How Blockchain Prediction Markets Are Changing 2024 Election Betting

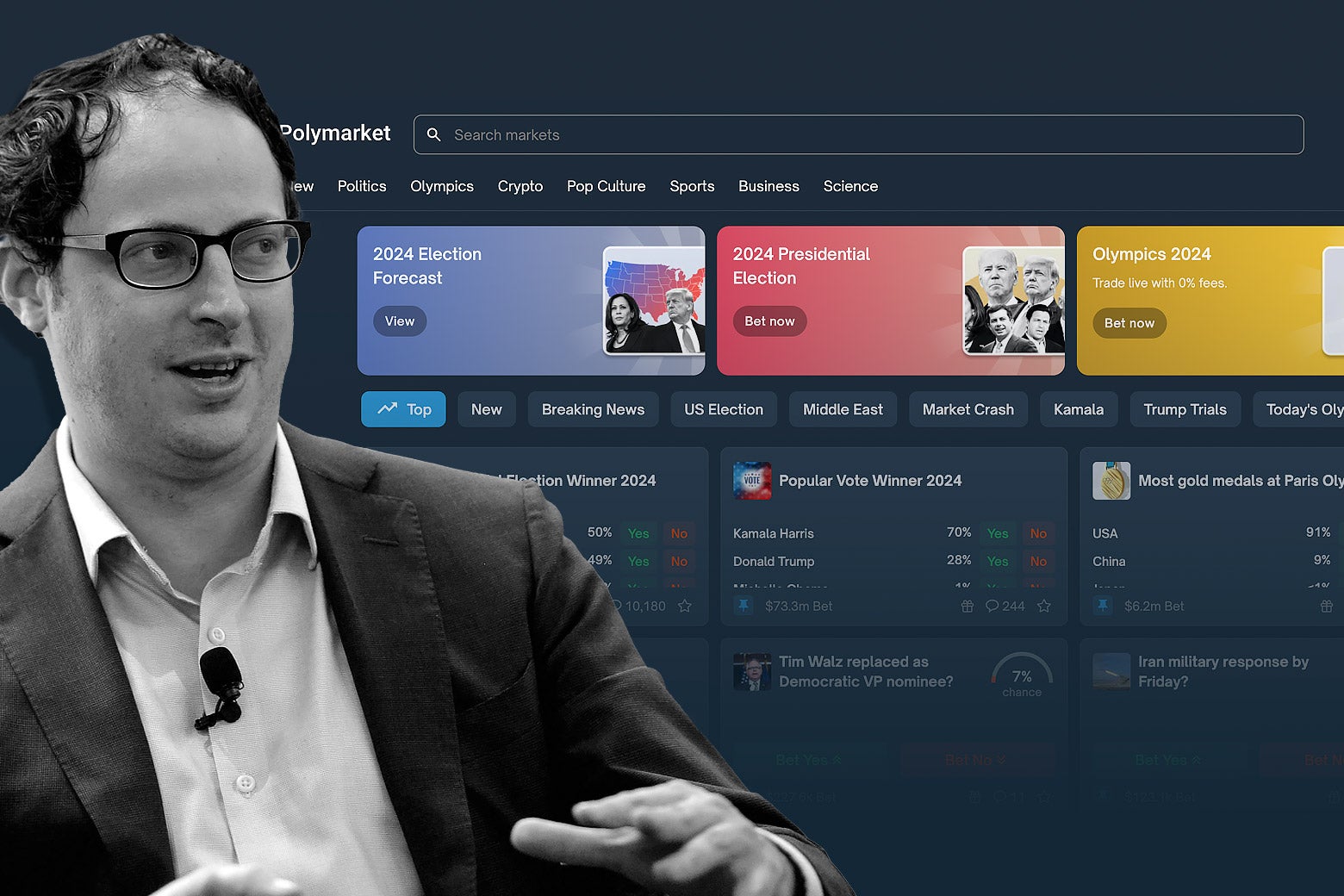

Forget the tired narratives about polls and pundits: blockchain prediction markets are rewriting the playbook for election betting, and 2024 was their watershed moment. The surge in decentralized election betting has not only captured the imagination of crypto enthusiasts but also delivered real-world results that outperformed traditional forecasting methods. In a year when trust in pollsters hit new lows, platforms like Polymarket proved that crowdsourced, blockchain-powered odds can be both more transparent and more accurate.

Why Blockchain Prediction Markets Are Winning Over Election Bettors

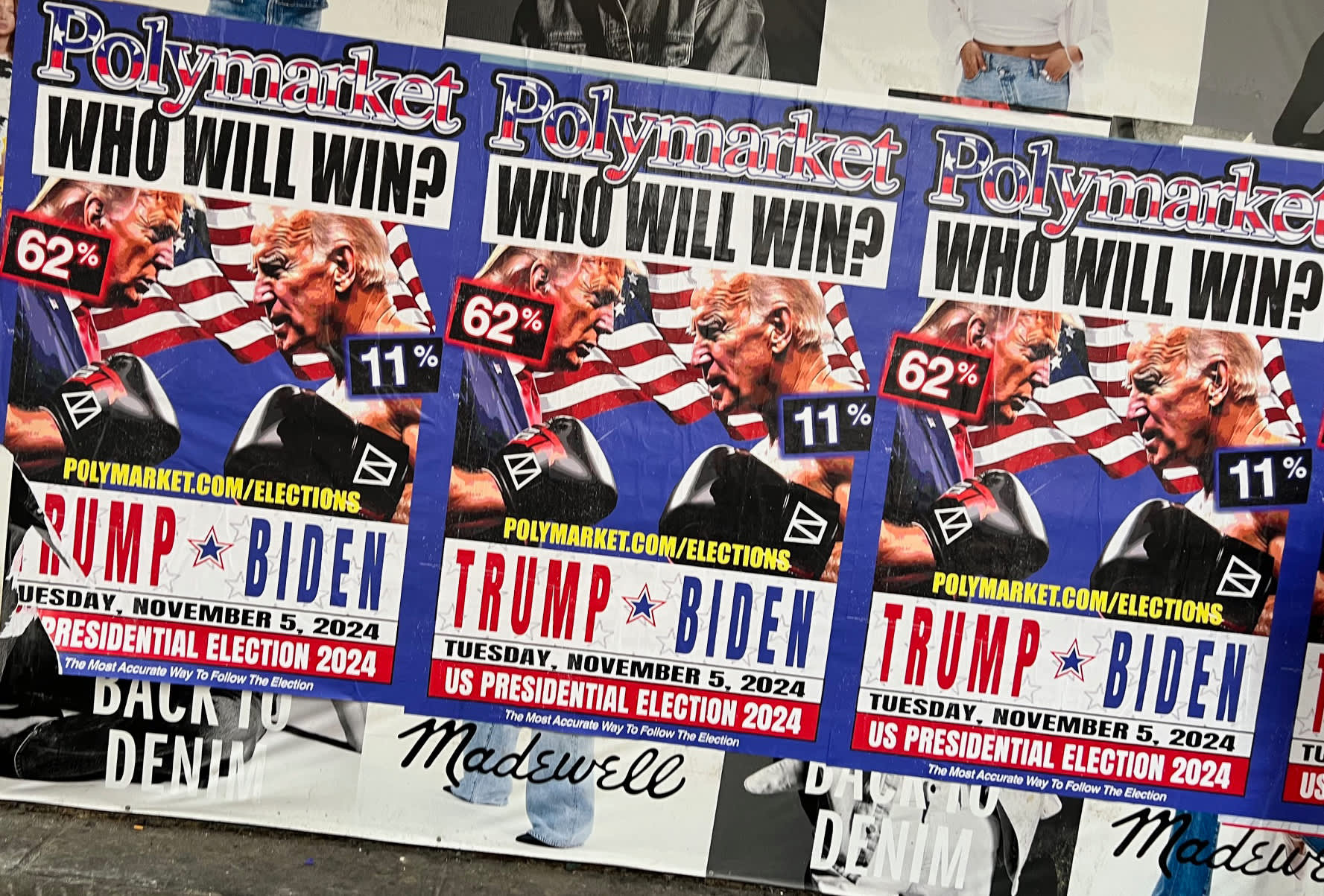

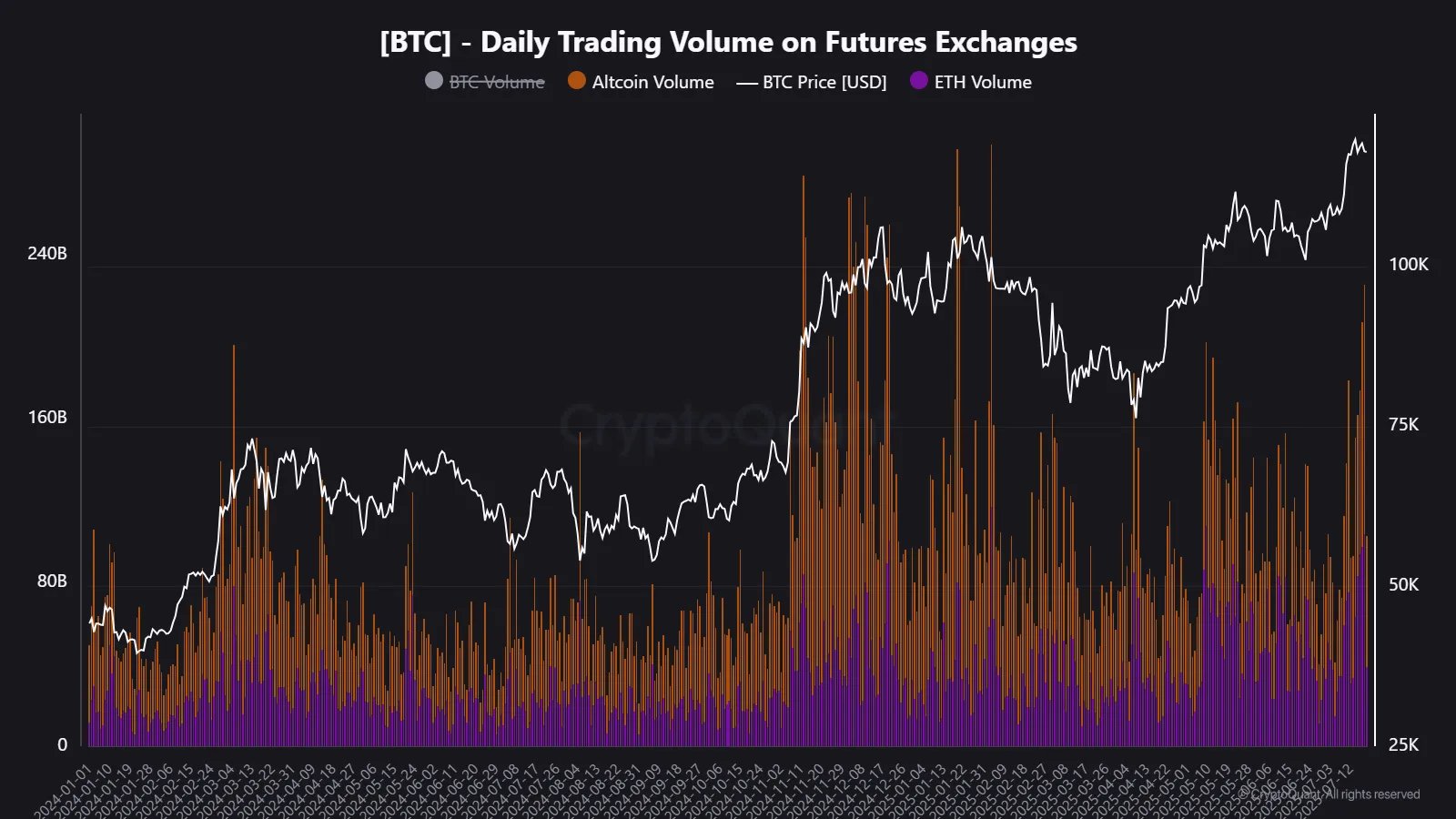

The numbers don’t lie. In Q3 2024, prediction markets saw a staggering 565% increase in betting volume, with total bets across the three largest markets hitting $3.1 billion. This explosion was fueled almost entirely by the U. S. presidential election, where bettors poured over $200 million into Polymarket’s election contracts alone. These aren’t just speculative bets – they’re data-driven signals from thousands of participants around the globe.

What’s behind this seismic shift? Three words: transparency, speed, and decentralization. Blockchain tech means every trade is on-chain and auditable. No backroom bookie decisions or shadowy odds adjustments – just raw market sentiment reflected in real time. Settlement is fast, fees are low, and anyone with crypto can participate, no matter where they are in the world.

Top Reasons Crypto Bettors Chose Decentralized Election Markets in 2024

-

Unmatched Accuracy in Forecasting: Blockchain prediction markets like Polymarket outperformed traditional polls and pundits in predicting the 2024 U.S. presidential election, with studies from the University of Cincinnati and arXiv confirming their superior accuracy, especially in swing states.

-

Massive Liquidity and Betting Volume: In Q3 2024, decentralized platforms saw a 565% surge in betting volume, reaching $3.1 billion across the three largest markets, driven largely by the U.S. election (source: Cointelegraph).

-

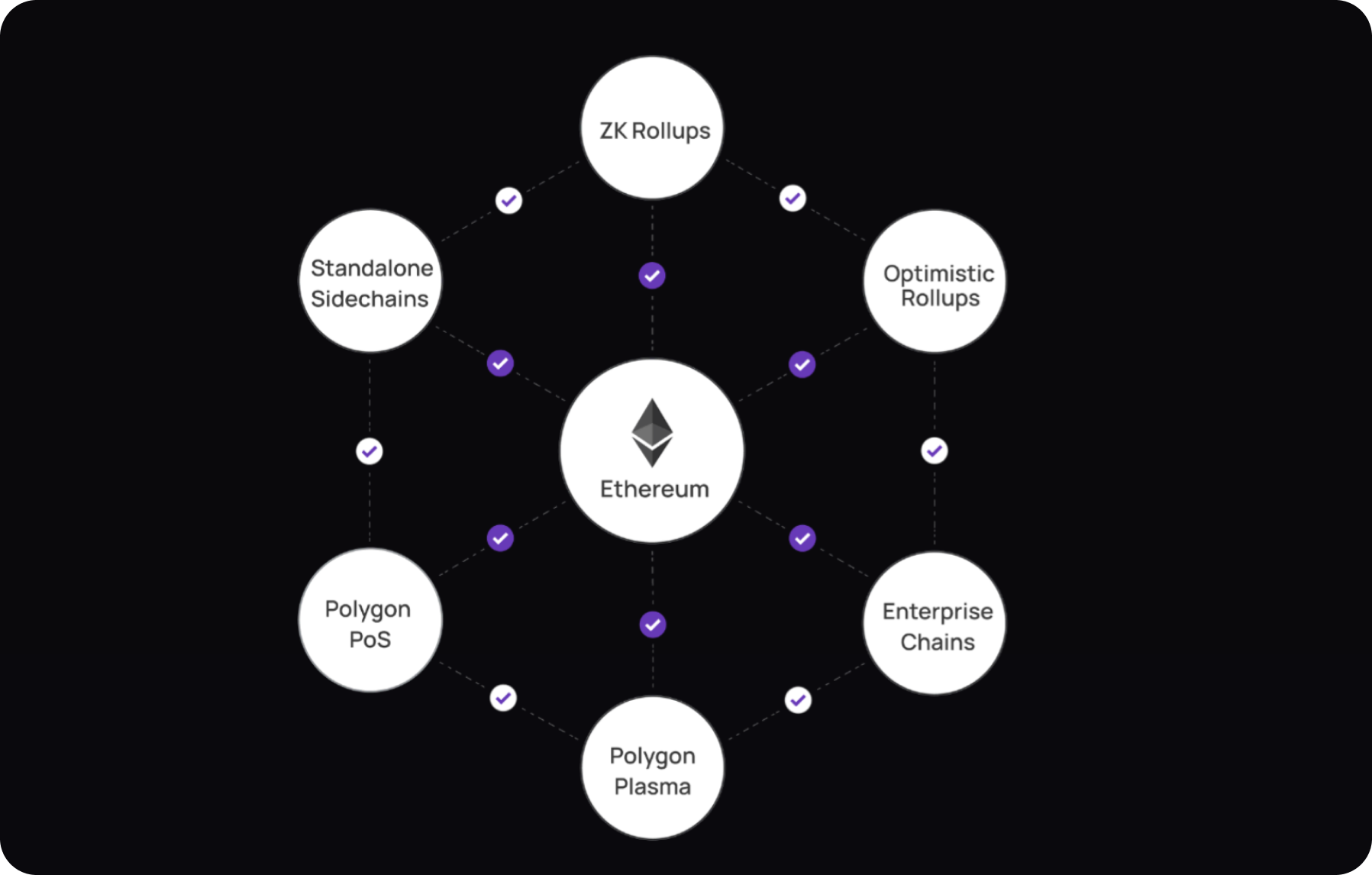

Transparency and Trust via Blockchain: Platforms like Polymarket run on the Ethereum-Polygon blockchain, ensuring transparent, tamper-resistant records of every bet and outcome, which builds trust among users.

-

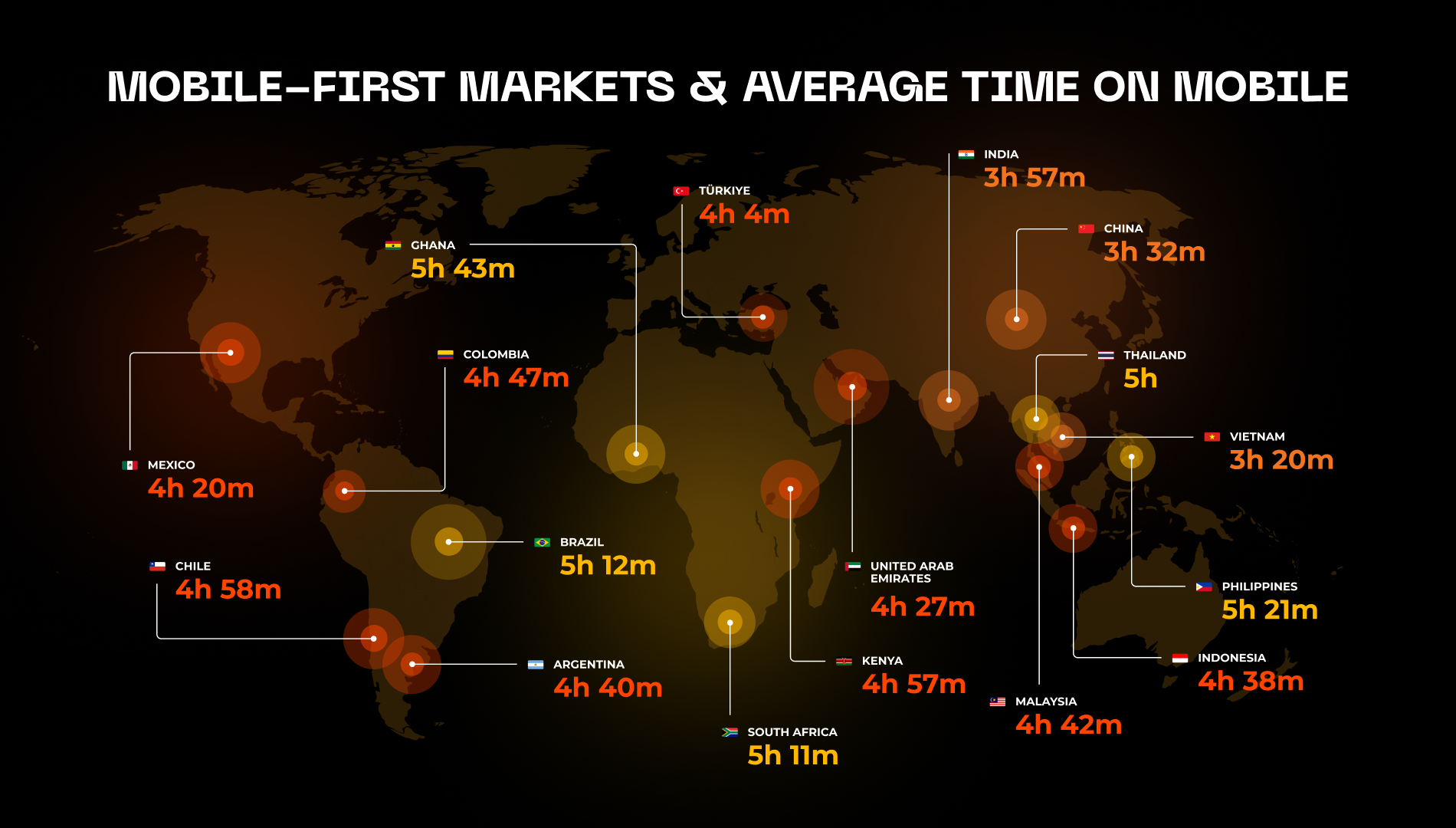

Global, Permissionless Access: Decentralized markets enable users worldwide to participate in election betting without the restrictions or barriers imposed by traditional bookmakers or national regulations.

-

Regulatory Breakthroughs: In 2024 and 2025, key legal victories—such as the U.S. Court of Appeals clearing Kalshi for congressional markets and the CFTC approving Polymarket‘s U.S. relaunch—boosted confidence and legitimacy in decentralized prediction markets.

-

Profitable Arbitrage and Market Efficiency: The open, liquid nature of these markets allowed savvy bettors to exploit inefficiencies and profit from real-time shifts in sentiment, often faster than traditional betting sites.

-

Diverse Betting Opportunities: Beyond presidential outcomes, markets offered bets on everything from congressional control to pop culture events, attracting a wider audience and keeping engagement high throughout the election cycle.

The Data Speaks: Prediction Markets Outperform Polls

The University of Cincinnati’s research dropped a bombshell: during the 2024 presidential race, a leading blockchain prediction market outperformed every major pollster and most political pundits (source). This wasn’t an isolated incident – swing state after swing state saw prediction market odds nail outcomes that left poll-based models scrambling for explanations.

This accuracy isn’t magic; it’s economics in motion. Every trade on a platform like Polymarket represents someone putting their money behind their conviction – not just voicing an opinion to an anonymous surveyor. As liquidity deepens and incentives align, these markets aggregate wisdom (and risk tolerance) from diverse sources far more efficiently than any focus group.

The Regulatory Rollercoaster

No revolution comes without turbulence. The explosion of election betting crypto drew swift regulatory scrutiny in the U. S. , with legal battles making headlines throughout late 2024. In October, Kalshi scored a provisional court victory allowing it to offer contracts on congressional control after regulators failed to prove these markets harmed public interest. Just months later, Polymarket received long-awaited CFTC approval to relaunch its U. S. operations after a three-year hiatus – a landmark move for decentralized finance advocates.

But it hasn’t all been smooth sailing. Critics warn that low trading volumes on smaller markets could leave them vulnerable to manipulation by whales or foreign actors. Governance questions persist as platforms scale up; even as transparency improves at the protocol level, operational risks remain front and center (especially after November’s FBI raid on Polymarket’s CEO).

Despite these headwinds, the appeal of decentralized election betting shows no signs of cooling. With Polymarket’s return to the U. S. market under CFTC oversight and Kalshi’s legal green light for congressional contracts, crypto election predictions are moving from the fringes to the mainstream. The stakes have never been higher: as trust in traditional polling erodes, prediction markets are becoming a critical alternative for both retail bettors and professional forecasters.

When you see $3.1 billion in volume and over $200 million staked on a single election, you’re not just witnessing hype, you’re watching a new financial infrastructure take root.

This shift isn’t just about technology, it’s about democratizing access to political forecasting. Blockchain-based platforms let anyone with an internet connection and some crypto skin in the game participate in what was once reserved for Vegas insiders or offshore bookies. And because every trade is public and immutable, bad actors face higher barriers to rigging outcomes or hiding behind opaque odds.

Risks, Rewards, and the Road Ahead

No system is perfect, especially one as young and disruptive as decentralized prediction markets. While large platforms like Polymarket have attracted deep liquidity and institutional interest, smaller markets remain exposed to manipulation risks if trading volumes lag. Regulatory clarity is still evolving, with authorities balancing innovation against concerns over gambling addiction, market integrity, and national security.

Yet even critics admit that blockchain prediction markets have already forced legacy players to rethink their approach. The ability to instantly audit every transaction, verify liquidity pools on-chain, and crowdsource intelligence from a global user base is fundamentally changing how we price political risk.

Key Risks and Rewards of Blockchain Election Betting

-

Superior Accuracy Over Traditional Polls: Blockchain prediction markets like Polymarket outperformed traditional polling in forecasting the 2024 U.S. presidential election, especially in swing states, according to University of Cincinnati and arXiv studies.

-

Unprecedented Transparency and Efficiency: Platforms built on Ethereum-Polygon, such as Polymarket, offer transparent, auditable records of all bets, eliminating hidden manipulation and increasing user trust.

-

Massive Growth and Liquidity: In Q3 2024, betting volume on blockchain prediction markets surged 565%, reaching $3.1 billion across the top three platforms, largely driven by the U.S. election.

-

Regulatory Uncertainty Remains: Despite recent CFTC approval for Polymarket’s U.S. relaunch and court clearance for Kalshi, ongoing legal scrutiny and sudden enforcement actions—like the 2024 FBI raid on Polymarket’s CEO—pose significant risks.

-

Potential for Market Manipulation: Critics warn that low trading volumes in some markets, ease of foreign influence, and questionable governance can undermine prediction reliability, as highlighted in Time and Axios reports.

-

Global Access and Decentralization: Decentralized platforms enable users worldwide to participate in election betting, bypassing traditional barriers and expanding the market’s reach.

The next frontier? Integration with DeFi protocols and cross-chain interoperability could make prediction markets even more liquid, and even harder for regulators to fence in. Expect more sophisticated governance models (think DAOs), advanced KYC options for compliant users, and deeper partnerships between major crypto exchanges and prediction market protocols as we approach 2028.

How To Get Started With Decentralized Election Betting

If you’re ready to ride this wave yourself, start by researching reputable platforms like Polymarket or Kalshi that have survived regulatory scrutiny. Fund your wallet with crypto (usually USDC or ETH), connect it securely to your chosen protocol, then browse active markets, everything from presidential races to “will Congress flip” contracts are now live with real-time odds.

Remember: volatility cuts both ways. While crowdsourced odds may be more accurate than polls over time, sharp swings can punish latecomers or those chasing momentum blindly. Study historical data, watch liquidity levels closely (especially near key news events), and never risk more than you can afford to lose.

The bottom line? Decentralized election betting isn’t just another crypto fad, it’s a paradigm shift for political forecasting. Whether you’re here for profit or insight, blockchain prediction markets offer an unprecedented lens into the world’s most consequential events, and they’re only getting bigger from here.