How Cumulative Voting Is Revolutionizing Onchain Prediction Markets

Prediction markets have long promised a more accurate, decentralized way to forecast real-world events, from sports outcomes to macroeconomic shifts. But as these platforms move onchain, the need for more expressive and fair voting mechanisms has become clear. Enter cumulative voting, a method that is rapidly gaining traction in the crypto prediction market space for its ability to capture nuanced opinions and empower users.

Cumulative Voting: Beyond Binary Bets

Traditional prediction markets typically force users into binary choices or simple proportional bets. This approach flattens the spectrum of conviction – a user who is 99% certain of an outcome has no more influence than one who is barely leaning that way. Cumulative voting prediction markets disrupt this paradigm by letting participants allocate multiple votes across different outcomes, reflecting both their preferences and confidence levels.

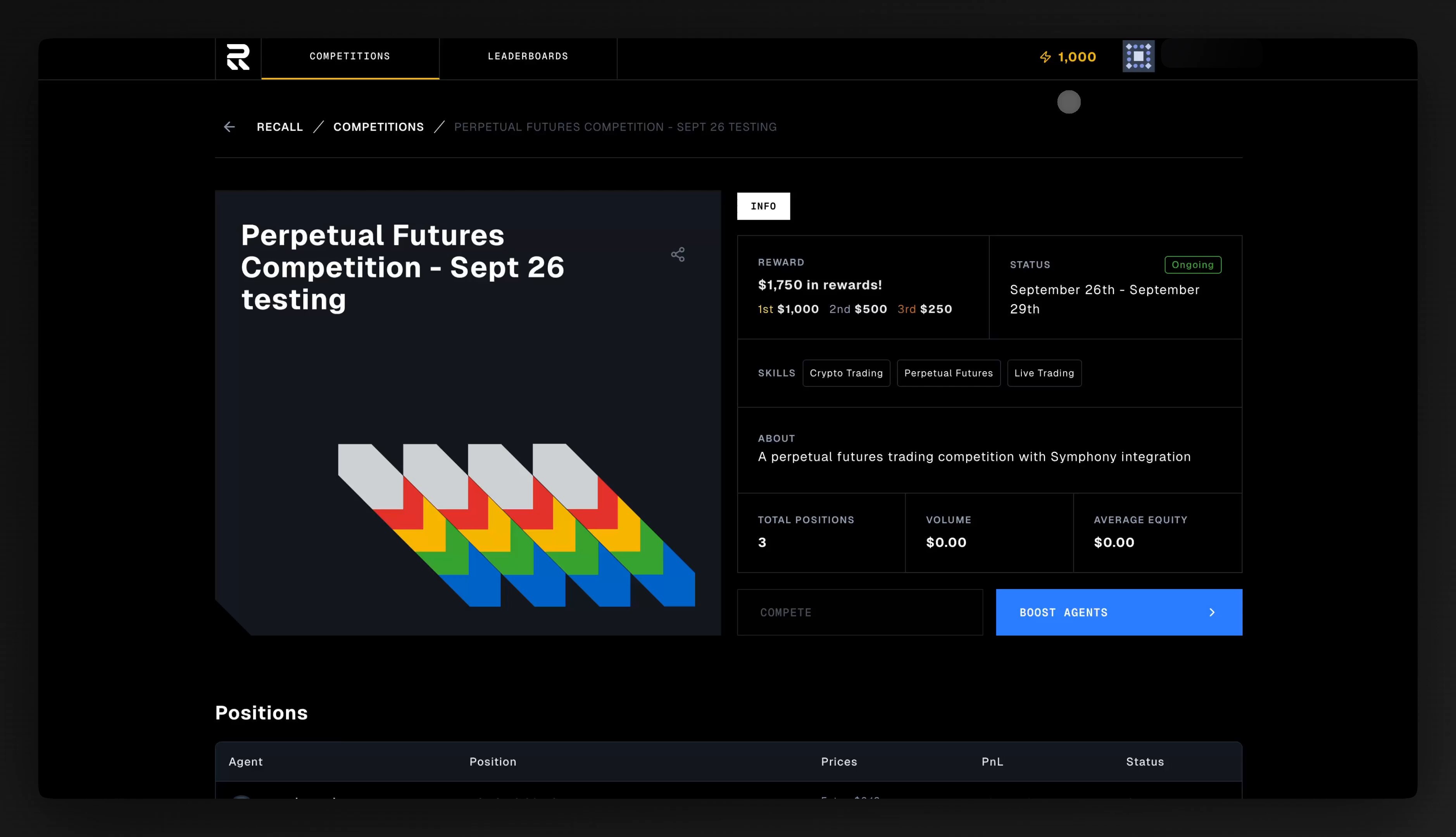

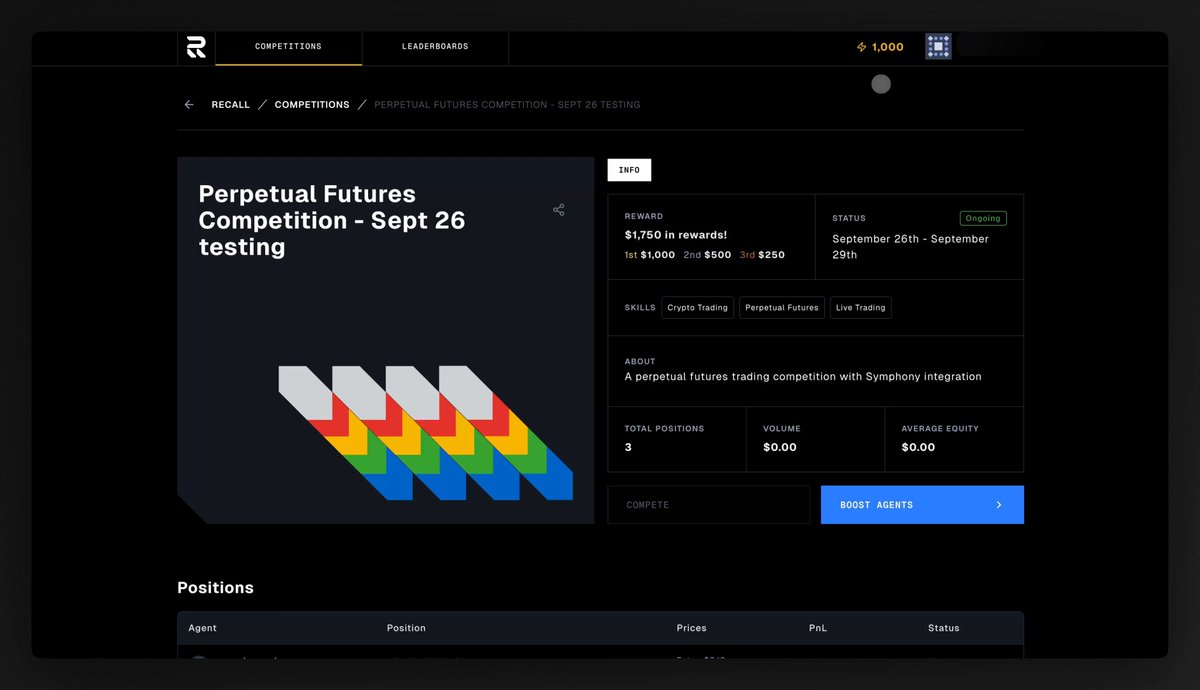

Platforms like Recall Network have embraced this innovation with features such as “Boost, ” where each participant receives 1,000 votes per competition. Users can stack all their votes on one AI agent to signal strong conviction or spread them across several agents to hedge their bets and increase their odds. This mirrors portfolio allocation strategies in finance, where risk management and conviction drive capital deployment.

This dynamic approach doesn’t just make prediction markets more engaging – it also makes them smarter. By aggregating rich data on user confidence, cumulative voting helps surface consensus with greater precision, potentially leading to more accurate forecasts and fairer reward distribution.

How Onchain Cumulative Voting Works in Practice

The mechanics are straightforward but powerful. In each competition, users receive a fixed number of votes (such as Recall’s 1,000 Boosts) to distribute however they choose across available options. Want to go all-in on a single AI agent you believe will outperform? Allocate your entire stack there. Prefer to back three contenders in varying proportions? Split your votes accordingly.

This flexibility is especially valuable in decentralized settings where diverse strategies and preferences abound. According to a study published on arxiv.org, while voters often default to simpler methods, cumulative voting becomes highly favored when participants seek greater expressiveness and control over outcomes.

The result is an environment where both high-conviction traders and cautious hedgers can coexist – each shaping the market according to their risk appetite and insights.

Why Cumulative Voting Matters for Decentralized Prediction Markets

The move toward onchain voting blockchain models isn’t just about transparency or efficiency; it’s about fairness and inclusivity too. Cumulative voting democratizes participation by giving every user equal initial power but letting them express it uniquely based on their beliefs. This stands in contrast to legacy systems where whales can dominate simply by outsizing others’ stakes.

Minaa. eth, an active participant in the Recall ecosystem, notes that this approach brings “more attention to AgentRank and smarter distribution of $RECALL rewards, ” turning simple predictions into sophisticated strategic plays that reward insight rather than just capital size.

- Portfolio allocation prediction markets: Users can manage risk by spreading votes like positions in a diversified portfolio.

- Risk management prediction markets: Allows nuanced hedging rather than all-or-nothing bets.

- Fair voting blockchain: Levels the playing field for new entrants versus established players.

The upshot? Decentralized platforms like finance.vote are building systems where collective intelligence is harnessed not just through numbers but through the quality of conviction expressed via cumulative voting mechanisms.

With cumulative voting now live on Recall and similar platforms, the onchain prediction market landscape is rapidly evolving. The ability to allocate votes based on conviction transforms how users approach crypto betting strategies, moving away from simplistic win-lose paradigms and toward a more nuanced, data-driven market dynamic. This shift aligns prediction markets with the sophistication of financial portfolio theory, where diversification and conviction both play critical roles in optimizing outcomes.

Key Advantages of Cumulative Voting in Decentralized Prediction Markets

-

Greater Expression of Conviction: Cumulative voting lets participants allocate multiple votes to a single outcome, allowing them to show strong support or confidence in their preferred prediction. This is now live on platforms like Recall and finance.vote.

-

Nuanced Opinion Capture: By distributing votes across several options, users can reflect complex or mixed beliefs about potential outcomes, leading to more accurate market forecasts. This approach is highlighted in studies on participatory budgeting and expressive voting.

-

Enhanced Fairness and Inclusivity: Cumulative voting empowers a wider range of participants to influence results, reducing the dominance of single-vote majorities and promoting a more democratic process in decentralized environments.

-

Improved Market Signal Quality: Aggregating more detailed preferences from users helps prediction markets like finance.vote and Recall produce sharper, more reliable forecasts by leveraging the collective intelligence of the community.

-

Flexible Strategy for Participants: Users can choose to stack votes for high conviction or spread them to hedge their bets, as seen in Recall’s “Boost” feature. This flexibility supports both risk-takers and cautious participants.

For participants, the implications are significant. You’re no longer boxed into binary choices or forced to overcommit to a single outcome. Instead, you can express uncertainty by spreading your Boosts or go all-in when your research gives you an edge. This flexibility not only boosts user engagement but also deepens the liquidity and informational content of each market.

Cumulative Voting in Action: Community and Market Impact

The community response has been telling. Social channels are buzzing with discussions about stacking votes for high-conviction AI agents versus spreading them for broader coverage. This mirrors real-world investment debates about concentration versus diversification, but now played out transparently onchain. As @JirayaKice6539 put it, “Through the cumulative voting feature, @recallnet provides participants with greater control. ”

Importantly, cumulative voting also addresses longstanding fairness concerns in decentralized ecosystems. By giving every participant equal initial voting power, and letting strategy dictate allocation, platforms reduce the influence of outsized bankrolls while amplifying signal from informed minority views. This makes decentralized prediction market innovation not just a technical upgrade but a step forward for trust and legitimacy.

Looking ahead, as more platforms adopt expressive mechanisms like Recall’s Boost system, expect sharper forecasts and more representative outcomes across sports betting blockchain events, elections, and macroeconomic predictions. The aggregation of weighted user insights can help surface consensus probabilities that reflect true market sentiment, not just noise or capital flows.

Getting Started: Practical Tips for Users

If you’re new to cumulative voting on blockchain prediction markets:

- Start small: Experiment by allocating your votes across multiple outcomes to see how it affects returns.

- Observe conviction trends: Watch how other traders stack their Boosts, market sentiment often clusters around key contenders.

- Diversify for risk management: Don’t be afraid to hedge; spreading votes can smooth out volatility if you’re uncertain.

- Track performance: Use tools like AgentRank and historical vote distributions to refine your strategies over time.

The rise of cumulative voting is already changing the game for blockchain-based forecasting. Whether you’re a seasoned trader or just exploring decentralized predictions, expressive mechanisms like these offer new ways to participate, and potentially profit, in one of crypto’s most innovative frontiers.