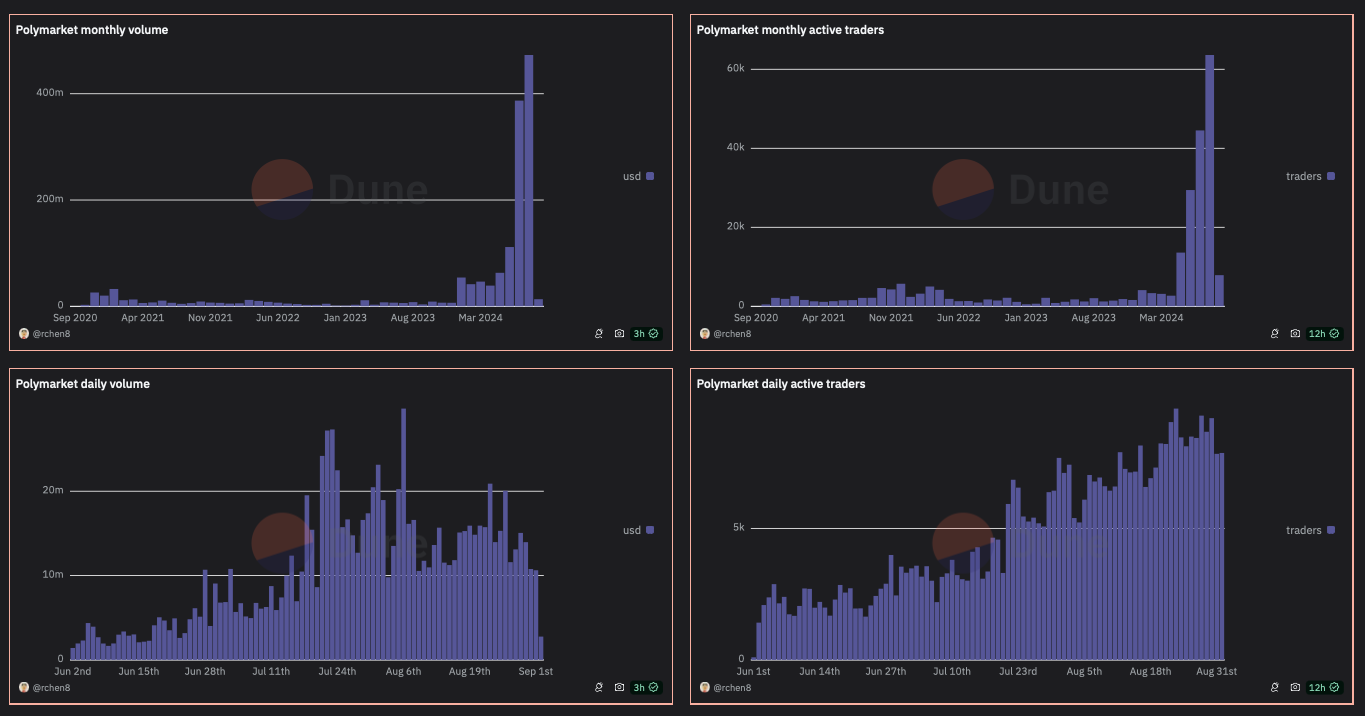

The latest generation of crypto prediction markets, such as Polymarket and Kalshi, leverage blockchain technology for transparency and trustless settlement. Every trade is recorded on-chain, making manipulation harder and ensuring that odds reflect genuine market consensus rather than behind-the-scenes adjustments.

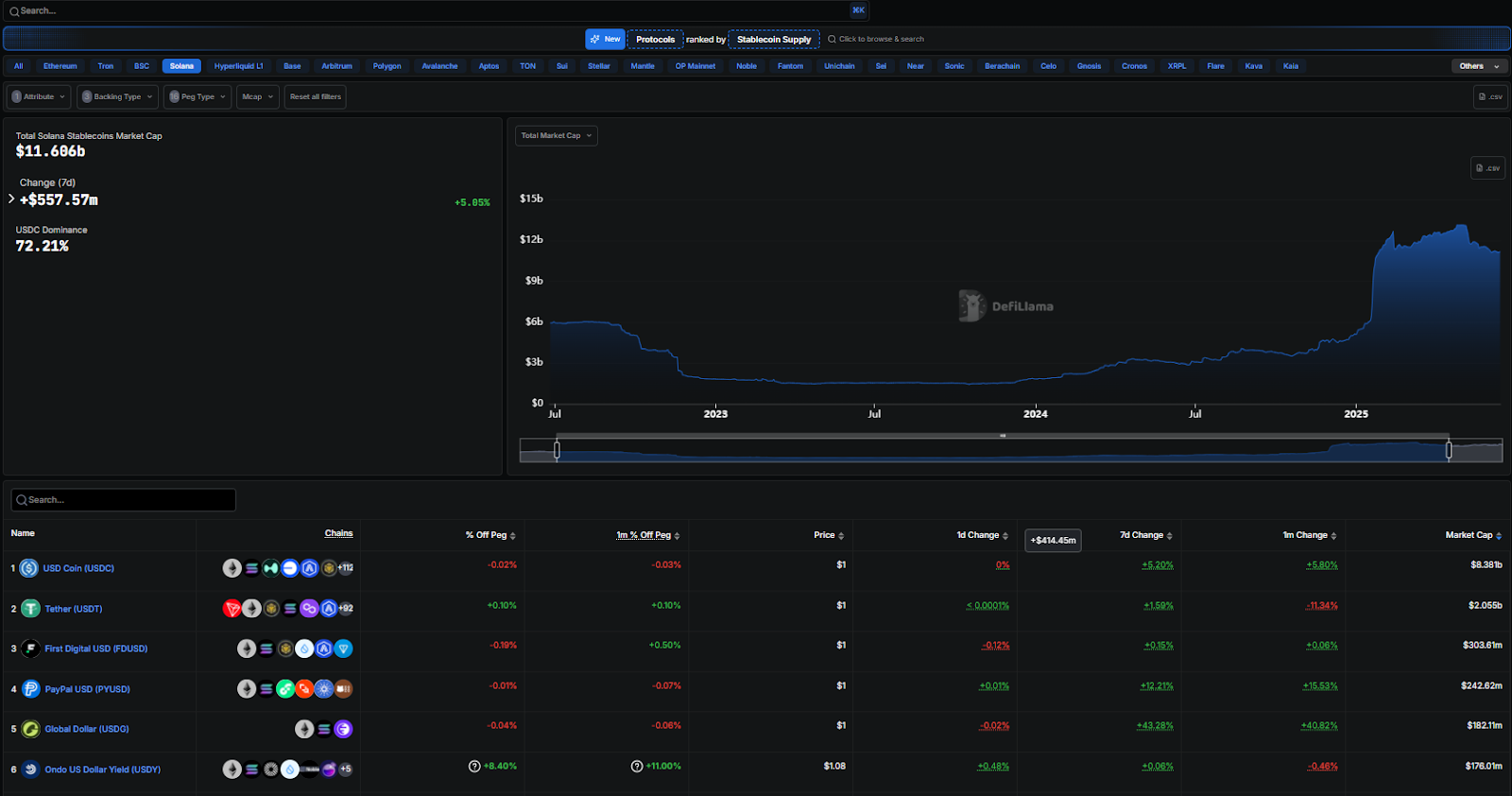

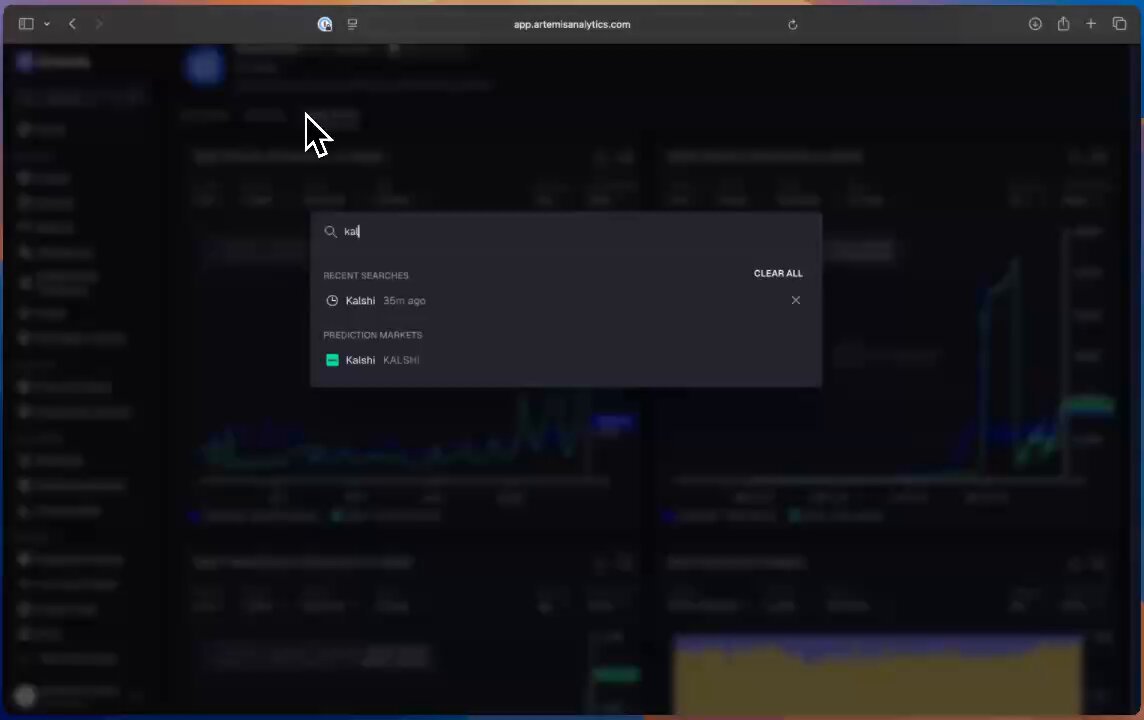

Polymarket, for instance, lets users trade with USDC via Polygon’s blockchain network. This not only lowers fees but also allows for near-instant settlement once results are confirmed. Meanwhile, regulated exchanges like Kalshi offer event contracts across everything from economic indicators to weather patterns, making them a go-to source for real-time election probabilities.

Key Advantages of Blockchain-Based Prediction Markets

-

Decentralized Operation: Blockchain-based platforms like Polymarket operate without a central authority, reducing the risk of manipulation and single points of failure often present in traditional sportsbooks.

-

Transparent and Immutable Transactions: All trades and outcomes are recorded on public blockchains, ensuring verifiable transparency and making it easy for users to audit market data and contract resolutions.

-

Global, 24/7 Accessibility: Users worldwide can participate at any time, bypassing regional restrictions and banking limitations that often apply to conventional sportsbooks.

-

Lower Fees and No House Edge: Platforms like Polymarket and Manifold typically charge lower transaction fees and do not act as the “house” setting odds, unlike traditional sportsbooks that build in a profit margin.

-

Wide Range of Market Topics: Blockchain prediction markets frequently offer contracts on diverse events—politics, weather, pop culture—not just sports, unlike most traditional sportsbooks.

-

Crypto-Based Settlement: Winnings are paid out in cryptocurrencies such as USDC, enabling fast, borderless transactions without reliance on traditional banking systems.

Recent Developments: Mainstream Adoption and Regulatory Shifts

The past year has seen major milestones in prediction market adoption:

- Robinhood’s Prediction Market Hub: In March 2025, Robinhood integrated a prediction markets hub powered by Kalshi into its app, focusing initially on college basketball tournaments (source). This move signals mainstream financial platforms see value in offering decentralized event forecasting alongside stocks and crypto.

- Nate Silver Joins Polymarket: The renowned statistician joined Polymarket as an adviser in July 2024 (source). His involvement highlights growing respect for these platforms as serious forecasting tools.

- Court Rulings Shape U. S. Landscape: In October 2024, Kalshi was provisionally cleared by the U. S. Court of Appeals to offer Congressional control markets despite previous CFTC opposition (source). Regulatory clarity remains key to further growth.

The Accuracy Debate: Are Prediction Markets Better Than Polls?

A growing body of evidence suggests that prediction markets often outperform traditional polling aggregators like FiveThirtyEight when it comes to forecasting elections (source). The key difference is incentives: traders risk real money (or crypto), so only those with conviction, and ideally inside knowledge or strong analysis, shape prices. However, critics warn about low liquidity in some markets and vulnerability to manipulation if volumes stay thin (source). Regulation remains patchy worldwide.

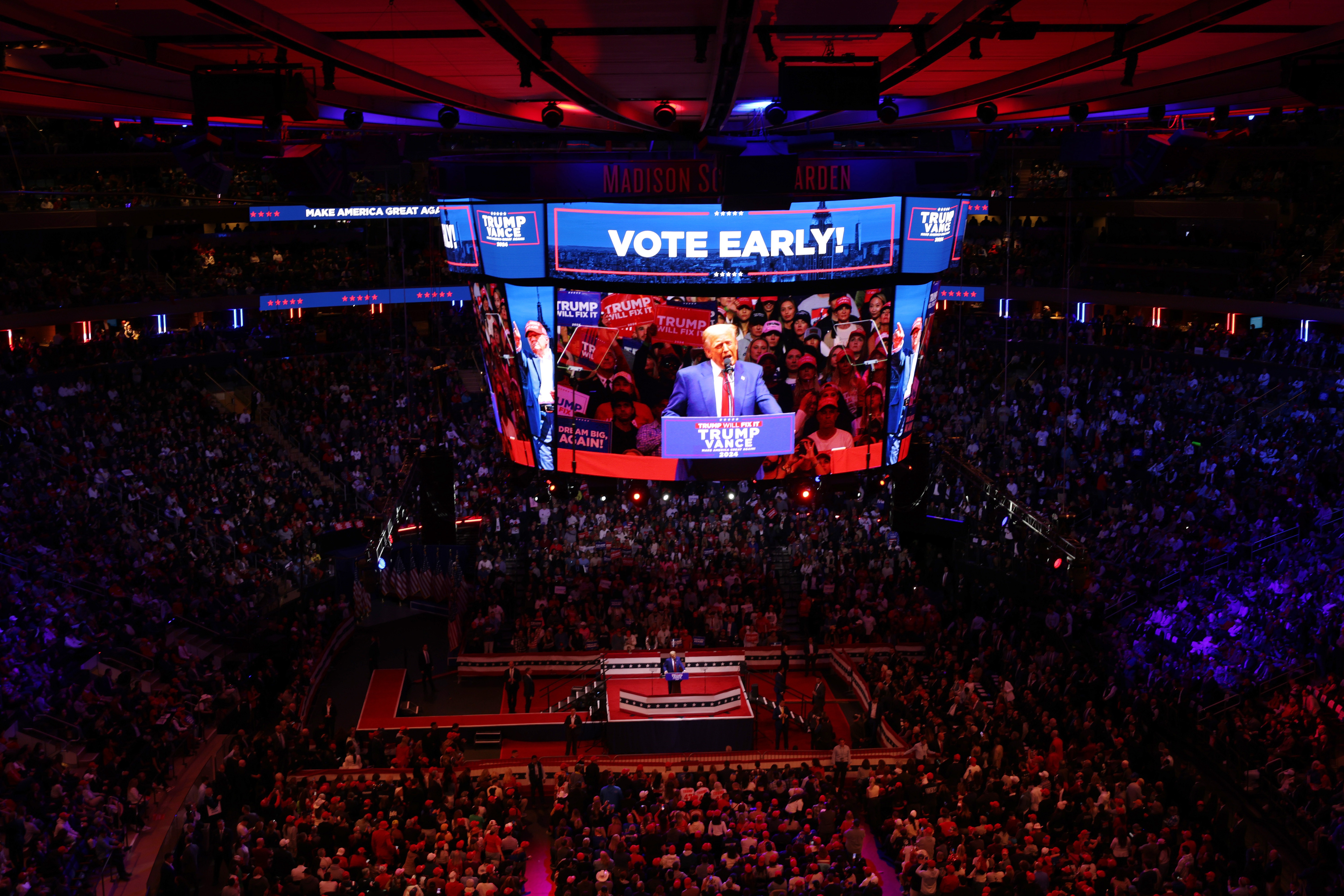

Despite the challenges, the rise of blockchain sports betting odds and decentralized event forecasting is reshaping how both retail traders and institutional players interpret news. The ability to react instantly to new information, be it a candidate’s debate performance or a star athlete’s injury, means that prediction markets are quickly becoming reference points for journalists, analysts, and even policymakers. Market prices become a living consensus, updated second by second as new data hits the wire.

For example, during the 2024 U. S. presidential election cycle, prediction market odds shifted within minutes of televised debates or major polling releases. This agility isn’t just about speed, it’s about accuracy. When thousands of informed participants put their money where their mouth is, the resulting probabilities often reflect reality more closely than static polls or expert forecasts.

What Makes Crypto Prediction Markets Different?

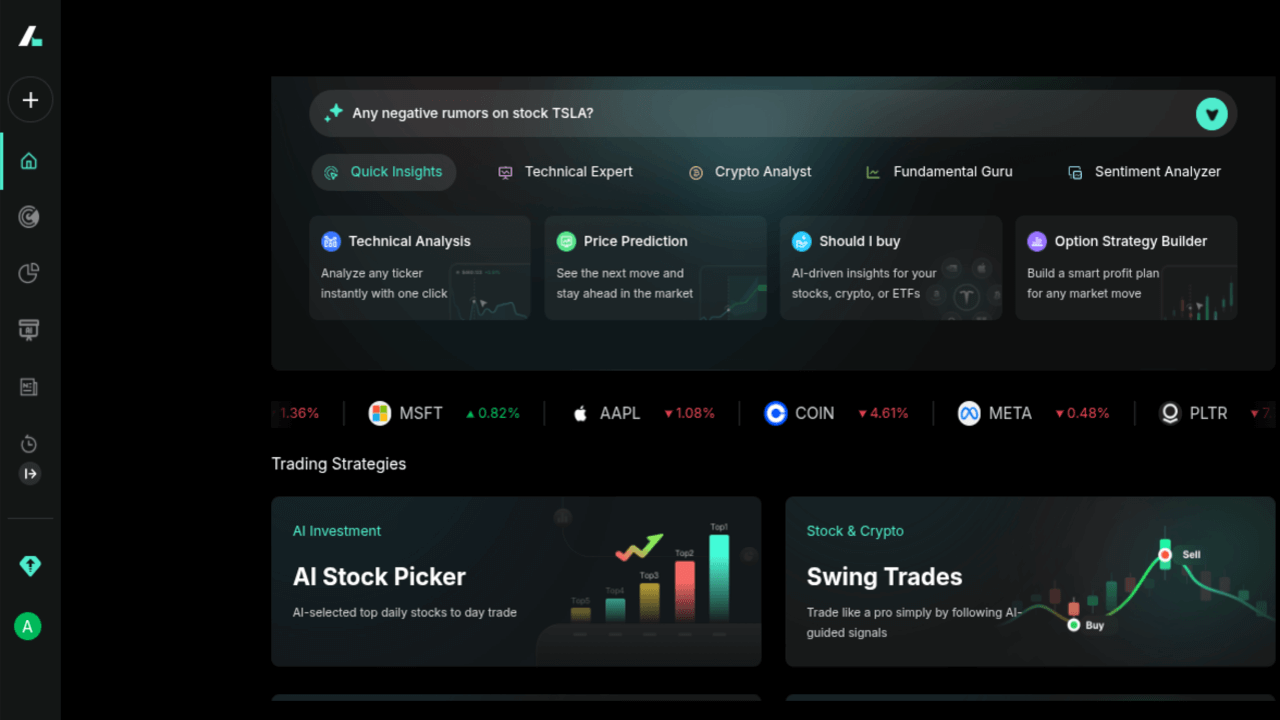

The move to blockchain has introduced several practical advantages over legacy betting platforms. Transaction fees are lower, settlements are faster, and transparency is built in by default. Platforms like Polymarket use smart contracts to automate payouts, eliminating the need for trust in a centralized operator. This makes them particularly appealing for tech-savvy users who value both privacy and efficiency.

Why Crypto Prediction Markets Attract Savvy Bettors

-

Access to Diverse, Real-Time Markets: Platforms like Kalshi and Polymarket let users trade on a broad range of events—from elections to sports—offering up-to-the-minute probabilities on outcomes.

-

Financial Incentives for Accurate Forecasting: Crypto prediction markets reward users who make correct predictions, aligning economic incentives with informed, data-driven forecasting.

-

Decentralization and Transparency: Blockchain-based platforms like Polymarket provide transparent transaction records and decentralized settlement, reducing reliance on a single authority.

-

Low Barriers to Entry: Users can participate globally with minimal capital using cryptocurrencies like USDC, making it easy for anyone to get involved in forecasting.

-

Potential for Higher Accuracy: Studies show prediction markets can outperform traditional polls, as collective wisdom and real-money stakes help aggregate dispersed information efficiently.

-

Regulated Options for U.S. Users: Platforms such as Kalshi operate under CFTC oversight, providing a compliant way for Americans to engage in event-based trading.

Still, there’s no free lunch. Even with blockchain’s benefits, users must remain vigilant about platform governance and regulatory risk. The CFTC’s previous action against PredictIt is a reminder that legal clarity is still evolving (source). Traders should always check whether their chosen platform is compliant with local laws before committing funds.

How to Use Prediction Markets for Smarter Event Forecasting

If you’re looking to harness real-time election probabilities or gain an edge in sports analysis, here’s a practical approach:

Actionable Steps to Use Prediction Markets for Forecasting

-

Choose a Reputable Platform: Start by selecting a well-established prediction market such as Kalshi (regulated U.S. exchange), Polymarket (crypto-based, not available to U.S. users), or Manifold (play-money forecasting). Each platform offers markets on elections, sports, and more.

-

Understand Market Probabilities: Interpret contract prices as real-time probabilities (e.g., a contract trading at $0.63 implies a 63% chance of the event occurring). Use these probabilities as a data point in your forecasts.

-

Monitor News and Market Reactions: Track breaking news and observe how prediction market odds shift in response. This helps identify how new information is being incorporated into collective expectations.

-

Compare Against Polls and Analyst Forecasts: Cross-reference prediction market probabilities with polling aggregators like FiveThirtyEight or expert analyses. Divergences can highlight market insights or potential inefficiencies.

-

Be Aware of Fees and Regulations: Review each platform’s transaction fees, funding requirements, and legal status in your region. For example, Kalshi is regulated in the U.S., while Polymarket restricts U.S. users.

-

Assess Market Liquidity and Manipulation Risks: Check trading volumes and participant diversity to gauge reliability. Low liquidity or concentrated trading can make markets more susceptible to manipulation.

-

Use Markets as One Input, Not the Only Source: Treat prediction market probabilities as a valuable input, but combine them with other research and context for a well-rounded forecast.

For crypto enthusiasts, these markets also offer a way to diversify exposure beyond traditional assets. Trading contracts on macroeconomic events or political outcomes can hedge risk or capitalize on unique information advantages.

Looking Ahead: The Future of Decentralized Betting News

The next wave of innovation will likely focus on improving liquidity and expanding market coverage. As more users enter the space, and as platforms secure regulatory clarity, we can expect tighter spreads and deeper order books. This will make the odds even more reliable as indicators of crowd wisdom.

Ultimately, prediction markets have proven their value as real-time barometers of public sentiment on everything from elections to sports championships. They won’t replace traditional polling or expert commentary overnight, but they’re already an essential tool for anyone seeking actionable insight into the world’s most-watched events.