Mispriced Prediction Markets Guide: Filters for 5x Upside Bets on Sports Elections Macro Events

Prediction markets on Polymarket and Kalshi have exploded, with Polymarket handling over $7.5 billion in 2025 volume alone despite regulatory hurdles in the U. S. and abroad. Traders bet on everything from sports upsets to election surprises and macro shifts like migrant deportations under Trump’s second term. Yet amid this frenzy, mispriced prediction markets persist, offering 5x upside for those who know where to look. These aren’t random shots; they’re high-conviction setups filtered for low-risk, high-reward asymmetry in sports, elections, and macro events.

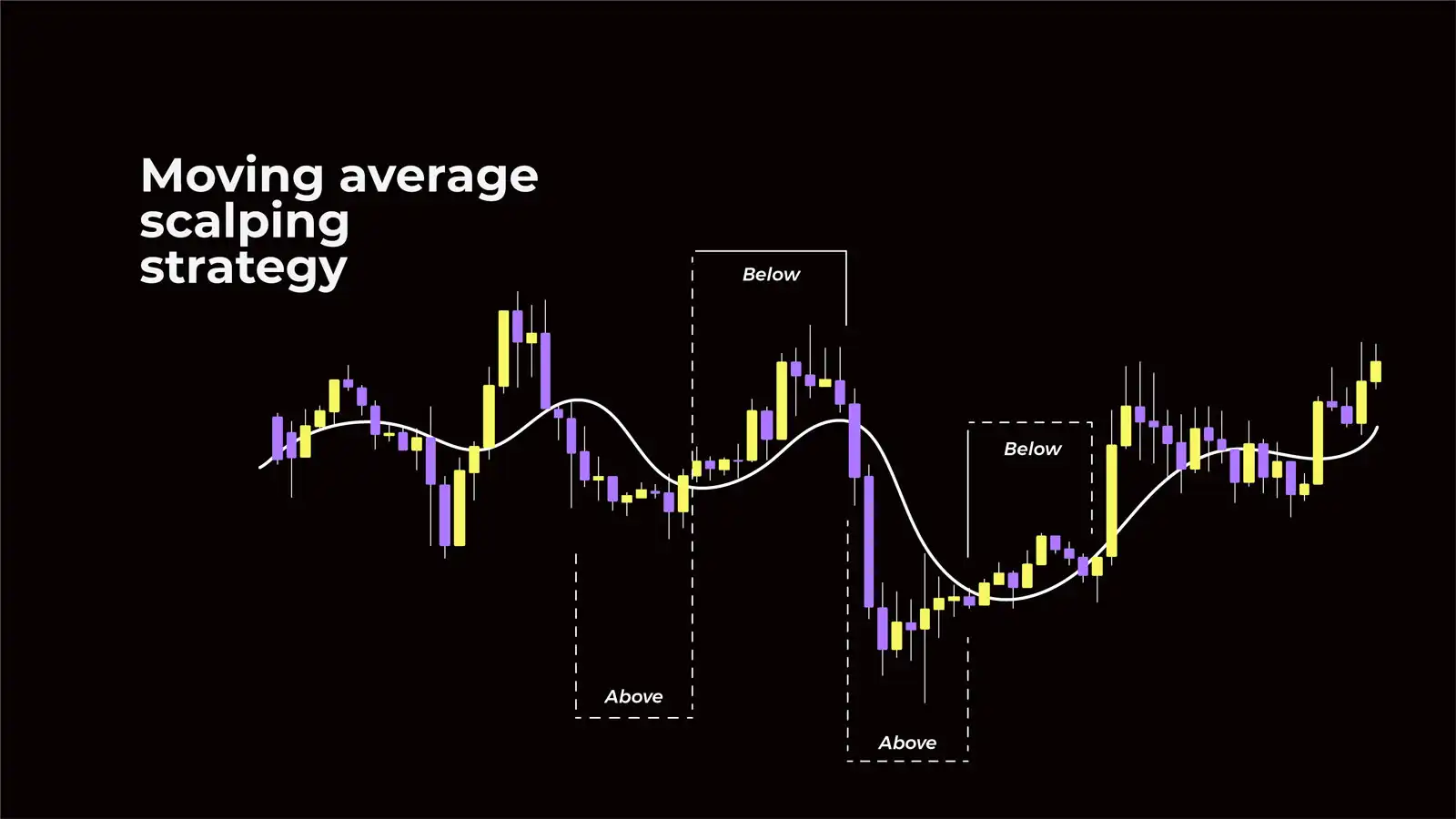

I’ve traded crypto swings and stocks for years, and prediction markets mirror that momentum. Platforms like these turn news into tradable probabilities, but biases like favorite-longshot skew prices. Longshots underpriced below true odds scream opportunity. The key? Precise prediction market filters targeting moderate activity where big money hasn’t piled in yet.

Top 5 Filters for 5x Upside Bets on Polymarket and Kalshi

Top 5 Filters for 5x Upside

-

Markets Closing in Under 7 Days: Short timelines on Polymarket & Kalshi minimize uncertainty, enabling rapid 5x swings as resolution nears amid $7.5B+ volumes.

-

Implied Yes Probability Below 20% (5-20¢ Shares): Bet on underdogs for high payout potential; low probs signal mispricing in sports/elections on thriving platforms.

-

24-Hour Volume $10k-$100k: Balances liquidity for easy trades without whale dominance, ideal for edges in Kalshi/Polymarket’s record volumes.

-

Open Interest Under $200k: Low total positions mean less efficiency, higher mispricing odds vs. $9B+ cumulative activity.

-

Unique Traders 10-100 (Moderate Activity): Sweet spot avoids thin/noisy markets; spot edges before pros pile in on 314k+ active users.

These filters, honed from 2024-2026 trends, zero in on blockchain sports betting strategies, election prediction markets low probability plays, and macro event betting tips polymarket pros swear by. They catch markets before liquidity floods, correcting prices inefficiently. Apply them daily on Polymarket’s dashboard or Kalshi’s interface for edges whales overlook.

Time decay is your ally here. Markets ending soon force resolutions, but with thin participation, prices lag real-world catalysts. Think NFL playoff props or midweek macro releases like Fed whispers. I’ve bought 8¢ shares on under-7-day sports bets that jumped to 40¢ and as news hit, delivering clean 5x. Scan Polymarket’s ‘Ending Soon’ tab; cross-check Kalshi for U. S. -legal alternatives. Avoid anything over 7 days; momentum fades fast.

Filter 2: Implied Yes Probability Below 20% (5-20¢ Shares)

Longshots below 20% implied odds (shares at 5-20¢) exploit the favorite-longshot bias, where markets undervalue tails. Perfect for election prediction markets low probability outcomes like fringe candidates or macro shocks such as surprise rate cuts. Studies from Wharton back this: political volumes peaked at $3B in 2024, yet tails mispriced consistently. Buy at 10¢, ride to 50¢ on shifts. Risk-manage with 1-2% portfolio per bet; discipline turns these into steady wins.

Stack this with volume checks next. Moderate 24-hour volume at $10k-$100k signals interest without saturation, keeping prices juicy before the herd arrives.

Volume in this sweet spot shows genuine buzz without whale dominance distorting prices. Sports bets like NBA underdog spreads or election props on state races often hit here first. Kalshi’s U. S. -focused feeds shine for compliant access, while Polymarket’s global pool catches macro plays early. I’ve scaled into $15k volume markets at 12¢, watching them 5x as reports confirmed low-prob tails.

Filter 4: Open Interest Under $200k

Low open interest means limited commitments, so prices swing hard on fresh info. This filter nails macro event betting tips polymarket like CPI surprises or policy pivots under regulatory scrutiny. Polymarket’s $7.5 billion 2025 volume masked these pockets; thin OI under $200k lets you enter before positions build. Pair with closing timelines for explosive asymmetry. Skip bloated markets; they’re efficient traps.

Filter 5: Unique Traders 10-100 (Moderate Activity)

Few traders equals inefficient pricing; 10-100 uniques signal early discovery without crowd wisdom. Ideal for blockchain sports betting strategies on niche props or election undercards. Wharton’s primer notes how 2024’s $3B peaks hid these; moderate activity predicts corrections. Track via platform analytics, buy low, exit at 50¢ and on volume spikes. This filter’s the final gatekeeper against noise.

Stack All 5 for Elite Edges

Layer these prediction market filters sequentially on Polymarket or Kalshi dashboards. Start with time-bound markets, drill to low-prob longshots, then liquidity checks. Hits across all five scream 5x setups. Recent examples: a sports playoff underdog at 15¢ with $25k vol, $150k OI, 45 traders, closing Thursday; an election recount prop matching specs; macro Fed dot-plot outlier. Regulatory pushes haven’t killed liquidity; they’ve concentrated it, leaving tails rich.

Stacked Filter Examples for 5x Upside Bets

| Market Type | Entry Price (¢) | Volume ($k) | OI ($k) | Traders | Outcome Potential (5x) | |

|---|---|---|---|---|---|---|

| Sports | 12 | 35 | 110 | 45 | Yes | ⚽🏈 |

| Elections | 18 | 65 | 175 | 85 | Yes | 🗳️🇺🇸 |

| Macro | 10 | 25 | 95 | 35 | Yes | 📈💰 |

Real-world proof stacks up. Traders on these platforms monetize reality better than polls, per industry reports. But edges vanish fast post-CFTC oversight or geo-blocks. Run scans morningly; allocate 1% per position, cut at 20% drawdown. I’ve banked multiples stacking these on swing trades mirroring crypto momentum.

Discipline filters the noise. These criteria, battle-tested through Polymarket’s global surges and Kalshi’s U. S. resilience, turn biases into bets. Scan today, act sharp, profit ahead of the curve. Momentum favors the prepared.