How Blockchain Prediction Markets Are Changing 2024 US Election Betting

Blockchain prediction markets are rapidly redefining how US election betting operates in 2024. Decentralized platforms like Polymarket have brought unprecedented transparency, accessibility, and liquidity to political forecasting, drawing in crypto enthusiasts and political observers alike. With over $200 million wagered on the presidential race by July 2024 and Donald Trump’s odds climbing to a commanding 63% probability, the scale and influence of these blockchain-based markets are impossible to ignore.

From Fringe to Mainstream: Why Blockchain Prediction Markets Are Booming

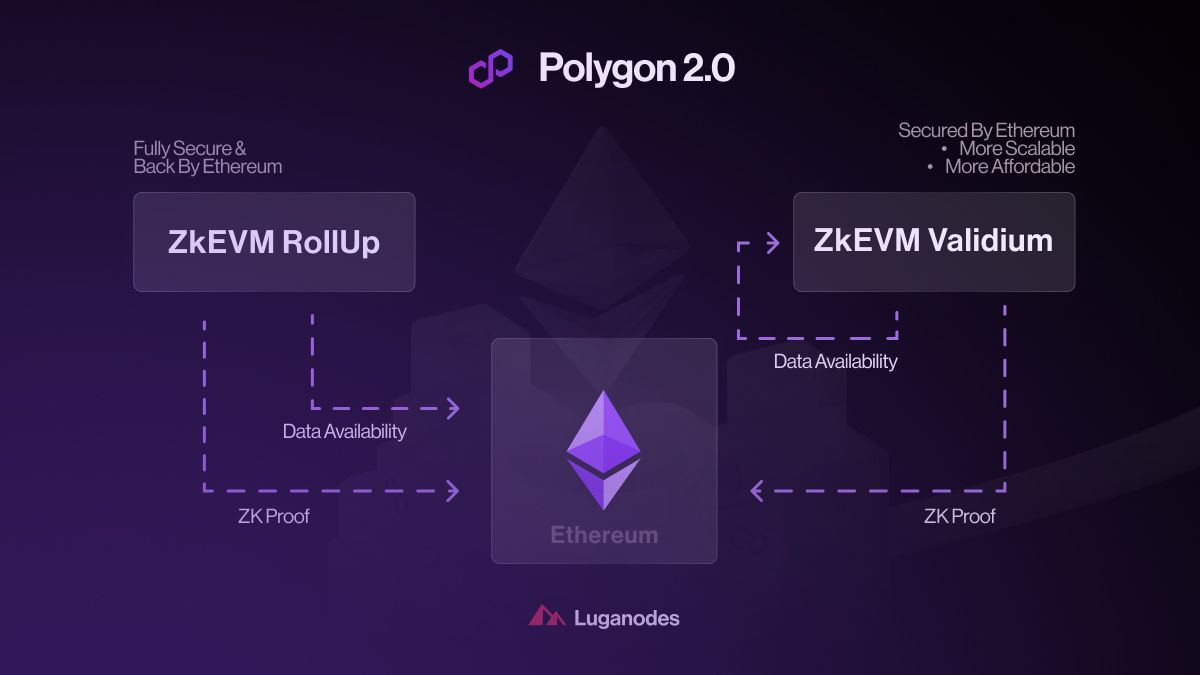

The surge in blockchain prediction market activity isn’t just a crypto phenomenon. In Q3 2024 alone, total betting volumes across the three largest decentralized markets skyrocketed by over 565%, reaching $3.1 billion. This explosive growth is largely driven by high-stakes events like the US presidential election, where participants seek both profit and insight into future outcomes. Platforms such as Polymarket leverage Ethereum-Polygon infrastructure to provide low fees, rapid settlements, and a user-friendly experience that appeals well beyond traditional bettors.

“A prediction market was more accurate in forecasting the 2024 presidential election than traditional polls and pundits. “ – University of Cincinnati study

This accuracy edge has fueled further interest among speculators disillusioned with conventional polling. As a result, crypto political betting is no longer just a niche pursuit; it’s now shaping public discourse around major elections.

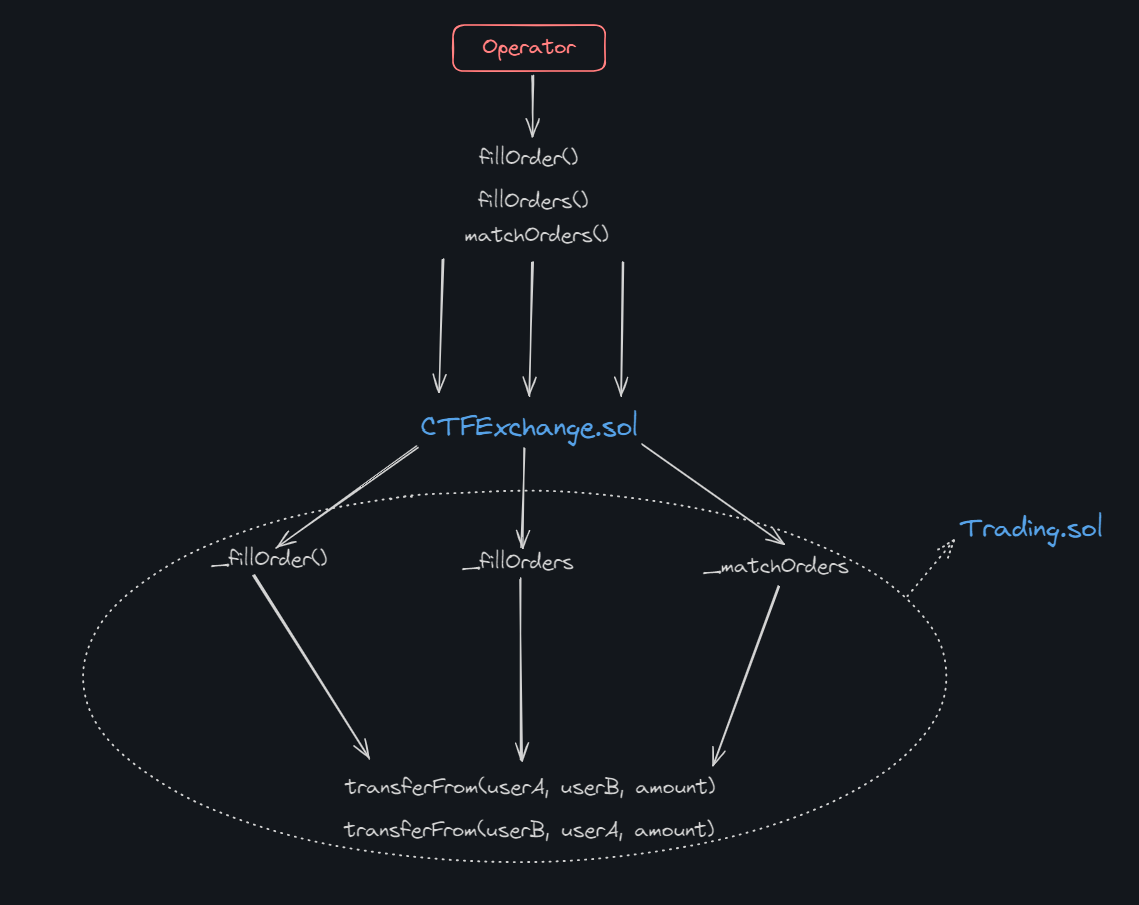

The Mechanics Behind Decentralized Election Betting

At their core, decentralized election markets use blockchain smart contracts to facilitate peer-to-peer betting on real-world outcomes. This model removes intermediaries, ensuring transparent order books and immutable transaction records. On leading platforms like Polymarket, users can buy shares in specific outcomes (e. g. , “Trump wins”) using stablecoins or other cryptocurrencies. The price of each share reflects the collective probability assigned by all market participants, creating a real-time barometer of crowd sentiment.

Distinctive Features of Blockchain Prediction Markets

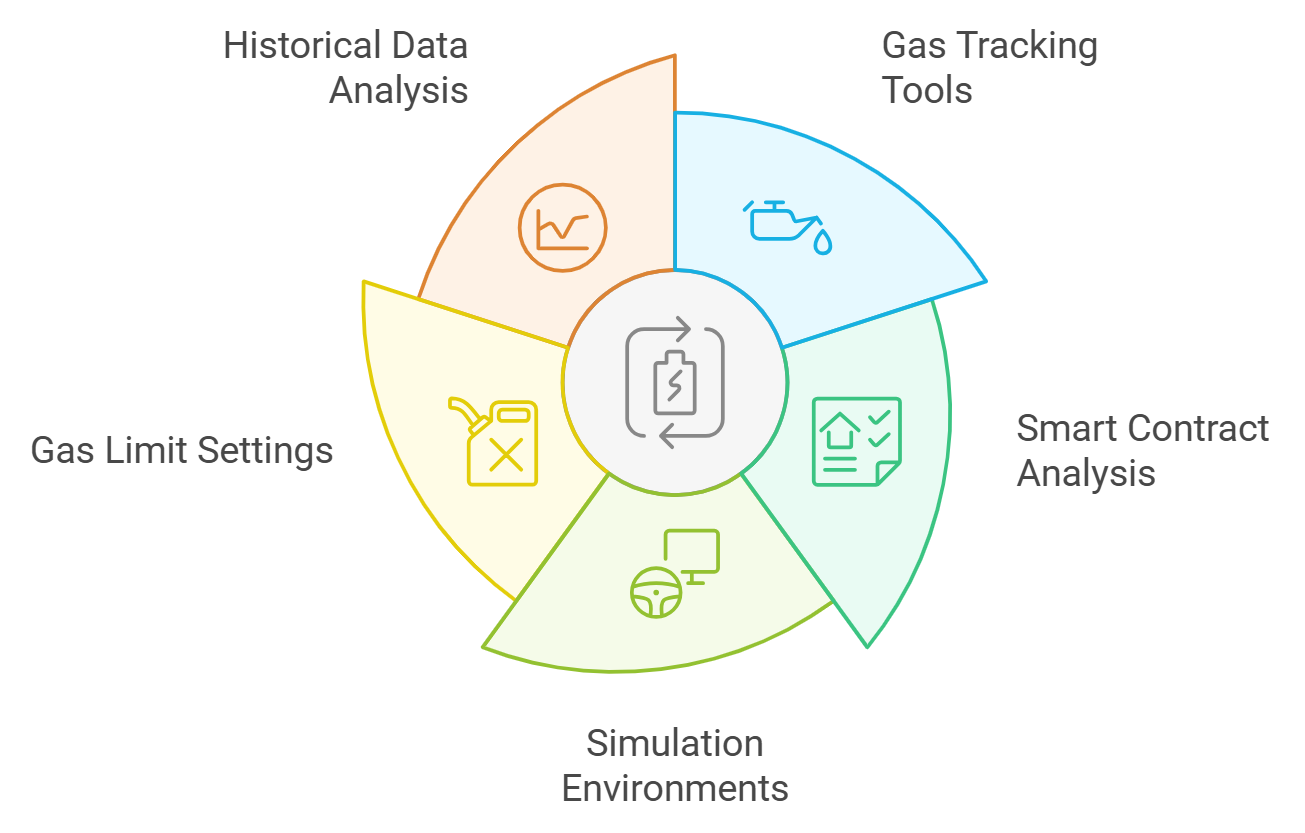

-

Decentralization and Transparency: Platforms like Polymarket operate on public blockchains, ensuring all bets and outcomes are transparently recorded and verifiable by anyone, unlike traditional bookmakers that rely on private ledgers.

-

Global Accessibility: Blockchain-based markets allow users worldwide to participate without geographic restrictions or the need for centralized intermediaries, broadening access compared to region-locked traditional bookmakers.

-

Lower Fees and Efficient Settlement: By leveraging smart contracts on networks like Ethereum-Polygon, platforms such as Polymarket offer lower transaction fees and near-instant settlement, reducing costs and delays common with traditional betting sites.

-

Market-Driven Odds: Prices on blockchain prediction markets are determined by open market trading, reflecting real-time collective sentiment rather than odds set by bookmakers, which can be subject to internal bias.

-

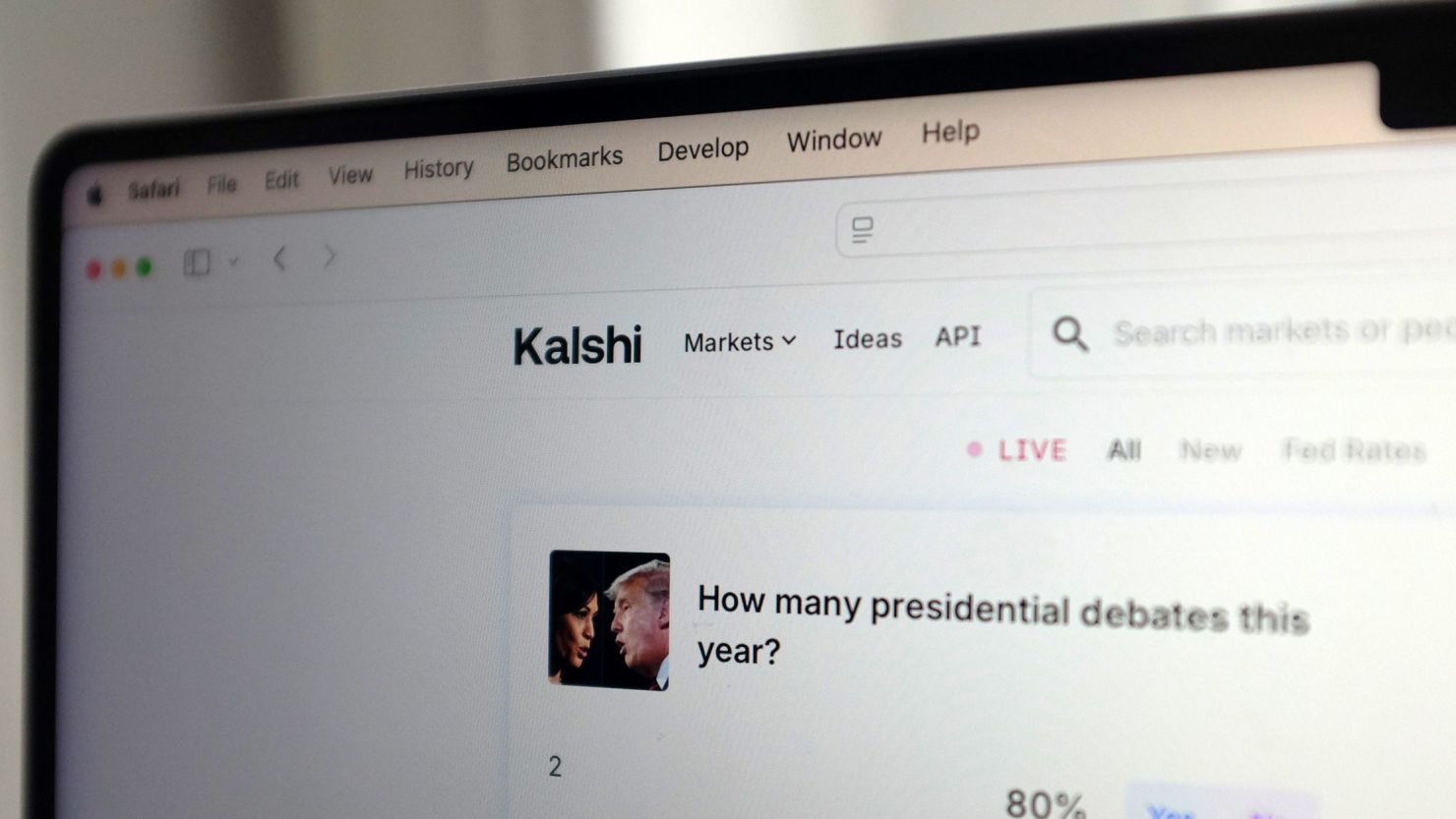

Regulatory Innovation and Scrutiny: Entities like Kalshi have pioneered regulated prediction markets in the U.S., with recent court decisions provisionally allowing congressional outcome betting, highlighting ongoing legal evolution absent in traditional bookmaking.

-

Demonstrated Predictive Accuracy: Recent studies and real-world results (e.g., University of Cincinnati, arXiv) show that blockchain prediction markets like Polymarket have outperformed traditional polls and pundits in forecasting the 2024 U.S. presidential election.

The decentralized nature also means these platforms are accessible globally (with some regulatory exceptions), democratizing participation for anyone with an internet connection and a crypto wallet.

Regulation and Reliability: Ongoing Debates Shaping the Sector

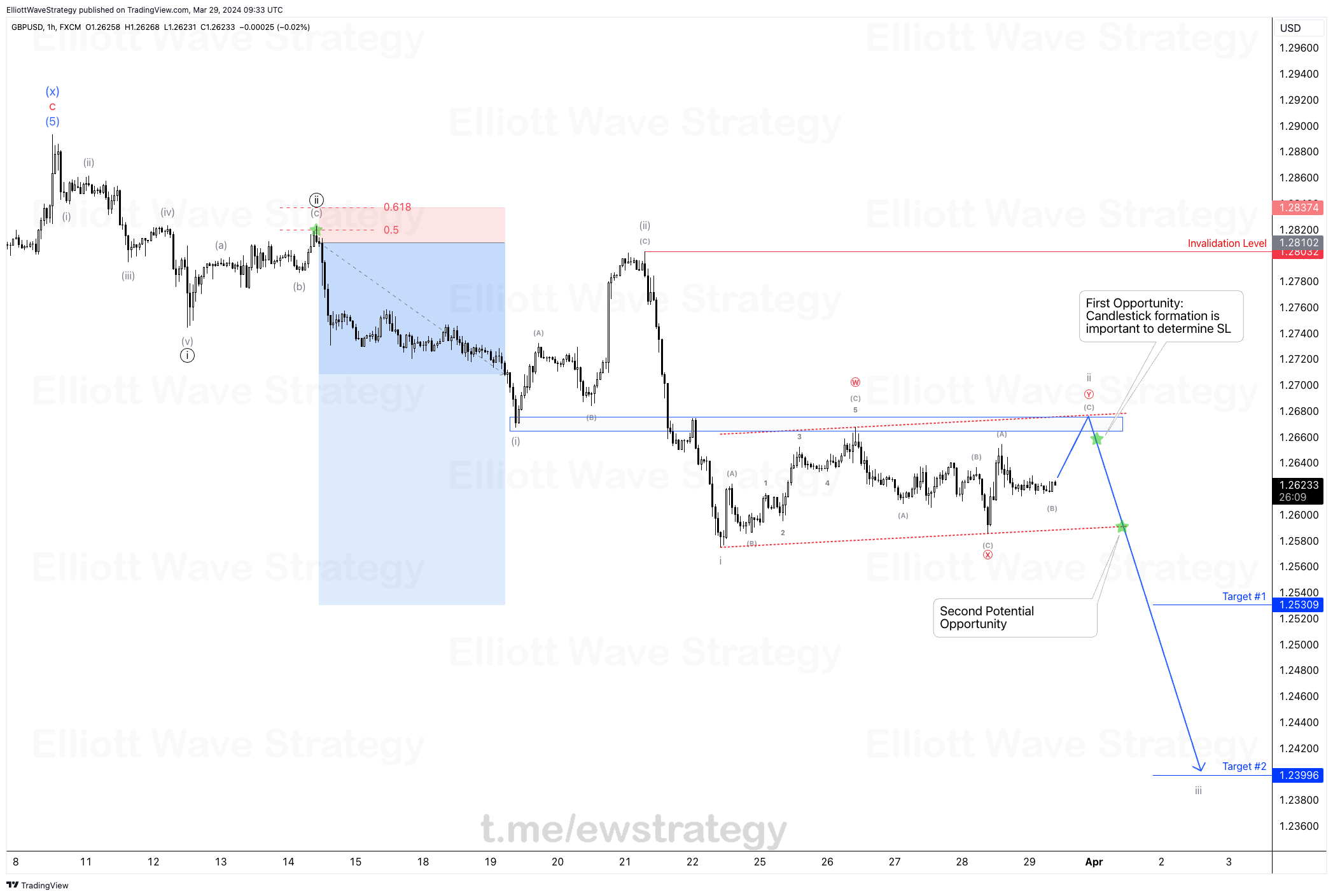

No discussion of election crypto betting would be complete without addressing regulatory scrutiny. In October 2024, the U. S. Court of Appeals provisionally cleared Kalshi, a regulated startup, to offer markets on congressional control outcomes after regulators failed to prove such markets harm public interest. Still, concerns remain about manipulation risks and whether these platforms truly reflect electoral realities or simply amplify speculative sentiment.

Skeptics argue that concentrated interests or coordinated campaigns could distort prices on even robust blockchains. Yet recent studies suggest that leading prediction markets outperformed established polling methods during the volatile 2024 cycle, especially in swing states where uncertainty was highest.

For market participants, this duality presents both opportunity and risk. While decentralized markets like Polymarket offer a transparent ledger and open access, the lack of centralized oversight means integrity relies on code and community vigilance. The debate over whether prediction markets should be regulated as financial products or remain in a legal gray area is far from settled. As platforms continue to scale, expect further legal challenges and evolving compliance frameworks to shape the next chapter of US election betting.

Despite these uncertainties, the appeal of blockchain prediction markets remains strong. The ability to place bets with cryptocurrencies, enjoy near-instant settlements, and monitor live odds, all without relying on traditional bookmakers, has resonated with a new generation of bettors. For many, these platforms represent not just a novel way to speculate but also a means to crowdsource intelligence about political outcomes.

What Sets Blockchain Election Markets Apart?

Key Advantages of Blockchain Prediction Markets in US Election Betting

-

Enhanced Transparency and Trust: Blockchain prediction markets like Polymarket operate on public ledgers, allowing all transactions and market outcomes to be independently verified. This transparency reduces the risk of hidden manipulation and builds user confidence.

-

Decentralization Reduces Single-Point Failures: By leveraging decentralized networks such as Ethereum-Polygon, these platforms eliminate centralized control, minimizing the risk of censorship, downtime, or unilateral changes by any single entity.

-

Superior Market Accuracy: Recent studies, including research from the University of Cincinnati and arXiv, found that blockchain prediction markets outperformed traditional polls in forecasting the 2024 US presidential election, especially in swing states.

-

Global Accessibility and User Participation: Decentralized prediction markets are accessible to users worldwide, bypassing geographic restrictions typical of traditional betting platforms and enabling broader participation in US election forecasting.

-

Scalability and High Liquidity: Platforms like Polymarket demonstrated significant scalability in 2024, with betting volumes surging 565% to $3.1 billion across major markets, ensuring high liquidity and efficient price discovery.

-

Regulatory Innovation and Legal Precedents: The provisional clearance for Kalshi to offer congressional control markets in October 2024 highlights evolving regulatory acceptance and the potential for compliant, legally recognized prediction markets.

The most significant differentiator is transparency. Every trade and settlement is recorded immutably on-chain, allowing users to audit outcomes and verify market data independently, something rarely possible with conventional sportsbooks or offshore betting sites. Additionally, the global reach of decentralized platforms widens the pool of participants and increases market liquidity, which can improve price discovery.

Still, it’s important for users to remain cautious. While studies have shown that blockchain prediction markets like Polymarket outperformed polls during the 2024 presidential race, assigning Donald Trump a 63% probability versus President Biden’s 18% by July 2024, there’s no guarantee that past predictive success will persist as these platforms grow more popular and potentially attract manipulation attempts.

Looking Ahead: The Future of Crypto Political Betting

The rapid ascent of crypto-powered prediction markets signals a broader shift in how people interact with real-world events online. As regulatory clarity improves and technology matures, these markets are poised to become even more influential, not just for election forecasting but across sports, finance, and global affairs.

For those considering entering this space, preparation remains paramount. Understand the mechanics, follow regulatory developments closely, and use robust risk management strategies when trading volatile political outcomes. Success in decentralized election markets comes not from chasing hype but from disciplined analysis and informed participation.

If you’re ready to explore further or want deeper insights into how blockchain is reshaping political forecasting in 2024, visit our full guide at How Blockchain Prediction Markets Are Changing Election Betting in 2024.