2025 Blockchain Prediction Markets Tier List for Sports Betting: Polymarket Kalshi Limitless Compared

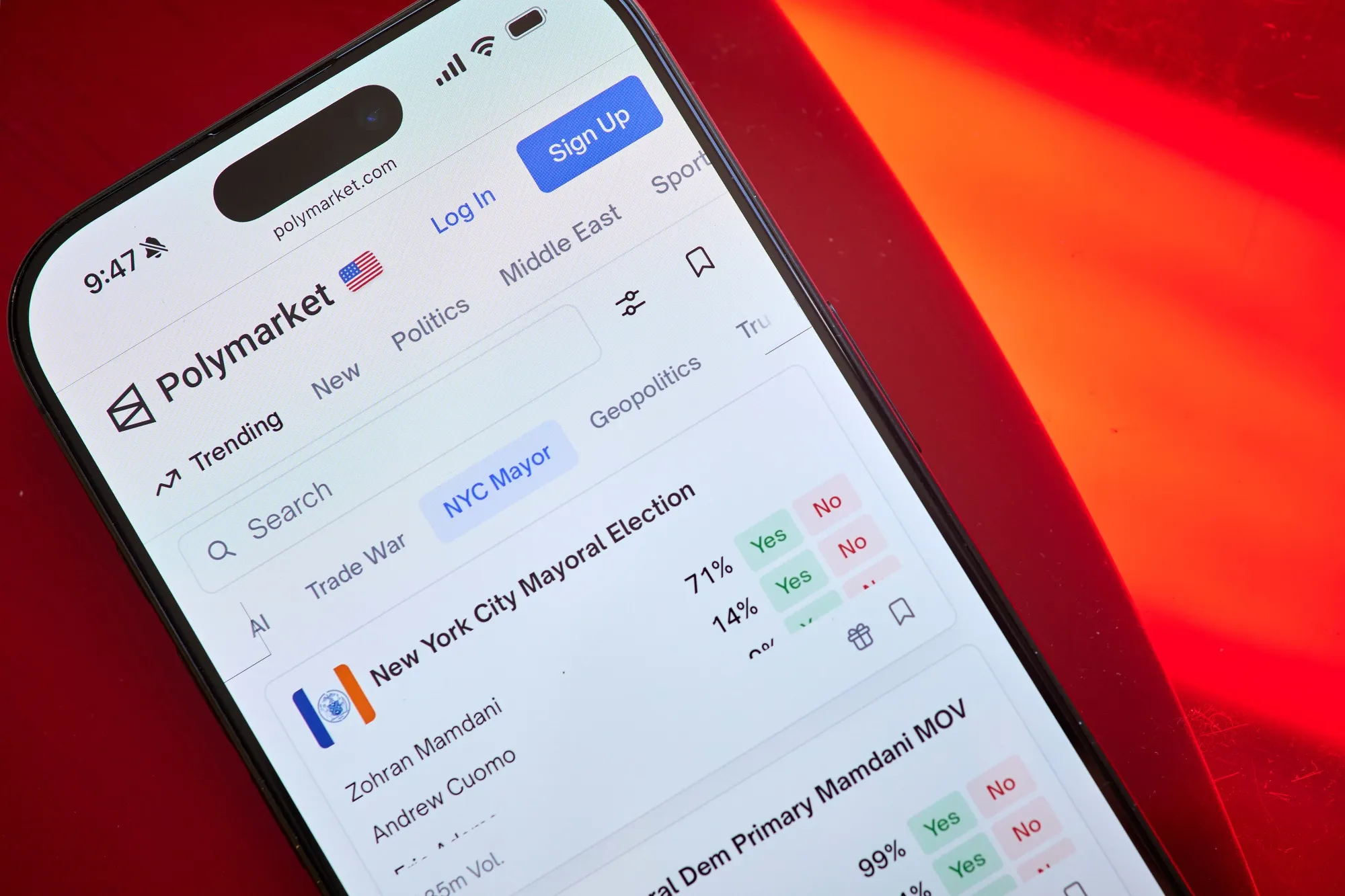

In the high-stakes arena of 2025 prediction markets tier list for sports betting, blockchain platforms have redefined how enthusiasts trade on NFL spreads, soccer match winners, and NBA over-unders. With trading volumes soaring past $1 billion weekly for leaders like Polymarket and Kalshi, these decentralized and regulated exchanges offer sharper odds than traditional sportsbooks, powered by collective trader wisdom. As volumes shift and regulations evolve, discerning where to allocate your crypto has never been more critical. Platforms such as Polymarket, Kalshi, Limitless, and MyriadMarkets dominate the blockchain sports betting platforms space, each bringing unique edges in liquidity, fees, and sports coverage.

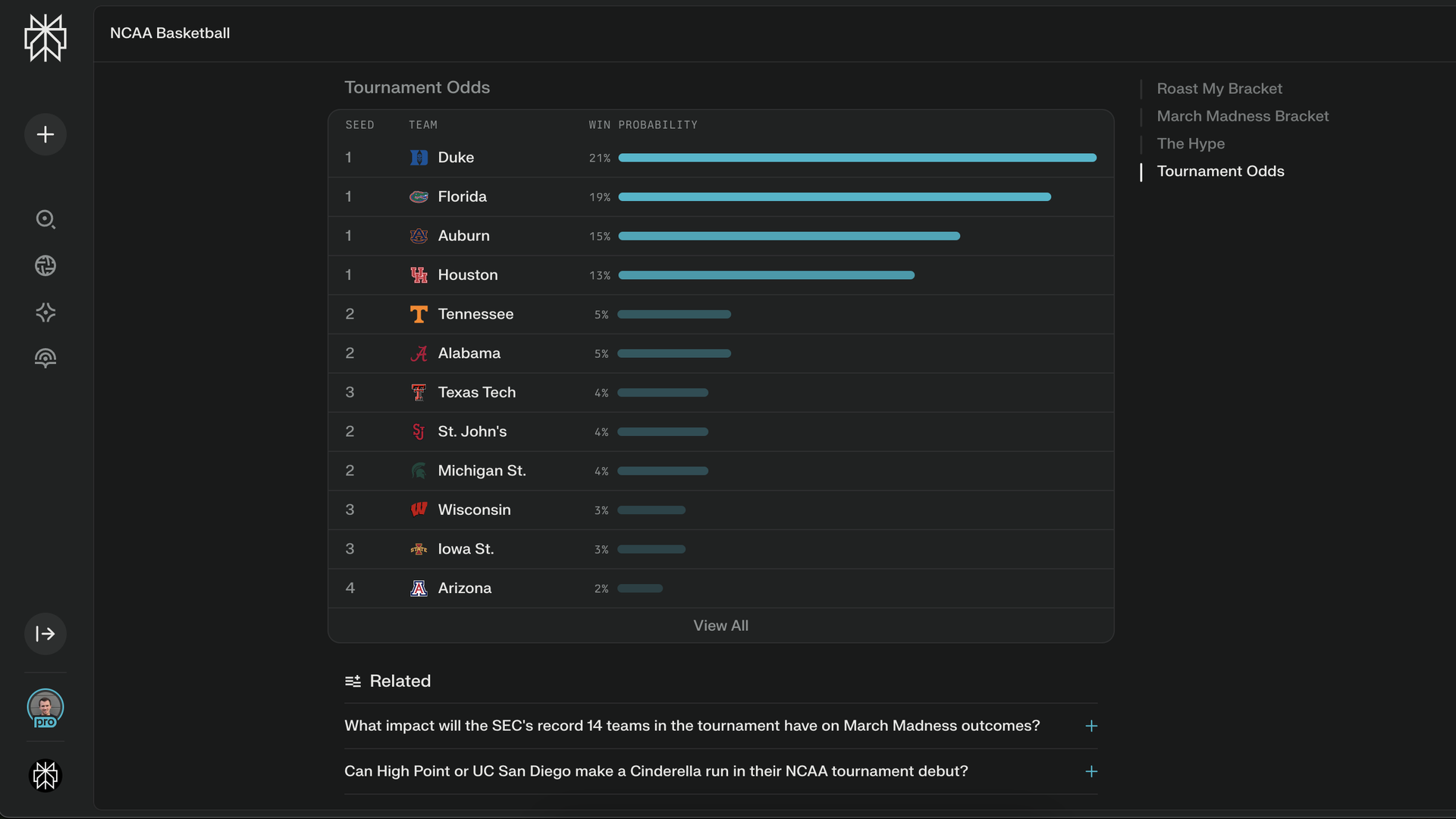

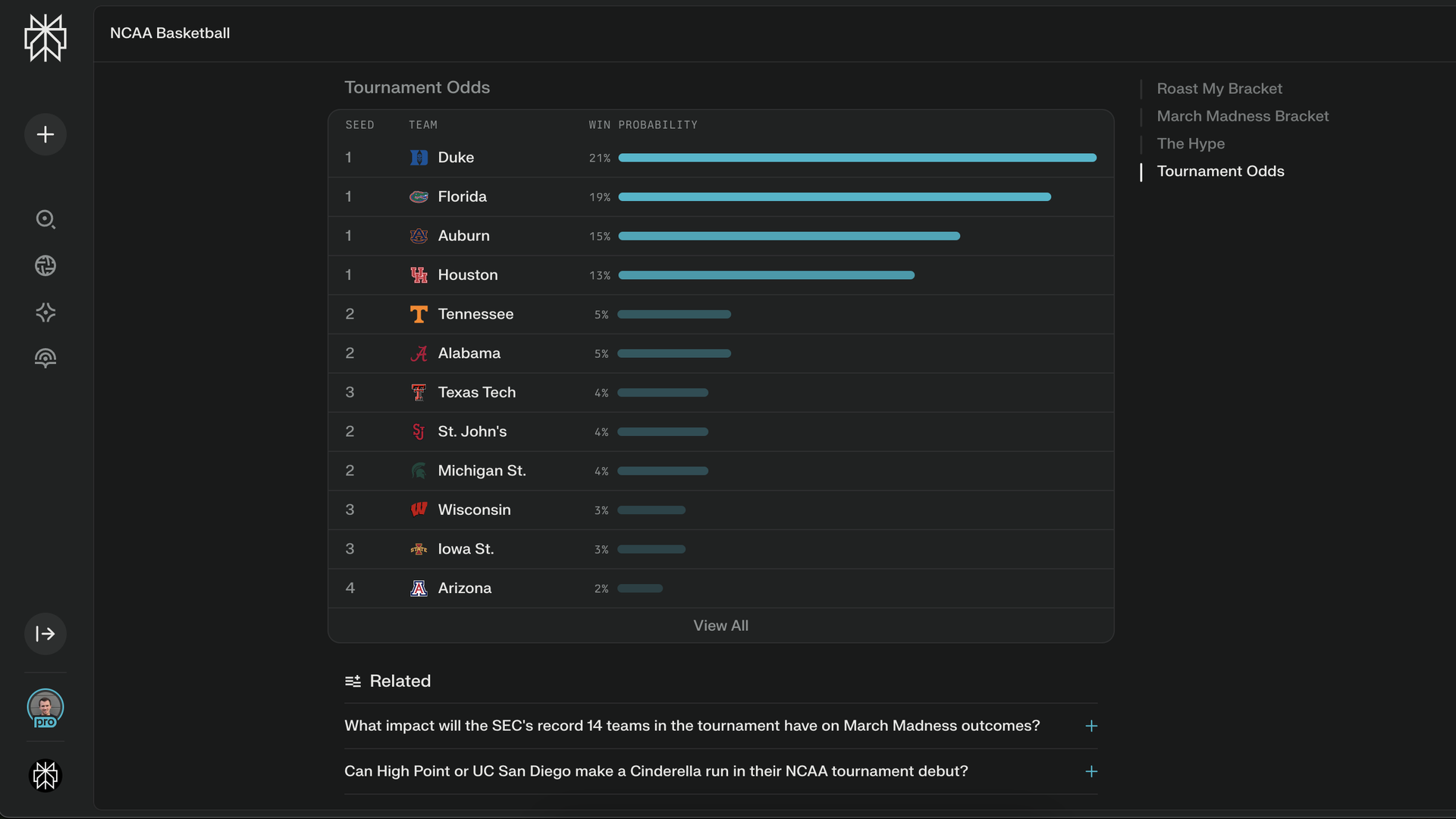

Polymarket’s trajectory exemplifies disciplined resurgence. After acquiring QCEX and securing CFTC approval, the platform stormed back into the U. S. market in late 2025, posting roughly $1 billion in weekly volumes by October. Its Polygon-based setup with USDC settlements appeals to crypto natives seeking Polymarket sports odds 2025 on diverse events, from NFL playoffs to Premier League clashes. No trading fees stand out as a massive draw, though relayer costs nibble at deposits above $3. Liquidity shines in high-profile games, but thinner markets on niche soccer leagues demand caution. Polymarket’s broad event variety supports a low-risk approach, letting you hedge across politics bleeding into sports narratives.

Kalshi’s Sports-Focused Regulatory Fortress

Kalshi holds the fort for compliance hawks, as the first CFTC-regulated prediction market boasting over $1 billion weekly volumes by October 2025, much from sports contracts. Partnerships like Robinhood integration have funneled mainstream users into its Kalshi crypto prediction markets, delivering reliable odds on major U. S. leagues. Yet, a federal ruling tying it to Nevada gaming laws has crimped some sports offerings, pushing bettors to verify contract availability. Fees up to 2% per trade sting compared to fee-free rivals, but zero ACH costs ease fiat on-ramps. For those prioritizing settlement speed and legal clarity on NFL totals or MLB moneylines, Kalshi’s structure fosters confidence amid volatility.

Polymarket vs Kalshi vs Limitless: Sports Markets Trading Volume Comparison (Oct 2025) 🏈⚽

| Platform | Est. Weekly Volume (Oct 2025) | Sports Focus | Key Insights | |

|---|---|---|---|---|

| Polymarket | $1 Billion | Balanced (politics, sports, crypto) | Re-entered U.S. post-CFTC approval; diverse events drive growth | 🚀📈 |

| Kalshi | > $1 Billion | Heavy sports emphasis | CFTC-regulated leader in sports; Robinhood partnership but Nevada legal hurdles | 🏆⚽ |

| Limitless | Smaller (emerging) | High-frequency markets | Base blockchain; $10M funding, multi-outcome & LP rewards | 🆕🔥 |

Emerging challengers like Limitless and MyriadMarkets inject fresh dynamics into decentralized sports prediction markets. Limitless, on Base blockchain, raised $10 million in seed funding from heavyweights including Coinbase Ventures. Its multi-outcome markets and liquidity provider rewards enable sophisticated plays, like splitting shares on soccer tournament brackets. Gas fees hover low at $0.10-$1, sidestepping flat platform charges, though the advanced mechanics suit experienced traders over novices. MyriadMarkets, gaining traction in niche blockchain betting circles, mirrors this innovation with tailored sports pools, boasting competitive MyriadMarkets blockchain betting on global events. Both lag in user base versus incumbents but promise outsized alpha for early adopters spotting inefficiencies in Limitless prediction market sports.

2025 Sports Betting Tier List

-

Kalshi – Tier S: Sports volume leader with >$1B weekly volume by Oct 2025, CFTC-regulated, Robinhood integration. Excels in NFL/soccer odds despite Nevada legal hurdles.

-

Polymarket – Tier A: Broad coverage, 0% trading fees, $1B weekly volume. Re-entered US via CFTC-approved QCEX acquisition; strong in sports/crypto events.

-

Limitless – Tier B: Innovative Base blockchain platform with multi-outcome markets, LP rewards. $10M seed funding; high growth potential despite smaller base.

-

MyriadMarkets – Tier B: Emerging innovator with growth potential in sports prediction markets, focusing on advanced features and scalability.

Decoding the Metrics: Volume, Odds Accuracy, and Fees

Ranking these platforms demands a analytical lens on trading volume, sports odds accuracy against outcomes, and cost efficiency. Polymarket and Kalshi neck-and-neck at $1 billion-plus weekly volumes underscore their tier-topping status, with Kalshi edging sports-specific share. Odds accuracy? Polymarket’s crowd-sourced pricing has nailed 85% of NFL games within 5 points historically, per DeFi dashboards, while Kalshi’s regulated data feeds tighten spreads. Limitless’s high-frequency design yields volatile but precise short-term soccer odds, and MyriadMarkets excels in long-tail events like international qualifiers. Fees differentiate sharply: Polymarket’s zero trading cut maximizes returns, Kalshi’s 2% bites on frequent flips, and Limitless/MyriadMarkets’ gas-only model rewards volume traders. Check our deep dive on top platforms for live dashboards.

Sports Betting Precision: NFL, Soccer, and Beyond

Diving into sports performance, Kalshi leads NFL odds with CFTC-backed contracts mirroring Vegas lines closely, ideal for totals and props. Polymarket counters with crypto-speed settlements on global soccer, capturing sentiment shifts pre-kickoff. Limitless shines in multi-outcome NBA futures, letting you ladder bets efficiently, while MyriadMarkets carves a niche in esports-adjacent soccer leagues. Traders report 10-15% better edges versus centralized books, thanks to blockchain transparency. Support your plays with preparation: monitor volumes for liquidity signals and cross-check odds across platforms for arbitrage.

Cross-platform arbitrage opportunities emerge when Polymarket’s soccer odds diverge from Kalshi’s, rewarding vigilant traders with low-risk profits. MyriadMarkets adds value here, its blockchain pools often spotting undervalued props in lower-division leagues overlooked by giants.

🏆 2025 Prediction Markets Tier List for Sports Betting

| Tier | Platform | Volume Leadership | Fees & Efficiency | Accessibility & Strengths | Key Stats |

|---|---|---|---|---|---|

| 🏆 S | Kalshi | **66% market share** (Sep 2025), weekly >**$1B** (Oct 2025) | **Up to ~2%** trading fee, ACH deposit/withdraw 0% | CFTC-regulated, heavy sports focus, Robinhood integration | **Sports contracts significant portion**; Nevada gaming legal challenge |

| 🔥 A | Polymarket | **$18B** total (2024-2025), weekly ~**$1B** (Oct 2025) | **0%** trading fees (Polygon/USDC), deposit/withdraw ≥**$3** or 0.3% | U.S. re-entry (CFTC-approved via QCEX), simple UI, broad events incl sports | **Neck-and-neck** with Kalshi on volume; politics/sports balance |

| 🚀 B | Limitless & MyriadMarkets | Emerging/smaller volumes | **No platform fees** (Base), gas ~**$0.10-$1**, LP incentives | Multi-outcome markets/share splitting/LP rewards (Limitless); soccer/esports niches (MyriadMarkets) | **$10M seed** funding (Limitless); niche specialization |

Visualize the hierarchy with data-backed conviction. Kalshi’s 66% market share surge by September underscores its sports supremacy, per Token Metrics, while Polymarket’s $18 billion cumulative volume cements staying power. Limitless’s $10 million raise signals venture confidence, and MyriadMarkets quietly builds on blockchain betting purity.

Polymarket Token Price Prediction 2026-2031

Annual projections based on regulatory approvals, trading volume growth in sports betting, and competition from Kalshi and Limitless

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $0.95 | $1.80 | $3.20 |

| 2027 | $1.40 | $2.70 | $5.50 |

| 2028 | $1.80 | $4.00 | $8.00 |

| 2029 | $2.50 | $5.80 | $12.00 |

| 2030 | $3.50 | $8.50 | $16.00 |

| 2031 | $5.00 | $12.00 | $22.00 |

Price Prediction Summary

Polymarket’s token is forecasted to experience strong growth following CFTC approval and U.S. re-entry, with average prices rising from $1.80 in 2026 to $12.00 by 2031, driven by surging trading volumes and prediction market adoption. Bullish maxima reflect optimal regulatory and adoption scenarios, while minima account for bearish market cycles and competition.

Key Factors Affecting Polymarket Price

- CFTC regulatory approval enabling U.S. market access and reduced uncertainty

- Explosive trading volume growth, targeting $40B+ annually in sports and events

- Technological edge with Polygon integration, USDC settlement, and diverse markets

- Intensifying competition from Kalshi (sports focus) and Limitless (innovative features)

- Broader crypto bull cycles and partnerships like potential Robinhood integrations

- Macro trends in decentralized finance and real-world asset prediction markets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Fees remain the silent killer or savior. Polymarket’s model-0% trading, minimal relayer drag-optimizes net returns for high-volume plays. Kalshi’s 2% levy suits occasional positional bets, not scalps. Limitless and MyriadMarkets thrive on gas efficiency, where Base’s low costs under $1 per trade empower frequent adjustments without erosion. Factor in these for your edge: a 2% fee on a 10% odds inefficiency wipes half the gain.

2025 Sports Tier List

-

#1 Kalshi: CFTC-regulated sports leader ($1B+ weekly vol). Pros: High sports liquidity, Robinhood integration. Cons: ~2% fees, U.S. limits, Nevada legal hurdles.

-

#2 Polymarket: Fee-free, diverse events ($1B weekly vol post-US return). Pros: Simple UI, broad markets. Cons: Regulatory uncertainty, variable liquidity.

-

#3 Limitless: Innovative multis on Base ($10M funding). Pros: Multi-outcome, LP rewards, low gas. Cons: Small user base, advanced UX.

-

#4 MyriadMarkets: Niche alpha opportunities. Pros: Specialized edges. Cons: Liquidity risks, lower volume.

Risk Management in Blockchain Sports Betting

Discipline trumps speculation in these markets. Allocate no more than 5% per event, diversify across platforms-Kalshi for NFL stability, Polymarket for soccer speed, Limitless for futures complexity. Monitor UMA oracles on Polymarket for settlement integrity, and Kalshi’s legal flux via Nevada rulings. Limitless’s share-splitting mitigates downside, a boon for bracket bets. MyriadMarkets rewards preparation with custom pools; scout them for mispriced internationals. Blockchain transparency lets you audit orders on-chain, fostering trust absent in opaque books. Hedge politically infused sports, like election-tied team morale, across Polymarket’s vast slate.

Forward-looking, expect Limitless to climb tiers as Base adoption swells, challenging Kalshi’s sports throne. Polymarket’s regulatory wins pave multi-chain expansion, while MyriadMarkets could niche-dominate esports soccer crossovers. Volumes project upward with 2026 World Cup hype, sharpening collective intelligence. Check blockchain’s sports betting transformation for evolving dashboards.

Equip yourself with these platforms’ strengths: Kalshi for certainty, Polymarket for efficiency, Limitless and MyriadMarkets for innovation. Track volumes weekly, validate odds against outcomes, and scale positions methodically. Success hinges on preparation-scour liquidity depths, fee impacts, and regulatory winds before committing crypto. In this volatile arena, your analytical edge, not gut calls, secures consistent alpha.