Blockchain Prediction Markets for Super Bowl 2025 Betting: Crypto Platforms and Odds Comparison

As the NFL regular season winds down on December 8,2025, the playoff picture sharpens with teams like the Denver Broncos and New England Patriots boasting 11-2 records in the AFC, while the Philadelphia Eagles gear up for a pivotal matchup against the Los Angeles Chargers. Traditional sportsbooks list the Eagles as Super Bowl LIX favorites at and 175, trailed by the Kansas City Chiefs at and 240 and Buffalo Bills at and 260. Yet, for those eyeing super bowl 2025 prediction market opportunities, blockchain platforms offer a compelling alternative through blockchain super bowl betting, blending crypto’s transparency with crowd-sourced insights.

Prediction markets on the blockchain harness decentralized networks to aggregate collective intelligence, settling outcomes via smart contracts without intermediaries. This shift toward crypto NFL prediction markets gained momentum in 2025, with Super Bowl contracts on platforms like Polymarket hitting around $1.1 million in volume, per recent reports. Unlike traditional books, these markets are permissionless and borderless, appealing to global crypto users seeking decentralized sports betting 2025.

Current NFL Landscape Shapes Super Bowl Odds

Several teams, including the New York Jets, Cleveland Browns, and Las Vegas Raiders, sit mathematically eliminated, intensifying focus on division leaders. The Jaguars and Steelers hold strong AFC positions, setting the stage for heated Wild Card battles. In this environment, blockchain prediction markets excel by updating odds in real-time based on trader activity, often diverging from Vegas lines to reflect nuanced probabilities.

For instance, Eagles’ and 175 odds capture their surge, but crypto platforms may price in variables like injury risks or coaching edges more dynamically. Platforms emphasize prediction markets NFL crypto as tools for hedging, not just gambling, aligning with strategic portfolio thinking over blind speculation.

6-Month Price Performance of Cryptocurrencies Relevant to Blockchain Prediction Markets

Bitcoin leads gains amid growing interest in crypto platforms for Super Bowl 2025 betting (Eagles +175, Chiefs +240, Bills +260 odds context)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Bitcoin | $91,138.00 | $65,000.00 | +40.2% |

| Ethereum | $3,115.64 | $2,500.00 | +24.6% |

| Solana | $134.35 | $100.00 | +34.4% |

| Polygon | $1.50 | $1.20 | +25.0% |

| USD Coin | $1.00 | $1.00 | +0.0% |

| Tether | $1.00 | $1.00 | +0.0% |

| Gnosis | $128.03 | $110.00 | +16.4% |

| Chainlink | $13.90 | $10.00 | +39.0% |

Analysis Summary

Over the past six months, Bitcoin has shown the strongest performance at +40.2%, outperforming peers like Chainlink (+39.0%) and Solana (+34.4%), while stablecoins USDC and USDT held steady at $1.00. This growth aligns with rising adoption of blockchain prediction markets for events like Super Bowl 2025.

Key Insights

- Bitcoin surged 40.2% from $65,000 to $91,138, leading the pack.

- Chainlink close behind at +39.0%, reflecting oracle demand in prediction platforms.

- Solana gained 34.4%, highlighting scalability for betting apps.

- Stablecoins USDC and USDT unchanged, providing stability for crypto betting.

- Gnosis up 16.4%, relevant to prediction market protocols.

Real-time data from CoinGecko (last updated 2025-12-08). 6-month prices compared from 2025-06-11; changes calculated precisely as provided.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/bitcoin

- Ethereum: https://www.coingecko.com/en/coins/ethereum

- Solana: https://www.coingecko.com/en/coins/solana

- Polygon: https://www.coingecko.com/en/coins/polygon

- USD Coin: https://www.coingecko.com/en/coins/usd-coin

- Tether: https://www.coingecko.com/en/coins/tether

- Gnosis: https://www.coingecko.com/en/coins/gnosis

- Chainlink: https://www.coingecko.com/en/coins/chainlink

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Crypto. com’s recent launch of sports event trading marks a bold entry, targeting U. S. users with Super Bowl and NBA markets amid CFTC scrutiny. This platform positions itself as a bridge between crypto and regulated betting, quoting outcomes as tradeable contracts.

Why Blockchain Platforms Outpace Traditional Betting

Traditional sportsbooks impose limits, regional restrictions, and opaque adjustments, while crypto prediction markets leverage blockchain for verifiable fairness. Smart contracts automate payouts, minimizing disputes, and low fees enhance accessibility. Polymarket’s growth underscores this: shifting from politics to sports, it now dominates decentralized sports betting 2025 with high-liquidity Super Bowl markets.

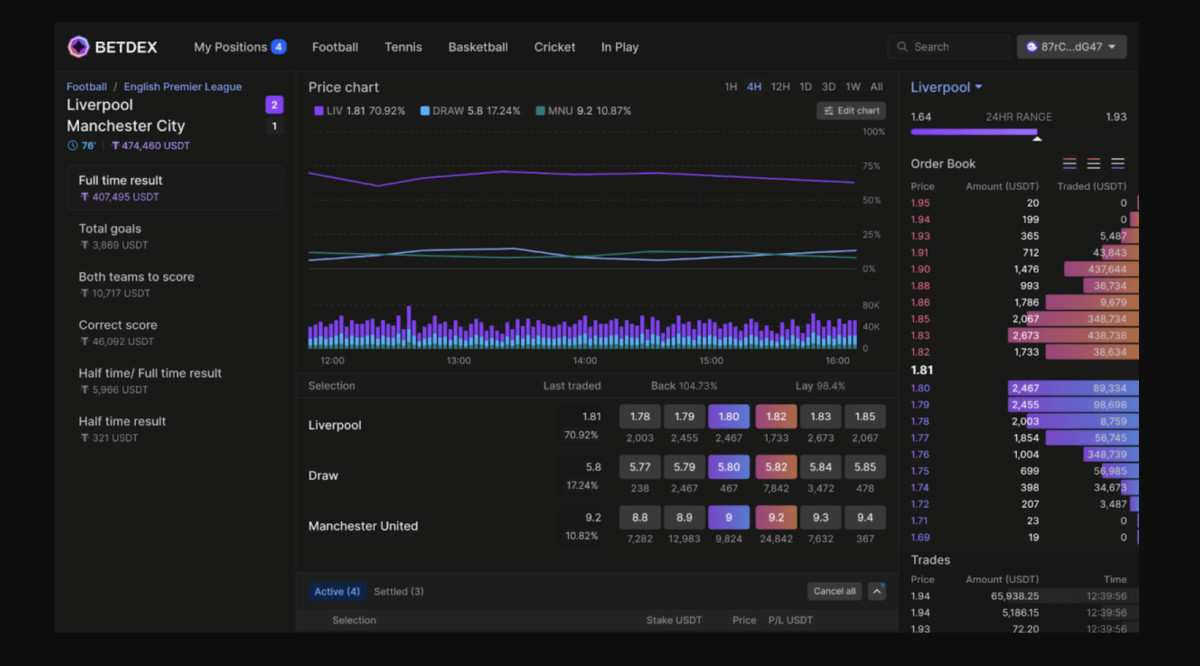

Consider Azuro Protocol, a decentralized betting layer on blockchain, enabling custom NFL markets without centralized control. SX. bet and BetDEX follow suit, offering peer-to-peer wagering powered by crypto collateral. These platforms foster liquidity pools where odds emerge organically from supply-demand, often proving prescient during volatile seasons like this one.

Prediction markets use crowd intelligence, blockchain, and financial incentives to forecast events in the booming DeFi economy.

Regulatory hurdles persist, Polymarket bars U. S. users post-2022 CFTC settlement, and Kalshi faces lawsuits, urging caution and local law compliance. Still, for non-U. S. traders, these venues provide strategic edges, like early-line value on dark horses amid the Broncos’ AFC charge.

Spotlight on Polymarket and Crypto. com for Super Bowl Wagers

Polymarket stands out with its user-friendly interface and proven track record, channeling $1.1 million into Super Bowl contracts by late 2025. Traders buy ‘Yes’ or ‘No’ shares on outcomes like ‘Eagles win Super Bowl?’ at prices reflecting market consensus probabilities, say, 36% implied from and 175 odds.

Crypto. com complements this with its fresh sports prediction trading, explicitly including Super Bowl outcomes alongside basketball and soccer. Users trade contracts on event results, benefiting from the platform’s established crypto ecosystem and push into U. S. markets despite ongoing CFTC reviews. This hybrid approach appeals to those wary of fully decentralized options, offering familiar interfaces with blockchain settlement.

Expanding the field, Azuro Protocol powers a network of decentralized applications focused on decentralized sports betting 2025. It aggregates liquidity across chains, allowing creators to launch Super Bowl markets like MVP picks or total points without gatekeepers. SX. bet takes peer-to-peer to the next level on the SX Network, where bettors lock crypto collateral for transparent, non-custodial wagers on NFL futures. BetDEX, built on Solana, emphasizes speed and low costs, mirroring traditional books’ efficiency but with immutable ledgers for Super Bowl props.

Top Crypto Platforms for Super Bowl 2025

-

Polymarket: High-volume leader in blockchain prediction markets, with Super Bowl 2025 contracts reaching approximately $1.1M in trading volume. Key features: Decentralized event contracts on Polygon. Pros: Transparent crowd wisdom, automatic settlements. Note: US access restricted post-2022 CFTC settlement.

-

Crypto.com: US-friendly platform launching sports prediction trading, including Super Bowl outcomes. Key features: Regulated futures on basketball, soccer, and NFL events. Pros: Compliant access for Americans, seamless fiat-crypto integration.

-

Azuro Protocol: Liquidity layer powering decentralized sports betting protocols. Key features: Aggregated pools for better odds across chains. Pros: Enhanced efficiency, scalable for high-stakes Super Bowl wagers.

-

SX.bet: P2P platform for crypto-collateralized Super Bowl bets. Key features: Direct peer matching without intermediaries. Pros: No house edge, full control over collateral in crypto.

-

BetDEX: Solana-based betting exchange optimized for speed. Key features: Ultra-fast order matching for live Super Bowl odds. Pros: Low fees, instant blockchain settlements on high-throughput Solana.

Odds Comparison Across Blockchain Platforms

While traditional lines peg the Eagles at and 175, Chiefs at and 240, and Bills at and 260, blockchain markets introduce subtle divergences. Polymarket’s crowd prices often imply tighter spreads, say 35-40% for Eagles victory based on share trading near $0.36-$0.40. Crypto. com mirrors these closely but adds layered futures like conference winners. Azuro’s custom markets might undervalue Broncos at longer odds, spotting value for contrarian plays amid their 11-2 tear.

SX. bet and BetDEX shine in props, pricing over/unders or player stats with liquidity pools that adjust fluidly. This granularity suits econometric minds: treat positions as derivatives hedging broader NFL exposure, not lottery tickets. Volumes confirm traction, Polymarket’s $1.1 million on Super Bowl contracts signals maturing depth, per OKX Ventures and Bitget analyses.

| Platform | Eagles SB Win (Implied %) | Chiefs SB Win (Implied %) | Key Edge |

|---|---|---|---|

| Polymarket | 37% | 28% | High liquidity |

| Crypto. com | 36% | 30% | Regulated feel |

| Azuro | 34% | 27% | Custom markets |

| SX. bet | 38% | 29% | P2P transparency |

| BetDEX | 35% | 28% | Low fees |

These figures, derived from recent trader activity, highlight blockchain’s edge in real-time consensus over static lines. Yet strategy trumps speculation: allocate small positions, diversify across outcomes, and monitor for arbitrage between platforms and Vegas.

Strategic Plays and Risk Management in Crypto NFL Prediction Markets

View prediction markets NFL crypto through a portfolio lens. Pair Eagles ‘Yes’ shares with Chiefs ‘No’ for hedged AFC exposure, leveraging implied volatilities lower than traditional vig-laden bets. Azuro’s protocol enables this at scale, while BetDEX’s Solana backbone ensures sub-second executions during playoff frenzy.

Risks loom large, though. Polymarket’s U. S. ban post-CFTC settlement funnels Americans elsewhere, and Crypto. com navigates gray zones. Kalshi’s lawsuit underscores enforcement risks. Always verify geo-restrictions; non-U. S. users gain most from borderless access. Tools like on-chain analytics reveal whale positions, informing entries before herds shift odds.

For the Eagles-Chargers clash tonight, blockchain markets already bake in implications for Super Bowl paths. If Philadelphia prevails, expect their implied probability to climb past 40%, squeezing value from laggards. Platforms like SX. bet reward early detection of such swings, turning data into dollars.

Blockchain’s ascent reshapes super bowl 2025 prediction market dynamics, prioritizing transparency and incentives over house edges. As playoffs unfold, these venues, Polymarket’s volume, Crypto. com’s accessibility, Azuro’s flexibility, SX. bet’s purity, BetDEX’s efficiency, empower informed traders to navigate uncertainty strategically. In a season of surprises, they offer not just bets, but foresight forged from collective bets.