How Blockchain Prediction Markets Are Changing Sports Betting in 2024

Blockchain prediction markets are fundamentally reshaping sports betting in 2024. Instead of relying on centralized sportsbooks, bettors now have access to decentralized platforms where they can trade opinions and insights on game outcomes with unmatched transparency. These crypto-powered markets are eliminating traditional barriers, offering lower fees, faster settlements, and a global reach that legacy operators struggle to match.

Decentralized Sports Betting Surges: The 2024 Landscape

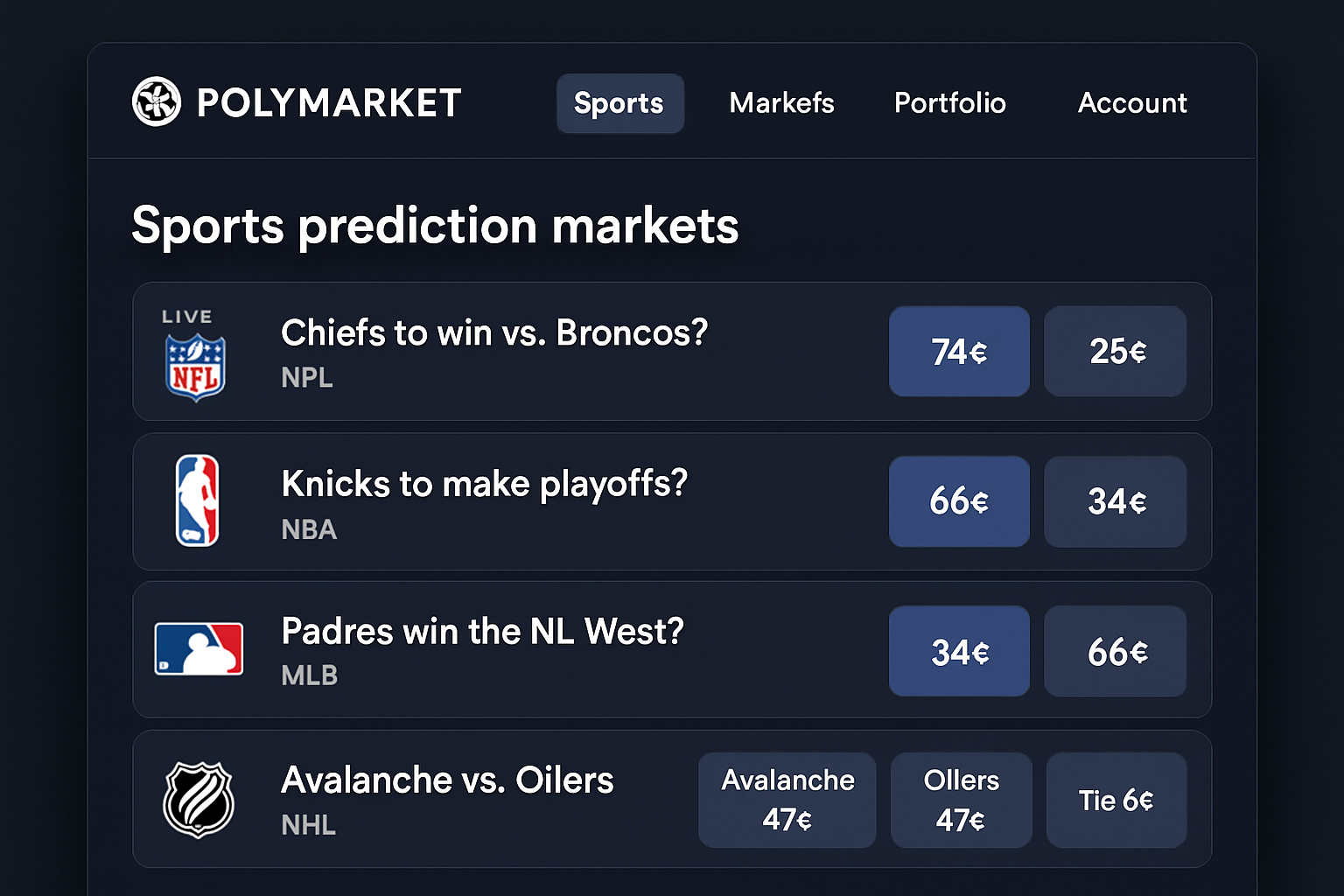

The numbers speak volumes. In August 2024 alone, Polymarket’s trading volume soared to $473 million, marking a 60-fold increase from the prior year. This explosive growth is driven by the platform’s diverse event selection and its integration with mainstream finance tools like Bloomberg Terminal. For context, legal online sports betting generated about $16 billion in 2024 (Crypto.com Research). But what sets blockchain-based prediction markets apart is their structure: smart contracts manage trades automatically, ensuring fairness and eliminating the house edge.

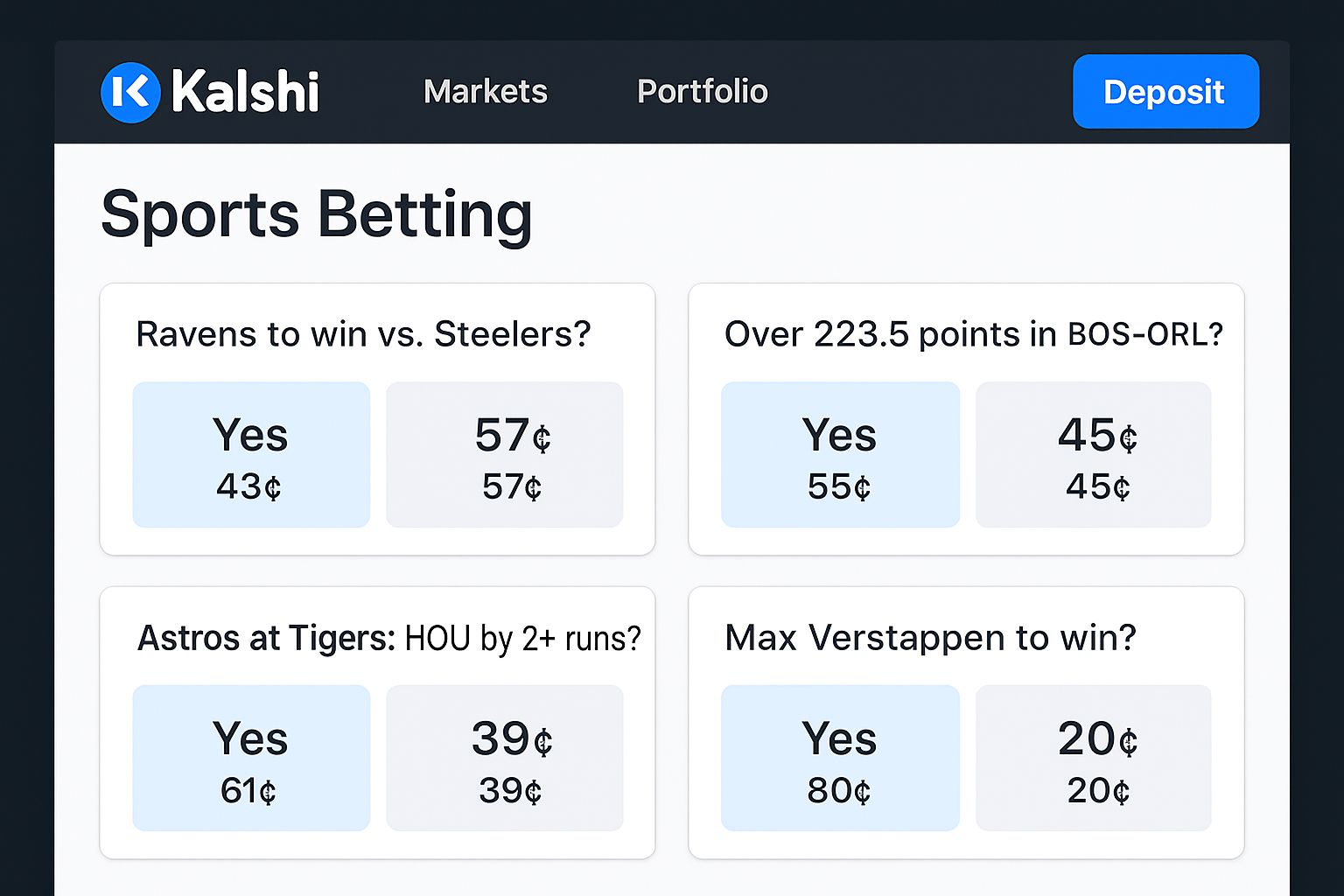

Kalshi’s rise is equally impressive. As the first CFTC-regulated prediction market in the US, Kalshi captured a 62.2% market share in Q3 2025. Weekly trading volumes exceeded $500 million, with football-related contracts accounting for over 70% of activity (AInvest). This dominance signals a clear shift: bettors are moving toward platforms that offer dynamic pricing, peer-to-peer liquidity, and transparent settlement.

Why Blockchain Prediction Markets Are Winning Over Bettors

Top Advantages of Decentralized Sports Betting in 2024

-

Enhanced Transparency: All bets and outcomes are recorded on public blockchains, allowing users to independently verify results and payouts. Platforms like Polymarket make transaction histories fully auditable.

-

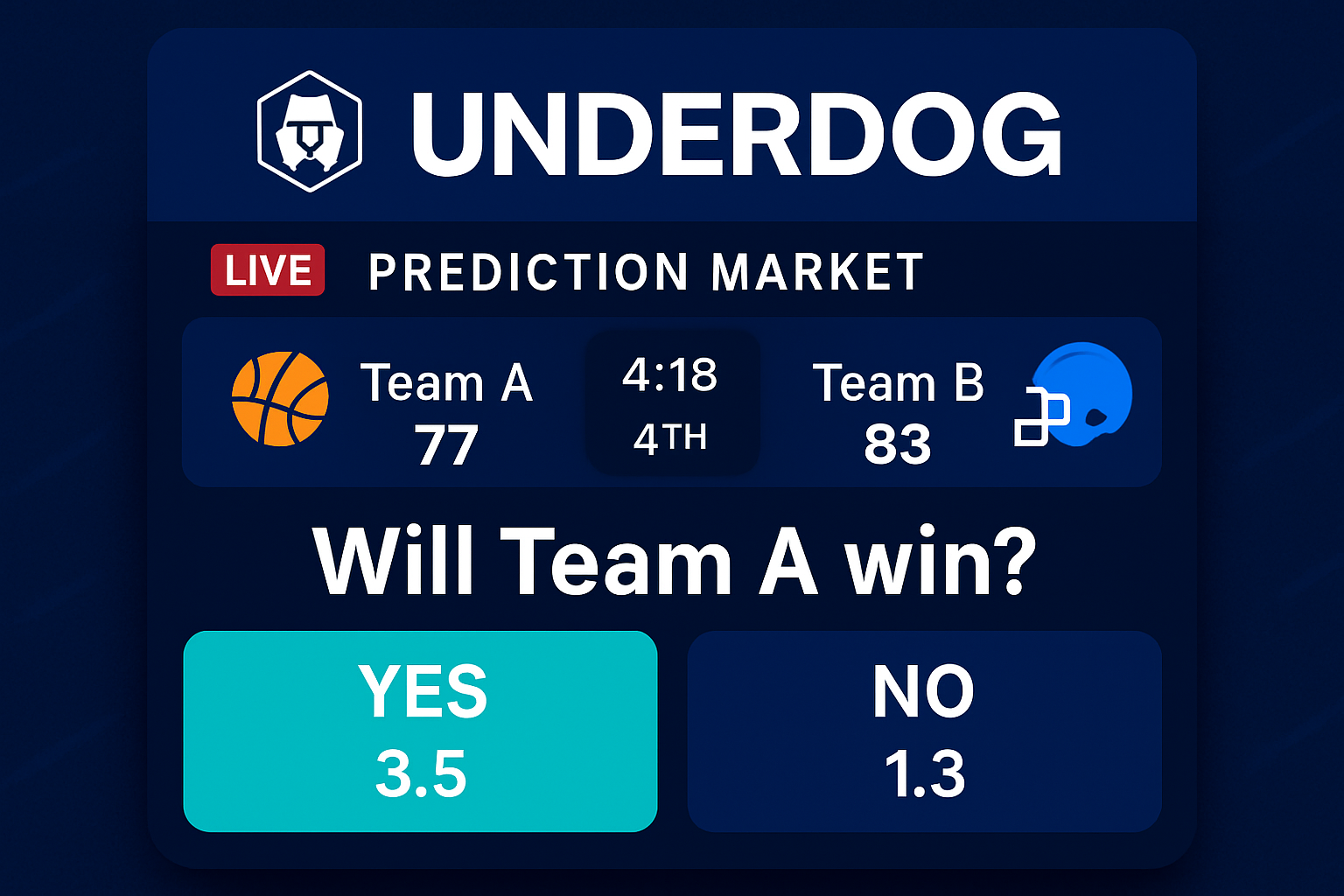

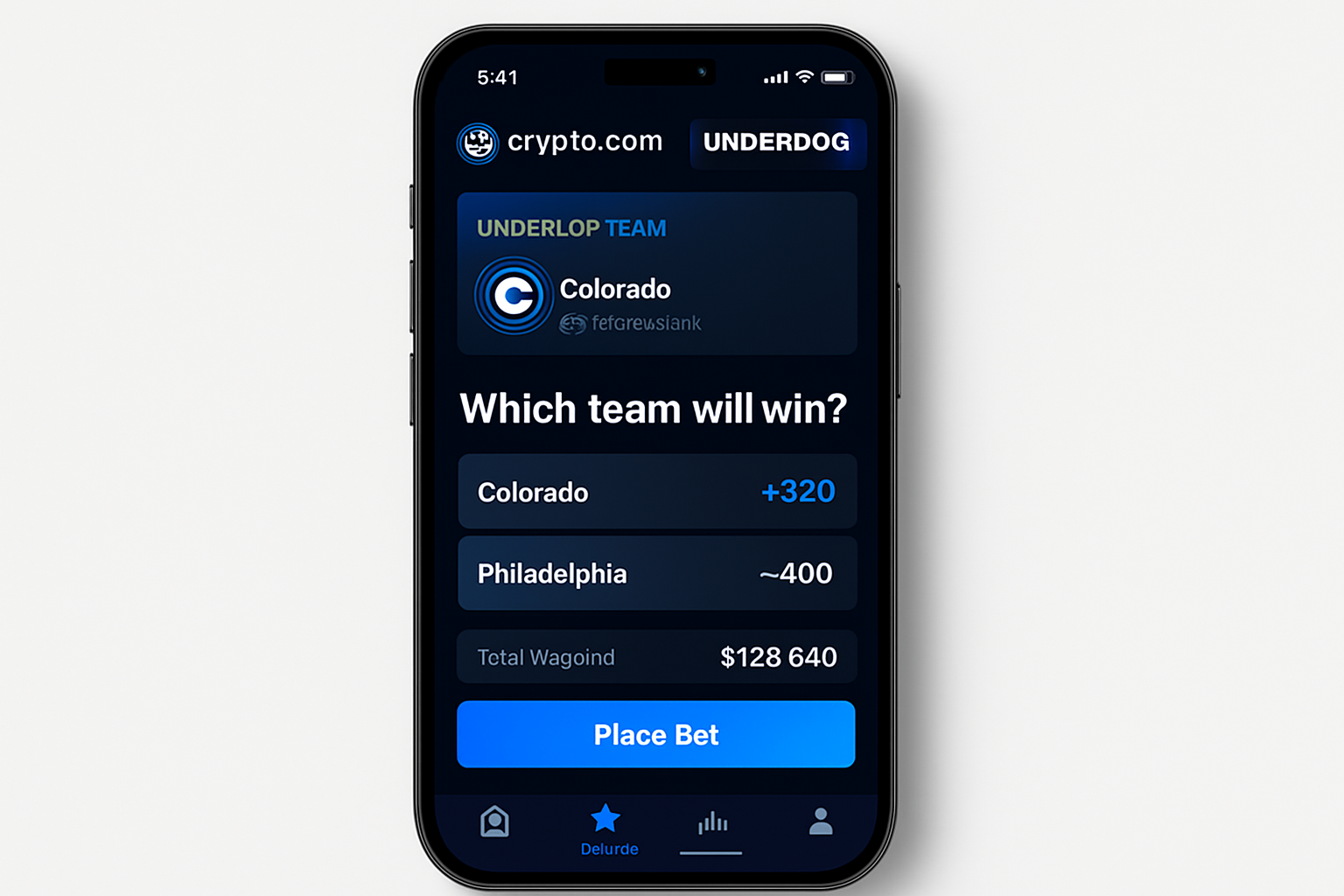

Lower Fees: By eliminating intermediaries, decentralized platforms like Crypto.com and Underdog offer significantly reduced transaction costs compared to traditional sportsbooks.

-

Global Accessibility: Users worldwide can participate without geographic restrictions, as seen with Polymarket’s rapid growth and integration into mainstream financial tools like Bloomberg Terminal.

-

24/7 Dynamic Trading: Decentralized markets operate around the clock, letting users trade positions and react to live events in real time, a key feature highlighted by the Crypto.com & Underdog launch in 16 US states.

-

Regulatory Innovation: Platforms such as Kalshi have pioneered CFTC-regulated sports contracts, providing a compliant environment for U.S. bettors and attracting mainstream adoption.

-

Financial Privacy: Crypto-based betting allows users to maintain greater control over their funds and personal data, with platforms like Polymarket and Crypto.com supporting anonymous or pseudonymous participation.

The appeal of blockchain sports betting boils down to three factors:

- Transparency: Every bet and payout is recorded on-chain for anyone to verify.

- Lower Fees: By cutting out intermediaries, platforms like Event Markets offer better odds and minimal commission.

- Global Access: Crypto wallets replace bank accounts, letting users from dozens of countries participate without friction or censorship.

This new breed of prediction market isn’t just for crypto enthusiasts – it’s attracting sharp sports traders who want more control over their bets and exposure to real-time price discovery.

The Regulatory Crossroads: Growth Meets Scrutiny

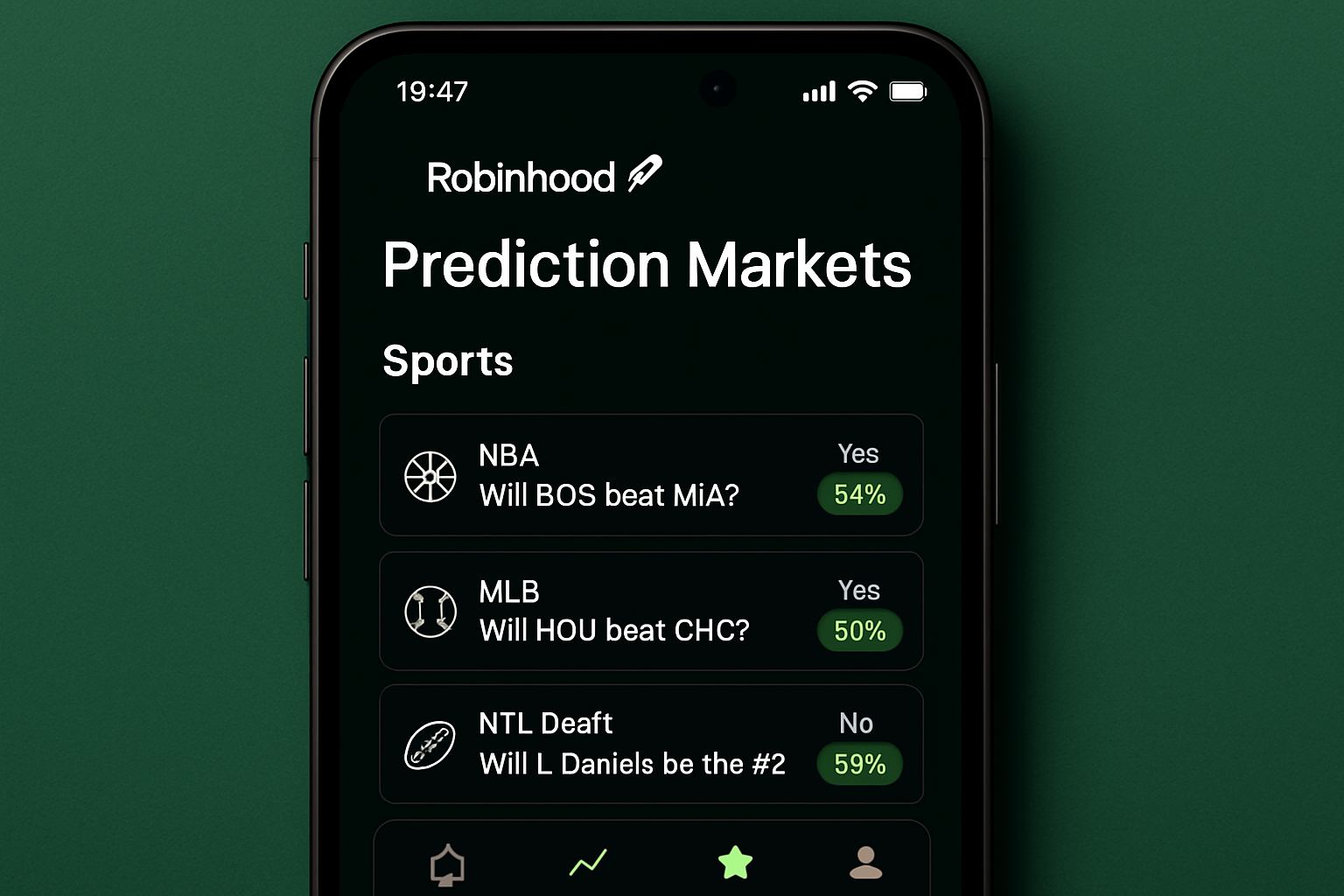

The rapid expansion hasn’t gone unnoticed by regulators. In March 2025, Massachusetts began investigating Robinhood’s launch of a prediction market hub featuring college basketball betting (Reuters). Meanwhile, the CFTC held roundtables to discuss how sports event contracts should be treated under US law. Industry leaders argue that clear frameworks will fuel innovation while protecting consumers from bad actors.

This regulatory uncertainty creates both risk and opportunity for blockchain-based operators. Platforms that can balance compliance with their core principles of transparency and decentralization will be best positioned as the sector matures.

Traditional sportsbooks are already feeling the heat. Giants like DraftKings and FanDuel are facing mounting pressure as decentralized competitors offer 24/7 trading, dynamic odds, and lower fees. The shift is forcing legacy operators to rethink their tech stacks and seek new partnerships just to keep pace. According to AInvest, football-related contracts alone now account for over 70% of Kalshi’s massive weekly trading volumes, highlighting how quickly user preferences are changing.

Robinhood’s move into prediction markets via Kalshi integration was a shot across the bow for both fintech and betting incumbents. By embedding event contracts directly in its app, Robinhood made it easy for millions of retail traders to access sports and macro prediction markets without leaving the platform. This mainstream accessibility is likely to accelerate adoption even further.

What’s Next for Blockchain Sports Betting?

The momentum behind decentralized sports betting shows no signs of slowing down. With Polymarket processing $473 million in August 2024 alone and Kalshi regularly exceeding $500 million in weekly volumes, liquidity is deeper than ever. As more platforms launch and compete on features like instant settlement, cross-chain support, and advanced analytics, bettors will have even more choice, and power, than before.

Looking ahead, regulatory clarity will determine how fast these markets can scale in the US and globally. If clear rules emerge that allow compliant operation without stifling innovation, expect blockchain-based prediction markets to capture an even greater share of the $16 billion US online sports betting market cited by Crypto.com Research.

Top Blockchain Sports Betting Trends for 2025

-

Decentralized Prediction Markets Go Mainstream: Platforms like Polymarket saw trading volumes surge to $473 million in August 2024, integrating with financial tools such as the Bloomberg Terminal and attracting a broader audience to blockchain-based sports betting.

-

Regulated U.S. Platforms Dominate Market Share: Kalshi, the first CFTC-regulated prediction market in the U.S., captured 62.2% market share in Q3 2025 with weekly trading volumes over $500 million, driven by football-related contracts.

-

Major Fintechs Enter Prediction Markets: In early 2025, Robinhood launched a prediction markets hub via Kalshi, offering sports event contracts and expanding access to millions of retail investors.

-

Real-Time, Peer-to-Peer Betting Expands: The Crypto.com and Underdog partnership brought sports prediction markets to 16 U.S. states, enabling fans to trade game outcomes in real time with enhanced transparency and lower fees.

-

Regulatory Scrutiny Intensifies: Increased adoption has triggered investigations, such as Massachusetts regulators probing Robinhood’s college basketball markets, and prompted the CFTC to hold roundtables on sports event contracts, shaping the future legal landscape.

-

Traditional Sportsbooks Face Disruption: Established operators like DraftKings and FanDuel are under pressure from blockchain competitors offering dynamic pricing, 24/7 trading, and lower fees, forcing them to innovate and seek partnerships.

For bettors seeking transparency, speed, and global access, combined with the upside of crypto rewards, blockchain prediction markets represent the future of sports wagering. Whether you’re a sharp trader or a casual fan looking for better odds, decentralized platforms like Event Markets are setting a new standard for what’s possible in sports betting.