How Blockchain Prediction Markets Are Transforming Election Forecasting in 2025

Election forecasting in 2025 is undergoing a seismic shift, driven by the rise of blockchain prediction markets. What was once the exclusive domain of pollsters and pundits is now a decentralized, transparent competition where anyone with an internet connection and crypto wallet can trade on real-time election odds. These platforms are not only upending how we measure political sentiment but also redefining what it means to “predict” an election outcome.

Why Blockchain Prediction Markets Outpace Traditional Polls

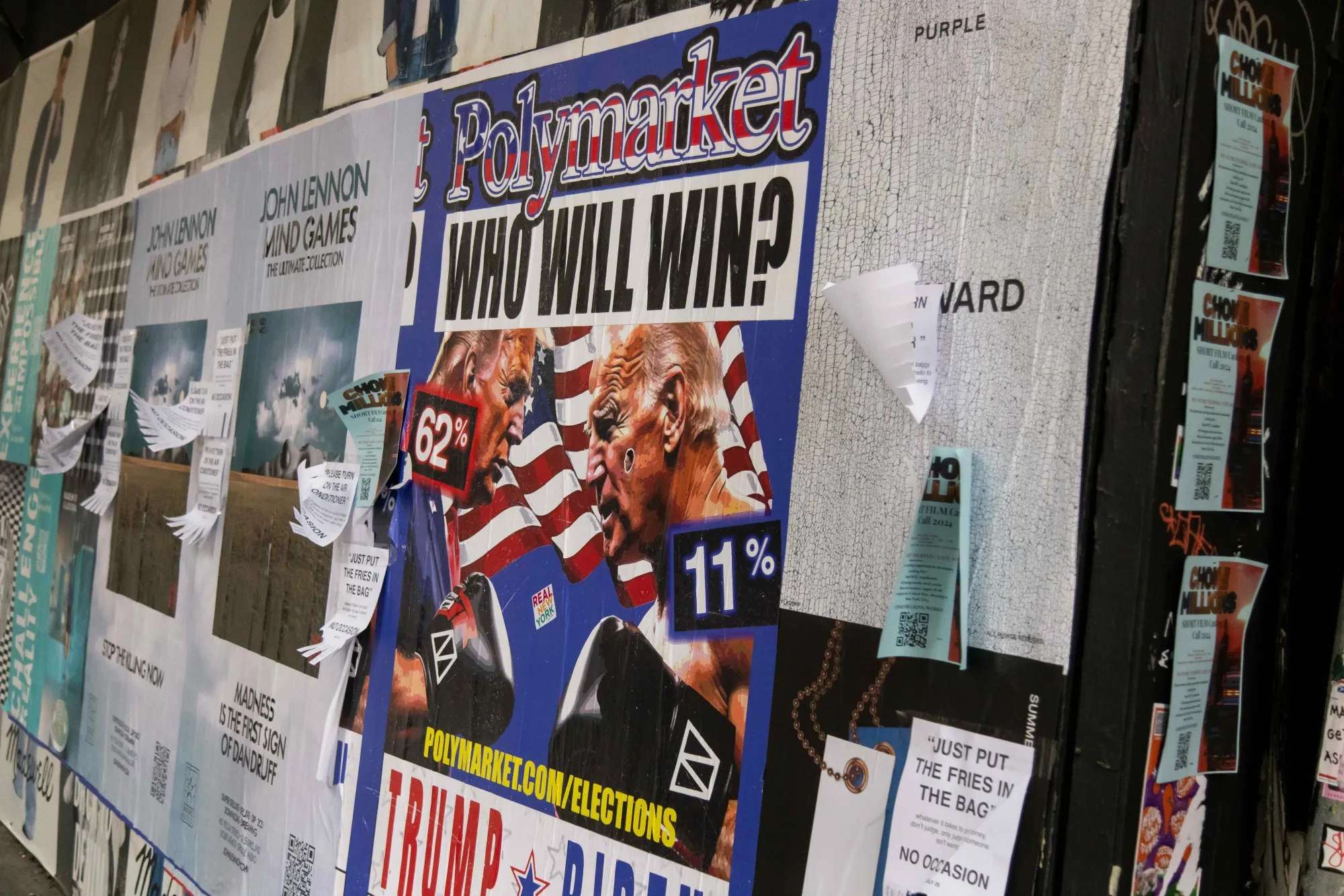

The appeal of crypto betting on elections is straightforward: blockchain-based prediction markets aggregate the wisdom (and conviction) of thousands, often millions, of participants. Unlike traditional polls, which can lag behind fast-moving news cycles and are susceptible to sampling bias, decentralized markets update instantly as new information hits the wires. For example, Polymarket – the world’s largest election prediction market – saw over $200 million in bets on the 2024 U. S. presidential race, with trading volumes surpassing $111 million in June alone. These numbers reflect unprecedented trust in decentralized platforms for political forecasting.

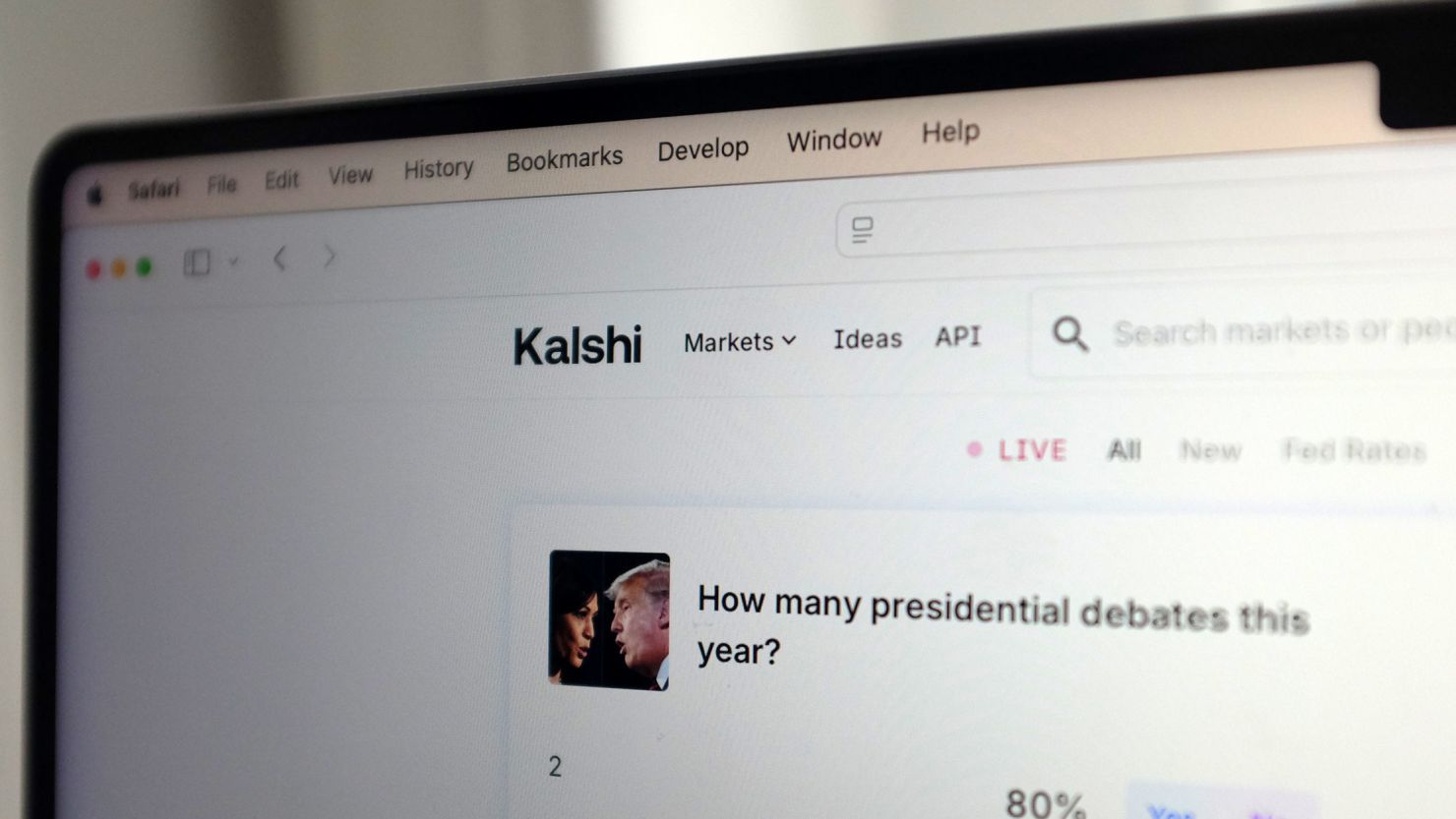

This surge isn’t just about volume; it’s about accuracy and transparency. As Kalshi CEO Tarek Mansour notes, prediction markets deliver real-time information, while legacy polls might take weeks to register shifts in public opinion. The net result? In 2024, blockchain-based markets were more accurate than most mainstream polls at calling key swing states – and investors have noticed.

The Tech Behind Decentralized Election Odds

The backbone of these platforms is blockchain technology itself. By settling trades on-chain (Ethereum-Polygon in Polymarket’s case), users enjoy tamper-proof records and rapid payouts with minimal fees. Each contract represents a binary event – for example, “Will Candidate X win State Y?” – with prices fluctuating between $0 and $1 based on real-time supply and demand.

This structure creates powerful incentives for accuracy: if you think the market is wrong, you can bet against it – putting your crypto where your mouth is. The best-informed traders profit from their insights, while misinformation or wishful thinking gets quickly arbitraged away. This collective intelligence effect has made platforms like Kalshi (now valued at $2 billion after its latest funding round) central to both retail speculators and institutional players seeking an edge for election night.

Key Advantages of Blockchain Prediction Markets for Elections

-

Enhanced Transparency and Tamper-Proof Records: Blockchain technology ensures all bets and trades are recorded immutably, making election forecasting data fully auditable and resistant to manipulation. Platforms like Polymarket leverage the Ethereum-Polygon blockchain to provide transparent, verifiable market activity.

-

Real-Time, Crowd-Sourced Insights: Unlike traditional polls that may lag by weeks, blockchain prediction markets aggregate live opinions and bets from a global user base, offering up-to-the-minute forecasts. Kalshi’s CEO notes that these markets reflect shifts in sentiment almost instantly.

-

Greater Accuracy Through Diverse Participation: By enabling anyone to participate, blockchain markets harness the collective intelligence of thousands of users. Studies have shown platforms like Polymarket outperformed traditional polls in the 2024 U.S. presidential election.

-

Regulatory Progress and Mainstream Adoption: Major platforms are gaining regulatory approval, increasing trust and legitimacy. For example, Polymarket received CFTC approval to operate in the U.S. after acquiring QCEX, and Kalshi is now valued at $2 billion following a $185 million funding round.

-

Financial Incentives for Accurate Forecasting: Participants can profit from accurate predictions by earning cryptocurrency, aligning incentives toward truthful forecasting rather than speculation or bias. This model rewards informed analysis over guesswork.

Regulatory Hurdles and Ongoing Debates

No innovation comes without friction. The explosive growth of decentralized election betting has drawn intense scrutiny from regulators like the U. S. Commodity Futures Trading Commission (CFTC). Concerns range from potential gambling violations to questions about foreign interference and market manipulation. In 2025, Polymarket secured CFTC approval to relaunch U. S. operations after acquiring QCEX – a CFTC-licensed derivatives exchange – but not every platform has cleared these hurdles yet.

Critics also point out that low trading volumes in niche races or susceptibility to coordinated campaigns could undermine reliability in some cases. Still, as major players continue to secure regulatory clarity and demonstrate robust security practices, confidence in these markets keeps rising among both retail users and institutional analysts.

Looking beyond regulation, the debate over prediction market vs polls is intensifying. While some political scientists worry about manipulation or overreliance on market sentiment, the empirical record is hard to ignore: in 2024, decentralized platforms like Polymarket and Kalshi consistently delivered sharper forecasts than leading poll aggregators. The transparent, open-access nature of these markets makes it much harder for bad actors to skew results undetected, every trade is visible and auditable on-chain.

For those new to this space, the mechanics are refreshingly simple. Users connect their crypto wallet, select an election contract (such as “Will Party X control the Senate?”), and buy shares reflecting their view. As news breaks or campaign dynamics shift, prices adjust instantly, offering a living snapshot of crowd sentiment that’s impossible to replicate with phone surveys or focus groups. This real-time feedback loop has proven invaluable for campaign strategists, journalists, and data-driven traders alike.

How Event Markets Are Shaping the Future of Election Forecasting

The rise of platforms like Event Markets signals a broader shift toward democratized forecasting tools. By lowering barriers to entry and leveraging blockchain for trustless settlement, these markets have made it possible for anyone, from seasoned quants to curious voters, to contribute to the collective intelligence driving election odds. The result is a more dynamic, resilient ecosystem that reflects both conviction and information quality in real time.

Top Use Cases for Decentralized Election Prediction Markets in 2025

-

Real-Time Election Forecasting: Platforms like Polymarket aggregate crowd predictions on election outcomes, offering up-to-the-minute odds and insights that often surpass the accuracy of traditional polls.

-

Transparent and Tamper-Proof Betting: Blockchain-based markets ensure all bets and outcomes are publicly verifiable, reducing the risk of manipulation and increasing trust in the forecasting process.

-

Regulatory-Compliant Political Event Contracts: Kalshi offers CFTC-approved event contracts on major elections, enabling secure and legal participation in political forecasting.

-

Global, Inclusive Participation: Decentralized platforms allow users worldwide to contribute their insights and predictions, creating a more diverse and representative forecasting pool than traditional polling methods.

-

Market-Based Incentives for Information Discovery: By rewarding accurate forecasts with cryptocurrency payouts, these platforms motivate participants to research and share high-quality information about electoral events.

While challenges remain, especially around regulatory harmonization and ensuring deep liquidity in less-covered races, the trajectory is clear. As more institutional capital flows into crypto betting on elections and as mainstream audiences grow comfortable with decentralized platforms, we can expect prediction markets to play an even larger role in shaping how we understand political risk.

Volatility is no longer something to fear, it’s an opportunity for those who can read the signals. In 2025’s high-stakes electoral landscape, blockchain prediction markets are providing those signals with unrivaled speed and transparency.

If you’re interested in learning more about how blockchain-based event trading is disrupting traditional election analysis, and what it means for your own strategies, see our latest research at How Prediction Markets Are Disrupting Election Forecasting in 2025.