How Blockchain Prediction Markets Are Changing Election Betting in 2024

The 2024 U. S. presidential election didn’t just break turnout records – it shattered the old playbook for political betting. This year, blockchain prediction markets like Polymarket took center stage, letting anyone with crypto and an opinion wager on the outcome, all with radical transparency and speed. Gone are the days of waiting for slow-moving bookies or trusting opaque odds set by insiders. Now, decentralized platforms empower users to trade their political insights in real time, with every bet recorded on-chain for all to see.

Polymarket’s $3.2 Billion Bet Surge: The Crypto Election Betting Boom

No story sums up the seismic shift in election betting 2024 quite like Polymarket’s explosive growth. During this cycle, Polymarket facilitated over $3.2 billion in bets on the U. S. presidential race alone, according to blocknews. com. That’s not just a headline – it’s a 565% volume spike in Q3 2024 as crypto-savvy bettors piled into markets tracking every twist and turn of Trump vs Harris.

This isn’t just about big numbers; it’s about democratizing access and insight. On platforms like Polymarket, odds aren’t set by pundits or pollsters but by thousands of independent traders staking real money on their convictions. The result? A dynamic market that often outpaces traditional polls when it comes to accuracy and responsiveness.

Decentralized Prediction Markets: Transparency Meets Innovation

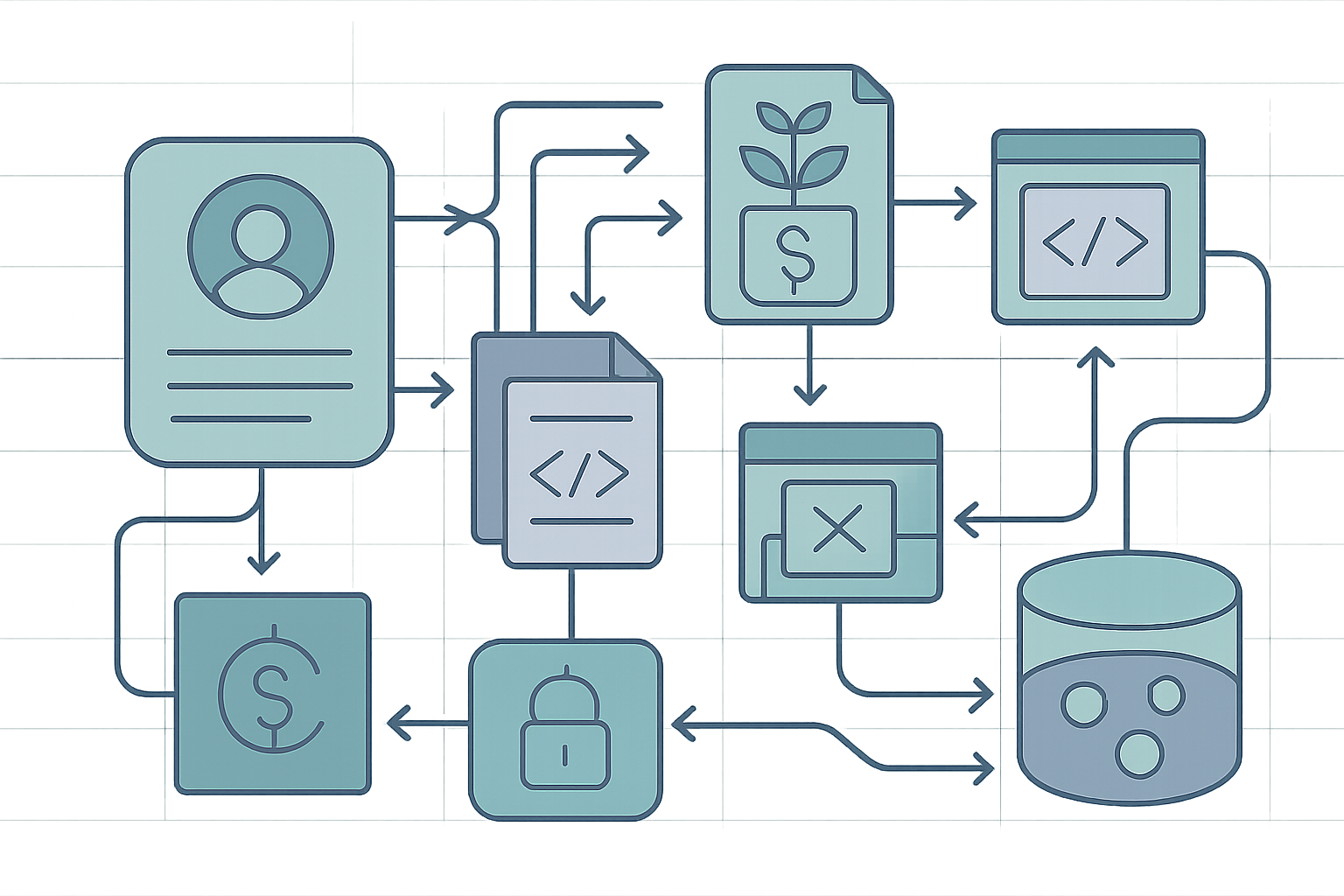

The heart of this revolution is decentralization. Unlike legacy betting sites, decentralized prediction markets run on public blockchains where every wager is transparent and settlement is trustless. Users hold their own keys, trades clear instantly, and smart contracts enforce outcomes without middlemen or delays.

This tech leap brings major advantages:

- No house edge: Odds are peer-generated; you’re trading against other users’ beliefs.

- Global access: Anyone with crypto can participate – no KYC headaches or geo-restrictions.

- Fast settlements: Payouts are triggered automatically when results are finalized – no more waiting days for your winnings.

- Immutable records: Every trade is permanent and auditable on-chain, boosting trust in market integrity.

The impact? As KuCoin highlights in their roundup of top platforms to watch this year, decentralized prediction markets have become a magnet for both retail bettors and institutional capital chasing alpha from political volatility.

Pushing Past Polls: Are Blockchain Markets More Accurate?

If you watched election night unfold online, you saw firsthand how prediction markets can react faster than any pollster or cable news panel. In fact, research from the University of Cincinnati found that blockchain-based prediction markets outperformed traditional polls at forecasting the actual result of the 2024 presidential race – echoing findings from arXiv that these markets gave Trump a 95% win probability before midnight as results rolled in.

This isn’t luck; it’s crowd-sourced intelligence at work. With thousands of traders adjusting positions minute by minute as new data drops, blockchain prediction markets provide a living snapshot of collective sentiment – one that can be more accurate than stale survey data or pundit hot takes. For those seeking an edge on crypto election betting, these platforms offer both actionable signals and transparent price discovery.

Yet, this revolution hasn’t come without friction. The dizzying rise in volume and visibility of decentralized platforms like Polymarket has drawn the attention of regulators and skeptics alike. In October 2024, a pivotal legal shift occurred: the U. S. Court of Appeals provisionally allowed Kalshi to offer contracts on congressional control, signaling a potential new era for regulated prediction markets. This move opened the door for more mainstream participation but also ignited fierce debate about how to balance innovation with oversight.

Critics warn that large bets from whales can skew perceived probabilities, potentially distorting the market’s signal. Others worry about manipulation or using prediction markets as vehicles for misinformation. Still, the blockchain foundation makes every trade traceable and public, far more transparent than shadowy offshore sportsbooks or backroom bookies ever could be.

Regulation and Reliability: The Road Ahead for Crypto Election Betting

The regulatory landscape remains unsettled, but momentum is building fast. With $3.2 billion wagered on Polymarket alone during the 2024 race and a 565% surge in overall prediction market volume, it’s clear that demand isn’t fading anytime soon. Platforms are racing to implement better safeguards, from on-chain audit trails to community-driven dispute resolution.

For serious traders and casual bettors alike, the appeal is obvious: low fees, instant payouts, global access, and a level playing field where your edge comes from insight, not insider status. As more institutional players eye this space and as regulatory clarity emerges, expect even greater liquidity and sophistication in future election cycles.

What does this mean for you? If you’re a crypto enthusiast or political junkie with an opinion, and skin in the game, blockchain prediction markets offer an unprecedented toolkit to express your views and profit from your foresight. Whether you’re trading minute-by-minute volatility or holding long-term positions on macro outcomes, these markets are rewriting what’s possible in political forecasting and decentralized finance.

The New Normal: Trading Insight for Impact

This year proved that decentralized prediction markets aren’t just a novelty, they’re now shaping narratives, influencing campaigns, and offering real-time feedback loops that traditional media can’t match. With every cycle, these platforms become more robust and essential for anyone serious about tracking or trading elections.

If you’re ready to dive deeper into how blockchain is transforming political wagering, and why it matters for both traders and democracy itself, explore our comprehensive guides on blockchain prediction markets and crypto election betting. The future is here; it’s time to trade your conviction.