How Prediction Markets Outperform Polls in Political Forecasting: 2024 Election Insights

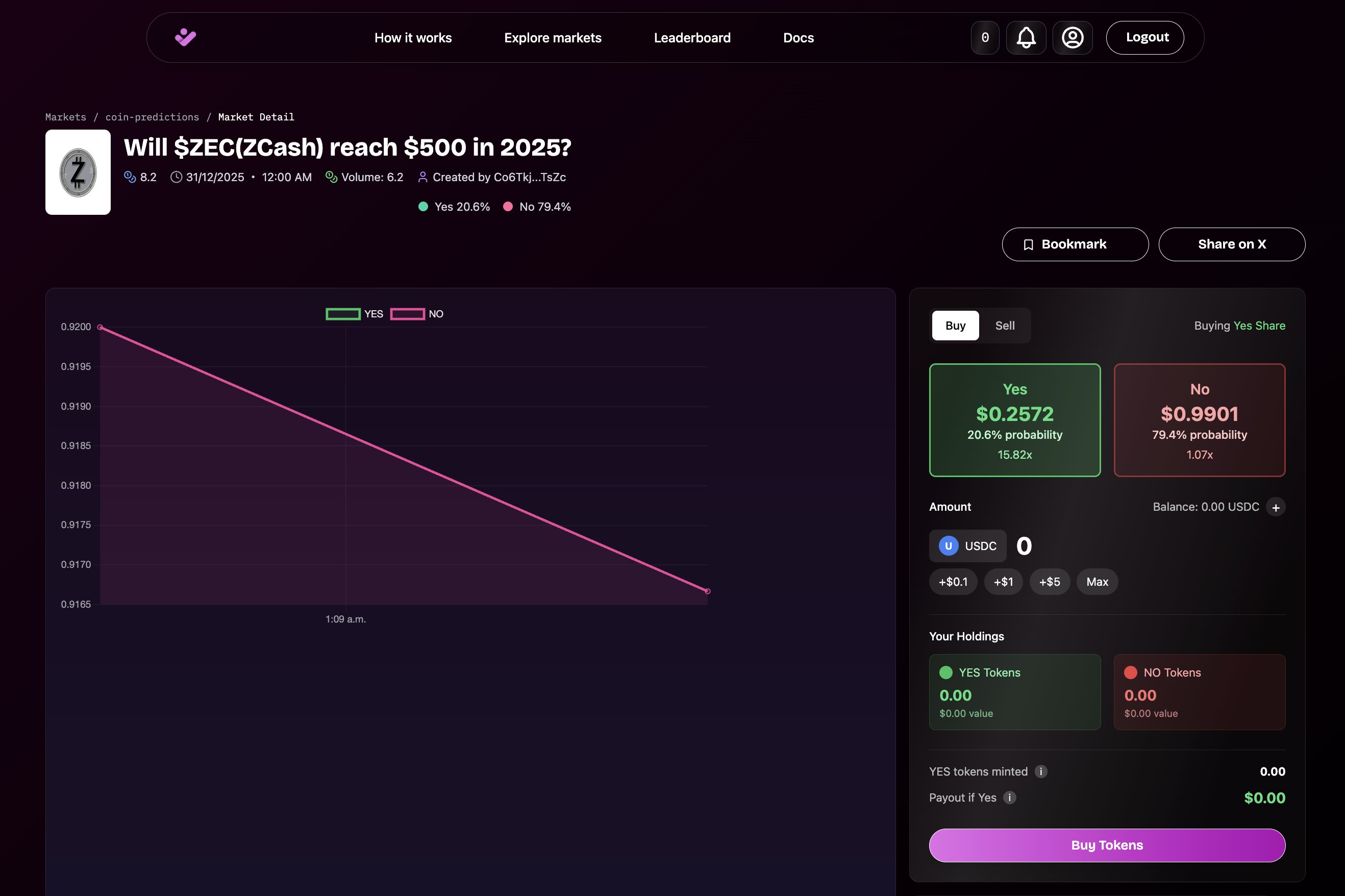

Prediction markets have taken center stage in the 2024 U. S. presidential election, outperforming traditional polling in both accuracy and agility. As the race tightened, platforms like Polymarket gave Donald Trump a 95% chance of victory before midnight, a stark contrast to major polls that consistently underestimated his odds. This divergence has reignited the debate: are real-money prediction markets the superior tool for political forecasting?

Why Prediction Markets Beat Polls: The Power of Skin in the Game

Unlike opinion polls, which rely on self-reported preferences and can be skewed by social desirability bias, prediction markets force participants to put their money where their mouth is. This financial stake incentivizes deeper research and more objective analysis, filtering out noise and wishful thinking. When real money is on the line, participants are less likely to be swayed by partisan loyalty or media narratives.

Platforms like Polymarket and Kalshi have harnessed blockchain technology to ensure transparent, tamper-proof betting on political outcomes. This has attracted a new wave of crypto-savvy traders who value both the integrity of the platform and the speed of settlement. The result? Markets that react instantly to breaking news, campaign shifts, and emerging data – often outpacing pollsters by hours or even days.

2024 Election: Prediction Market Accuracy in Action

The 2024 election was a stress test for both polling and crypto political betting platforms. As late as election day, many reputable polls still showed a tight race or even favored Kamala Harris. Meanwhile, prediction markets had already priced in a Trump win with overwhelming confidence. When the results were tallied, the markets proved prescient.

This isn’t just anecdotal. According to research from the University of Cincinnati and several independent analysts, prediction market accuracy outstripped that of traditional polls and pundit forecasts for the 2024 contest. The key advantage? Markets aggregate information from thousands of informed traders, each with their own sources and incentives to get it right.

Key Differences: Prediction Markets vs. Polls in Elections

-

Financial Incentives Drive Accuracy: Prediction markets like Polymarket reward participants for correct forecasts, encouraging objective analysis over personal bias. In contrast, polls rely on self-reported opinions, which can be influenced by social desirability or lack of engagement.

-

Real-Time, Dynamic Forecasts: Prediction markets update odds continuously as new information emerges, providing a live snapshot of sentiment. Polls are typically conducted at set intervals, leading to slower updates and potentially outdated insights.

-

Aggregated Wisdom vs. Sampled Opinions: Markets aggregate the views of a broad range of participants with financial stakes, potentially filtering out noise. Polls depend on the responses of a selected sample, which may not always represent the broader electorate.

-

Susceptibility to Manipulation: While both methods can be influenced, prediction markets face unique risks like coordinated trades or regulatory intervention. Polls can suffer from biased question wording or sampling errors.

-

Regulatory and Legal Challenges: Prediction markets, especially those involving real money like Kalshi or Polymarket, operate in a complex legal environment, sometimes facing restrictions. Polls are generally less regulated and widely accepted as a standard tool.

How Blockchain Election Betting Drives Real-Time Forecasting

Blockchain-based platforms have unlocked new possibilities for election forecasting. By removing intermediaries and enabling decentralized betting, these platforms offer lower fees and faster settlement times compared to legacy sportsbooks or centralized exchanges. Transparency is built in – every trade is recorded on-chain, and odds update in real time as traders react to new developments.

This real-time feedback loop allows prediction markets to turn news into actionable probabilities far faster than pollsters can conduct surveys or analysts can publish reports. For crypto enthusiasts and political bettors alike, this means sharper insights and a more efficient marketplace for political risk.

For a deeper dive into how blockchain technology is transforming election prediction markets, check out this analysis.

Despite their strong showing in 2024, prediction markets are not without criticism. Some analysts point to the risk of market manipulation, where deep-pocketed players could temporarily distort odds to sway public perception or hedge unrelated positions. Others highlight regulatory uncertainty, especially in the United States, where legal clarity around real-money political betting is still evolving. However, the transparent nature of blockchain-based platforms means that every bet is auditable, making manipulation harder to conceal and easier to investigate compared to opaque polling methodologies.

Another edge for prediction markets is their ability to synthesize global sentiment. Unlike polls, which are often limited by geography, language, or sampling bias, blockchain election betting platforms attract a diverse, international user base. This diversity can surface insights that local pollsters might miss, especially on issues with cross-border implications or diaspora voting patterns.

What Can Go Wrong?Limits and Lessons from 2024

It’s important to acknowledge that prediction markets are not infallible. In thinly traded markets or those with low liquidity, prices can be volatile and less reflective of true probabilities. In 2024, some critics argued that the overwhelming confidence in a Trump victory on Polymarket (95% odds before midnight) may have overstated certainty, especially as some states remained uncalled late into the night. Still, the market’s collective wisdom proved more resilient than most polls.

For traders and political analysts, the lesson is clear: use prediction market accuracy as a complement, not a replacement, for other forecasting tools. Combining market odds with polling data, historical trends, and qualitative analysis yields the sharpest edge. But when there’s real money at stake, the crowd’s incentives to be right tend to filter out a lot of noise.

Pros and Cons of Prediction Markets in Political Forecasting

-

Pro: Higher Accuracy in Recent Elections – In the 2024 U.S. presidential race, platforms like Polymarket accurately predicted Donald Trump’s victory, outperforming most traditional polls.

-

Pro: Financial Incentives Encourage Objective Analysis – Prediction markets reward participants for correct forecasts, motivating them to analyze data without personal or partisan bias.

-

Pro: Real-Time, Dynamic Forecasts – Market odds update instantly as new information emerges, providing a continuously refreshed snapshot of public sentiment.

-

Con: Susceptibility to Market Manipulation – Large investors or coordinated groups can influence prices, potentially distorting the true probability of outcomes.

-

Con: Regulatory and Legal Uncertainty – Platforms like Kalshi and Polymarket face ongoing scrutiny from regulators, which can impact market accessibility and reliability.

-

Con: Limited Participation and Accessibility – Not all voters or experts participate in prediction markets, which may limit the diversity of insights compared to broad-based polling.

Actionable Takeaways for 2025 and Beyond

With the 2024 US election in the rearview, savvy market participants are already looking ahead to future cycles. Here’s how to make the most of blockchain election betting and crypto political forecasting:

- Follow the liquidity: Markets with higher trading volumes are generally more reliable. Thin markets are more prone to wild swings and manipulation.

- Cross-reference data: Use prediction market odds alongside reputable polls and expert analysis to triangulate the most likely outcomes.

- Watch for regulatory updates: The legal landscape for real-money political forecasting is evolving rapidly. Stay informed on which platforms are compliant in your jurisdiction.

- Leverage blockchain transparency: Platforms that record all trades on-chain offer unparalleled auditability, helping you spot unusual activity or sudden sentiment shifts.

For a step-by-step guide to getting started with decentralized election forecasting, see this resource.

Ultimately, the 2024 cycle proved that when you want fast, dynamic, and often more accurate political forecasts, prediction markets, especially those powered by blockchain, are a game changer. While not immune to flaws, their blend of transparency, financial incentives, and real-time information flow puts them a step ahead of traditional polling in today’s high-stakes, rapidly evolving political landscape.