2025 Blockchain Prediction Markets Tier List for Sports Elections and Macro Bets

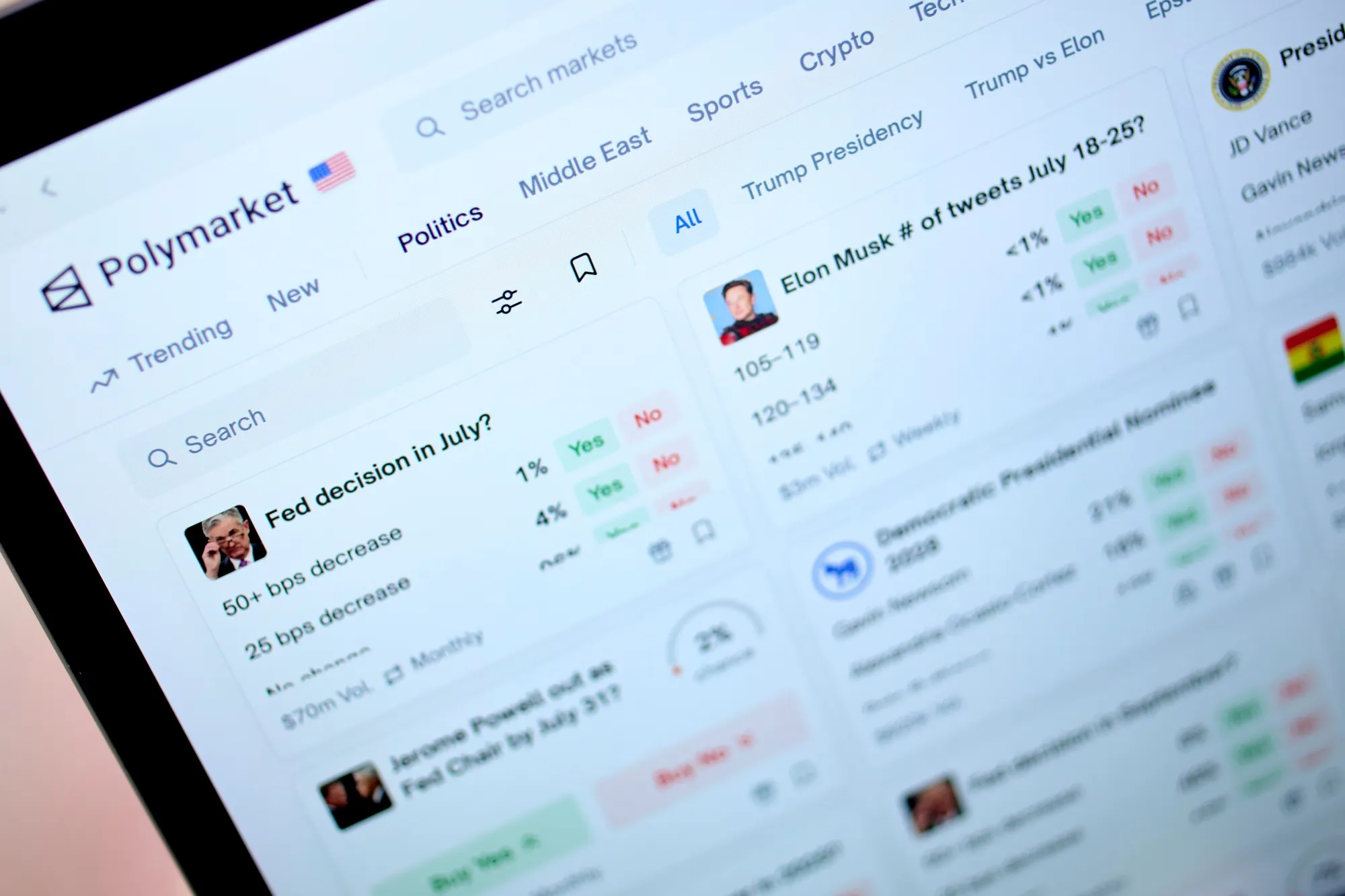

As 2025 draws to a close, blockchain prediction markets stand at the forefront of decentralized betting, reshaping how enthusiasts wager on sports outcomes, election results, and macroeconomic shifts. Platforms like Polymarket and Kalshi have captured billions in volume, driven by surging interest in blockchain sports betting platforms and crypto election prediction markets. This tier list ranks the top eight by trading volume, liquidity, and user growth, drawing from real-time data as of December 2,2025. With sports eclipsing politics, these markets offer precise tools for hedging risks or speculating on real-world events.

Polymarket’s ascent underscores the power of decentralization. Built on Polygon, it processed over $1 billion in sports bets this year, including nearly $466,000 on the NFL Draft alone. Its permissionless markets enable seamless crypto trades, appealing to those eyeing macro event betting blockchain alongside touchdowns. Meanwhile, Kalshi, the CFTC-regulated pioneer, hit $50 billion in annualized volume, expanding into sports and integrating with Robinhood for broader access. In sports, Kalshi commands 90% of its activity, with $1.1 billion in one recent week. The Polymarket vs Kalshi 2025 rivalry highlights a key divide: crypto-native freedom versus regulated reliability.

Tier 1: Volume Kings Reshaping Bets

These leaders dominate due to unmatched liquidity and event coverage. Polymarket’s user growth exploded post-elections, pivoting to sports where bettors favor its low fees and fast Polygon settlements. Kalshi’s real-money contracts shine in macroeconomics, from Fed rate decisions to GDP forecasts, backed by institutional trust. Together, they hold over 60% market share, per recent dashboards. For sports fans, Polymarket edges ahead with niche NFL and esports markets; Kalshi counters with broader, compliant offerings.

Kalshi vs Polymarket: 2025 Key Metrics Comparison

| Platform | Avg Weekly Volume | Sports Share (%) | Liquidity Score (/10) | User Growth (YoY %) |

|---|---|---|---|---|

| Kalshi | $961M | 90 | 9.4 | +1,500 |

| Polymarket | $173M | 50 | 9.7 | +150 |

Tier 2: Decentralized Innovators Gaining Traction

Descending the tiers, Azuro Protocol emerges as a sports betting powerhouse on its own chain, optimizing for high-frequency wagers with oracle integrations that ensure accurate resolutions. Its liquidity pools attract professional traders betting on soccer leagues and NBA props. Hedgehog Markets on Solana introduces “no-loss” pools, blending DeFi yields with predictions, stake, earn, and only risk the yield if wrong. This Solana prediction markets sports model has fueled rapid adoption among yield farmers.

Thales, another Polygon contender, specializes in binary options for elections and crypto prices, boasting high leverage without KYC hurdles. Its volume spiked during macro volatility, like recent token surges: Gnosis (GNO) at $126.83, up 4.97%. These platforms bridge the gap between Tier 1 scale and niche innovation, offering deeper liquidity for 2025 prediction markets tier list climbers.

Key Features: Chain, Focus & USPs

-

Polymarket: Polygon chain. Focuses on sports ($1B+ wagered), elections, macro. USP: Largest decentralized platform with $18B+ volume.

-

Kalshi: Centralized, CFTC-regulated. Focuses on sports (90% volume), politics, macro. USP: $50B annualized volume, Robinhood integration.

-

Azuro Protocol: Ethereum & multi-chain. Focuses on sports betting. USP: Decentralized liquidity network & oracle for predictions.

-

Hedgehog Markets: Solana chain. Focuses on no-loss predictions. USP: Stake for DeFi yields, retain principal if wrong.

-

Thales: Optimism chain. Focuses on sports, binary options. USP: Peer-to-pool model, low fees, fast settlements.

-

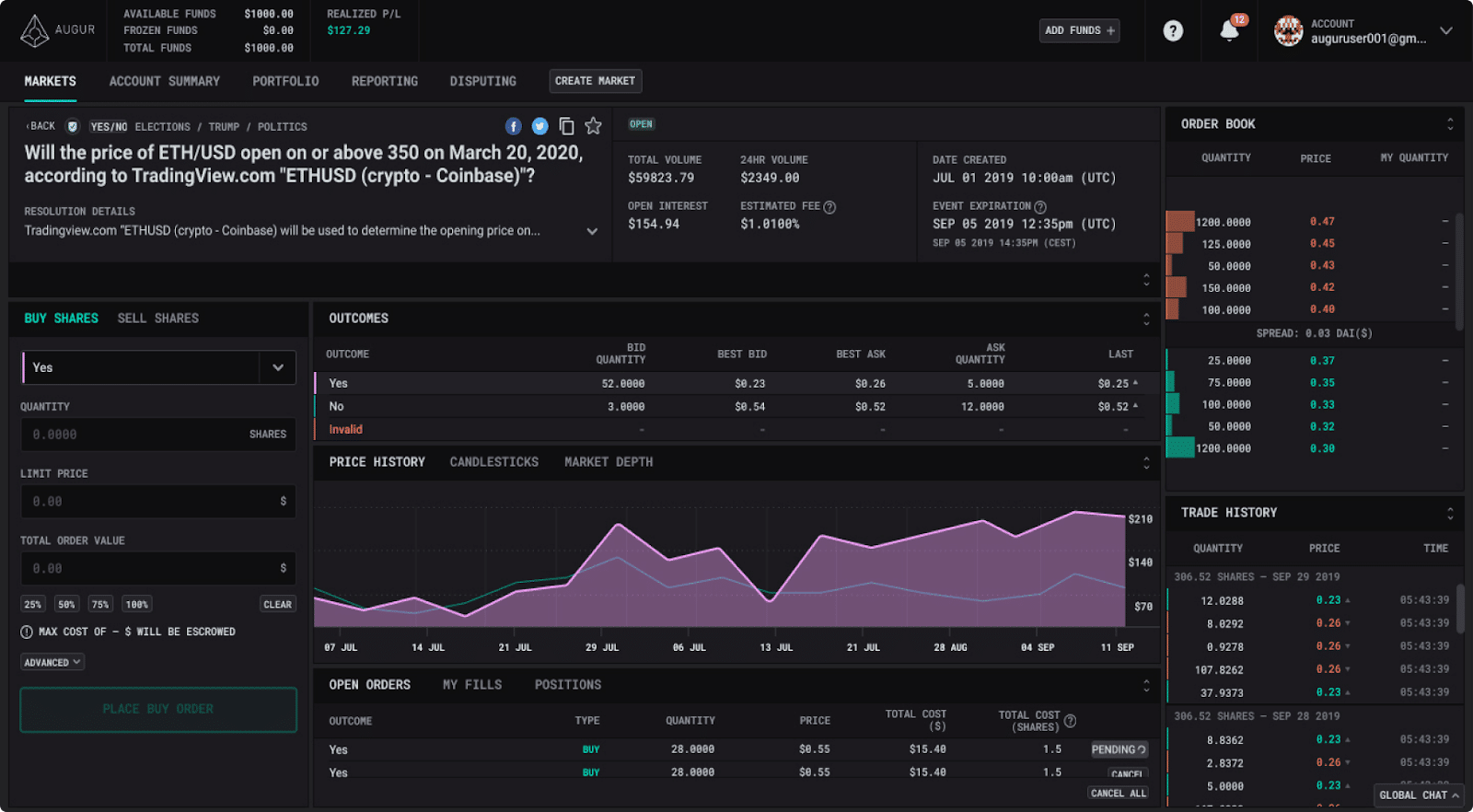

Augur: Ethereum chain (REP: $1.27). Focuses on any event. USP: Pioneer decentralized market creator.

-

Omen by Gnosis: Gnosis Chain (GNO: $126.83). Focuses on event predictions. USP: Conditional tokens framework.

-

Zeitgeist: Polkadot chain. Focuses on finance, Web3 trends. USP: Interoperable, community-governed markets.

Navigating Liquidity and Token Momentum

Liquidity defines viability in prediction markets, where thin books amplify slippage on volatile events. Augur, Ethereum’s OG, persists with flexible market creation despite UX hurdles; its REP token trades at $1.27, up 9.48%, signaling renewed interest. Omen by Gnosis leverages conditional tokens for custom bets, tied to GNO’s $126.83 strength, ideal for macro plays like inflation targets. Zeitgeist on Polkadot rounds out the pack with cross-chain governance, focusing on Web3 trends and regulatory bets. These tokens’ gains, pNetwork (PNT) at $0.00072472 up 8.41%, UMA at $0.817243 up 4.76%: reflect broader ecosystem health, drawing users to sports and elections alike.

While Tier 1 and 2 platforms capture the bulk of volume, these lower tiers reward patient traders with asymmetric opportunities. Augur’s decentralized oracle system empowers users to launch markets on anything from Olympic medals to central bank policies, though liquidity often lags on obscure events. Omen by Gnosis stands out for its atomic swaps and collateralized outcomes, perfect for macro event betting blockchain like yield curve inversions or commodity spikes. Zeitgeist’s Polkadot foundation enables seamless parachain bets, with governance tokens incentivizing accurate forecasters in sports underdogs or election recounts.

Tier 3: Legacy and Niche Contenders

Augur, Omen by Gnosis, and Zeitgeist form the foundation for this tier, prioritizing decentralization over scale. Augur’s REP at $1.27, up 9.48%, benefits from Ethereum’s upgrades, reducing gas costs for election bets. Omen ties directly to Gnosis (GNO) at $126.83, up 4.97%, enabling fixed-product market makers that minimize impermanent loss in volatile macro scenarios. Zeitgeist appeals to Polkadot maximalists with its prediction futures, where users trade on Solana prediction markets sports analogs across ecosystems. These platforms excel in user-created markets, fostering innovation amid regulatory gray areas.

Gnosis Technical Analysis Chart

Analysis by Lila Carmichael | Symbol: BINANCE:GNOUSDT | Interval: 1D | Drawings: 7

Technical Analysis Summary

To annotate this GNOUSDT chart effectively in my balanced hybrid style, begin by drawing a primary downtrend line connecting the September 2025 high around 145 on 2025-09-15 to the late November low near 115 on 2025-11-25, highlighting the overarching bearish channel amid prediction market sector volatility. Add horizontal support at 120 and resistance at 135, using strong horizontal lines. Mark a short-term uptrend from the November low at 115 (2025-11-20) to the current price zone near 127 (2025-12-02). Overlay a 0.618 Fibonacci retracement from the October high (135 on 2025-10-10) to November low for potential bounce levels. Use callouts for volume spikes in late November indicating accumulation, and arrow markers for MACD bullish divergence near current levels. Rectangle the consolidation range from early November (125-130) to now. Vertical line for potential news catalyst on 2025-12-01. Text boxes for key insights like ‘Medium risk long entry at 125 with SL 118’. This setup emphasizes strategy over speculation, aligning macro prediction market growth with technical confirmation.

Risk Assessment: medium

Analysis: Volatile prediction market sector with macro tailwinds but technical resistance overhead; aligns with my medium tolerance and balanced style

Lila Carmichael’s Recommendation: Cautious long on confirmation above 130, scale out at 135; diversify within portfolio

Key Support & Resistance Levels

📈 Support Levels:

-

$120.5 – Strong volume-backed support from late Oct/Nov lows

strong -

$115 – Recent swing low, potential deeper retracement

moderate

📉 Resistance Levels:

-

$130 – Immediate resistance from Nov highs

moderate -

$135 – Key Oct high, Fibonacci 0.618 level

strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

-

$125 – Bounce from 120 support with volume pickup and MACD divergence

medium risk -

$122 – Aggressive entry on pullback to support

high risk

🚪 Exit Zones:

-

$135 – Profit target at resistance confluence

💰 profit target -

$118 – Stop loss below key support

🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Decreasing on downside moves, spikes on recent up candles

Suggests weakening selling pressure and potential accumulation

📈 MACD Analysis:

Signal: Bullish divergence and potential crossover

Histogram contracting, lines converging near zero line

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Lila Carmichael is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (medium).

Token performance underscores momentum: Polymath (POLY) at $0.0254865, up 4.47%, hints at broader oracle network growth supporting these bets. Traders should monitor liquidity depth; for instance, Polymarket’s pools dwarf Augur’s, but the latter offers uncensorable edges in contested elections.

| Platform | Primary Chain | Key Focus | Token Price (Dec 2,2025) | 24h Change |

|---|---|---|---|---|

| Polymarket | Polygon | Sports/Elections | N/A | N/A |

| Kalshi | Regulated Fiat | Sports/Macro | N/A | N/A |

| Augur | Ethereum | Flexible Events | $1.27 | and 9.48% |

| Omen (Gnosis) | Ethereum | Custom Macro | $126.83 (GNO) | and 4.97% |

| Zeitgeist | Polkadot | Web3 Trends | N/A | N/A |

This 2025 prediction markets tier list reveals a maturing ecosystem where sports drive 70% of activity, per dashboards tracking Kalshi and Polymarket. Azuro Protocol’s chain-agnostic liquidity and Thales’ leverage suit high-conviction plays, while Hedgehog’s yields mitigate downside in prolonged resolutions. Bettors blending Tiers 1-3 portfolios capture diversified alpha, hedging NFL spreads against Fed pivots.

Regulatory tailwinds favor Kalshi’s compliance, yet Polymarket’s crypto ethos prevails in global adoption. Watch for cross-chain bridges accelerating volume; pNetwork (PNT) at $0.00072472, up 8.41%, positions interoperability as the next catalyst. UMA at $0.817243, up 4.76%, powers synthetic assets underpinning macro bets. As blockchain matures, these platforms transform speculation into strategic foresight, equipping users to navigate uncertainty with data-driven precision.

Ultimately, success hinges on aligning platform strengths with your edge: Polymarket for sports liquidity, Kalshi for macro trust, or Zeitgeist for frontier bets. With volumes projected to double in 2026, early positioning in this tier list yields enduring advantages in the decentralized betting arena.