How Prediction Markets Quantify Cultural Shifts: Real-Time Forecasting for 2025 and Beyond

Prediction markets are no longer niche tools for finance geeks and crypto insiders. In 2025, they have become the pulse monitors of society, quantifying cultural shifts with a clarity that traditional polls and punditry cannot match. As blockchain rails make these markets more transparent and accessible, platforms like Kalshi, Manifold, and Melee are empowering users to place decentralized bets on everything from political upheavals to viral pop culture moments. The result is a new form of real-time forecasting that captures not just what people think will happen, but how collective sentiment moves as events unfold.

How Blockchain Prediction Markets Make Culture Quantifiable

The core innovation of blockchain-based prediction markets is their ability to turn opinions into liquid, tradeable assets. Every contract – whether on a presidential election outcome or the next viral meme – reflects the aggregated probability assigned by thousands of participants. Unlike static opinion polls, these prices update instantly as new information hits the public sphere.

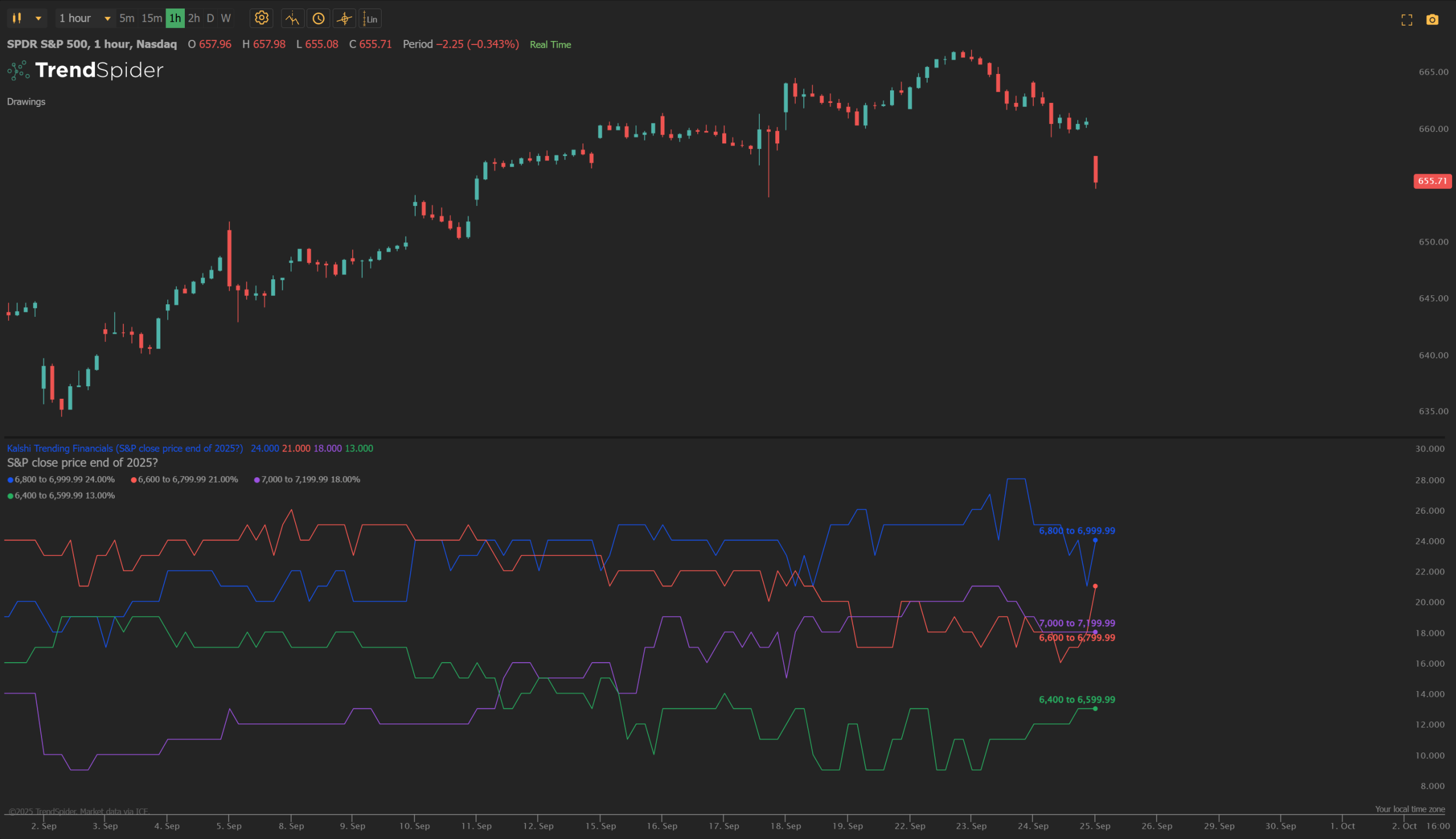

Consider Kalshi’s event contracts: users can buy or sell positions on issues like presidential approval ratings or landmark legislation passing Congress. If a new scandal breaks or a major bill is tabled, contract prices adjust in real time, providing an immediate readout of how public expectations are shifting. This dynamic pricing mechanism transforms abstract cultural trends into concrete numbers that can be tracked, analyzed, and even traded.

The Mainstreaming of Market-Based Forecasting in 2025

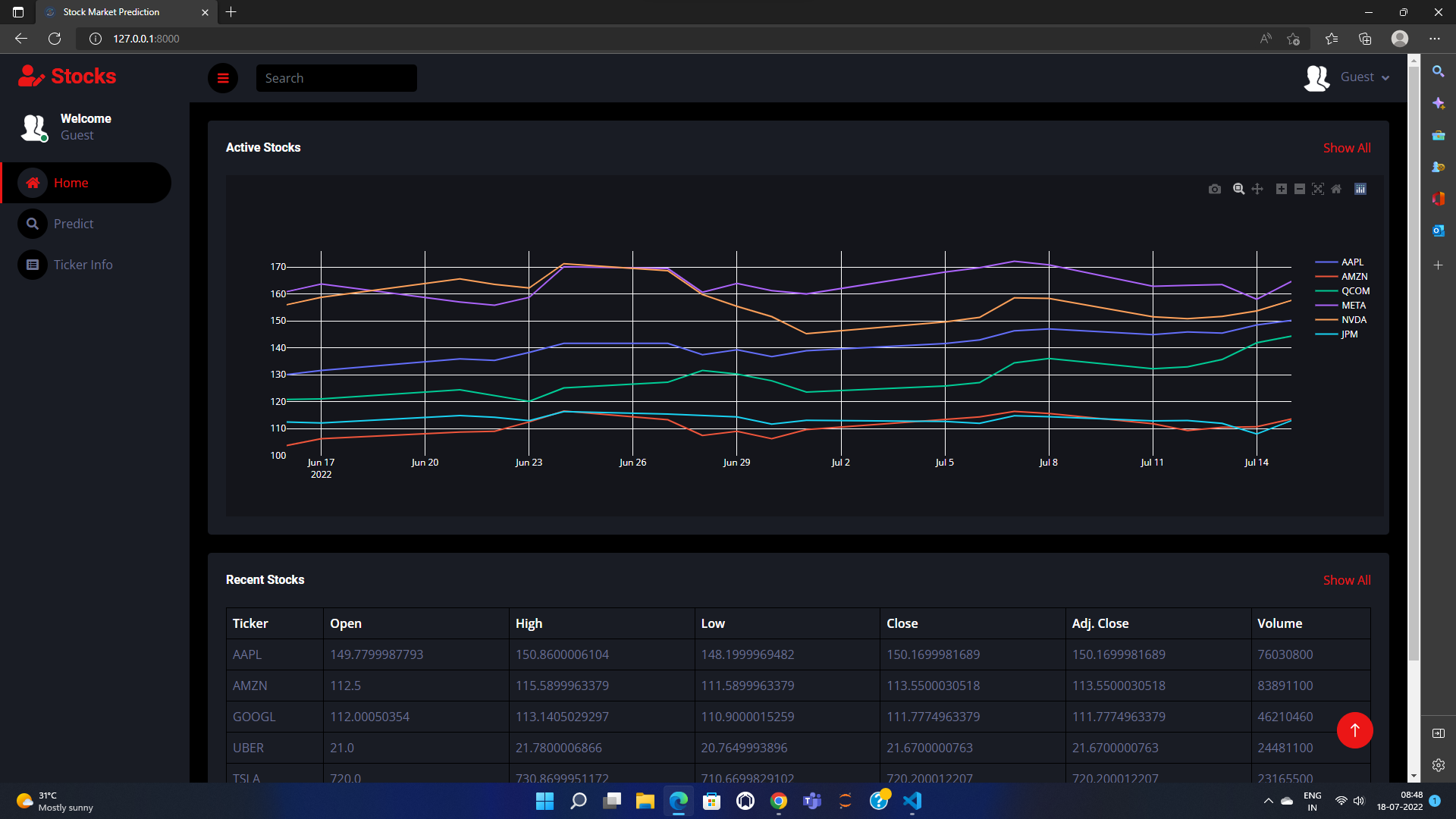

The past year has seen prediction markets go mainstream. Perhaps the most telling sign: in 2025, Google Finance began integrating live market probabilities from leading platforms such as Kalshi and Polymarket directly into its dashboards. Now anyone tracking macroeconomic data or political races can see at-a-glance what the crowd thinks about upcoming Federal Reserve moves or election outcomes.

This mainstream adoption is not just about convenience; it’s about credibility. As institutional investors and retail traders alike use prediction market data to inform their strategies, the line between betting and forecasting continues to blur. These decentralized betting platforms are quickly becoming trusted barometers for social trends – an evolution explored further in our deep dive on how prediction markets are revolutionizing cultural trend forecasting.

Academic Insights: Markets as Mirrors of Cultural Drift

Recent academic research has begun to validate what market participants have long suspected: prediction markets don’t just reflect public opinion – they actively track deeper semantic shifts across society. Studies like “Stories that (are) Move(d by) Markets” reveal causal links between market shocks and changes in partisan discourse online. Others show how continuous drifts in collective attention can be measured through both economic activity and cultural consumption patterns.

These findings underscore why decentralized betting on social trends isn’t just entertainment; it’s a powerful tool for understanding the evolving narratives that shape our world. For strategists, marketers, and policymakers alike, blockchain event markets offer an unprecedented window into real-time cultural dynamics.

As prediction markets cement their role as real-time cultural barometers, their influence is rippling far beyond finance and politics. In 2025, the integration of these platforms into mainstream analytics tools has made decentralized betting on social trends a key input for everyone from brand strategists to public policy analysts. The transparency and immediacy of blockchain rails mean that shifts in collective mood, whether sparked by a viral video, a political gaffe, or an unexpected economic report, are instantly visible and actionable.

This new layer of market-driven cultural intelligence is already reshaping decision-making. For example, entertainment studios are using prediction market data to gauge audience anticipation for upcoming releases, adjusting marketing spends in real time as sentiment fluctuates. Political campaigns monitor contract prices to spot momentum swings before traditional polls catch up. Even sports franchises are tapping into these signals to predict fan engagement and merchandise demand.

The Power (and Limits) of Collective Forecasting

While the wisdom of crowds can be remarkably prescient, it’s not infallible. Prediction markets are susceptible to herd behavior and information cascades, especially when high-profile events draw in waves of speculative capital. Yet the distributed nature of decentralized betting platforms mitigates some risks: with thousands of independent actors trading on open protocols, manipulation becomes more difficult than in closed polling or opaque bookmaking systems.

What sets blockchain event markets apart is their radical transparency. Every trade is recorded on-chain, allowing independent analysts to audit flows and spot anomalies. This accountability not only boosts trust but also attracts sophisticated participants who bring deeper research and sharper insights into the ecosystem.

Top Ways Prediction Markets Quantify Cultural Shifts in 2025

-

Real-Time Sentiment Tracking on Kalshi: Platforms like Kalshi aggregate user predictions on topics such as presidential approval ratings and major legislation, providing up-to-the-minute data on public sentiment and expectations.

-

Integration with Financial Platforms like Google Finance: In 2025, Google Finance began displaying live probabilities from prediction markets, making cultural and economic forecasts accessible to mainstream investors and analysts.

-

Blockchain-Based Platforms such as Polymarket and Melee: These decentralized platforms leverage blockchain technology to ensure transparency and trust, letting users bet on outcomes ranging from global elections to pop culture events.

-

Academic Research Validating Market Insights: Studies like “Stories that (are) Move(d by) Markets” demonstrate how prediction market shocks can causally influence public discourse and semantic shifts, cementing their role in quantifying cultural change.

-

Coverage of Diverse Cultural Phenomena: Modern prediction markets now offer contracts on everything from sports and entertainment to economic indicators, reflecting and quantifying the evolving interests and values of society.

Looking Ahead: The Next Frontier for Cultural Trend Prediction

The evolution isn’t slowing down. As AI-powered bots join human traders in parsing news feeds and social sentiment, expect even faster price discovery in markets tied to emerging cultural phenomena. Platforms like Melee are experimenting with new contract types that let users bet on everything from meme stock surges to TikTok trends going mainstream, further blurring the boundaries between financial speculation and cultural participation.

The regulatory landscape remains fluid, as seen with Kalshi’s ongoing legal battles over which event types can be listed. But even amid compliance headwinds, the appetite for real-time forecasting tools continues to grow. For crypto-native users especially, decentralized betting on societal shifts feels less like gambling and more like strategic positioning within an ever-changing narrative marketplace.

Ultimately, prediction markets do more than just forecast, they make abstract cultural currents measurable and tradable at scale. As we move deeper into 2025 and beyond, expect these platforms to shape not only how we bet on the future but how we understand it.