Opinion Labs vs Polymarket: Weekly Volume Leaders in Blockchain Prediction Markets for Sports Betting 2026

In the high-stakes arena of blockchain prediction markets 2026, Opinion Labs and Polymarket are locked in a fierce battle for weekly volume supremacy, especially within crypto sports betting platforms. As prediction markets shattered records with over $76 billion in total volume, driven by sports betting explosions and election fervor, these two platforms stand out. Opinion Labs recently outpaced Polymarket’s weekly notional volume by 25% during the week of December 29,2025, signaling a shift in the polymarket vs opinion labs dynamic. Yet Polymarket countered with 217% more weekly users, highlighting divergent paths to dominance.

Explosive Growth Fuels Sports Betting Volume Race

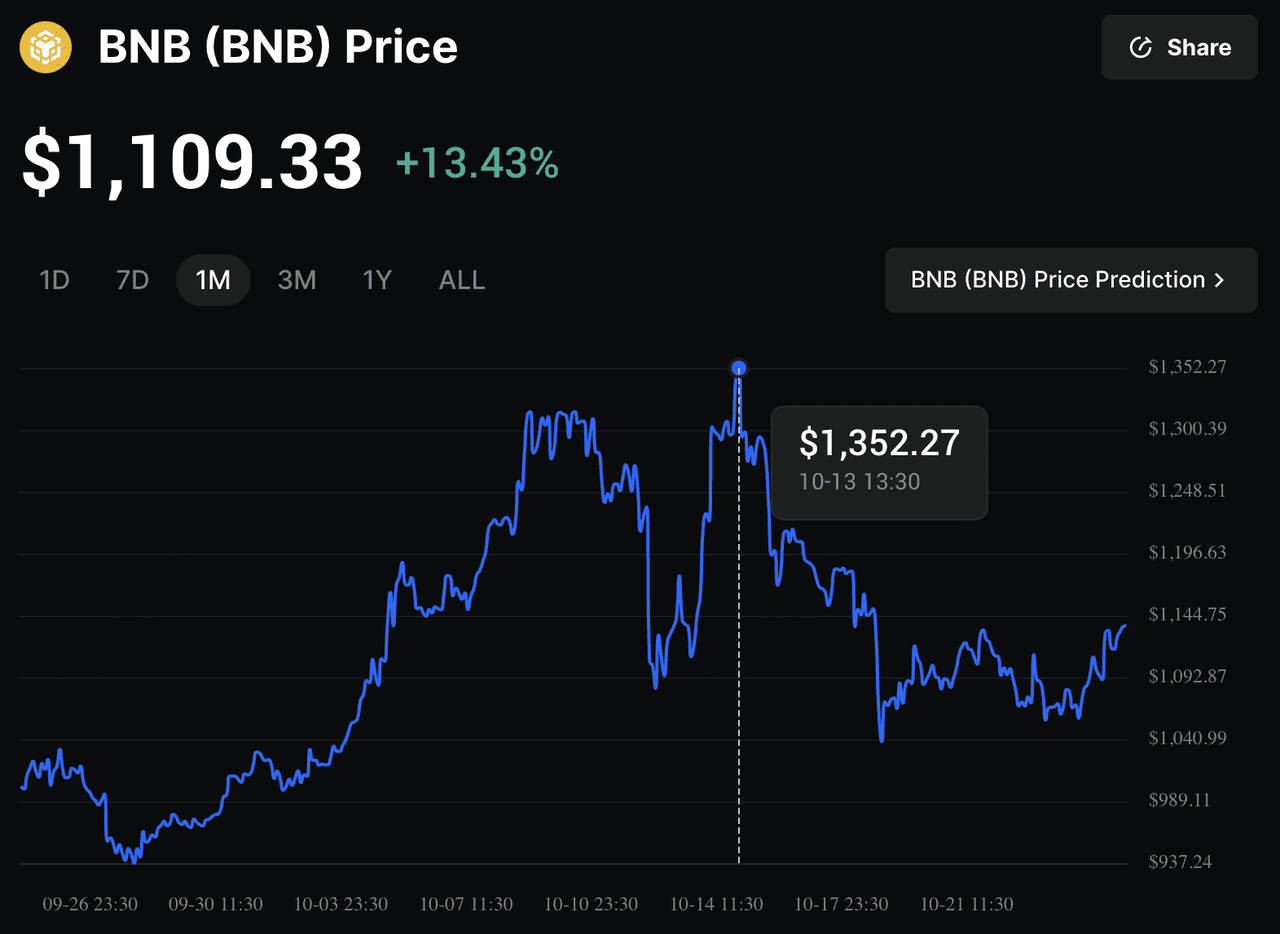

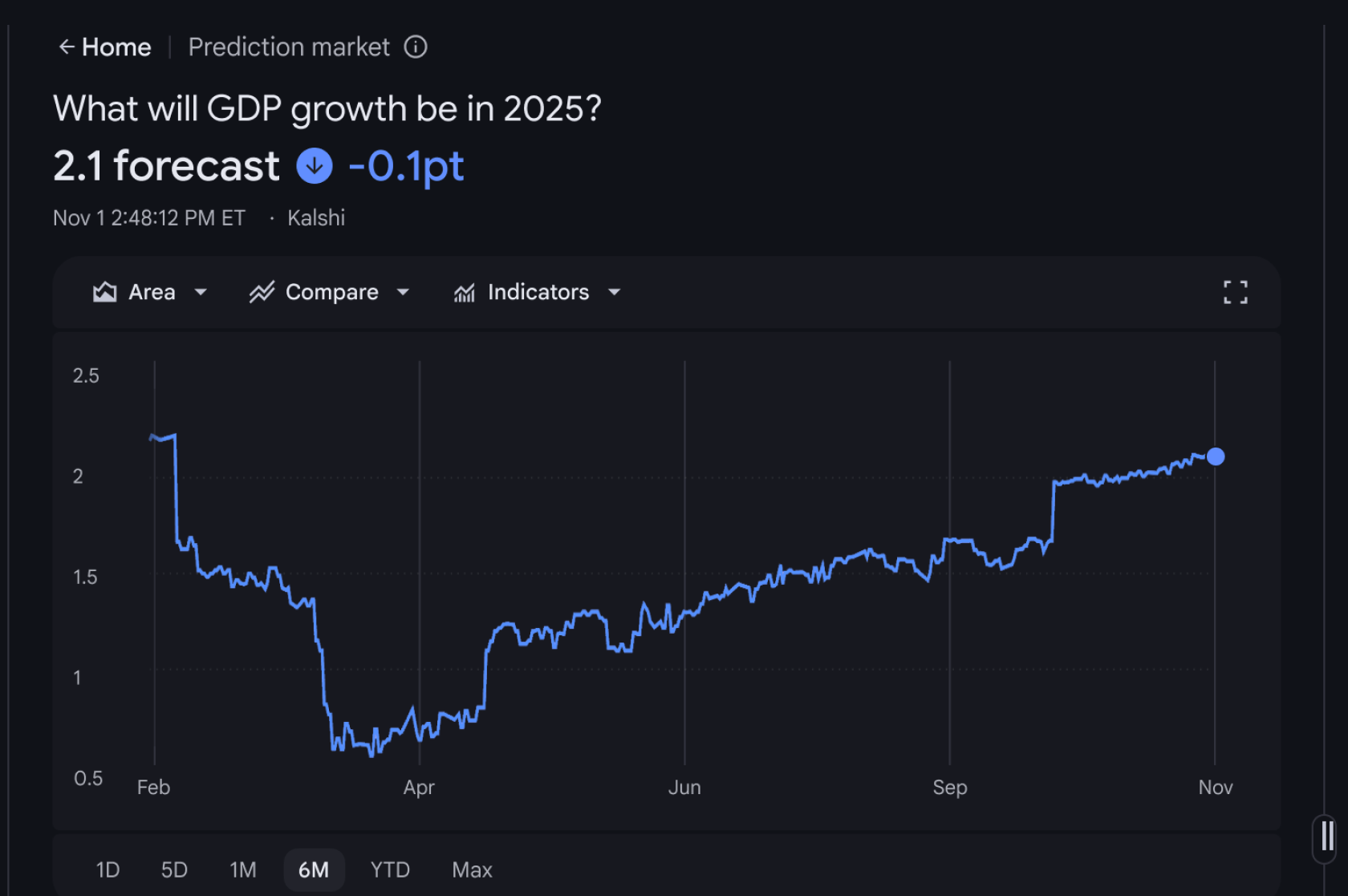

The broader prediction market ecosystem has transformed into a $76 billion industry, with sports volumes nearing $1 billion per week and open interest consistently above $100 million. Kalshi leads overall, capturing 66.4% of global trades by early January 2026 thanks to regulatory nods and Robinhood integration, but blockchain pure-plays like Opinion Labs and Polymarket are carving niches in decentralized sports and election bets. Opinion Labs, backed by Binance’s YZi Labs and built on BNB Chain, processed $2.17 billion in volume over the first 20 days of January 2026 alone. Its 7-day volume hit $725.56 million, while 30-day figures reached $3.35 billion, ranking it third overall.

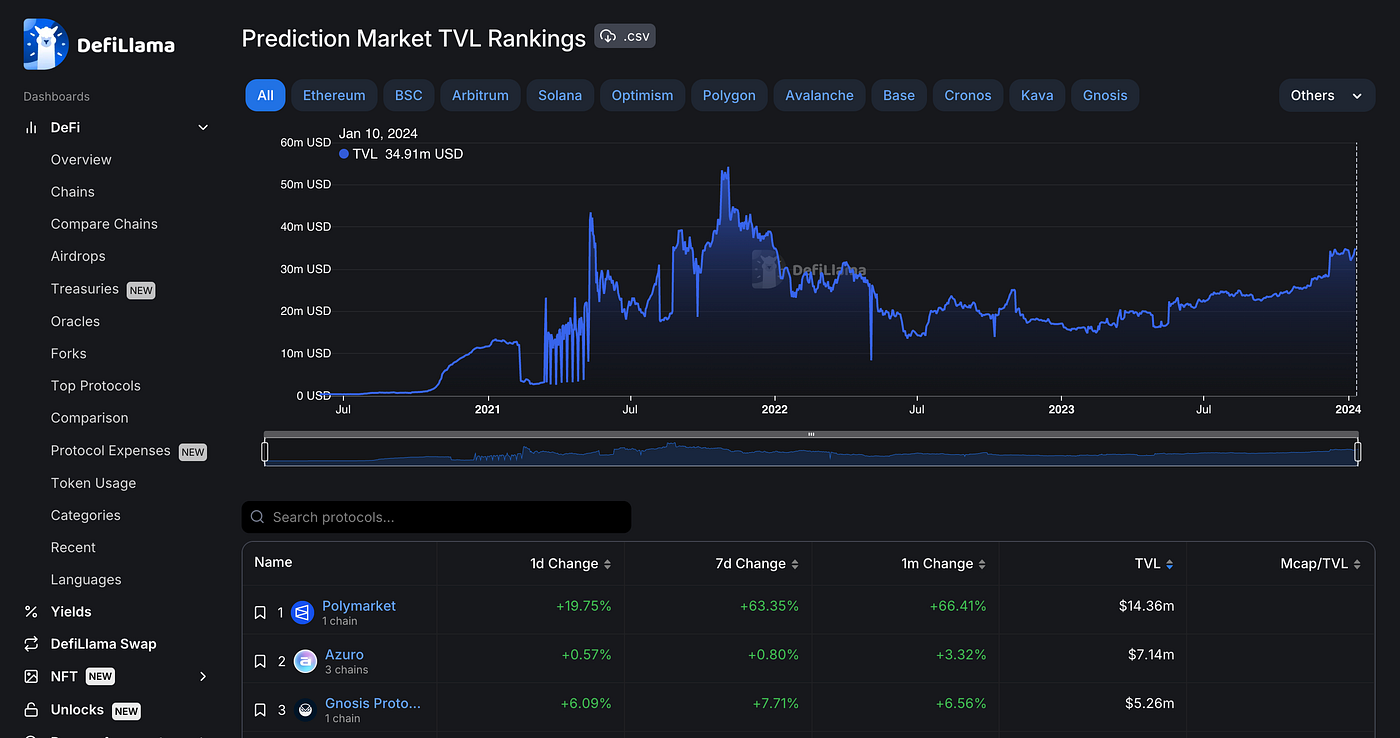

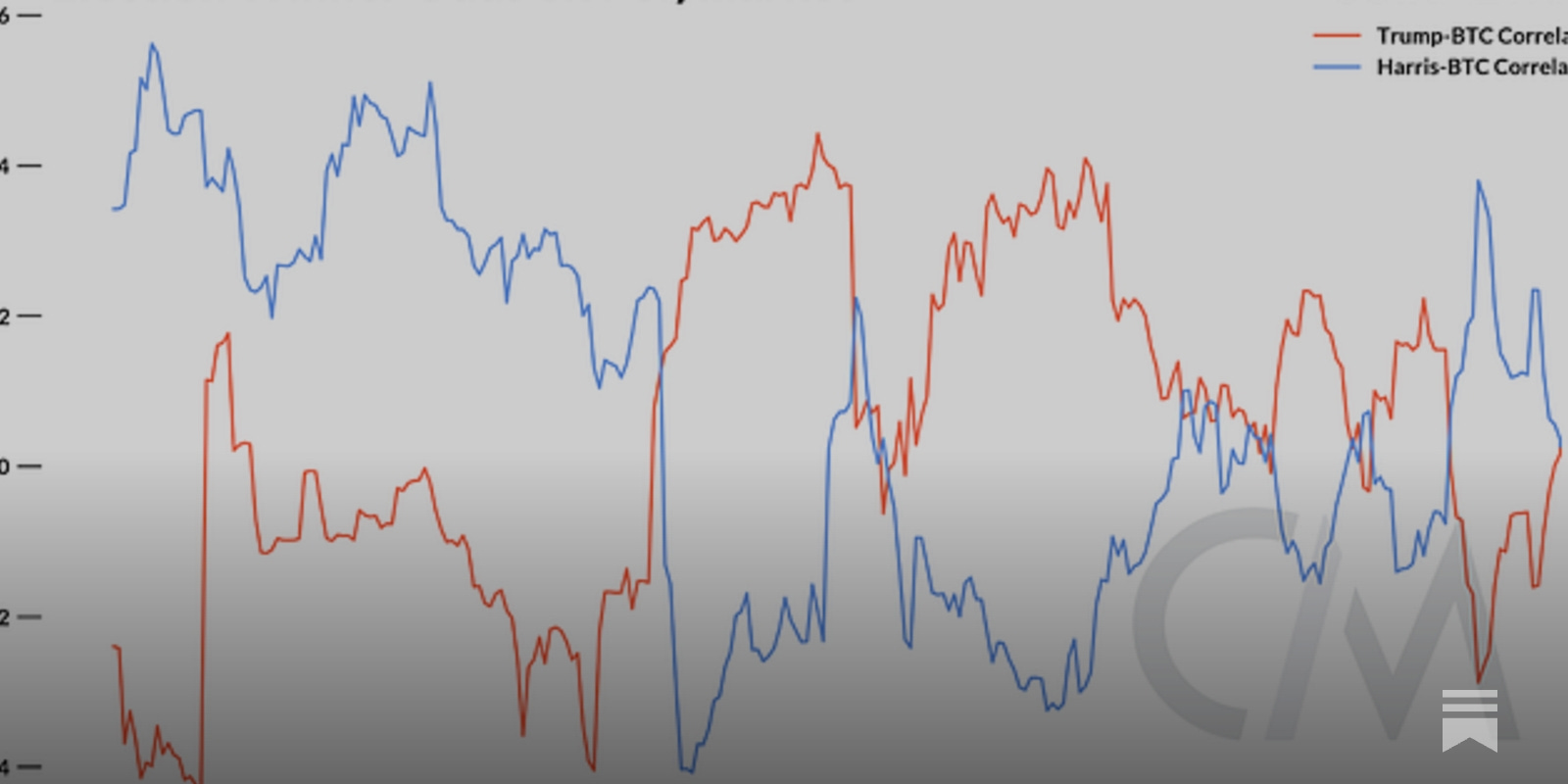

Polymarket, no stranger to scale, contributed $21.5 billion to December 2025’s cumulative trading, building on its infamous $3.6 billion wager on a single 2024 election outcome. Monthly volumes peaked at $2.6 billion, with sports markets drawing heavy action despite some high-profile losses, like two traders dropping nearly $10 million on bets at 48-57 cents odds. This prediction market weekly volume surge underscores how blockchain platforms are disrupting traditional betting, offering transparent, low-fee alternatives for crypto-savvy users.

Opinion Labs Emerges as Volume Powerhouse

Launched in October 2025, Opinion Labs wasted no time disrupting the leaderboard. By November 17, it amassed $3.1 billion in cumulative notional volume, averaging $132.5 million daily. The week of November 11-17 saw it lead with $1.5 billion weekly, grabbing 54.3% of fee share at over $1.5 million generated. This edge stems from BNB Chain’s efficiency, enabling high-frequency trades with minimal friction. In sports betting, where milliseconds matter, Opinion Labs’ design caters to rapid markets, positioning it as a contender in decentralized election markets and beyond.

What sets Opinion Labs apart? Its aggressive expansion on a cost-effective chain appeals to volume chasers. During the December 29 week, it not only beat Polymarket’s volume but smashed fee records alongside quick crypto up/down bets. As sports betting dominates up to 98% of some platforms’ activity, Opinion Labs’ opinion labs volume trajectory suggests it’s optimizing for this megatrend.

Drivers of Opinion Labs’ 25% Lead

-

BNB Chain Efficiency: Low-cost, high-speed transactions on BNB Chain fueled $725.56M 7-day and $3.35B 30-day volumes, enabling larger trades vs Polymarket.

-

Binance Backing: Supported by Binance’s YZi Labs, Opinion Labs hit $2.17B volume in Jan 2026’s first 20 days, drawing ecosystem liquidity.

-

Larger Bet Sizes: Despite Polymarket’s 217% more users, Opinion Labs’ 25% volume edge shows traders placing bigger bets on sports markets.

-

Rapid Sports Growth: Launched Oct 2025, reached $1.5B weekly volume by Nov, capitalizing on sports betting surge to $1B/week industry-wide.

-

Fee Market Dominance: Captured 54.3% share with $1.5M fees vs Polymarket’s $787K, signaling strong trader retention and liquidity.

Polymarket’s Resilience Through Diversification

Polymarket’s story is one of endurance and scale. With $33.45 billion in total volume alongside Kalshi’s $43.16 billion, it remains a flow leader. Its user base dwarfs competitors – 217% more than Opinion Labs in late December – fueled by diverse bets spanning economics, tech, culture, and sports. This breadth mitigates risks from any single vertical, even as sports bets expose vulnerabilities, like the $10 million trader wipeouts.

Yet Polymarket’s quick 15-minute crypto bets generated $787,000 in fees recently, proving its innovation in short-term plays. In a landscape where Kalshi rules regulated U. S. sports, Polymarket’s decentralized ethos keeps it relevant globally, especially as blockchain prediction markets evolve for 2026’s high-volume sports seasons.

Head-to-head metrics reveal why the polymarket vs opinion labs rivalry captivates traders. Opinion Labs prioritizes raw opinion labs volume, leveraging BNB Chain’s low costs for high-throughput sports bets. Polymarket, however, banks on user stickiness through varied markets, from crypto price binaries to cultural events. This contrast plays out in fees: Opinion Labs claimed 54.3% share with $1.5 million, outstripping Polymarket’s $787,000 from nimble 15-minute trades. As prediction market weekly volume climbs, platforms blending speed and diversity may pull ahead.

📊 Opinion Labs vs Polymarket vs Kalshi: January 2026 Key Metrics Comparison

| Metric | Opinion Labs | Polymarket | Kalshi |

|---|---|---|---|

| Weekly Notional Volume | $725.56M (7-day) | N/A | $2B+ (week ending Jan 11) |

| Volume (first 20 days Jan) | $2.17B | N/A | N/A |

| Market Share (early Jan) | N/A | N/A | 66.4% |

| Sports Betting % of Volume | High (ranks 3rd in volumes) | Diversified incl. sports | Up to 98% |

| Open Interest (Sports) | >$100M regularly | >$100M regularly | >$100M regularly |

| Weekly Users (Dec 29 week ref.) | Base | 217% more than Opinion Labs | N/A |

| Recent Fees (proxy for activity) | $1.5M (54.3% share) | $787K | N/A |

| Performance Notes | Outpaced Polymarket volume by 25% (Dec 29) | High user growth; sports bets e.g. $10M losses | Regulatory approval; Robinhood integration |

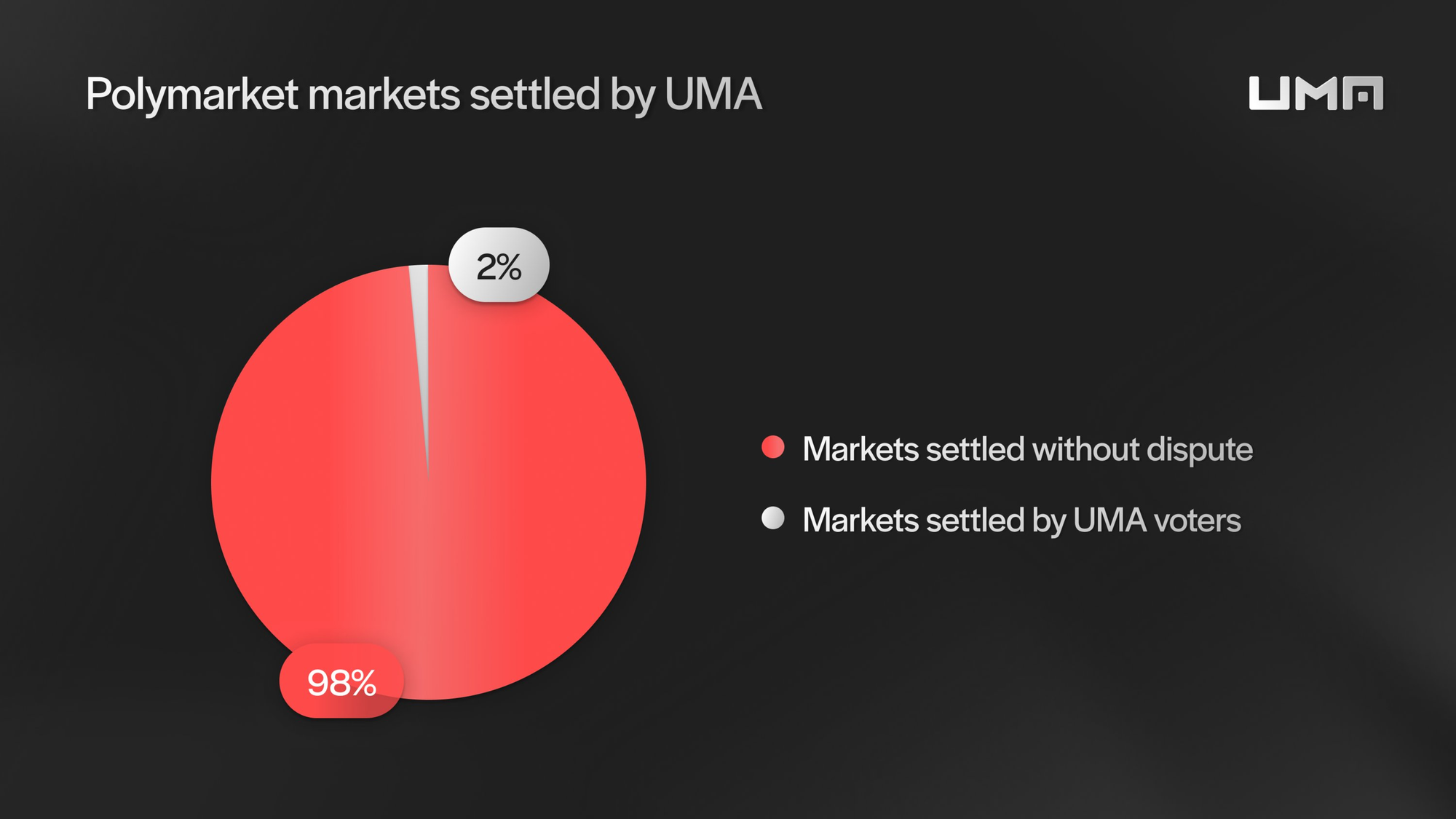

Traders weigh these dynamics daily. Opinion Labs suits volume hunters chasing sports liquidity; its $3.35 billion 30-day mark signals scalability. Polymarket appeals to diversified portfolios, where a single election bet once hit $3.6 billion. Both platforms smash traditional books by settling on-chain, slashing disputes and enabling global access.

Strategic Edges and Blind Spots

Opinion Labs’ playbook hinges on chain-native perks. Backed by YZi Labs, it hit $3.1 billion cumulative by mid-November 2025, averaging $132.5 million daily. This velocity thrives in sports’ high-frequency bets, from player props to live in-play wagers. Blind spots? Smaller user base limits oracle diversity, risking manipulation in niche events.

Polymarket’s strength lies in network effects. Its 217% user lead fosters tighter spreads and faster resolutions, vital for decentralized election markets bleeding into sports. Yet sports-heavy bets expose it to variance; 46.24% win rates on 346 predictions underscore the house-free edge, but also sharper losses. Quick bets innovate, pulling fees despite volume dips.

Opinion Labs vs Polymarket: Pros & Cons

-

Opinion Labs Pro: Volume Leadership – Outpaced Polymarket by 25% in weekly notional volume (e.g., $1.5B week of Nov 11-17, 2025; $725.56M 7-day).

-

Opinion Labs Pro: Rapid Growth – $3.1B cumulative by Nov 17, 2025; $2.17B in first 20 days of Jan 2026 on BNB Chain.

-

Opinion Labs Pro: Fee Dominance – Captured 54.3% share with over $1.5M fees vs Polymarket’s $787K.

-

Polymarket Pro: Massive Scale – $33.45B total volume; $21.5B in Dec 2025; $3.6B on single 2024 election.

-

Polymarket Pro: User Engagement – 217% more weekly users than Opinion Labs in key weeks.

-

Polymarket Con: Sports Losses – Traders lost nearly $10M on sports markets in under a month.

-

Opinion Labs Con: Newer Platform – Launched Oct 2025, shorter track record vs Polymarket’s established history.

-

Polymarket Con: Volume Lags – Trailed Opinion Labs in select weekly volumes despite overall scale.

Forward-looking, 2026’s calendar favors aggressors. Olympics, midterm primaries, and crypto bull runs will test throughput. Opinion Labs’ BNB momentum could erode Kalshi’s lead if U. S. regs tighten offshore access. Polymarket’s diversification hedges volatility, positioning it for macro crossovers like Fed rate bets influencing game-day economies.

Opinion Labs Price Prediction 2027-2032

Projections based on Q1 2026 weekly volume leadership ($1.2B avg for Opinion Labs vs. $900M for Polymarket) and sports betting market expansion

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2027 | $0.95 | $1.85 | $3.60 |

| 2028 | $1.40 | $2.95 | $6.20 |

| 2029 | $2.10 | $4.70 | $10.50 |

| 2030 | $3.15 | $7.50 | $16.80 |

| 2031 | $4.70 | $11.80 | $26.00 |

| 2032 | $7.00 | $18.50 | $40.00 |

Price Prediction Summary

Opinion Labs is forecasted to see robust price appreciation from 2027 to 2032, with average prices rising from $1.85 to $18.50 (~58% CAGR), driven by dominance in high-volume sports betting prediction markets. Minimums reflect bearish scenarios like regulatory hurdles, while maximums capture bullish outcomes from market share gains, crypto cycles, and adoption surges exceeding $5B+ annual platform volumes.

Key Factors Affecting Opinion Labs Price

- Explosive volume growth: $1.2B weekly avg in Q1 2026, $2.17B in Jan 2026 first 20 days

- Sports betting dominance amid major events and calendar trends

- BNB Chain scalability and YZi Labs backing enhancing competitiveness

- Regulatory progress favoring decentralized prediction markets post-2025

- Intensifying rivalry with Polymarket and Kalshi spurring innovation and user growth

- Alignment with crypto bull cycles (2028-2029 peak) and broader DeFi adoption

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Data-driven bettors thrive here. Platforms like these turn crowd wisdom into tradable edges, with blockchain ensuring immutability. Opinion Labs’ volume crown may rotate weekly, but its BNB roots signal staying power. Polymarket’s user moat endures, blending sports surges with election spectacle. As volumes eclipse $5.3 billion records, savvy participants pick platforms matching their risk appetite, riding the wave of prediction markets’ ascent.