How Prediction Markets Use Blockchain to Make Sports and Election Forecasts More Accurate

Prediction markets have rapidly evolved from niche financial experiments to headline-grabbing platforms that rival traditional polls and pundits in accuracy. In the wake of the 2024 U. S. presidential election, decentralized blockchain prediction markets like Polymarket made waves by outperforming mainstream polling in forecasting the outcome, capturing public sentiment with a precision that stunned many observers. This transformation is not just about technology – it’s about harnessing crowd intelligence forecasting and aligning incentives for truth-seeking in ways legacy systems cannot match.

How Blockchain Reshapes Prediction Markets

The advent of blockchain technology has been a game-changer for prediction markets. Traditional platforms were often hampered by centralization, opaque rules, and limited access. In contrast, blockchain prediction markets operate on decentralized ledgers where every trade is publicly verifiable and governed by smart contracts. For example, Polymarket runs on the Polygon blockchain, allowing users to trade on everything from election results to sports outcomes – all with transactions recorded transparently on-chain. This structure minimizes manipulation risk and creates an immutable audit trail for every bet placed (source).

This transparency is more than a technical feature; it is foundational to building trust among participants who might otherwise be wary of market fairness or payout reliability. When combined with global access (no arbitrary borders or banking restrictions), these platforms are catalyzing a new era of decentralized betting platforms.

The Power of Crowd Intelligence: Why Markets Often Beat Polls

The core strength of prediction markets lies in their ability to aggregate diverse information through financial incentives. Unlike opinion polls, which simply ask people what they think will happen, prediction markets require participants to put their money where their mouth is – literally buying and selling shares tied to specific outcomes.

Key Advantages of Blockchain Sports Betting

-

Decentralization and Transparency: Blockchain-based sports betting platforms like Polymarket operate without central authorities, using smart contracts to automate transactions and ensure that all bets and outcomes are immutably recorded on a public ledger. This reduces the risk of manipulation and provides bettors with transparent, verifiable records of every wager.

-

Global Accessibility: Unlike traditional bookmakers that may restrict users based on geography or local regulations, blockchain platforms are accessible worldwide. This inclusivity allows participants from various regions to engage in sports betting, broadening the market and increasing liquidity.

-

Enhanced Accuracy Through Crowd Wisdom: By aggregating the financial stakes and opinions of a diverse user base, blockchain prediction markets often provide more accurate odds and forecasts than traditional bookmakers. For example, during the 2024 U.S. presidential election, Polymarket’s trading volume reached approximately $1.7 billion, reflecting a robust collective forecast.

-

Lower Fees and Faster Settlements: Smart contracts on blockchain platforms automate payouts and reduce the need for intermediaries, resulting in lower transaction fees and quicker settlement times compared to traditional bookmakers.

-

Regulatory Clarity and Mainstream Adoption: Recent regulatory approvals, such as the U.S. Commodity Futures Trading Commission (CFTC) greenlighting Polymarket’s U.S. operations in September 2025, and mainstream integrations like Robinhood’s prediction markets hub, signal growing acceptance and trust in blockchain-based sports betting.

This mechanism attracts a broad spectrum of informed actors: data analysts, insiders, fans with deep knowledge, and even algorithmic traders seeking arbitrage opportunities. The result? Real-time odds that reflect not just sentiment but also the latest information flows and rational expectations.

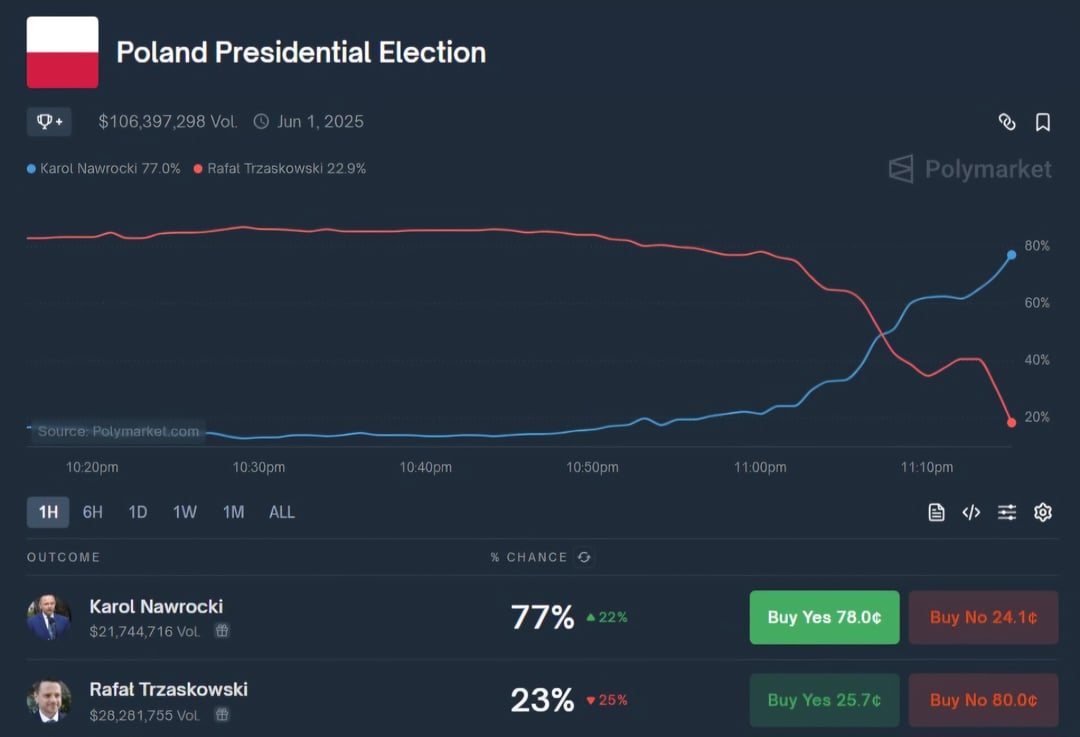

The 2024 U. S. presidential race was a watershed moment for these platforms. With trading volumes reaching approximately $1.7 billion on Polymarket alone (source), the market’s aggregated odds proved more accurate than most major polls – a fact now cited by university studies and media outlets alike.

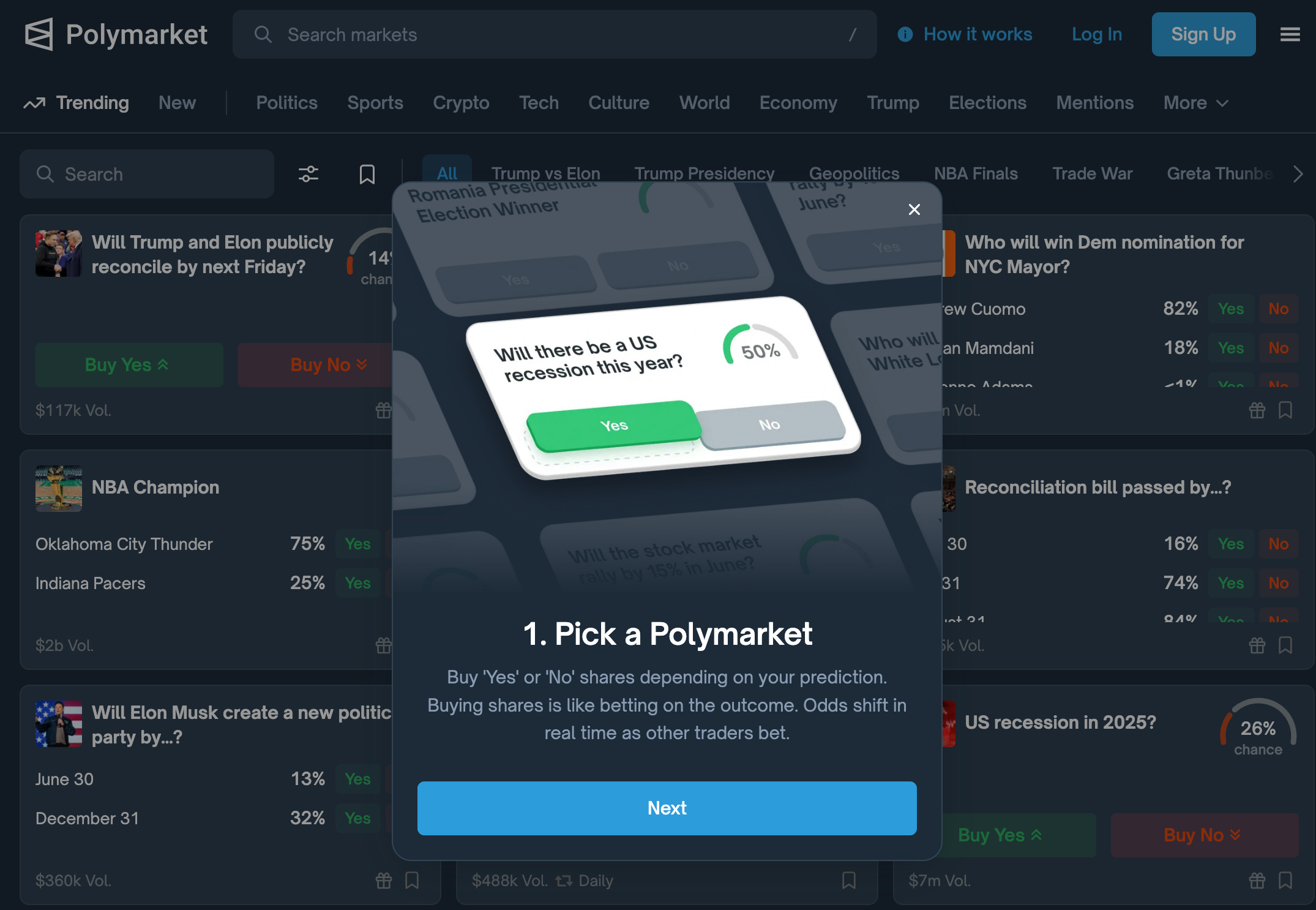

Mainstream Adoption Accelerates Amid Regulatory Shifts

The success of blockchain-based crypto event markets has not gone unnoticed by regulators or mainstream financial players. In September 2025, the CFTC granted Polymarket approval to relaunch operations in the United States after its $112 million acquisition of QCEX, marking a pivotal step toward regulatory legitimacy (source). Similarly, Robinhood’s launch of an integrated prediction market hub in March 2025 allowed millions more users easy access to event-driven trading (source). These moves signal that decentralized forecasting is moving out of crypto subcultures into everyday finance.

Yet, as blockchain prediction markets scale, new complexities emerge. Regulatory scrutiny remains intense, particularly in jurisdictions where event-based betting blurs the line between financial innovation and gambling. The legal landscape continues to evolve, with some countries embracing these platforms as tools for transparent forecasting and others imposing outright bans or severe restrictions. This patchwork of regulations means that accessibility and liquidity can vary widely depending on geography.

Another challenge is ensuring robust participation. While Polymarket’s $1.7 billion trading volume during the 2024 U. S. election demonstrated the power of network effects, smaller or less-publicized markets sometimes struggle with thin liquidity. Low trading volumes can make prices more susceptible to manipulation by determined actors or coordinated groups, a concern highlighted by critics and regulators alike (source). Addressing this requires ongoing innovation in market design, incentives for market makers, and perhaps even new models for decentralized governance.

The Future: Real-Time Forecasts for Sports, Elections, and Beyond

Looking ahead, blockchain prediction markets are poised to expand far beyond political races. Sports betting blockchain applications are already attracting mainstream attention from platforms like Kalshi, Crypto. com, and Robinhood. These systems offer real-time odds on outcomes ranging from championship games to player statistics, providing a dynamic alternative to traditional sportsbooks (source). As smart-contract-powered platforms lower fees and speed up settlements, they are likely to draw in both casual fans and sophisticated traders seeking an edge through data-driven analysis.

The integration of crowd intelligence forecasting into everyday decision-making is another frontier. Businesses and policymakers are increasingly interested in harnessing these markets not just for entertainment but as serious tools for risk assessment and strategic planning. By tapping into global pools of knowledge and capital, decentralized betting platforms can provide early warning signals on everything from economic trends to public health risks.

How Blockchain Prediction Markets Are Shaping Sports Analytics

-

1. Real-Time, Transparent Odds via Platforms Like PolymarketBlockchain-based prediction markets such as Polymarket provide real-time, transparent odds for sports events. All trades and positions are recorded on-chain, allowing analysts and fans to verify market sentiment and activity instantly.

-

2. Harnessing Collective Intelligence for More Accurate ForecastsBy aggregating the financial stakes and insights of a global user base, blockchain prediction markets capture the wisdom of the crowd. This can lead to more accurate sports forecasts than traditional expert or algorithmic models.

-

3. Decentralized Data for Enhanced IntegrityOn-chain markets operate without centralized control, reducing the risk of manipulation by bookmakers or insiders. This decentralized structure ensures greater trust in the integrity of sports analytics derived from market data.

-

4. Integration with Mainstream Finance Through Regulatory ApprovalsRecent CFTC approval for Polymarket and the launch of Robinhood’s prediction markets hub signal growing mainstream acceptance. This integration enables sports analysts to access regulated, high-liquidity markets for data-driven insights.

-

5. Global Accessibility and InclusivityBlockchain prediction markets are open to participants worldwide, allowing for a broader, more diverse set of opinions to inform sports analytics. This global reach can help reduce regional biases in forecasting.

For participants, the benefits extend beyond potential profits. Engaging with decentralized betting platforms fosters financial literacy and a deeper understanding of probability, skills that translate well beyond the markets themselves.

Balancing Innovation with Integrity

Sustaining trust is paramount as adoption accelerates. Blockchain’s open ledgers make it possible for anyone to audit trades or outcomes after the fact, but ensuring fairness in real time requires vigilant monitoring of market activity and continued refinement of smart contract logic. As with any fast-growing sector at the intersection of finance and technology, bad actors will test system boundaries; robust security protocols and transparent dispute resolution mechanisms will be key to long-term credibility.

The evolution of election prediction crypto markets illustrates both promise and peril: while they have proven their predictive accuracy in high-stakes scenarios like the 2024 presidential race, their future depends on striking a careful balance between openness, compliance, and user protection.

Key Takeaways for Users and Observers

If you’re considering participating in blockchain-based prediction markets, or simply tracking their forecasts, keep these principles in mind:

- Diversify your sources: No single market captures all available information; compare odds across multiple platforms when possible.

- Understand local regulations: Legal status varies widely; always check if participation is permitted in your jurisdiction.

- Watch liquidity: Higher trading volumes generally mean more reliable pricing, and greater opportunities for informed bets.

- Pursue education: Successful users treat prediction markets as learning tools as much as speculative venues.

The rise of blockchain-powered prediction markets marks a pivotal shift toward more accurate, and more accessible, event forecasting worldwide. As regulatory clarity improves and user bases grow, expect these platforms to become indispensable tools not just for bettors but also analysts, policymakers, and anyone seeking an edge in understanding tomorrow’s headlines today.