How Blockchain Prediction Markets Are Changing Election Betting in 2024

Blockchain prediction markets have rapidly become the focal point of election betting in 2024, offering a transparent, decentralized alternative to traditional wagering and polling. As the U. S. presidential race ignited global attention, these crypto-powered platforms shattered records, drawing both retail speculators and institutional capital into a new era of political forecasting. With over $3.1 billion in total betting volume during Q3 2024 alone, the magnitude of this shift is impossible to ignore. But what’s truly driving this surge, and how are blockchain prediction markets reshaping the way we bet on elections?

The Meteoric Rise of Blockchain Prediction Markets in 2024

The past year marked a watershed moment for decentralized betting platforms. According to recent data, activity on blockchain-based political prediction markets soared by 565% in Q3 2024 compared to the previous quarter. This explosion in volume coincided directly with the U. S. presidential election cycle, highlighting a growing appetite for crypto election betting that bypasses traditional bookmakers and regulatory bottlenecks.

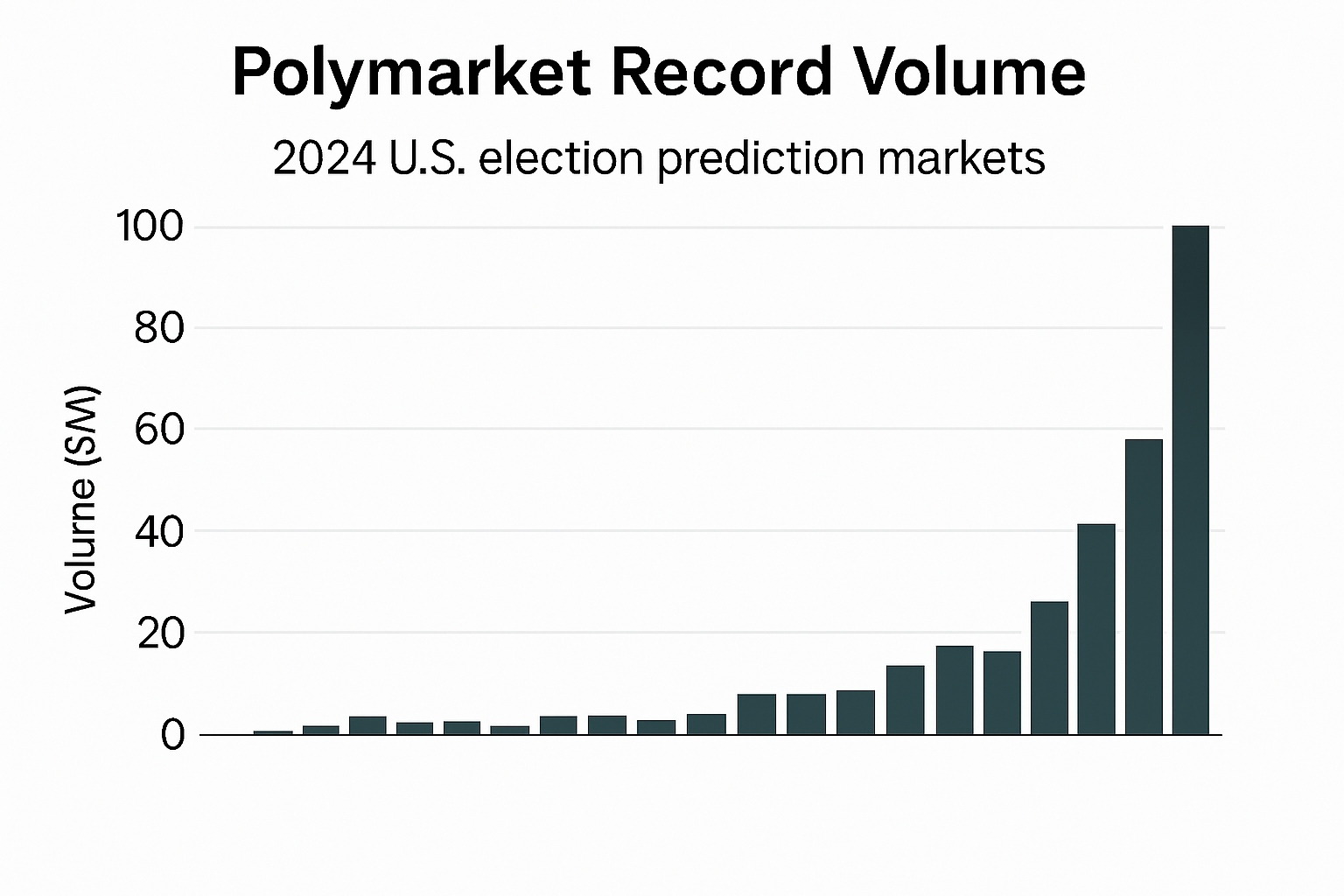

Polymarket, a leading name in this space, dominated headlines by capturing over 99% of market share in September 2024. The platform alone processed approximately $1.7 billion in wagers on the presidential outcome, nearly half of its yearly volume. This outsized influence has positioned Polymarket as the go-to destination for those eager to trade on political sentiment in real time. For a deeper dive into Polymarket’s rise, see our feature on how Polymarket dominated the 2024 US election prediction markets using crypto.

Why Are Crypto Election Markets Booming?

Several factors explain why blockchain prediction markets are thriving in the current political climate:

- Transparency and Trust: Every bet and settlement is recorded on-chain, making manipulation more difficult and outcomes auditable by anyone.

- Global Accessibility: Unlike legacy sportsbooks limited by jurisdiction, decentralized platforms are open to anyone with an internet connection and crypto wallet.

- Speed and Settlement: Blockchain-based markets settle instantly after results are verified, eliminating withdrawal delays and counterparty risk.

- Crowdsourced Intelligence: By aggregating thousands of bets from diverse participants, these markets often outperform traditional polls and pundits. In fact, a University of Cincinnati study found that a prediction market was more accurate than established polling in forecasting the 2024 presidential outcome.

This blend of accessibility, transparency, and accuracy is fueling unprecedented growth, and challenging the dominance of both pollsters and conventional betting shops.

Legal Shifts and Regulatory Milestones

The legal landscape for political betting in the U. S. has evolved dramatically. In October 2024, the U. S. Court of Appeals for the D. C. Circuit ruled in favor of Kalshi, a New York-based derivatives exchange, allowing it to list contracts on election outcomes. The court found that the Commodity Futures Trading Commission (CFTC) failed to demonstrate any public harm from such contracts. This landmark decision has emboldened both existing platforms and new entrants to expand their offerings and challenge regulatory gray zones.

Still, concerns persist. Critics warn of potential market manipulation by wealthy “whales, ” low liquidity in certain markets, and ongoing questions about legal compliance. These issues remain under close scrutiny as platforms like Polymarket and Kalshi continue to innovate at breakneck speed. For an in-depth analysis of how regulation is shaping this space, explore how blockchain prediction markets are changing election betting in 2024.

From Polls to Prediction Markets: A Paradigm Shift

The reliability gap between polls and prediction markets has never been more apparent. After several election cycles marred by polling errors and media bias, many analysts now view decentralized prediction markets as a more accurate barometer of political reality. The wisdom of crowds, when expressed via real-money bets, often cuts through noise and reflects shifting probabilities faster than traditional methodologies.

As digital assets become further entwined with political speculation, expect crypto election betting to remain a bellwether for both sentiment and capital flows. The surge in prediction market activity is not just a trend, it’s a fundamental shift in how we gauge and wager on political outcomes.

But this evolution is not without its complexities. As blockchain prediction markets claim center stage in election betting, the interplay between technology, regulation, and market psychology is generating both opportunities and growing pains. For seasoned traders and newcomers alike, understanding these dynamics is critical to navigating the new landscape of political speculation.

Key Challenges Facing Blockchain Election Markets

Despite their explosive growth, decentralized betting platforms face persistent hurdles:

- Market Manipulation: Concerns over large players (“whales”) influencing prices are not unfounded. While on-chain transparency allows public scrutiny, it doesn’t eliminate the risk of coordinated action or outsized single bets swaying market odds.

- Regulatory Uncertainty: The October 2024 court ruling was a breakthrough, but the broader legal environment remains unsettled. Platforms must adapt to shifting interpretations from regulators like the CFTC, which could impact the availability of certain contracts or even the legality of political betting in some jurisdictions.

- Liquidity Gaps: While headline volumes are impressive provides $3.1 billion in Q3 2024 alone, some markets, especially on down-ballot races or international elections, can still suffer from thin order books and wide spreads.

- Information Asymmetry: The speed at which news propagates through crypto communities can lead to sharp, sometimes irrational price swings, particularly during volatile news cycles.

These challenges underscore the need for ongoing innovation in market design, risk management, and user education. As platforms like Polymarket and Kalshi mature, expect new tools for monitoring market integrity and enhancing liquidity to emerge.

The Real-World Impact: Are Prediction Markets Outperforming Polls?

The 2024 U. S. presidential race provided a striking case study. According to a University of Cincinnati analysis, blockchain-based prediction markets outperformed traditional polls in forecasting the eventual winner. This isn’t just anecdotal, academic research increasingly finds that prediction markets, when liquid and widely participated in, aggregate dispersed information more efficiently than survey-based methods.

For political analysts, campaign strategists, and financial speculators alike, the implications are profound. Real-time market odds now shape media narratives, influence campaign tactics, and even move related digital asset prices. The line between political forecasting and financial speculation has blurred, creating a feedback loop that amplifies the predictive power of these platforms.

What’s Next for Crypto Election Betting?

With volumes hitting $3.1 billion in Q3 2024 and regulatory doors opening, blockchain prediction markets are poised to expand beyond U. S. elections. Expect to see:

- Broader Market Coverage: From local races to global referendums, decentralized platforms are likely to list a wider array of political events.

- Integration with DeFi: As DeFi protocols mature, expect deeper liquidity pools and more sophisticated hedging tools for political event risk.

- Greater Public Engagement: The gamification of political forecasting could drive civic participation, with more voters directly invested, financially and intellectually, in election outcomes.

Yet the sector’s growth will depend on continued progress in regulatory clarity, user experience, and responsible innovation. The lessons of 2024 suggest that the crowd, when given transparent, decentralized tools, can often see around corners where experts cannot.

The revolution in election betting isn’t just about wagering; it’s about harnessing collective intelligence on a global scale.

For more insights on how these platforms are reshaping political forecasting, see our analysis on how blockchain prediction markets are transforming election forecasting in 2025.