How Blockchain Prediction Markets Are Changing 2024 US Election Betting

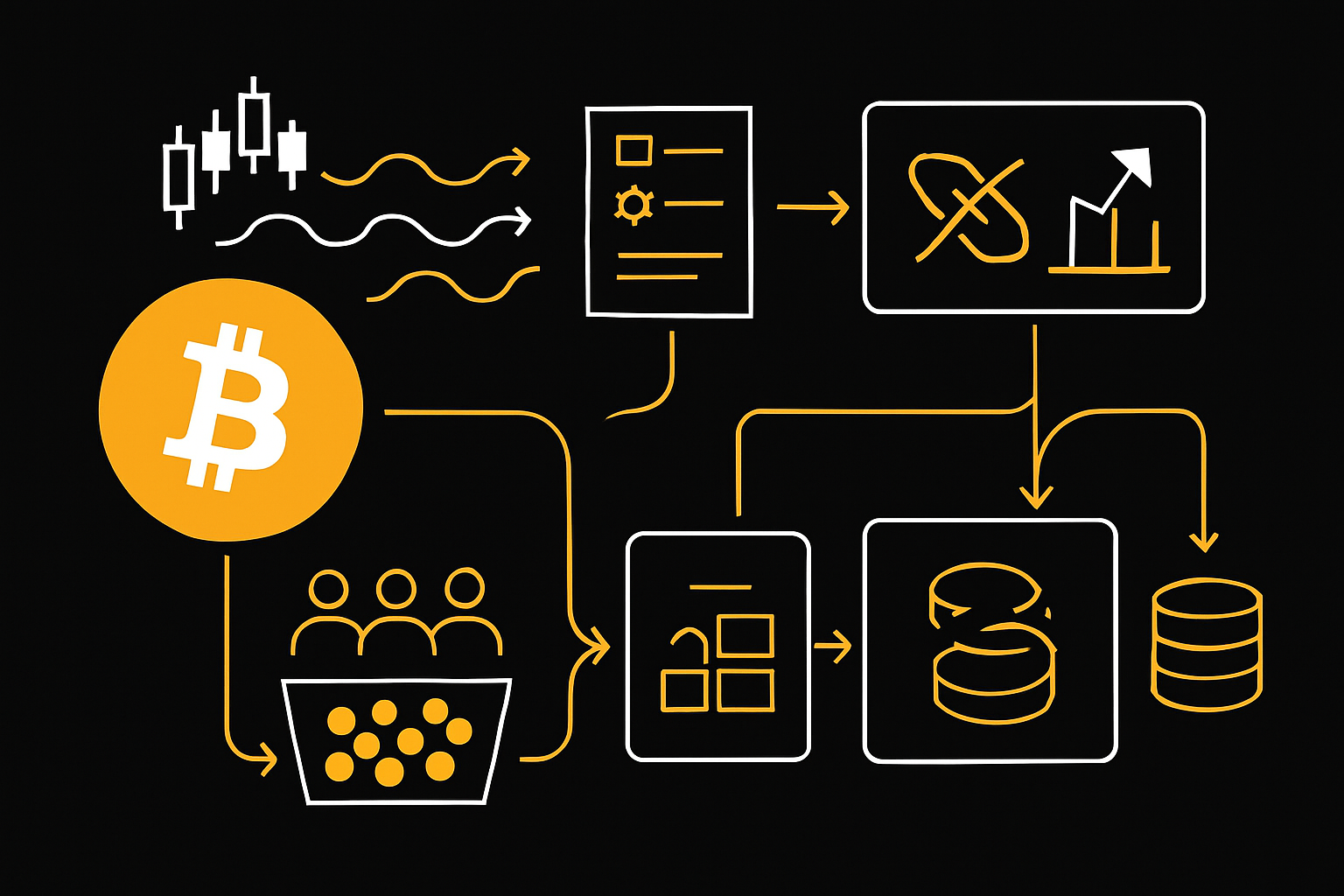

Blockchain prediction markets have rapidly become the epicenter of 2024 US election betting, drawing both crypto enthusiasts and political analysts into a new era of decentralized speculation. Unlike traditional bookmakers or offshore betting sites, blockchain-based platforms such as Polymarket and Kalshi offer a transparent, trustless environment where every wager is recorded on-chain, visible to all, and resistant to manipulation. This shift is not just technological – it’s fundamentally changing how Americans engage with political forecasting.

Election Betting Enters the Blockchain Era

The surge in blockchain prediction markets during the 2024 US presidential race was nothing short of historic. In Q3 2024 alone, market volume soared by 565%, reaching $3.1 billion, up from $463.3 million in the previous quarter. Polymarket dominated this landscape, capturing over 99% of market share with an astonishing $1.7 billion staked on the outcome. These numbers dwarf previous cycles and signal a clear appetite for decentralized election prediction among both retail and institutional participants.

What’s behind this explosion? For one, blockchain technology provides an open ledger that guarantees every bet is auditable and settlements are automatic. This level of transparency has attracted users disillusioned by opaque odds and slow payouts elsewhere. Furthermore, platforms like Polymarket allow for micro-bets on nuanced scenarios – from “Who will win Pennsylvania?” to “Will there be a recount in Georgia?” – offering far more granular engagement than legacy sportsbooks.

Accuracy: Can Prediction Markets Beat Polls?

A key argument for blockchain prediction markets is their predictive power compared to traditional polling methods. Recent academic research underscores this advantage: a University of Cincinnati study found that a major prediction market outperformed both polls and pundits in forecasting the 2024 presidential result. The reason? Markets aggregate diverse opinions backed by real financial stakes, filtering out noise more effectively than survey-based approaches.

This was vividly illustrated as Polymarket odds swung sharply throughout election night, reflecting real-time sentiment shifts as results trickled in. At one point, posts on social media platform X noted that Polymarket gave Donald Trump a 95% chance of victory before midnight – a figure that tracked closely with eventual outcomes while many mainstream polls lagged behind.

Regulatory Winds Shift: The Legalization Debate

The legal landscape for blockchain prediction markets remains complex but is evolving quickly. In October 2024, the U. S. Court of Appeals provisionally allowed Kalshi to offer contracts on congressional control after determining that regulators had not shown sufficient public harm from such markets. This ruling marked a watershed moment, signaling greater openness from policymakers toward regulated event contracts involving political outcomes.

Yet uncertainty persists. In November 2024, an FBI raid on Polymarket CEO Shayne Coplan’s home highlighted ongoing concerns about oversight and compliance – especially as these platforms grow in size and influence. Critics argue that widespread election betting could undermine public trust or incentivize bad actors; proponents counter that decentralization makes manipulation harder and improves information flow.

Both sides agree on one point: the stakes are rising. As billions of dollars flow into decentralized election prediction, the question is not whether blockchain will play a role in future cycles, but how regulators and market participants will adapt to its new realities.

Ethical Dilemmas and Public Trust

While advocates tout the transparency and efficiency of blockchain prediction markets, some worry about their broader impact on democracy. Critics contend that high-stakes betting on political outcomes could foster cynicism or even incentivize attempts to sway elections for financial gain. The FBI’s investigation into Polymarket has only intensified these debates, with lawmakers calling for clearer regulatory frameworks and enhanced oversight.

On the other hand, supporters argue that these platforms democratize access to information and empower citizens to express their views financially. By aggregating thousands of individual predictions, blockchain markets can serve as a real-time barometer of public sentiment, potentially offering insights more accurate than traditional polling or punditry. This duality captures the tension at the heart of decentralized election prediction: innovation versus risk, openness versus control.

What Comes Next for Crypto Election Betting?

The 2024 cycle has set a precedent, but the evolution of crypto betting on elections is far from over. With $3.1 billion in Q3 2024 market volume and platforms like Polymarket accounting for $1.7 billion staked on presidential outcomes, it’s clear that appetite for decentralized forecasting is only increasing. Yet the future will hinge on several factors:

- Regulatory clarity: Will U. S. authorities embrace regulated event contracts or impose stricter limits?

- Technological improvements: Can platforms enhance user experience while maintaining security and compliance?

- Cultural acceptance: Will blockchain-based prediction markets become mainstream tools for political engagement, or remain niche products for crypto-savvy users?

The answers will shape not just betting behavior but also how Americans, and global audiences, interpret political risk and opportunity in real time.

Why Decentralized Markets Matter

The rise of decentralized election prediction is about more than speculation; it’s about trustless systems challenging legacy institutions. As users demand transparency and instant settlement, blockchain sports betting and political wagering could set new standards across industries, from finance to journalism. The technology isn’t just enabling new types of bets; it’s redefining how we collectively process uncertainty and forecast world events.

This transformation isn’t without growing pains or controversy, but its momentum appears unstoppable as we look toward future cycles. Whether you’re a crypto enthusiast, political junkie, or simply curious about where tech meets governance, keeping an eye on this space will be essential in understanding tomorrow’s information markets.