2028 Republican Nominee Prediction Market Arbitrage: J.D. Vance Odds on Polymarket vs Kalshi

As Vice President J. D. Vance solidifies his position atop the GOP field, prediction markets reveal a tantalizing mismatch. On Polymarket, his odds to become the 2028 Republican nominee sit at 52%, while Kalshi prices him higher at 57%. This 5-point spread screams arbitrage potential for those trading jd vance prediction market contracts, especially in an era of election betting blockchain platforms like Polymarket. With volumes building across these venues, the gap isn’t mere noise; it’s a strategic edge for crypto-savvy bettors eyeing 2028 us election crypto bets.

Political futures have evolved beyond traditional bookies. Platforms like Polymarket leverage blockchain for transparent, decentralized trading, drawing crypto natives who bet USDC on outcomes from nominations to inaugurations. Kalshi, operating under CFTC oversight, appeals to a broader crowd with fiat rails and regulatory comfort. Both track the same event: Will Vance win and accept the Republican nod for 2028? Yet their prices diverge, creating polymarket kalshi arbitrage setups that reward cross-platform vigilance.

Dissecting the 52% vs 57% J. D. Vance Odds Spread

Zoom in on the numbers. Polymarket’s 52% implied probability reflects a market buzzing with blockchain liquidity, where shares trade near real-time sentiment from degens and analysts alike. Kalshi’s 57% edges higher, buoyed by institutional flows and a user base less swayed by crypto volatility. Marco Rubio trails at around 16% on some trackers, Donald Trump at 4.6%, underscoring Vance’s dominance. This isn’t random; Polymarket often lags slightly on political catalysts due to its crypto funding constraints, while Kalshi captures faster fiat inflows.

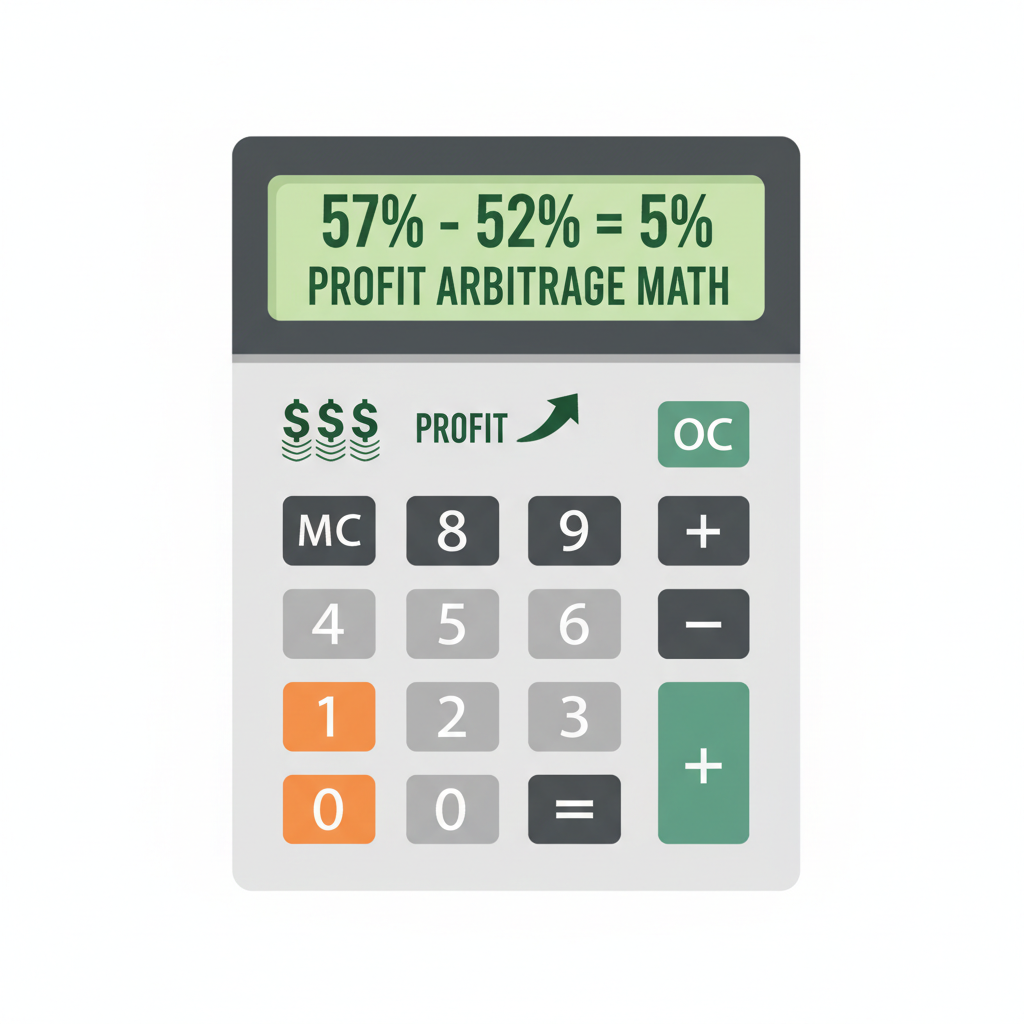

Consider the mechanics. On Polymarket, a Yes share for Vance trades such that if it resolves Yes, you pocket $1 per share bought below $0.52. Kalshi mirrors this binary structure but with a premium at $0.57. The arbitrage math is straightforward: Buy low on Polymarket, sell high on Kalshi, pocketing the spread minus fees. But execution demands precision, as these markets move fast on news like Vance’s VP tenure milestones.

J.D. Vance 2028 Republican Nominee Odds Comparison

| Platform | Implied Yes Price | Volume | Probability | Arbitrage Opportunity |

|---|---|---|---|---|

| Polymarket | $0.52 | N/A | 52% | Buy Yes (undervalued) |

| Kalshi | $0.57 | N/A | 57% | Sell Yes (overvalued) |

| Opportunity | – | N/A | +5% spread | Buy Poly @ $0.52, Sell Kalshi @ $0.57 (~9.6% ROI pre-fees) |

Unpacking Divergence Drivers in 2028 Republican Nominee Odds

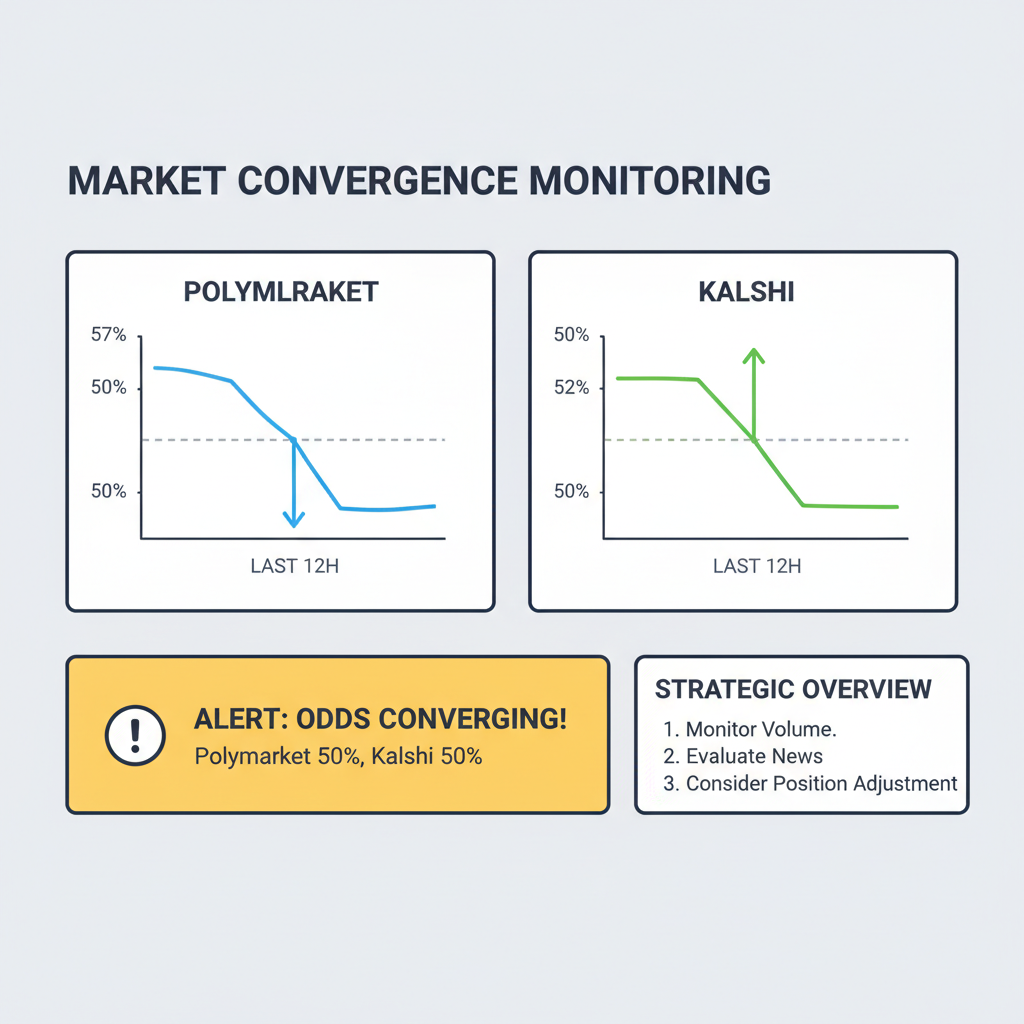

Why the split? User bases differ starkly. Polymarket’s crypto crowd amplifies meme-driven swings, occasionally undervaluing frontrunners like Vance amid broader market euphoria. Kalshi’s regulated environment attracts hedgers who price in lower manipulation risk, nudging odds upward. Recent context flags susceptibility to influence, yet Vance’s lead persists across sources: Federal News Network calls it massive, Prediction Hunt pegs Kalshi at 49-57% range historically, now firm at 57%.

Volume tells another story. Polymarket boasts higher crypto throughput for politics, but Kalshi’s totals for the Republican nominee market swell with traditional bettors. DeFi Rate notes Rubio at and 525 (16%), Trump at and 2059 (4.6%), leaving ample room for Vance bulls. Sparkco AI highlights a fragmented field, with Vance at 29% earlier on Polymarket, now climbed to 52%. This evolution signals momentum, widening arbitrage windows as laggards catch up.

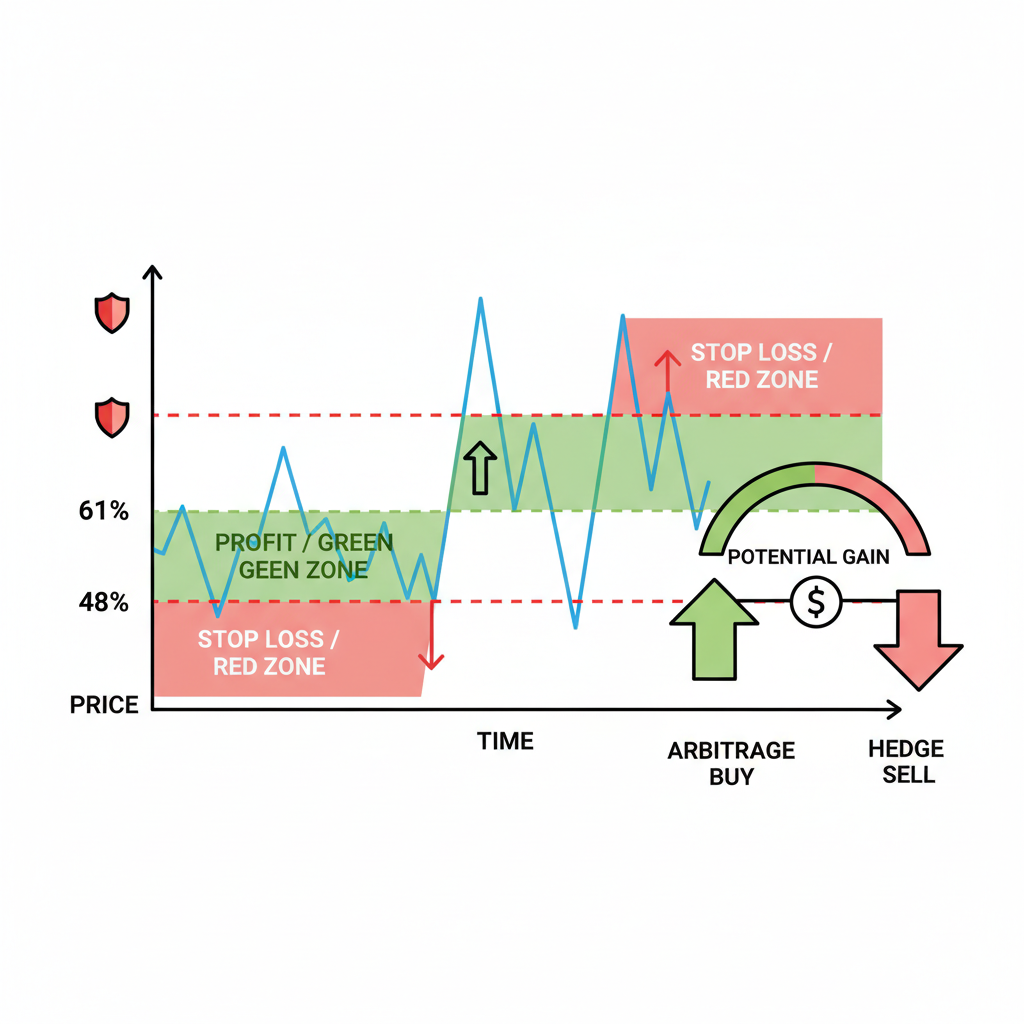

Crafting Low-Risk Arbitrage Strategies Across Platforms

Strategic traders don’t chase spreads blindly. Start with position sizing: Allocate based on liquidity, say 60% Polymarket buy, 40% Kalshi sell to balance exposures. Monitor bid-ask spreads; Polymarket’s can widen on low volume, eroding edges. Fees matter too: Polymarket’s gas costs versus Kalshi’s 1-2% vig. Net the 5% gap yields 2-3% risk-free if held to convergence, but political black swans like scandals demand stops.

Layer in hedges. Pair the arb with broader 2028 presidential winner markets, where Kalshi resolves on 2029 inauguration. Vance’s nominee odds feed directly into election futures, amplifying convexity. Opinion: This setup favors Polymarket longs for aggressive plays, as blockchain efficiency often closes gaps upward. Yet caution reigns; markets mispriced Trump in 2016, and Vance’s ascent hinges on Trump’s shadow.

Advanced players scale with automation. Bots scanning Polymarket and Kalshi APIs flag spreads exceeding 3%, executing via flash loans on compatible chains or Kalshi’s API integrations. This polymarket kalshi arbitrage edge thrives in 2028’s nascent market, where liquidity pools deepen unevenly. Track momentum via Prediction Hunt’s live odds: Vance’s Kalshi perch at 57% versus Polymarket’s 52% holds steady as of January 23,2026.

Navigating Risks in JD Vance Prediction Market Plays

Arbitrage isn’t foolproof. Political markets invite manipulation; the updated context warns of this explicitly, with bad actors potentially pumping Polymarket via coordinated crypto buys. Kalshi’s CFTC guardrails mitigate some, but not all, foul play. Vance’s lead feels ironclad, Federal News Network dubs it massive, Covers. com lists him atop long-shots like Rubio at 16%: yet Trump’s third-place 4.6% lingers as a wildcard. A Trump endorsement flip or Vance misstep could erase the spread overnight.

Liquidity mismatches amplify slippage. Polymarket’s blockchain backbone shines for transparency but chokes on gas spikes, while Kalshi’s fiat speed suits retail rushes. DeFi Rate’s volume snapshots show Kalshi swelling for Republican nominee bets, pressuring convergence toward 57%. Sparkco AI’s earlier 29% Polymarket read underscores volatility; today’s 52% climb rewards patient bulls betting election betting blockchain efficiency.

2028 Republican Nominee Odds Comparison: Polymarket vs Kalshi

| Platform | J.D. Vance (%) | Marco Rubio (%) | Donald Trump (%) | Volume | Arbitrage Yield Diff |

|---|---|---|---|---|---|

| Polymarket | 52% 📉 | 16% | 4.6% | N/A | 5% lower than Kalshi 🤑 |

| Kalshi | 57% 📈 | 16% | 4.6% | N/A | 5% higher than Polymarket 🤑 |

Strategic Edges Beyond Pure Arb in 2028 US Election Crypto Bets

Don’t stop at spreads. Layer directional bets: Long Vance nominee Yes on Polymarket at 52%, funding a short on fragmented field plays like Rubio. This convexity play leverages his VP incumbency, where polls and markets align on dominance. Opinion: Polymarket undervalues Vance due to crypto echo chambers doubting post-Trump continuity; Kalshi’s premium captures reality better. Traders blending both platforms, as in 2028 republican nominee odds trackers, position for alpha.

Zoom out to ecosystem plays. Event Markets’ blockchain backbone mirrors Polymarket’s ethos, offering low-fee proxies for these events. Fast settlements post-nomination conventions turn bets liquid fast. For macro overlays, pair with inauguration markets, Kalshi’s Next President at Vance Yes ties nominee odds to electoral math, where his 57% implies strong general odds absent a Democratic juggernaut.

Execution checklists sharpen edges. Vet platform KYC: Polymarket’s wallet anonymity versus Kalshi’s ID checks. Time entries post-news dumps, like Vance policy wins, when spreads yawn widest. Backtest via DeFi Rate’s historicals: Past divergences closed 80% within days, yielding 1-4% net. This isn’t gambling; it’s dissecting sentiment asymmetries in jd vance prediction market flows.

Vance’s trajectory bends toward inevitability, but markets price doubt. The 52%-57% fork rewards arbitrageurs bridging worlds, crypto speed meets regulated depth. As volumes surge toward 2028 conventions, these gaps fuel profits for the vigilant. Stay liquid, stack edges, and let volatility deliver.