How to Profit from Arbitrage Between Kalshi and Polymarket in 2025: Step-by-Step Guide

As prediction markets surge in global volume and sophistication, the silent engine driving consistent profits for advanced traders in 2025 is arbitrage between Kalshi and Polymarket. This isn’t theory – it’s a proven, data-driven strategy that leverages price inefficiencies across two of the world’s largest event trading platforms. If you’re ready to move beyond casual betting into systematic, risk-managed profit extraction, understanding the nuances of cross-market arbitrage is essential.

Why Arbitrage Opportunities Flourish in 2025

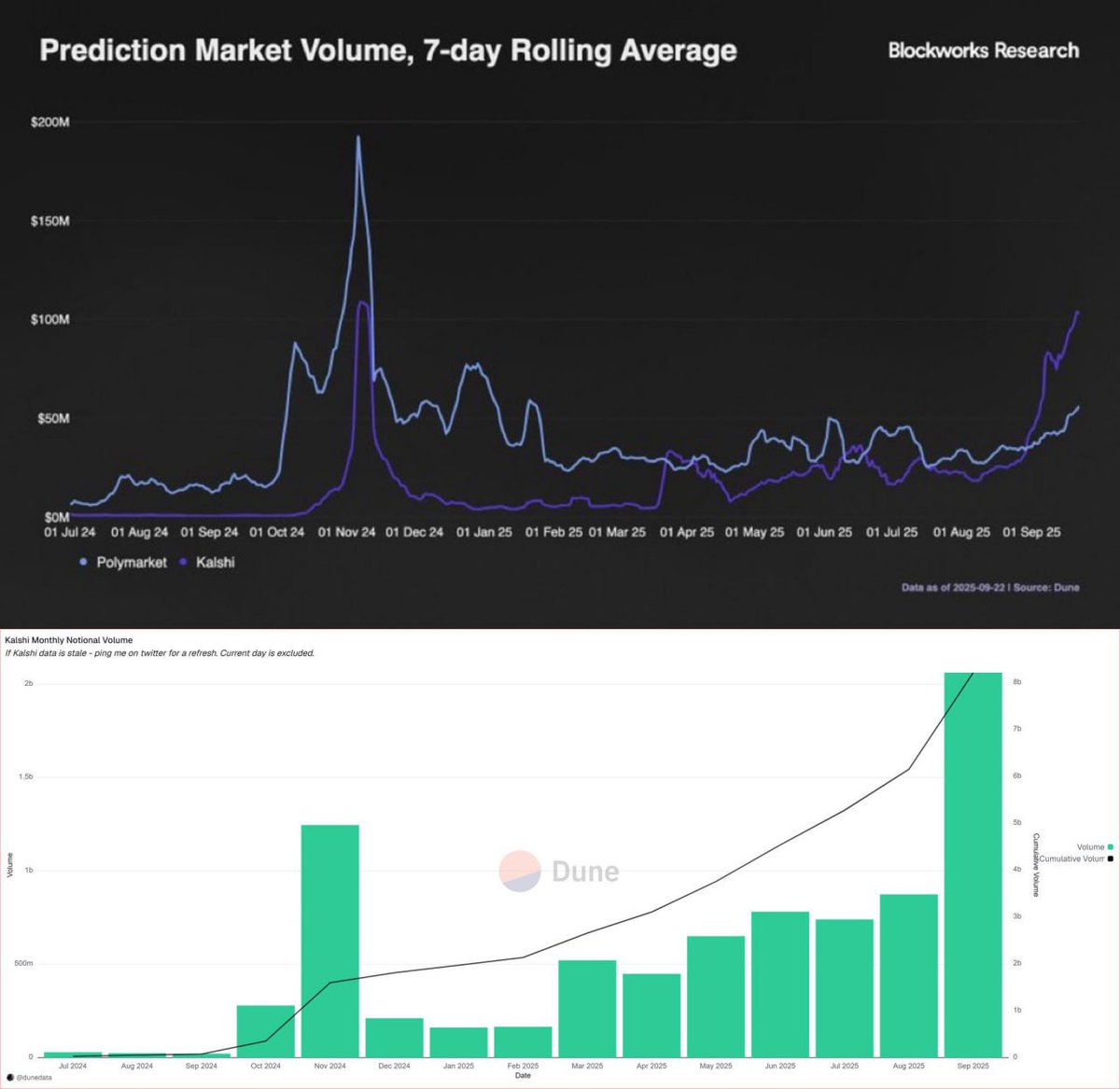

Kalshi’s explosive growth to $50 billion in annualized volume and Polymarket’s record-breaking weekly notional turnover have brought unprecedented liquidity – but also persistent pricing gaps. Each platform serves a different user base: Kalshi is CFTC-regulated with USD settlements, while Polymarket operates on Polygon blockchain with crypto-native flows. These structural differences create frequent short-lived spreads for identical contracts, especially around major political events and macroeconomic releases.

The most successful arbitrageurs are not simply reacting to headlines; they employ a toolkit of advanced strategies tailored for high-frequency prediction market trading. Here are the top five actionable approaches that define the edge in 2025:

Actionable Strategies for Profiting from Kalshi vs Polymarket Arbitrage

Top 5 Strategies for Arbitraging Kalshi & Polymarket in 2025

-

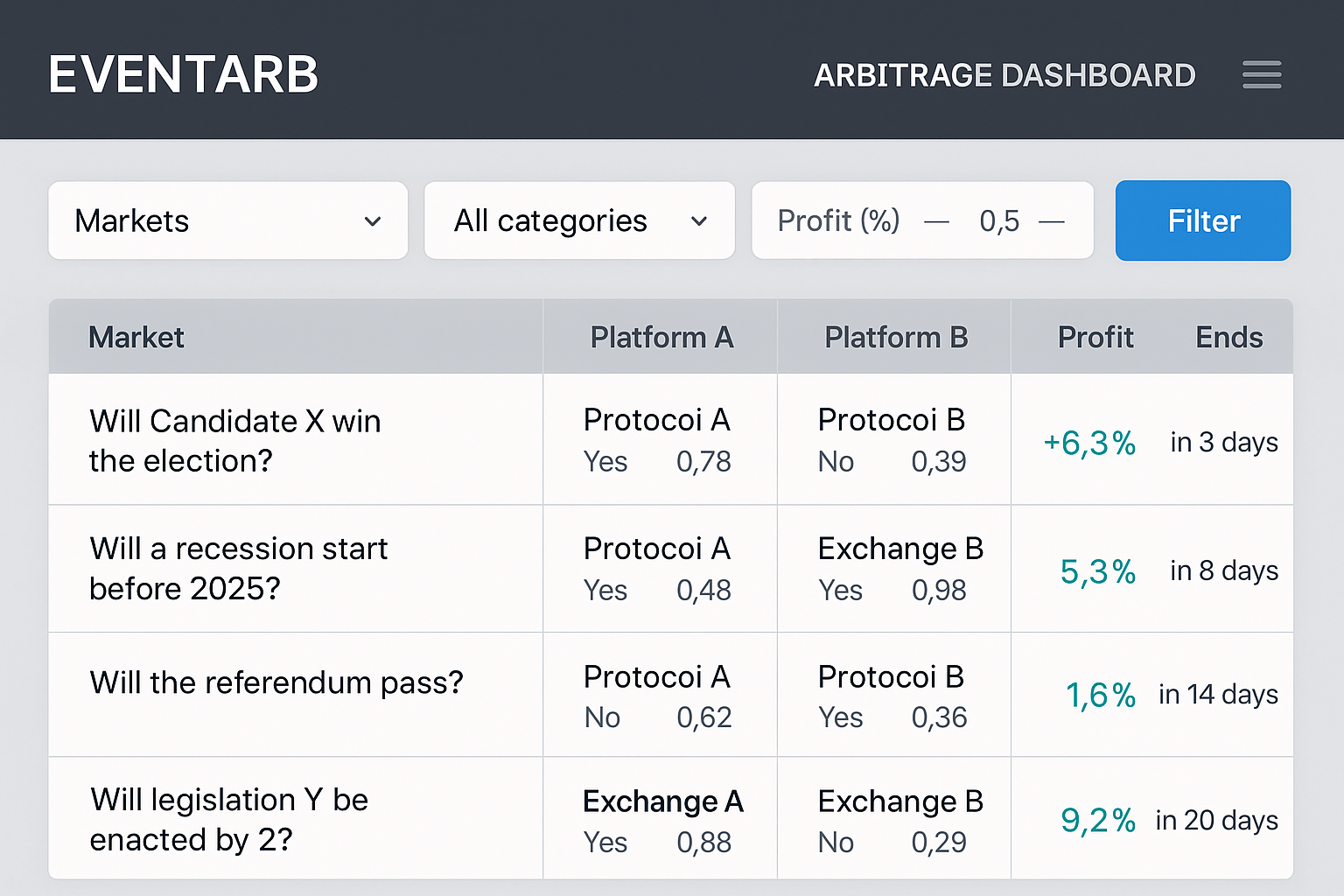

Real-Time Price Monitoring with Automated Alerts: Set up advanced bots or leverage trusted tools like Eventarb to continuously track contract prices for identical events on both Kalshi and Polymarket. This enables instant identification of arbitrage windows as price spreads emerge, maximizing your opportunity to lock in risk-free profits.

-

Cross-Platform Order Execution Automation: Utilize API integrations or custom trading scripts—such as open-source solutions on GitHub—to simultaneously place buy and sell orders on both platforms. This minimizes latency and slippage, ensuring you capture arbitrage opportunities the moment they appear.

-

Liquidity Analysis and Sizing: Prioritize markets with sufficient depth on both Kalshi and Polymarket. Analyze order books and recent volumes to ensure your arbitrage trades can be executed at scale without moving the market or incurring excessive fees. This is crucial for advanced traders aiming for consistent, sizable profits.

-

Hedging Currency and Blockchain Risks: Use stablecoins like USDC or cross-chain bridges to mitigate volatility between USD-based (Kalshi) and crypto-based (Polymarket) settlements. This ensures your arbitrage profits aren’t eroded by FX or network fluctuations, especially during high-volume trading periods.

-

Regulatory and Settlement Risk Management: Stay updated on platform-specific rules, KYC/AML requirements, and event resolution mechanisms. Regularly review official resources from Kalshi and Polymarket to avoid unexpected losses from voided markets or delayed payouts, and ensure full compliance with evolving regulations.

1. Real-Time Price Monitoring with Automated Alerts

The heart of prediction market arbitrage is speed. Advanced traders deploy bots or subscribe to third-party alert services that track contract prices on both platforms in real time. When spreads emerge – such as “Yes” at $0.45 on Polymarket versus “No” at $0.49 on Kalshi – these systems instantly flag opportunities where the combined cost is less than $1.00 per share.

This rapid identification transforms prediction markets from speculative playgrounds into precision tools for systematic profit-taking. In volatile periods (e. g. , election night), automated monitoring is indispensable as price gaps can close within seconds.

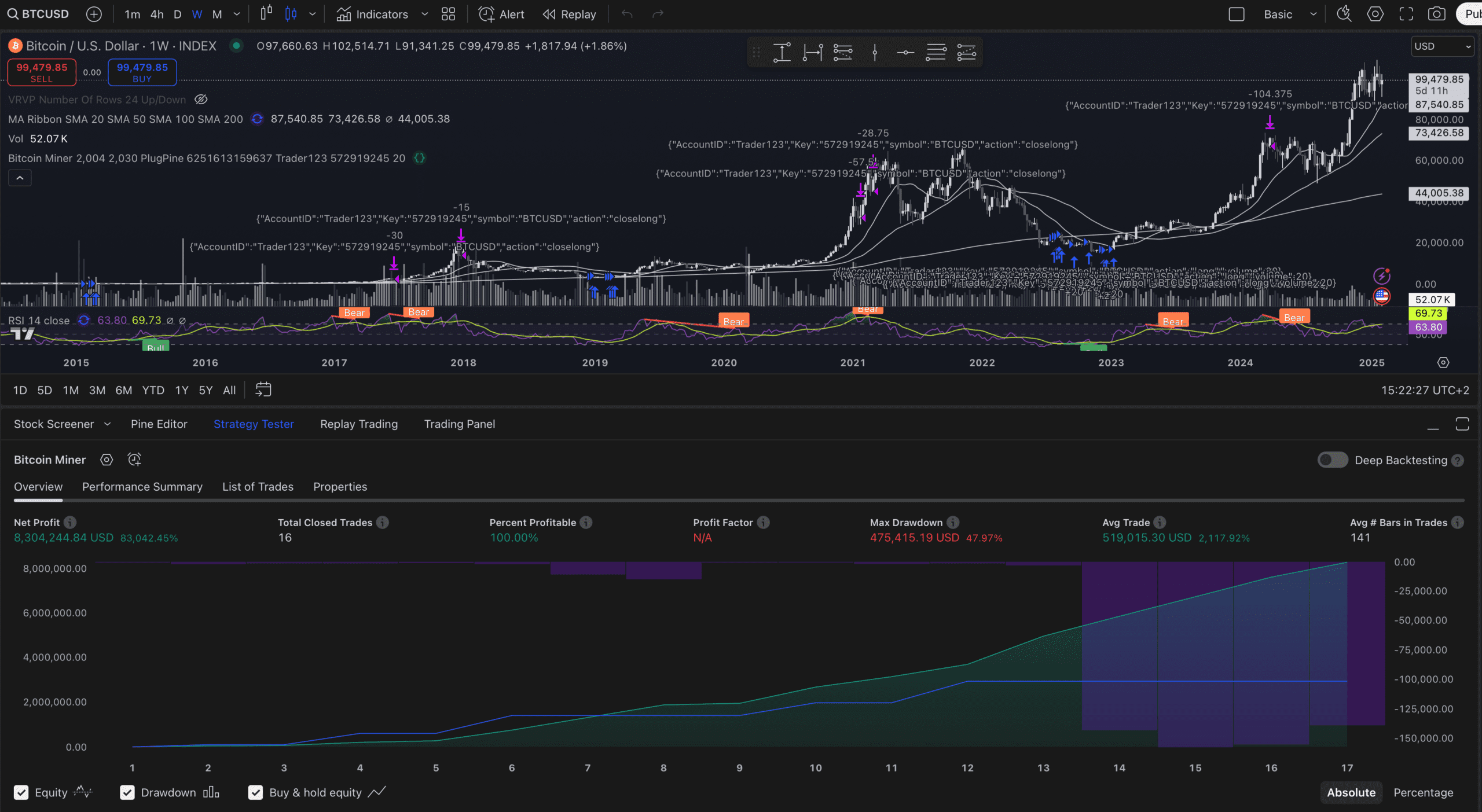

2. Cross-Platform Order Execution Automation

Spotting an arbitrage window is only half the battle; executing trades without delay or slippage is equally critical. Top traders use API integrations or custom trading scripts that simultaneously place buy and sell orders on both platforms as soon as an opportunity appears.

This approach minimizes latency risk – ensuring you lock in the spread before it vanishes due to other sophisticated participants or sudden market moves. For those scaling up, automation isn’t optional: it’s your ticket to consistent returns without manual bottlenecks.

3. Liquidity Analysis and Sizing

No matter how attractive an arbitrage spread may appear, execution at scale depends on liquidity depth on both Kalshi and Polymarket. Before committing capital, advanced traders analyze order books to assess whether their desired position size can be filled without significant price impact or excessive fees.

This means prioritizing high-volume markets – such as US presidential elections or major economic indicators – where both sides of your trade can be entered (and exited) efficiently. Smart sizing ensures your profits aren’t eroded by slippage or partial fills, which can turn risk-free trades into costly lessons.

4. Hedging Currency and Blockchain Risks

One of the unique complexities in Kalshi vs Polymarket arbitrage is navigating settlement currencies and blockchain infrastructure. Kalshi settles in USD, while Polymarket operates natively in crypto (often USDC on Polygon). Rapid price moves in crypto or network congestion can eat into your profits if not managed properly. Savvy traders use stablecoins or cross-chain bridges to keep exposure neutral, ensuring that gains from arbitrage aren’t offset by unexpected FX swings or blockchain transaction delays.

For example, after buying “Yes” on Polymarket at $0.45 and “No” on Kalshi at $0.49, you’ll want to ensure your profits aren’t diminished by USDC/USD conversion costs or sudden gas fee spikes. Many advanced participants maintain balances on both platforms and pre-position stablecoins to enable instant settlement at favorable rates.

5. Regulatory and Settlement Risk Management

Regulatory regimes for prediction markets are evolving rapidly, especially as volumes soar and new users enter the space. Kalshi’s CFTC oversight means strict KYC/AML requirements and clear event resolution rules, while Polymarket’s decentralized model can introduce ambiguity around market outcomes or user eligibility.

Before executing cross-platform trades, always review the specific event rules and payout criteria for each contract. Timing mismatches (e. g. , “before Jan 1,2026” on Kalshi versus “during 2025” on Polymarket) can create risks if the event resolves differently across platforms. Staying current with compliance updates ensures that your arbitrage profits are protected from voided markets or delayed payouts due to regulatory intervention.

Sample Arbitrage Execution Script

If you’re ready to automate your workflow, here’s a simplified Python code snippet that demonstrates how an API-driven bot might monitor prices and execute trades across both platforms:

Python Example: Monitoring Arbitrage Opportunities Between Kalshi and Polymarket

Here’s a simple Python script that demonstrates how to monitor prices on Kalshi and Polymarket, and detect arbitrage opportunities. This example assumes you have access to the relevant APIs and have replaced the placeholder market IDs and parsing logic as needed.

import requests

import time

KALSHI_API_URL = 'https://api.kalshi.com/markets/EXAMPLE_MARKET_ID'

POLYMARKET_API_URL = 'https://api.polymarket.com/markets/EXAMPLE_MARKET_ID'

KALSHI_FEE = 0.02 # Adjust as needed

POLYMARKET_FEE = 0.02 # Adjust as needed

MIN_PROFIT = 0.01 # Minimum profit per trade to trigger arbitrage

def get_kalshi_price():

response = requests.get(KALSHI_API_URL)

data = response.json()

# Replace with actual parsing logic

price_yes = float(data['market']['yes_price'])

price_no = float(data['market']['no_price'])

return price_yes, price_no

def get_polymarket_price():

response = requests.get(POLYMARKET_API_URL)

data = response.json()

# Replace with actual parsing logic

price_yes = float(data['market']['yes_price'])

price_no = float(data['market']['no_price'])

return price_yes, price_no

def check_arbitrage():

k_yes, k_no = get_kalshi_price()

p_yes, p_no = get_polymarket_price()

# Buy YES on Kalshi, NO on Polymarket

profit1 = p_no - k_yes - KALSHI_FEE - POLYMARKET_FEE

# Buy YES on Polymarket, NO on Kalshi

profit2 = k_no - p_yes - KALSHI_FEE - POLYMARKET_FEE

if profit1 > MIN_PROFIT:

print(f"Arbitrage Opportunity: Buy YES on Kalshi at {k_yes}, NO on Polymarket at {p_no}, Expected Profit: {profit1}")

# Place trades here

elif profit2 > MIN_PROFIT:

print(f"Arbitrage Opportunity: Buy YES on Polymarket at {p_yes}, NO on Kalshi at {k_no}, Expected Profit: {profit2}")

# Place trades here

else:

print("No arbitrage opportunity detected.")

if __name__ == "__main__":

while True:

check_arbitrage()

time.sleep(30) # Check every 30 secondsRemember to replace the API URLs and parsing logic with the correct endpoints and fields for your target markets. For real trading, you’ll also need to implement authentication and order placement with both platforms’ APIs.

Final Thoughts: The Edge Belongs to the Prepared

Prediction market arbitrage between Kalshi and Polymarket is no longer a niche pursuit – it’s an institutional-grade strategy accessible to independent traders who combine technical tools with disciplined risk management. The edge comes not from luck but from relentless execution of these actionable strategies:

- Real-time price tracking with automated alerts

- Instant cross-platform order execution

- Liquidity-aware trade sizing

- Cautious currency risk hedging

- Diligent regulatory awareness

If you’re serious about profiting from prediction markets in 2025, mastering these five tactics will put you ahead of the curve as volume explodes, spreads persist, and competition intensifies.