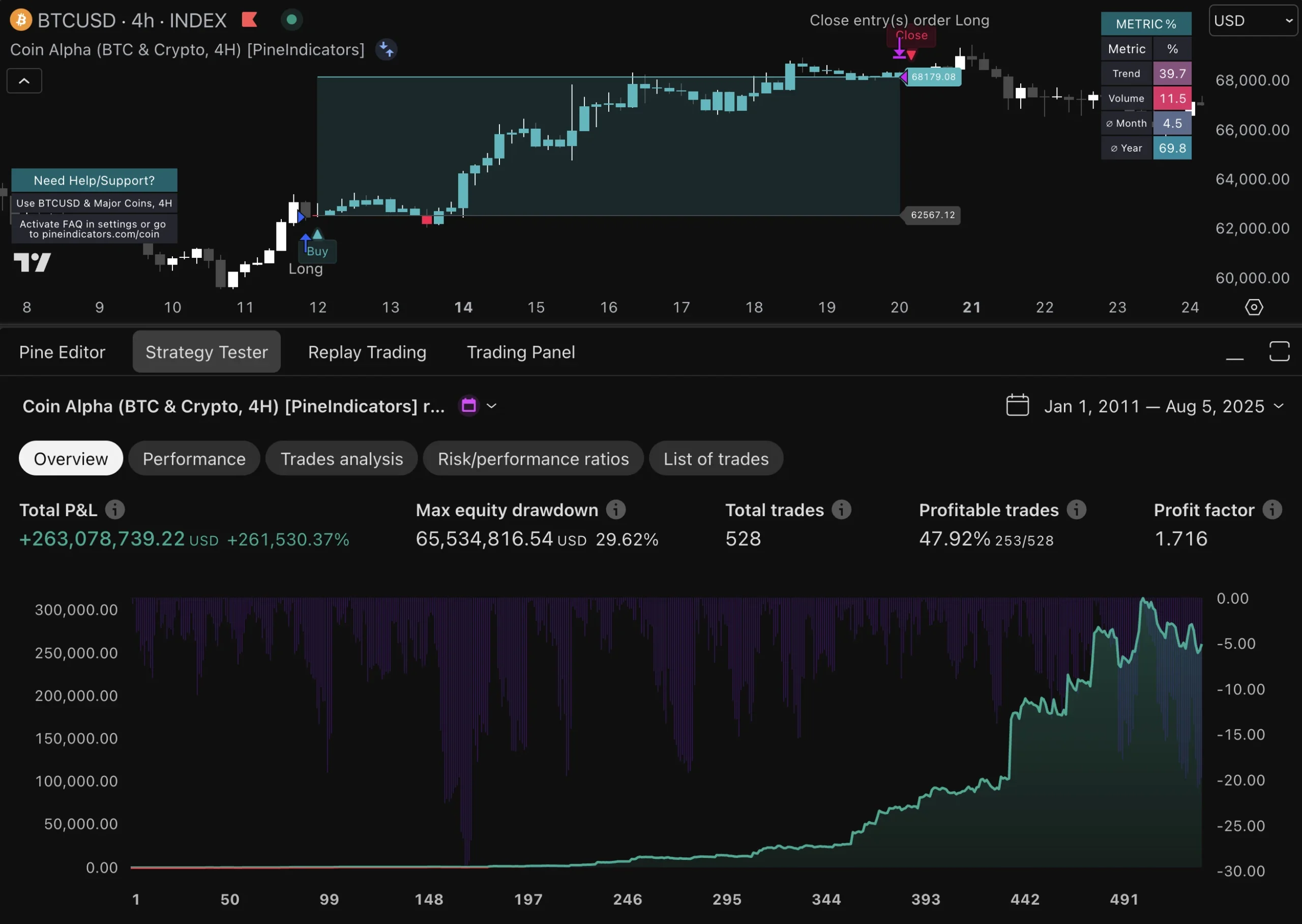

5-Minute Prediction Markets on Blockchain: Betting Bitcoin Price Moves with Event Markets in 2026

Bitcoin’s price at $66,819.00 today reflects the kind of subtle yet telling volatility that savvy traders thrive on, up $494.00 or 0.75% in the last 24 hours with a high of $67,252.00 and low of $65,683.00. In this environment, 5-minute prediction markets on blockchain are emerging as a precise tool for capturing those fleeting moves. Platforms like Event Markets are making it possible to bet on whether Bitcoin heads up or down in the next five minutes, blending the thrill of short-term speculation with the security of decentralized tech.

These blockchain short term bets turn Bitcoin’s micro-fluctuations into actionable opportunities. Unlike traditional derivatives that tie up capital for hours or days, 5-minute markets settle almost instantly, letting you redeploy funds rapidly. Event Markets, optimized for crypto enthusiasts, leverages Polygon for low fees and fast execution, positioning itself as a compelling event markets Polymarket alternative amid Polymarket’s own push into this space.

Decoding the Mechanics of 5-Minute Bitcoin Bets

At their core, these markets operate like binary options on steroids: you buy shares in ‘Up’ or ‘Down’ for Bitcoin’s price at the end of five minutes. Prices reflect crowd wisdom, often more accurate than solo charting in choppy conditions. Polymarket’s recent launch drew $17 million in volume within days on Polygon, signaling massive demand, while their total 2026 volume hits billions. Event Markets builds on this, offering seamless integration for sports, elections, and now crypto volatility bets.

Consider today’s action: from $65,683.00 to $67,252.00 and settling at $66,819.00. A trader spotting momentum at $66,000 could buy ‘Up’ shares at 55 cents, cashing out at $1 if correct. This granularity suits high-frequency minds without the exchange slippage. Importantly, blockchain oracles like Chainlink ensure tamper-proof price feeds, a reassuring layer in an industry rife with manipulation fears.

Navigating Bitcoin Volatility Through Prediction Lenses

Bitcoin at $66,819.00 isn’t just a number; it’s a snapshot of macro forces – ETF flows, regulatory whispers, halving echoes. Bitcoin price prediction market tools like these distill that into probabilities updated in real-time. Polymarket’s markets now blur lines between predictions and perpetuals, with $7.6 billion in 30-day volume as of mid-February 2026, up 42.8% month-over-month. Yet, for those eyeing crypto sports betting blockchain crossovers, Event Markets expands the playbook beyond pure crypto.

Bitcoin (BTC) Price Prediction 2027-2032

Long-term forecasts incorporating prediction market innovations, market cycles, regulatory developments, and adoption trends from 2026 baseline of $66,819

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prior Year) |

|---|---|---|---|---|

| 2027 | $75,000 | $95,000 | $130,000 | +36% |

| 2028 | $90,000 | $120,000 | $170,000 | +26% |

| 2029 | $110,000 | $150,000 | $220,000 | +25% |

| 2030 | $140,000 | $200,000 | $300,000 | +33% |

| 2031 | $180,000 | $260,000 | $400,000 | +30% |

| 2032 | $230,000 | $340,000 | $550,000 | +31% |

Price Prediction Summary

Bitcoin’s price is forecasted to experience steady growth through 2032, with average prices climbing from $95,000 in 2027 to $340,000 by 2032 (CAGR ~29%), fueled by DeFi prediction markets, halvings, and mainstream adoption. Ranges account for bearish corrections (min) and euphoric bull peaks (max).

Key Factors Affecting Bitcoin Price

- Expansion of short-term prediction markets like Polymarket’s 5-minute BTC bets enhancing liquidity and volatility trading

- 2028 Bitcoin halving driving supply shock and historical bull cycles

- Increasing institutional adoption and regulatory clarity boosting market cap beyond $5T

- Technological upgrades (e.g., Layer 2 scaling) expanding BTC use cases in payments and DeFi

- Macro factors: inflation hedging amid potential rate cuts; competition from altcoins tempered by BTC dominance

- High 2026 volumes ($4.9B+ on Polymarket) signaling sustained retail and speculative interest

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

These platforms quantify uncertainty methodically. A 72% implied chance of dipping below $65,000 sometime in 2026 underscores long-term caution, but 5-minute slices let you play the now. Event Markets’ user-friendly interface shines here, with crypto deposits yielding instant access, no KYC hurdles, and settlements in under a minute.

Strategic Edges in Ultra-Short Blockchain Markets

Why commit to 5-minute bets when scalping exists? The edge lies in market efficiency and liquidity gauging. Polymarket’s volumes prove skin-in-the-game sharpens forecasts; pros use these as sentiment thermometers before bigger trades. At $66,819.00, with tight 24-hour bounds, liquidity in ‘Up’ shares might signal $67,252.00 retests. Event Markets enhances this with macro event tie-ins, like Fed decisions impacting BTC, creating layered strategies.

Risk management feels intuitive too. Position sizes stay small per bet, capping drawdowns while compounding wins over dozens of rounds daily. For long-term holders, it’s a hedge: volatility bets fund dips without selling core positions. This measured approach aligns with building wealth steadily, turning Bitcoin’s $494.00 daily wiggle into portfolio alpha.

Event Markets takes this further by nesting 5-minute bitcoin price prediction market bets within broader event ecosystems. Imagine pairing a BTC ‘Up’ wager with an election outcome or NFL spread; conditional markets unlock combinatorial plays that Polymarket’s crypto focus overlooks. This hybrid appeal draws sports fans and political junkies into crypto’s orbit, fostering deeper liquidity across categories.

Building a Disciplined Playbook for Short-Term Bets

Discipline separates winners from gamblers in these arenas. Start by tracking implied probabilities against your analysis: if ‘Up’ shares trade at 60 cents on Bitcoin at $66,819.00 but technicals scream bullish post-$65,683.00 low, that’s your edge. Layer in volume cues; Polymarket’s $17 million sprint validates demand, but Event Markets’ lower fees amplify returns on smaller stakes.

Position sizing merits emphasis. Allocate no more than 1% of your stack per 5-minute round, even with 80% hit rates in backtests. This reins in variance, much like dollar-cost averaging into bonds during rate hikes. Over 50 daily markets, a 55% win rate compounds steadily, mirroring the marathon mindset that sustains wealth through cycles.

5 Key 5-Min BTC Bet Strategies

-

1. Momentum Confirmation post-lows like today’s $65,683: Wait for price rebound above the low on Polymarket’s 5-min Up/Down markets to confirm upward momentum before betting ‘Up’. This reduces false signals.

-

2. Pair with Macro Events: Align 5-min BTC bets on Polymarket with broader events like Fed announcements or halvings. Short-term volatility often amplifies during these, improving prediction accuracy.

-

3. Size Bets at 1% Portfolio: Limit each 5-min bet to 1% of your portfolio. With BTC at $66,819, this methodical risk management preserves capital across multiple trades.

-

4. Exit Early on Liquidity Spikes: Monitor Polymarket volume surges and close positions early. High liquidity, like the recent $17M+ in days, signals potential reversals—secure profits promptly.

-

5. Hedge Long Holds with ‘Down’ Plays: Offset long-term BTC positions with short 5-min ‘Down’ bets on Polymarket during pullbacks from highs like $67,252. This balances exposure reassuringly.

Technological reassurances abound. Polygon’s throughput handles peak frenzy without gas wars, while oracle redundancies guard against flash crashes. Event Markets’ dashboard visualizes probabilities evolving live, empowering data-driven calls over gut feels. In a year where Bitcoin’s 24-hour range spanned $1,569 from $65,683.00 to $67,252.00, such tools demystify chaos.

Event Markets as Your Gateway to Smarter Speculation

What sets Event Markets apart in this crowded field? Breadth. While Polymarket dominates crypto with billions in 2026 volume, Event Markets weaves crypto sports betting blockchain seamlessly, letting you pivot from BTC 5-minutes to election odds or Super Bowl totals on one ledger. No silos, just unified exposure to real-world edges. For the CFA-minded trader, this diversification tempers crypto’s wild swings, akin to balancing equities with treasuries.

Regulatory tailwinds bolster confidence too. As prediction markets mature, blockchain’s transparency courts legitimacy, sidestepping centralized exchange pitfalls. Betting Bitcoin’s next $494.00 twitch at $66,819.00 becomes not just sport, but a calibrated forecast honing your market read. Volumes speak: Polymarket’s $4.9 billion year-to-date underscores the trend, with 5-minute innovations driving adoption.

Zoom out to portfolio implications. These blockchain short term bets serve as alpha generators atop HODLing, funding accretive buys without liquidation stress. A measured 10% allocation yields uncorrelated returns, smoothing drawdowns in macro downturns. Event Markets’ intuitive onboarding – wallet connect, USDC deposit, instant markets – lowers barriers, inviting methodical engagement over FOMO rushes.

Platforms evolve fast; by late 2026, expect 1-minute slices or AI-augmented odds. Yet the timeless lesson holds: precision in short bursts builds enduring gains. With Bitcoin steady at $66,819.00 amid measured volatility, now’s the moment to explore these tools, transforming daily wiggles into strategic wins on a platform built for the long game.

Discover how blockchain prediction markets are disrupting sports and election betting