Solana Prediction Markets for NBA Betting: Top Crypto Platforms 2026

Solana’s SOL sits at $81.05, nursing a 4.71% drop over the past 24 hours after touching $85.99. This dip barely dents its momentum in solana nba betting. Fans now wager crypto on live quarters, player props, and parlays with sub-second settlements that legacy books can’t match. Platforms built on Solana turn NBA games into liquid markets, blending DeFi yields with sports action.

NBA stars like Tristan Thompson fuel this shift. He launched basketball. fun, tokenizing athletes as tradable assets. Pair that with Kalshi’s on-chain jump to Solana, and you’ve got TradFi order flow meeting crypto speed. Lines move like stocks now, not casino odds. Discipline here means spotting edges before the herd piles in.

Solana Crushes Legacy Betting for NBA Props

Solana’s 65,000 TPS and fees under $0.01 make it perfect for crypto prediction markets nba. No more waiting minutes for bets to clear during a Curry hot streak. Platforms like Hedgehog Markets use AMM pools for instant liquidity on any NBA outcome, from spread bets to over/unders. TVL tops $20M across 2,500 and markets, proving demand.

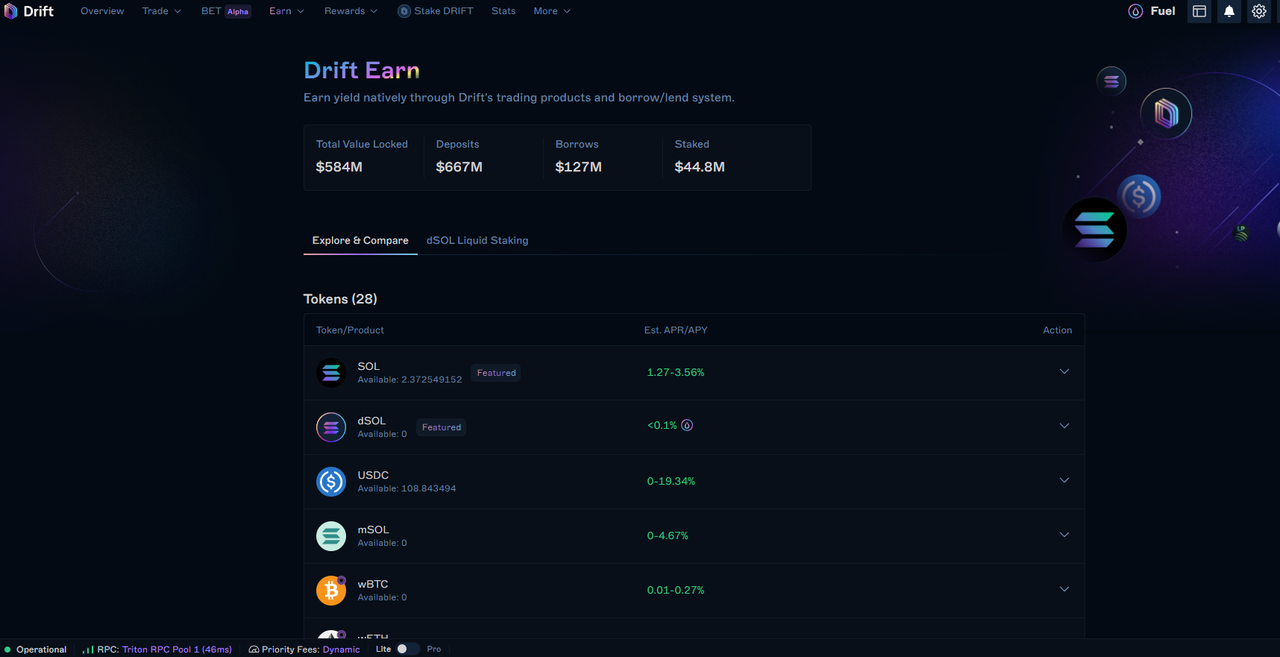

Regulatory fog lingers, but NBA teams eye blockchain revenue streams. DraftKings adds player contracts via new deals, yet on-chain spots like Drift BET outpace them with yield on collateral. Post SOL, USDC, or mSOL, earn real returns while holding positions. Permissionless market creation hits early 2026, letting you launch verified NBA props tied to oracles.

Top Solana Platforms: basketball. fun to Drift Protocol

Start with basketball. fun. Thompson’s brainchild lets you trade NBA stars like stocks. Bet on LeBron’s triple-doubles or Jokic assists; outcomes settle fast on Solana. It’s fan-owned disruption, pulling in crypto natives tired of Vegas vig.

BetDEX follows, a pure play on decentralized order books. No pools, just peer-to-peer matches for NBA moneylines and totals. Low slippage on big games, non-custodial wallets keep funds yours. Perfect for parlays across Eastern Conference clashes.

Hedgehog Markets innovates with Uniswap-style pools. Classic books, spreads, contests, all instant. Bet ranges on Harden points or contest friends on playoff odds. Aggregated liquidity kills fragmented books.

Azuro Protocol powers oracle-secured events. NBA games feed directly, no disputes. Integrates across chains but thrives on Solana speed for live in-play bets. Builders use it for custom NBA markets without coding headaches.

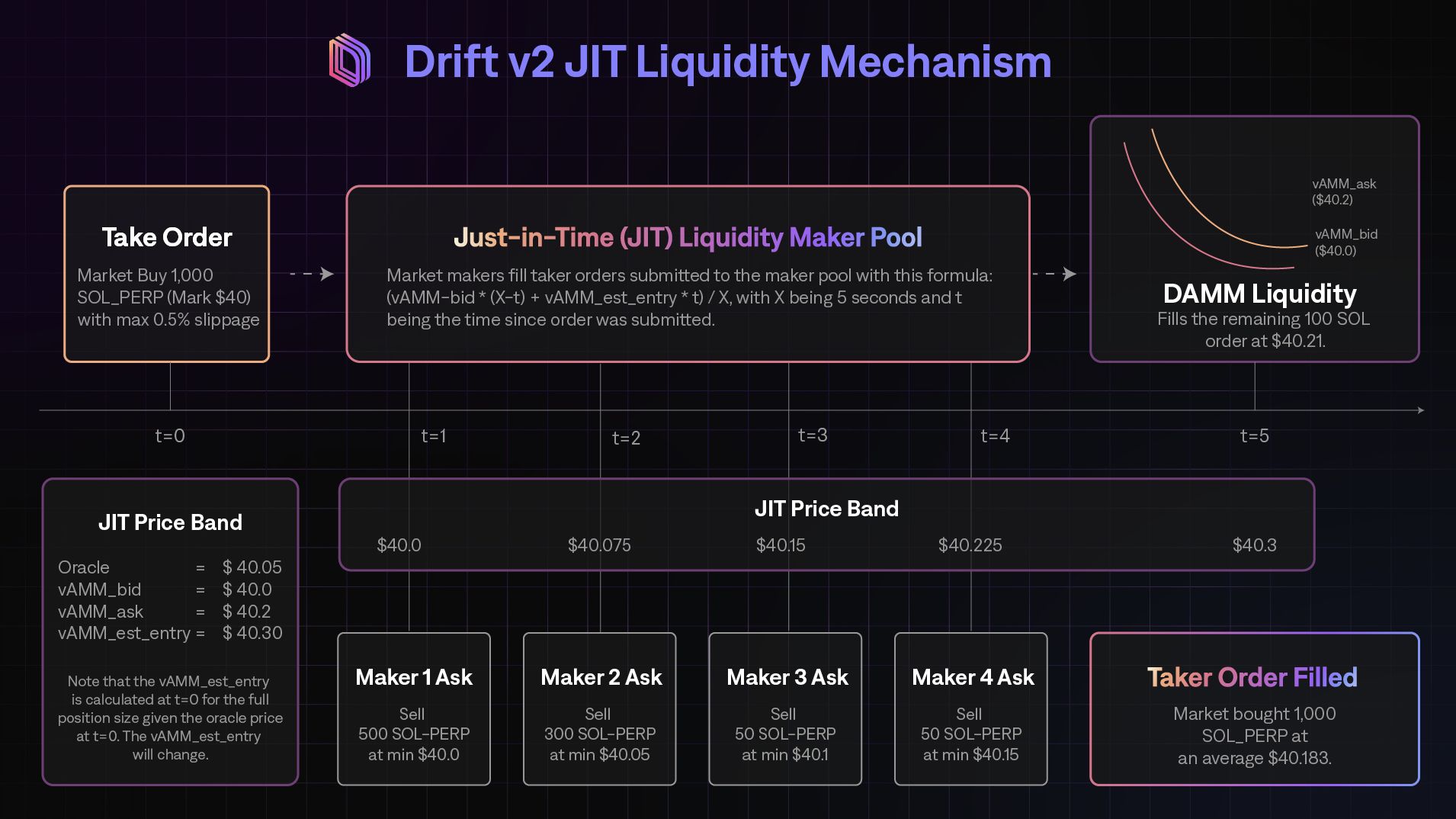

Drift Protocol via Drift BET embeds predictions in perps and lending. Margin in 30 assets, earn yield on idle capital. Transform a Warriors win bet into passive income. DAO governance opens floodgates for community NBA markets.

Solana (SOL) Price Prediction 2027-2032

Forecasts driven by Solana’s leadership in NBA prediction markets, high-speed blockchain adoption, and sports betting platforms amid bullish market cycles

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2027 | $180 | $320 | $500 |

| 2028 | $250 | $480 | $750 |

| 2029 | $350 | $650 | $1,100 |

| 2030 | $450 | $850 | $1,500 |

| 2031 | $600 | $1,100 | $1,900 |

| 2032 | $800 | $1,400 | $2,500 |

Price Prediction Summary

Solana’s price is projected to surge from an estimated $200 end-2026 baseline, fueled by explosive growth in prediction markets like Drift BET, Hedgehog, and Jupiter integrations with NBA betting. Average prices could climb to $1,400 by 2032 in a bullish scenario, with min/max ranges accounting for market cycles, regulatory hurdles, and competition. YoY average growth targets 30-40% amid adoption trends.

Key Factors Affecting Solana Price

- Booming Solana-based NBA prediction markets (Drift BET, Hedgehog, Jupiter, Kalshi on-chain) driving TVL and usage

- High-speed/low-cost advantages positioning SOL as go-to for real-time sports betting

- Regulatory developments in prediction markets and crypto sports integration (e.g., NBA, DraftKings, Coinbase)

- Crypto market cycles with potential 2028-2029 bull run post-2026 peak

- Technological upgrades enhancing scalability and oracle integrations

- Market cap expansion potential to $500B+ by 2032, competition from ETH L2s and AVAX

- Macro factors: TradFi adoption (Kalshi, Coinbase) and sports token emergence

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

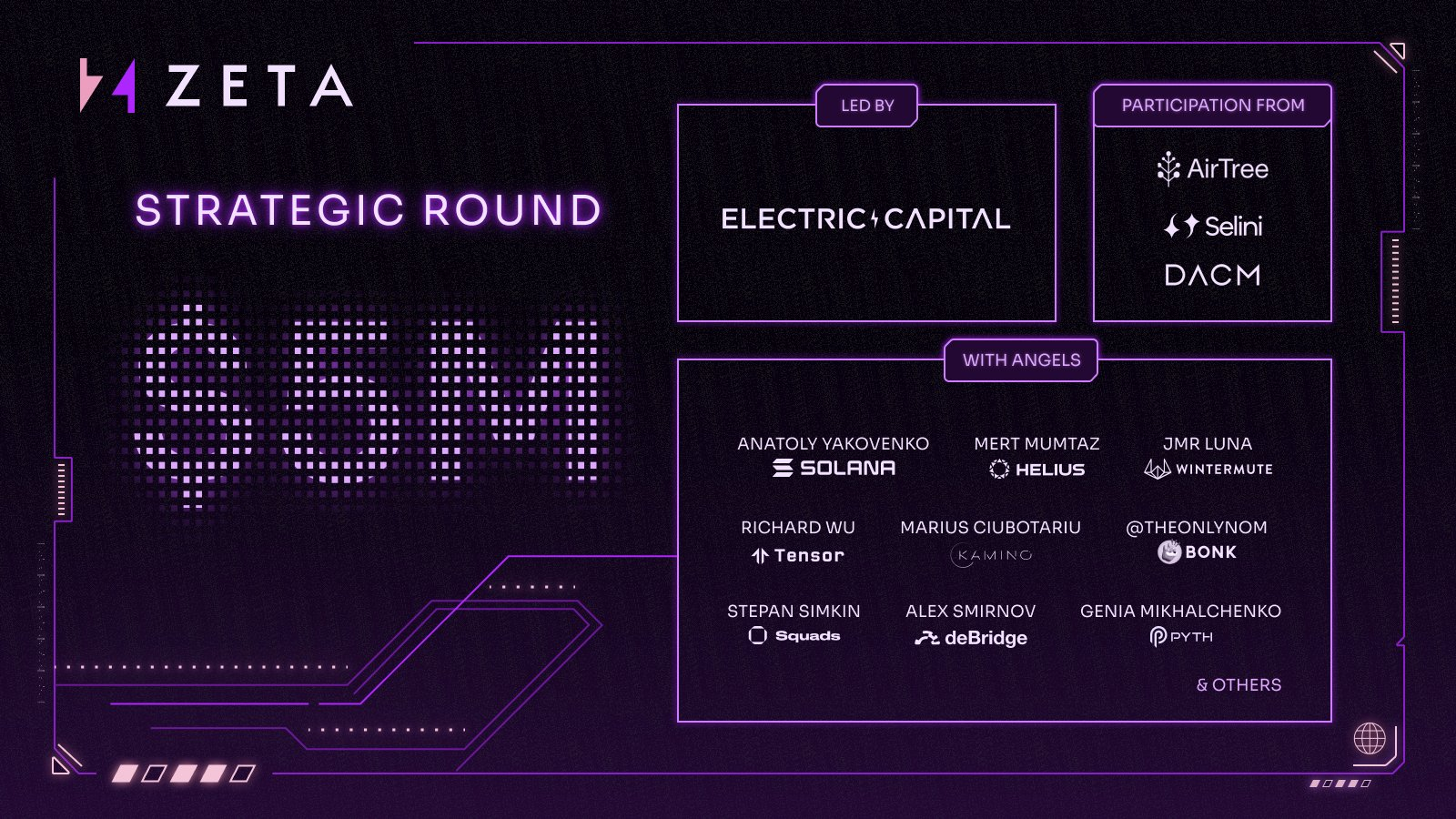

Zeta Markets and Beyond Raise the Yield Bar

Zeta Markets blends perps with event contracts. Long volatility on NBA finals or short underdogs; leverage without liquidation roulette. Solana backbone ensures ticks update mid-possession.

Mango Markets adds lending twist. Borrow against NBA positions, compound bets. Cross-margin across sports keeps capital efficient. Risk-managed, it fits swing traders eyeing multi-game series.

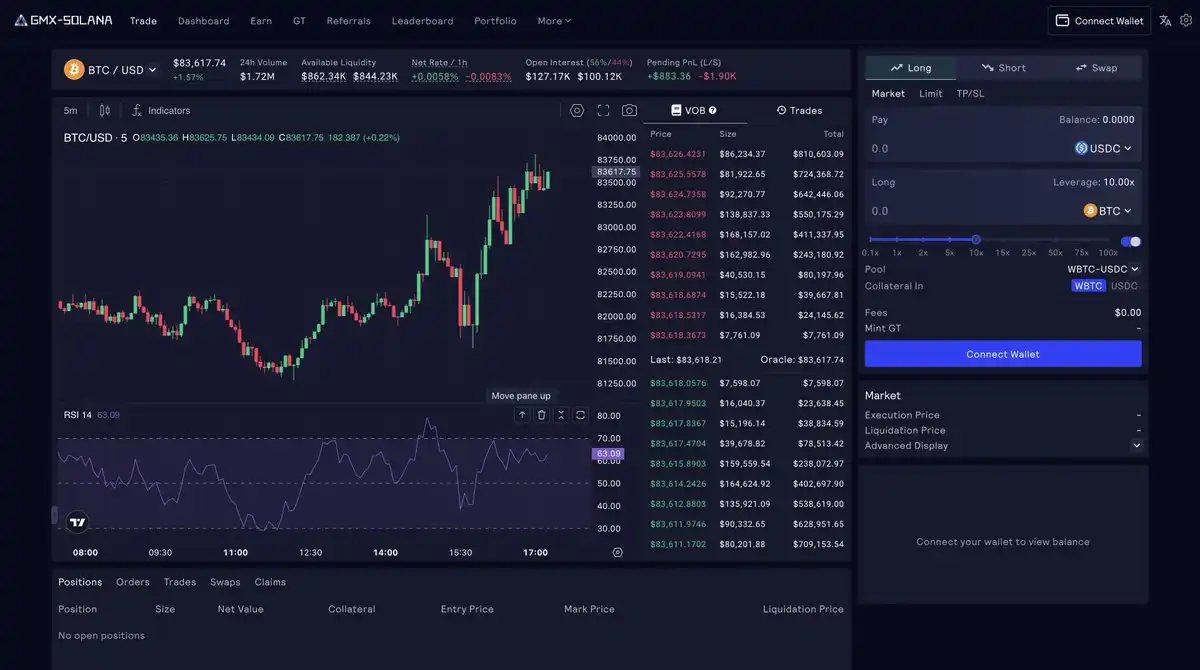

Halfway through the top 10, these platforms redefine nba crypto bets 2026. Jupiter Perps beta from Jupiter DEX taps Kalshi for regulated micro-bets, starting F1 but eyeing NBA quarters. Kamino Finance automates liquidity for deeper books, slashing impermanent loss on pools.

Jupiter Perps rolls out prediction markets via its DEX aggregator, pulling Kalshi feeds for NBA yes/no bets. Micro-wager on Jokic rebounds per quarter; settlements hit in blocks. With Solana’s speed, it crushes TradFi latency, drawing $3.5B sector projections.

Kamino Finance optimizes liquidity vaults for these markets. Stake LP positions on NBA parlays, automate rebalances to dodge IL. Deeper books mean tighter spreads on Lakers-Celtics totals, turning passive holders into yield chasers.

PsyOptions caps the list with structured bets. Options on NBA outcomes: calls on over totals, puts on blowouts. Leverage without perps risk, oracle-backed expiry. Solana’s low gas lets retail traders stack complex plays profitably.

Top 10 Solana NBA Platforms

-

#10 basketball.fun: Athlete tokens for NBA stars like Tristan Thompson’s launch. Trade player props and game outcomes with real-time Solana speed.

-

#9 BetDEX: P2P order books for NBA bets. Non-custodial matching on Solana with no KYC, ideal for parlays and props.

-

#8 Hedgehog Markets: AMM pools for instant NBA liquidity. Pooled model like Uniswap for constant settlements on game spreads.

-

#7 Azuro Protocol: Oracle-secured data for NBA events. Permissionless markets with reliable feeds for accurate betting.

-

#6 Drift Protocol: Yield-bearing collateral for NBA positions. Earn on SOL/USDC margins while holding event bets.

-

#5 Zeta Markets: Event perps for NBA futures. High-leverage trades on game totals and winners with fast execution.

-

#4 Mango Markets: Lending margins for NBA bets. Borrow against collateral for efficient capital use in props.

-

#3 Jupiter Perps: Micro-bets on NBA real-time events. Aggregated liquidity for yes/no tokens via Kalshi integration.

-

#2 Kamino Finance: LP vaults optimized for NBA liquidity. Stake for yields while providing betting pool depth.

-

#1 PsyOptions: Structured options for NBA parlays. Advanced derivatives for complex bets with Solana efficiency.

These 10 crush blockchain sports betting platforms standards. Hedgehog’s $20M TVL shows traction; Drift’s 30-asset margins add flex. But edges fade fast in crowded lines. Track oracle disputes, liquidity depth pre-tipoff. SOL at $81.05 funds it all, down 4.71% today yet primed for $200 calls by year-end.

Edges and Traps in Solana NBA Markets

Discipline separates winners. Solana prediction market nba shines on props: Curry threes, Embiid points. Platforms aggregate odds via Purebet-style engines, but check TVL first, shallow pools slip. Yield beats holding USDC idle, yet oracle fails (rare on Solana) wipe edges. Regs loom; NBA eyes guidelines as Kalshi on-chains flow.

Thompson’s basketball. fun tokenizes hype, but volatility bites. BetDEX P2P avoids AMM fees, ideal for high-odds dogs. Zeta, Mango layer leverage safely, cross-margin NBA/MLB. Jupiter eyes NBA post-F1; Kamino vaults compound wins. PsyOptions for pros scripting Greeks on series odds.

Stack positions smart: 1% risk per bet, ladder entries on momentum shifts. Solcasino. io adds casino flair, but stick core 10 for pure predictions. Drift BET DAOs empower; launch your market by Q1.

Action Plan: Bet NBA on Solana Today

Connect Phantom wallet, bridge USDC. Scout Hedgehog contests, Drift yields. Monitor SOL $81.05 for dips to load. Parlay Warriors props on Azuro; contest playoffs on Hedgehog. Lines tick live, edges last seconds. Track via Jupiter aggregator.

Machines Picks-style algos move books now. Counter with TA: volume spikes pre-news. Mango borrows amp parlays without liquidation traps. Kamino automates the grind. PsyOptions hedges finals chaos.

Solana flips NBA from spectator sport to trader’s arena. Low fees, real yields, crypto-native. Position before 2026 boom hits, SOL chasing $200 amid $3.5B market swell. Discipline locks profits; FOMO burns stacks.