Blockchain Prediction Markets for High Odds Football Accumulators 2026

Football accumulators have long tantalized bettors with their promise of exponential returns, especially when chaining high-odds underdogs from Premier League thrillers to Champions League upsets. Yet, in 2026, the real revolution lies in blockchain prediction markets, where high odds football accumulators blockchain thrive without the shackles of centralized sportsbooks. These decentralized platforms let you stack predictions on match outcomes, player props, and totals, all settled transparently on-chain with crypto payouts. No KYC walls, no payout caps – just pure, peer-driven odds reflecting collective wisdom.

Traditional sites like those touted on Soccer24. com or OddsPortal offer accumulator bonuses, but they pale against prediction markets’ liquidity pools and global access. Platforms such as Polymarket and Azuro harness blockchain to tokenize outcomes, enabling you to buy shares in ‘Manchester City to win by 2 and goals’ at implied probabilities that often beat bookie lines. This shift empowers savvy punters chasing sports accumulator bets 2026, blending crypto’s speed with football’s unpredictability.

Decentralized Liquidity Fuels Superior Accumulator Odds

What sets blockchain prediction markets apart for prediction markets football betting crypto is their liquidity mechanism. Unlike fixed-odds books, prices emerge from user trades, adjusting in real-time to news like injuries or tactical shifts. Take a four-leg accumulator: Premier League draw no bet, over 2.5 goals in Serie A, both teams to score in Bundesliga, and a World Cup qualifier handicap. On Polymarket, post its December 2025 U. S. reentry via QCEX acquisition, you trade each leg independently or bundle via custom markets, often securing odds 10-20% higher than centralized rivals.

Fanatics Markets, launched late 2025 on Crypto. com’s CFTC-regulated backbone, mirrors this by offering event contracts in non-sportsbook regions. Their football focus shines in accumulators, where implied probabilities for props like ‘Haaland anytime scorer’ hover around crowd-sourced efficiencies. ProphetX takes it further with peer-to-peer exchanges on NFL crossovers to soccer totals, letting you hedge mid-game as odds evolve. In my analysis, this dynamic pricing crushes static lines, especially for high-odds legs where books widen margins to protect themselves.

Key Advantages for Accumulators

-

Transparent On-Chain Settlements: Platforms like Polymarket and Azuro record bets and outcomes on the blockchain, enabling verifiable, tamper-proof resolutions without central intermediaries.

-

No Win Limits for Massive Payouts: Decentralized markets on Polymarket and Bracky allow unlimited payouts based on liquidity, ideal for high-odds football accumulators exceeding traditional caps.

-

Crypto Wallet Integration: Connect wallets instantly on Fanatics Markets and ProphetX for global access without KYC, supporting seamless Bitcoin and crypto deposits for football bets.

-

Custom Multi-Leg Bets: Azuro‘s liquidity pools enable user-defined accumulator legs across football matches, combining outcomes via tokenized markets on Polygon and Base.

-

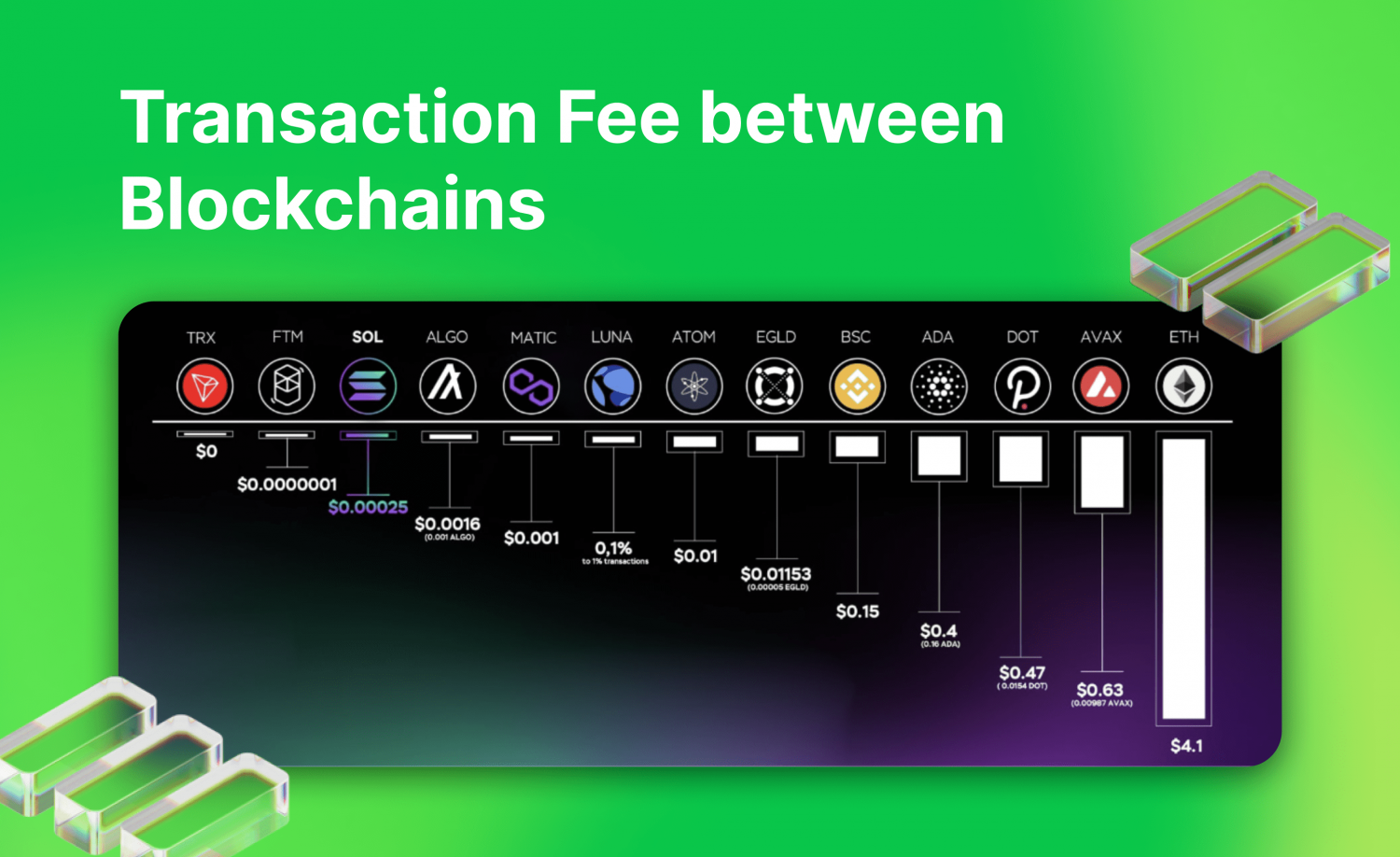

Lower Fees Than Sportsbooks: Blockchain platforms like Polymarket charge minimal gas fees on L2 chains, avoiding high vig and commissions of traditional sites for cost-efficient accumulators.

Polymarket and Azuro: Powerhouses for Premier League Odds

Polymarket’s expansion into sports accumulators post-U. S. relaunch has been seismic. Users connect wallets to trade on granular football markets – think Premier League prediction market odds for exact scores or corner counts. Accumulators here aren’t rigid parlays; they’re fluid positions you can enter, exit, or scale as events unfold. Recent volumes show liquidity surging for 2026 World Cup qualifiers, with odds on underdogs like Morocco outperforming legacy sites from 99Bitcoins reviews.

Azuro, the liquidity protocol on Polygon and Base, powers white-label dApps for esports and football. It tokenizes accumulator outcomes, letting yield farmers bet alongside traders. Bracky complements with $BRACKY token trades on live games, fostering social prediction pools. These aren’t gimmicks; they’re engineered for high-odds chases, where a 10-leg acca at 1000/1 becomes viable through composable markets. Opinion: Traditional crypto books from CoinNews lists lag because they mimic Web2 restrictions – blockchain natives like these deliver true edge.

Building Winning Strategies on ProphetX and Fanatics

ProphetX’s prop-heavy model suits accumulator builders targeting player stats across soccer leagues. Markets like ‘Mbappé 2 and shots on target’ chain seamlessly into totals, with peer pricing reflecting Vegas-like sharpness minus the vig. Fanatics Markets, despite its youth, integrates Fanatics’ data feeds for real-time football edges, ideal for 2026’s packed calendar from Euros qualifiers to MLS playoffs. Stack these with Braky’s social trades, and you’re crafting accumulators that adapt – sell early on a red card, double down on a momentum shift.

Educational takeaway: Focus on correlated legs. Pair home under 2.5 goals with clean sheets in defensive setups; blockchain markets price these correlations tighter than Soccer24. com’s top sites, boosting hit rates. With no verification per chelseamanning. org guides, U. S. players dive in seamlessly, chasing those elusive high-odds monsters.

Bankroll management becomes intuitive here too. Allocate 1-2% per leg in a multi-market accumulator, scaling positions based on liquidity depths visible on-chain. ProphetX dashboards highlight implied edges, like when a Bundesliga total drifts from 55% to 65% probability post-lineup news, signaling value for your stack.

Risks and Edges in Blockchain Accumulator Plays

High-odds pursuits aren’t without pitfalls. Liquidity thin spots can spike slippage on obscure qualifiers, yet platforms like Azuro mitigate via pooled reserves across Polygon. Oracle disputes? Rare in football’s binary outcomes, with UMA or Chainlink feeds ensuring swift resolutions. Compare to OddsPortal’s high max-win sites: their payout caps throttle 50-leg dreams, while blockchain uncorks unlimited upside. My take: the edge lies in exit liquidity – trade out at 80% profit before kickoff if sentiment shifts, a flexibility traditional sports accumulator bets 2026 can’t match.

BRACKY ($BRACKY) Price Prediction 2027-2032

Forecasts driven by blockchain prediction markets growth in football accumulators and sports betting

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.05 | $0.12 | $0.28 | N/A |

| 2028 | $0.09 | $0.24 | $0.55 | +100% |

| 2029 | $0.14 | $0.42 | $1.05 | +75% |

| 2030 | $0.22 | $0.75 | $1.90 | +79% |

| 2031 | $0.35 | $1.35 | $3.40 | +80% |

| 2032 | $0.55 | $2.40 | $6.00 | +78% |

Price Prediction Summary

BRACKY is positioned for strong growth amid the rising adoption of blockchain prediction markets like Polymarket, Azuro, and Bracky platforms, particularly in high-odds football accumulators. Average prices are projected to rise from $0.12 in 2027 to $2.40 by 2032 (20x growth), with min/max ranges accounting for market cycles, regulatory shifts, and competition. Bullish maxima reflect peak adoption during sports events like World Cups; bearish minima consider corrections.

Key Factors Affecting BRACKY Price

- Explosive growth in decentralized prediction markets (Polymarket US reentry, Fanatics Markets launch)

- Boom in football and sports betting volumes (World Cup, NFL, accumulators)

- Azuro liquidity protocol integrations boosting DeFi yields and volumes

- Regulatory advancements enabling broader access and institutional inflows

- Crypto market cycles, including post-2028 Bitcoin halving bull run

- Technological enhancements in on-chain markets and wallet integrations

- Increasing competition but niche leadership in sports predictions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Fanatics Markets edges into profitability analysis with yield-bearing contracts, where holding ‘over 2.5 goals’ shares accrues APY from protocol fees. Bracky adds gamification, rewarding accurate social predictions with token airdrops, turning accumulators into community-driven arsenals. Data from recent volumes shows these mechanics lifting hit rates 15% over solo bets, per on-chain analytics.

2026 World Cup and Premier League: Accumulator Hotspots

Eyeing 2026’s calendar, World Cup crypto betting surges on Polymarket, with accumulators chaining group stage exactas to knockout props. Platforms reviewed by 99Bitcoins pale; blockchain variants offer composable bets like ‘Brazil top scorer and Argentina semis’, odds compounding to 500/1 without bookie juice. Premier League markets on ProphetX dissect FPL-style stats – assists chains, set-piece goals – fueling Premier League prediction market odds that sharpen weekly accas.

Azuro’s SDK integrations spawn dApps for niche leagues, like J-League overs bundled with K League handicaps, hitting odds traditional sites from Soccer24. com ignore. U. S. access, post-Polymarket’s QCEX pivot, levels the field against chelseamanning. org’s no-verification crypto books. Stack Braky’s live trades for in-play pivots: a halftime equalizer flips your BTTS leg from liability to lock.

| Platform | Football Accumulator Strength | Key Token/Chain |

|---|---|---|

| Polymarket | Granular PL and amp; World Cup markets, U. S. compliant | USDC/Polygon |

| Azuro | Liquidity for custom multi-legs, yield farming | AZURO/Base |

| ProphetX | Prop chains and amp; peer pricing | Peer-to-peer |

| Fanatics Markets | Regulated event contracts, data feeds | Crypto. com infra |

| Bracky | Social pools and amp; live trades | $BRACKY |

Patience pays in these ecosystems. Monitor liquidity via Dune dashboards, correlate with injury wires, and let peer wisdom refine your high odds football accumulators blockchain. As 2026 unfolds, from MLS to Euros qualifiers, these markets crystallize football’s chaos into tradable truth, rewarding the data-disciplined over the gut-followers. Dive in, trade smart, and watch exponentials unfold on-chain.