How Blockchain Voting Tokens Are Changing On-Chain Election Prediction Markets

Blockchain voting tokens are reshaping the landscape of on-chain election prediction markets, providing a leap forward in transparency, efficiency, and accessibility. With platforms like Polymarket and OutcomeMarket driving innovation, decentralized prediction markets are rapidly outpacing traditional polling methods both in accuracy and user engagement. As the 2024 U. S. presidential race demonstrated, these blockchain-powered systems aggregated collective intelligence more effectively than conventional polls, according to research from the University of Cincinnati.

How Blockchain Voting Tokens Power On-Chain Election Forecasts

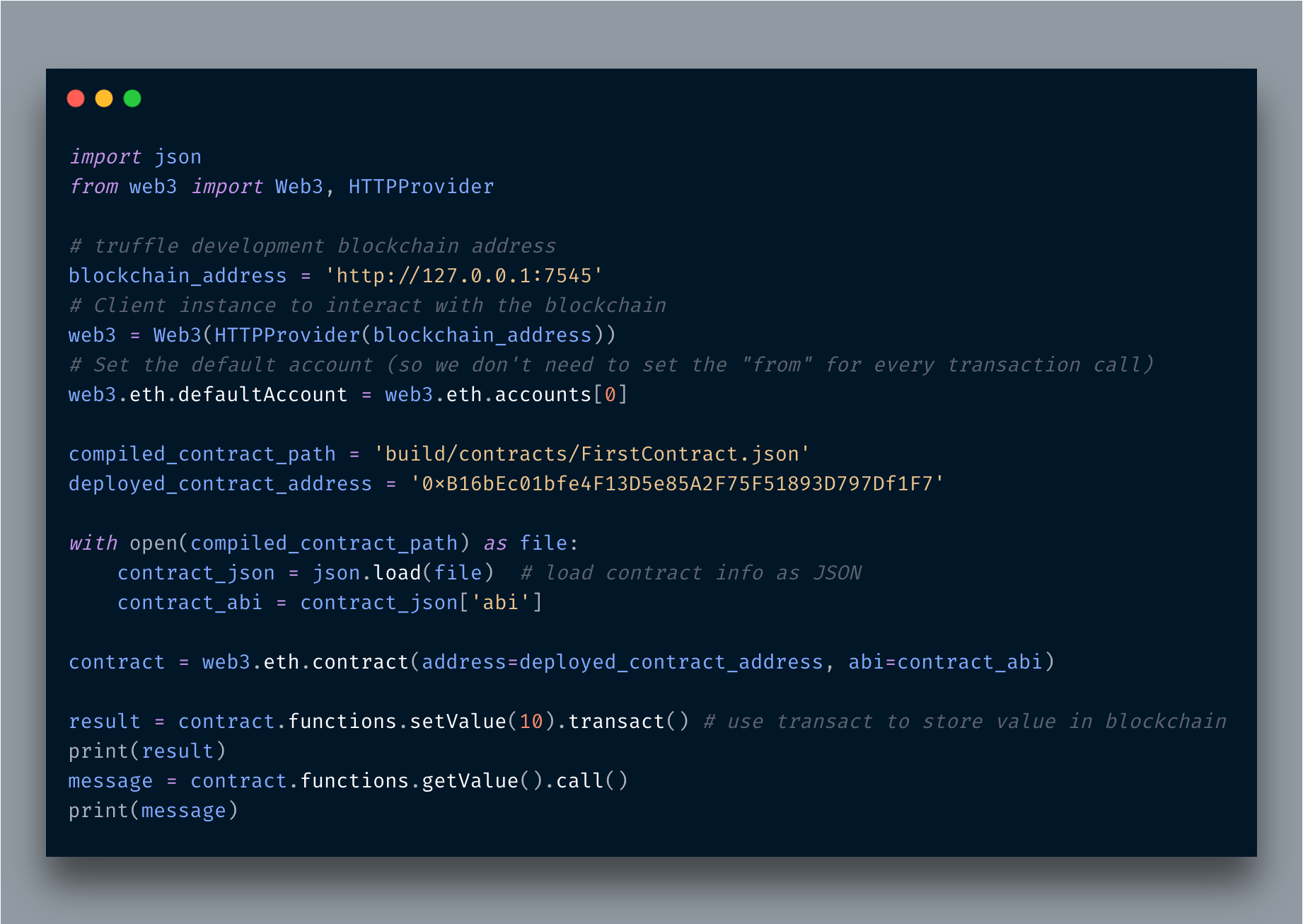

At the core of this transformation are blockchain voting tokens. These digital assets represent specific electoral outcomes, such as a candidate’s victory or defeat, and can be freely traded by users on decentralized platforms. The price of each token reflects the probability that its associated outcome will occur, dynamically updating based on supply and demand. This mechanism not only democratizes participation but also creates an ongoing real-time barometer of public sentiment.

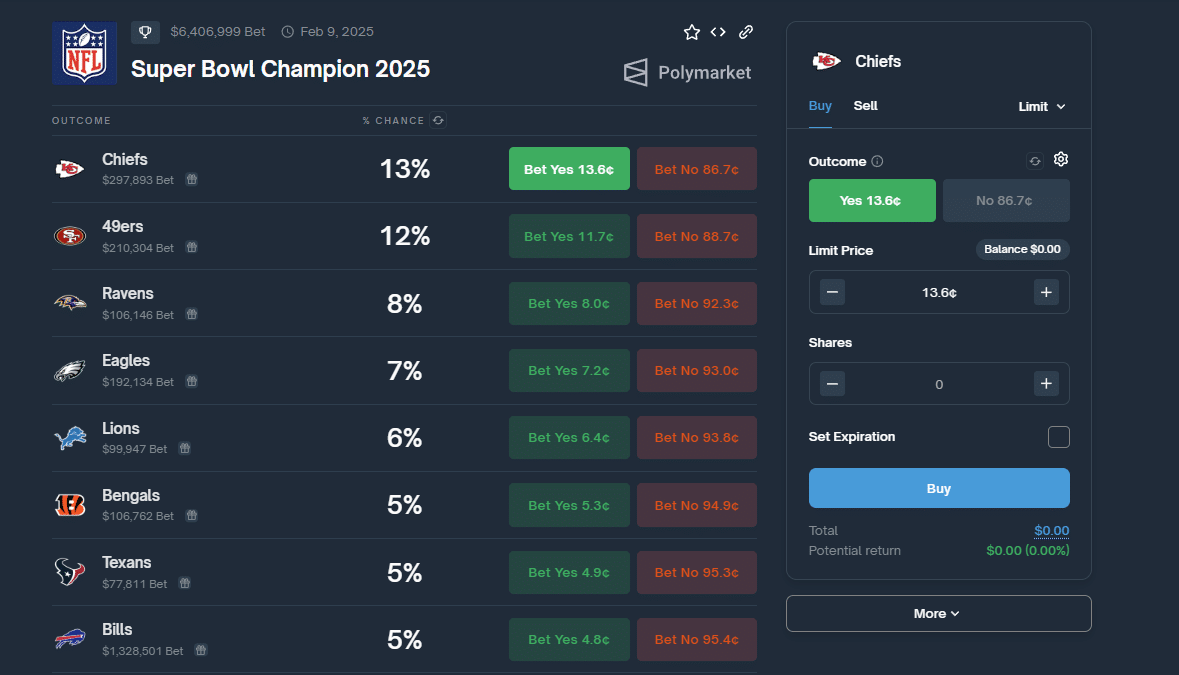

For example, Polymarket’s 2024 surge saw trading volumes hit $3.2 billion by November, underscoring a remarkable shift toward blockchain-based election forecasting (Forbes). Users bought and sold outcome tokens for leading candidates, with prices moving minute-by-minute as new information entered the market. This process aggregates insights from thousands of participants worldwide, effectively crowd-sourcing election predictions with unprecedented speed and transparency.

Pioneering Platforms: From Polymarket to OutcomeMarket

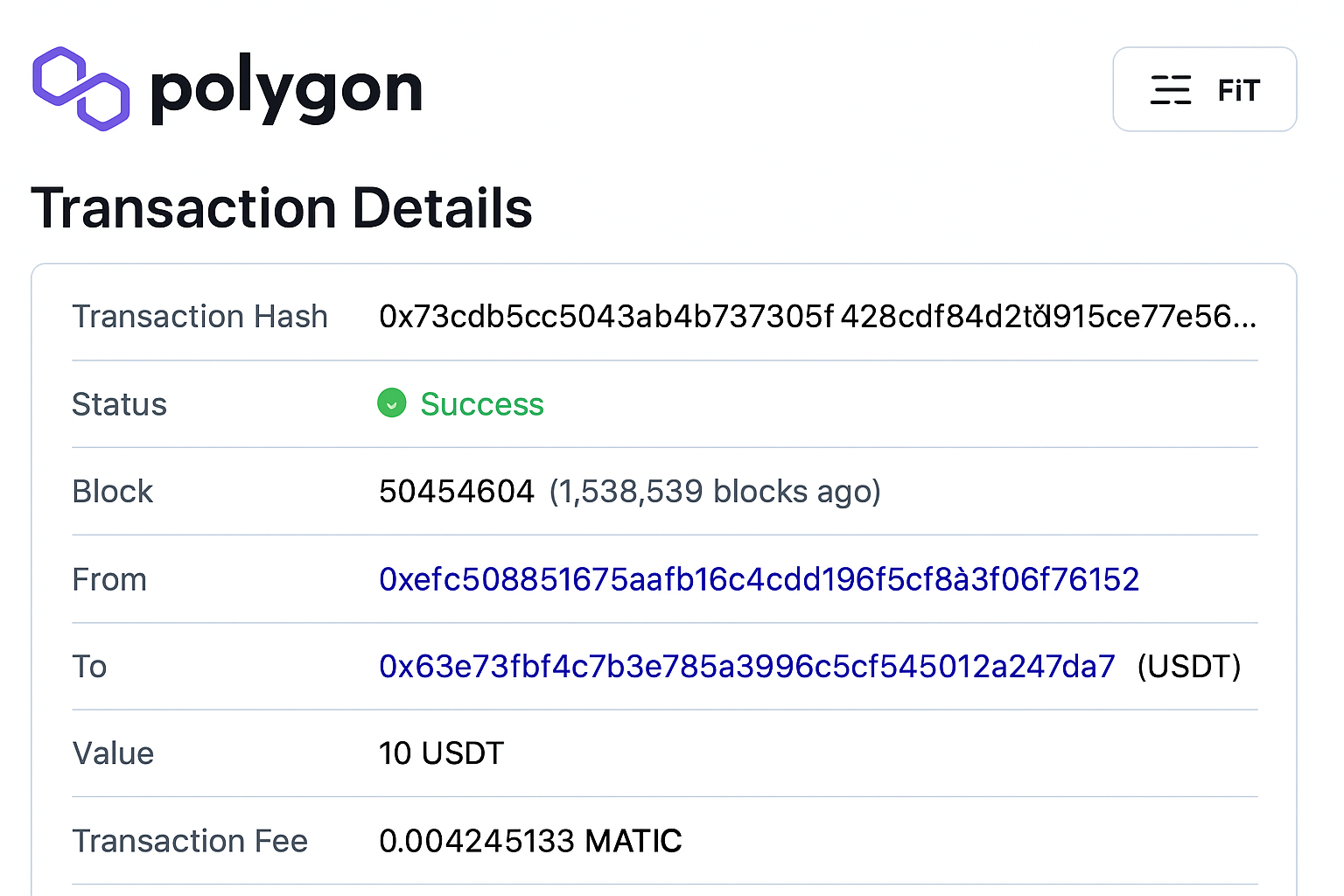

The past year has seen rapid development among major prediction market platforms. Polymarket, running on the Polygon blockchain, leverages smart contracts to automate settlement and ensure all trades are transparent and tamper-proof. Meanwhile, Wintermute’s OutcomeMarket, launched in September 2024, introduced a multi-chain approach, allowing tokens like TRUMP or HARRIS to be traded seamlessly across Ethereum, Base, Arbitrum, and more (CryptoSlate). This eliminates complex asset bridging and brings greater liquidity into decentralized voting crypto markets.

The integration with broader DeFi applications means these election tokens aren’t siloed; they can be used as collateral or swapped for other assets across decentralized exchanges. The result is an ecosystem where political events directly impact crypto flows, and where anyone with internet access can participate in high-stakes forecasting.

Top 5 Ways Blockchain Voting Tokens Boost Transparency

-

Immutable Record-Keeping: Every transaction and vote using blockchain voting tokens is permanently recorded on public ledgers, such as Polygon for Polymarket. This ensures that all prediction market activities are transparent and verifiable by anyone in real time.

-

Real-Time Market Sentiment: Platforms like Polymarket and Augur reflect collective market sentiment through token prices, which dynamically adjust based on user trades. This provides a transparent, up-to-the-minute snapshot of public opinion on election outcomes.

-

Automated and Auditable Smart Contracts: Blockchain-based prediction markets utilize smart contracts to automate trade settlements and payouts. These contracts are open-source and auditable, reducing the risk of manipulation and ensuring transparent execution of election-related bets.

-

Decentralized Access and Participation: Platforms such as OutcomeMarket enable users worldwide to participate without centralized gatekeepers. Multi-chain support (Ethereum, Base, Arbitrum) further enhances transparency by allowing open access and cross-chain verification of token movements.

-

Aligned Incentives via veToken Models: The veToken model, recently adopted in prediction markets, requires users to lock tokens for voting power. This mechanism, analyzed in academic research, increases transparency by aligning user incentives with the long-term integrity of the market, discouraging short-term manipulation.

Innovative Governance Models: The veToken Example

The evolution of on-chain governance is also shaping prediction market integrity. The veToken model, where users lock their tokens for increased voting power, aligns short-term speculation with long-term platform health (arXiv.org). By requiring commitment over extended periods, veToken systems discourage manipulation and foster responsible participation among traders.

This structure is crucial for maintaining trust in blockchain-powered prediction market platforms. It encourages thoughtful engagement rather than fleeting speculation, a necessary foundation as these systems become more influential sources of public opinion data.

Security and transparency remain at the forefront of the blockchain prediction market revolution. Distributed ledger technology ensures that every transaction, trade, and outcome resolution is immutably recorded and publicly auditable. This drastically reduces the risk of tampering or centralized interference, which has historically plagued both traditional betting markets and online polling systems. As a result, participants can verify outcomes and payouts without relying on a single authority, a core value proposition for decentralized voting crypto enthusiasts.

Beyond security, the user experience has evolved rapidly. Platforms now offer intuitive interfaces for trading outcome tokens, real-time price feeds, and seamless wallet integrations. The ability to participate from any location with an internet connection has democratized access to election forecasting, no longer confined to institutional investors or professional gamblers. Retail users are empowered to express their opinions on global political events while directly influencing market sentiment.

Real-Time Public Sentiment: Why Prediction Market Blockchain Data Matters

The predictive power of these markets is increasingly recognized by researchers and analysts. In 2024, studies found that blockchain-based prediction markets outperformed traditional polls in accuracy for major elections, often providing more reliable forecasts days or even weeks ahead of official results (Forbes). This is possible because token prices respond instantly to breaking news, campaign developments, or shifts in voter mood, creating a living consensus view that adapts with every new data point.

- Transparency: Every trade is on-chain and auditable by anyone.

- Efficiency: Fast settlement via smart contracts eliminates delays in payouts.

- Accessibility: Anyone with crypto can enter the market, no geographic restrictions.

- Resilience: Decentralized infrastructure resists censorship or shutdowns.

- Accuracy: Collective intelligence often beats expert forecasts or polls.

This real-time data is invaluable not only for traders but also for journalists, policymakers, and campaign strategists seeking unfiltered insight into public sentiment. The rise of blockchain voting tokens signals a paradigm shift in how societies measure, and ultimately influence, the direction of democratic processes.

Key Takeaways: The Future of Crypto Election Betting

The explosion in trading volume provides $3.2 billion on Polymarket by November 2024: is not just a headline; it’s evidence of growing mainstream trust in prediction market blockchain platforms. Innovations like multi-chain tokenization and veToken governance models are setting new standards for fairness and reliability in crypto election betting. As adoption widens and regulatory clarity improves over time, expect even deeper integration between political events and decentralized finance ecosystems.

The next wave will likely see further interoperability between platforms, enhanced privacy features for participants, and broader use cases beyond politics, including sports betting blockchain applications and macroeconomic forecasting. For those navigating these dynamic markets today, preparation remains key: understand platform mechanics, monitor live price movements (such as Polymarket’s $3.2 billion milestone), and engage with communities committed to transparency.