How Polymarket Dominated the 2024 US Election Prediction Markets Using Crypto

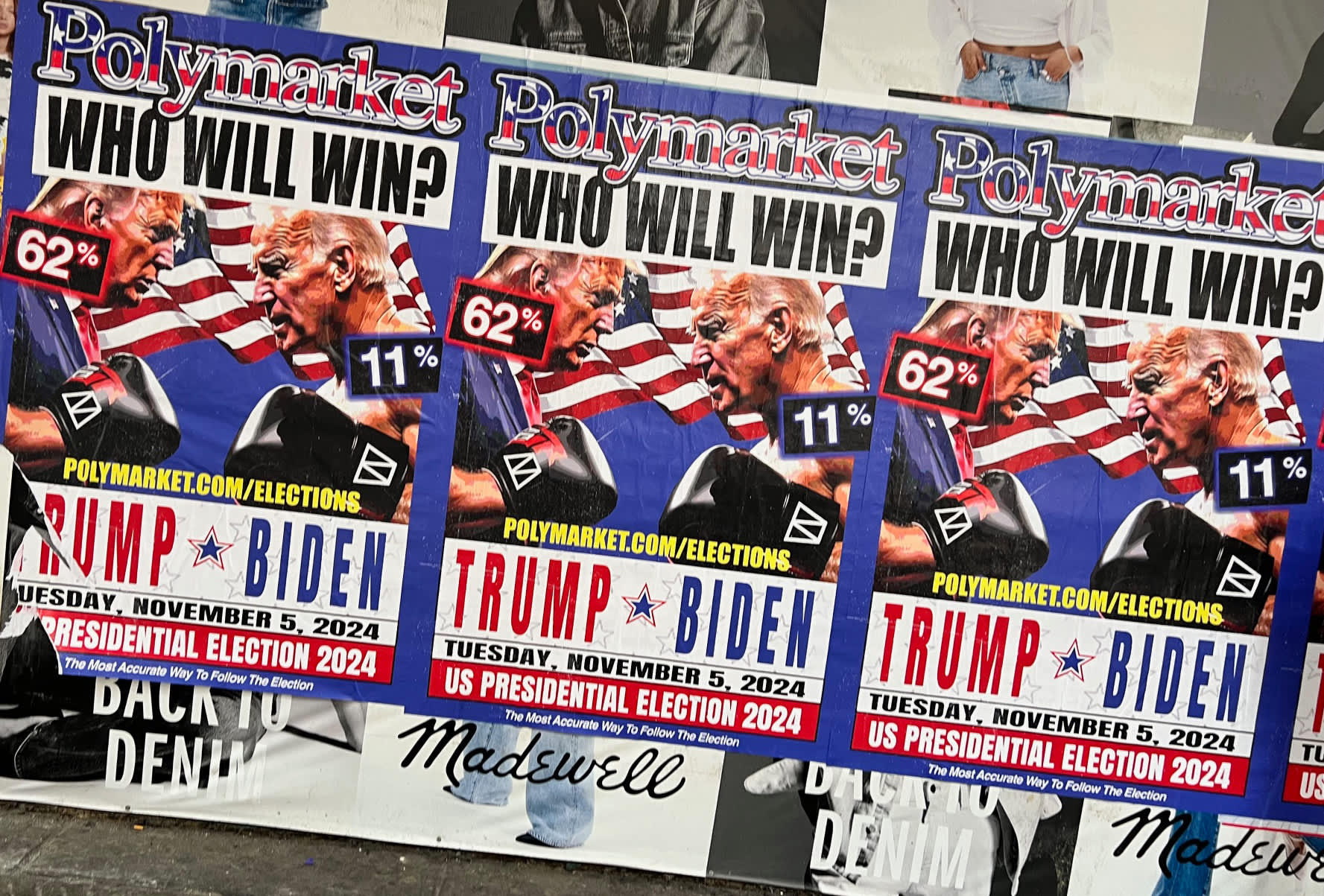

When the 2024 US presidential election cycle reached its fever pitch, one name dominated the crypto prediction market landscape: Polymarket. As voters, pundits, and pollsters scrambled to interpret shifting narratives, Polymarket’s blockchain-powered platform quietly became the most trusted barometer for political sentiment and election odds. With its decentralized architecture and transparent betting mechanics, Polymarket enabled users worldwide to place informed bets on the presidential outcome, offering a real-time pulse that frequently outperformed traditional polling methods.

Polymarket’s Meteoric Growth: The Numbers Behind the Dominance

The scale of Polymarket’s influence in the 2024 US election wasn’t just anecdotal – it was measurable. In the run-up to November 2024, Polymarket’s betting volume on the presidential race soared past $2 billion by late October. Even more striking, this figure doubled from $1 billion in just 24 days, reflecting a dramatic surge in user engagement as election day approached. By November 4, over $3 billion had been wagered across all presidential markets, with a staggering $1.2 billion focused solely on Donald Trump’s chances.

This exponential growth wasn’t limited to a single market. According to industry reports, prediction market activity exploded by 565% in Q3 2024, with Polymarket commanding a dominant 99% market share during this period. The platform’s liquidity and rapid settlement times made it a magnet for both retail and institutional participants seeking to trade on real-world outcomes with crypto.

Polymarket (POLY) Price Prediction 2026-2031

Comprehensive multi-year forecast based on Polymarket’s growth, regulatory outlook, and mainstream adoption potential.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg, YoY) | Key Scenario |

|---|---|---|---|---|---|

| 2026 | $2.00 | $2.65 | $3.50 | +32% | ICE partnership drives institutional adoption |

| 2027 | $2.20 | $3.10 | $4.25 | +17% | Mainstream finance integration, regulatory clarity improves |

| 2028 | $2.40 | $3.60 | $5.10 | +16% | Increased prediction market use cases, global expansion |

| 2029 | $2.60 | $4.15 | $6.00 | +15% | Tokenization of new asset classes, competition intensifies |

| 2030 | $2.80 | $4.85 | $7.25 | +17% | Wider DeFi integration, improved UX attracts retail |

| 2031 | $3.10 | $5.60 | $8.50 | +15% | Prediction markets become mainstream financial instruments |

Price Prediction Summary

Polymarket (POLY) is poised for steady growth through 2031, driven by its dominance in prediction markets, strong institutional backing, and ongoing blockchain innovation. While regulatory risks and competition remain, the platform’s unique positioning and real-world adoption suggest a bullish long-term outlook. Price volatility will persist, but the average price trajectory is upward, reflecting increasing utility and market confidence.

Key Factors Affecting Polymarket Price

- ICE’s $2B investment and NYSE integration could accelerate adoption and liquidity.

- Regulatory clarity (especially in the US) will be pivotal for sustained growth.

- Expansion of prediction market use cases beyond politics (e.g., finance, sports, entertainment).

- Technological improvements in scalability and user experience.

- Potential competition from both centralized and decentralized platforms.

- Macro crypto market cycles and overall DeFi adoption trends.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Why Crypto Prediction Markets Outperformed Polls in 2024

What set Polymarket apart from conventional polling and betting outlets was its ability to harness collective intelligence in real time. Unlike polls, which are often plagued by sampling bias and lagging updates, Polymarket’s markets reflected the aggregated views of thousands of participants willing to risk capital on their convictions. This dynamic pricing mechanism provided a more accurate and continuously updated forecast of the likely election outcome.

Major media outlets and academic studies have since noted that prediction markets like Polymarket anticipated key shifts in voter sentiment ahead of traditional polls. The platform’s transparent order books and blockchain settlement also minimized the risk of manipulation, further boosting user confidence. For crypto enthusiasts and political bettors alike, this was a watershed moment – proof that decentralized betting platforms could offer not just entertainment, but actionable insight into major geopolitical events.

Regulatory Hurdles and Institutional Recognition

Despite its runaway success, Polymarket’s journey was not without obstacles. In 2022, the platform settled with the Commodity Futures Trading Commission (CFTC) over operating an unregistered derivatives market, leading to a $1.4 million fine and a strategic pivot offshore. This regulatory saga underscored the complex legal environment facing crypto-based election betting in the US. Nevertheless, demand only grew stronger – by October 2025, Intercontinental Exchange (ICE), parent of the New York Stock Exchange, announced a landmark investment of up to $2 billion in Polymarket, valuing the company at $8 billion.

This institutional endorsement marks a pivotal shift in perception. What began as a niche experiment in decentralized finance is now being woven into the fabric of mainstream financial infrastructure. For those following the evolution of blockchain election betting and decentralized prediction markets, Polymarket’s rise is a case study in both innovation and resilience.

For a deeper dive into how blockchain technology is transforming election prediction markets, explore our detailed analysis here: How Blockchain Technology is Transforming Election Prediction Markets in 2024.

As the dust settled on the 2024 presidential race, Polymarket’s data-driven odds proved to be not just a curiosity but a genuine alternative to mainstream polling. While traditional surveys struggled with response rates and demographic imbalances, Polymarket’s decentralized betting platform synthesized millions of dollars of real-time opinion, creating a living, breathing forecast that adapted instantly to every campaign twist. The platform’s transparent blockchain records and open-access order books allowed anyone to audit market probabilities, fostering a level of trust unmatched by opaque polling methodologies.

How Crypto Prediction Markets Changed Political Forecasting

The 2024 cycle revealed a seismic shift in how political risk is quantified and traded. Polymarket’s success was not just about volume or liquidity, but about how it democratized access to political forecasting. Anyone with crypto could participate, regardless of geography or institutional affiliation. This global reach brought fresh perspectives and diverse capital to the table, reducing the echo chamber effect that can plague traditional polling.

Moreover, the use of stablecoins like USDC insulated users from the volatility often associated with cryptocurrencies, ensuring that betting on elections with crypto was both accessible and reliable. The platform’s rapid settlement times and low fees were particularly attractive during high-volatility moments, such as debates or breaking news cycles, when market consensus could shift in seconds.

Why Polymarket Outperformed in 2024 Election Betting

-

Unmatched Market Liquidity and Volume: In the run-up to the 2024 U.S. presidential election, Polymarket’s betting volume soared past $3 billion, with over $1.2 billion wagered on Donald Trump’s candidacy alone. This unprecedented liquidity enabled tighter spreads, more accurate pricing, and a dynamic market unmatched by traditional platforms.

-

Superior Forecast Accuracy: Academic and media analyses, including those from University of Cincinnati and CNN, highlighted that Polymarket’s prediction markets consistently outperformed traditional polls and pundits in forecasting the 2024 presidential outcome, demonstrating the wisdom-of-crowds effect in action.

-

Decentralized and Transparent Infrastructure: Built on blockchain technology, Polymarket ensures all trades and market outcomes are verifiable and tamper-resistant. This level of transparency and trust is not matched by most legacy betting platforms, which rely on centralized control.

-

Instant Settlement and Efficient Payouts: By leveraging stablecoins like USD Coin (USDC), Polymarket enabled near-instant settlement of bets. This efficiency stands in contrast to the slower, more cumbersome withdrawal processes of traditional betting sites.

-

Global Accessibility and Crypto Integration: Polymarket’s crypto-native design allowed users worldwide to participate using cryptocurrencies, such as USDC and Bitcoin (BTC) (priced at $121,837.00 as of October 2025), bypassing many geographical and banking restrictions faced by conventional platforms.

-

Institutional Endorsement and Mainstream Recognition: The October 2025 investment of up to $2 billion by Intercontinental Exchange (ICE), parent of the New York Stock Exchange, validated Polymarket’s model and signaled a shift toward integrating prediction markets into mainstream finance.

Polymarket’s dominance also sent ripples through the broader financial world. The $2 billion investment from Intercontinental Exchange (ICE) was not just a vote of confidence in prediction markets, but a signal that mainstream finance is ready to embrace blockchain-powered event trading. This partnership is expected to accelerate tokenization initiatives and bring regulatory clarity, potentially opening the door for compliant US-based election markets in the future.

Looking Ahead: The Future of Blockchain Election Betting

The Polymarket story is far from over. As of October 2025, Bitcoin sits at $121,837.00, reflecting crypto’s growing influence in global finance and event markets. With institutional capital and regulatory interest converging on decentralized prediction platforms, the next wave of innovation will likely focus on expanding market offerings, improving user experience, and integrating with traditional financial infrastructure.

For political bettors and crypto enthusiasts alike, Polymarket’s 2024 US election campaign stands as a watershed moment. It demonstrated that blockchain technology can deliver transparent, efficient, and accurate price discovery for real-world events at scale. As more participants seek alternatives to legacy polling and centralized betting houses, decentralized prediction markets are poised to play an even larger role in shaping public expectations, and financial outcomes, of major global events.

Those interested in a technical breakdown of the mechanics behind blockchain election betting can find a comprehensive guide here: How Blockchain Prediction Markets Are Changing 2024 US Election Betting.