How Blockchain Technology is Transforming Election Prediction Markets in 2024

Throughout 2024, blockchain election prediction markets have rapidly matured, fundamentally reshaping how political forecasting is conducted. The convergence of decentralized finance and prediction markets has made it possible for anyone with internet access and cryptocurrency to participate in real-time, transparent election betting. This shift was nowhere more evident than during the 2024 U. S. presidential race, which saw a historic surge in both market volume and user engagement.

From Niche to Mainstream: The Rise of Blockchain Election Prediction Markets

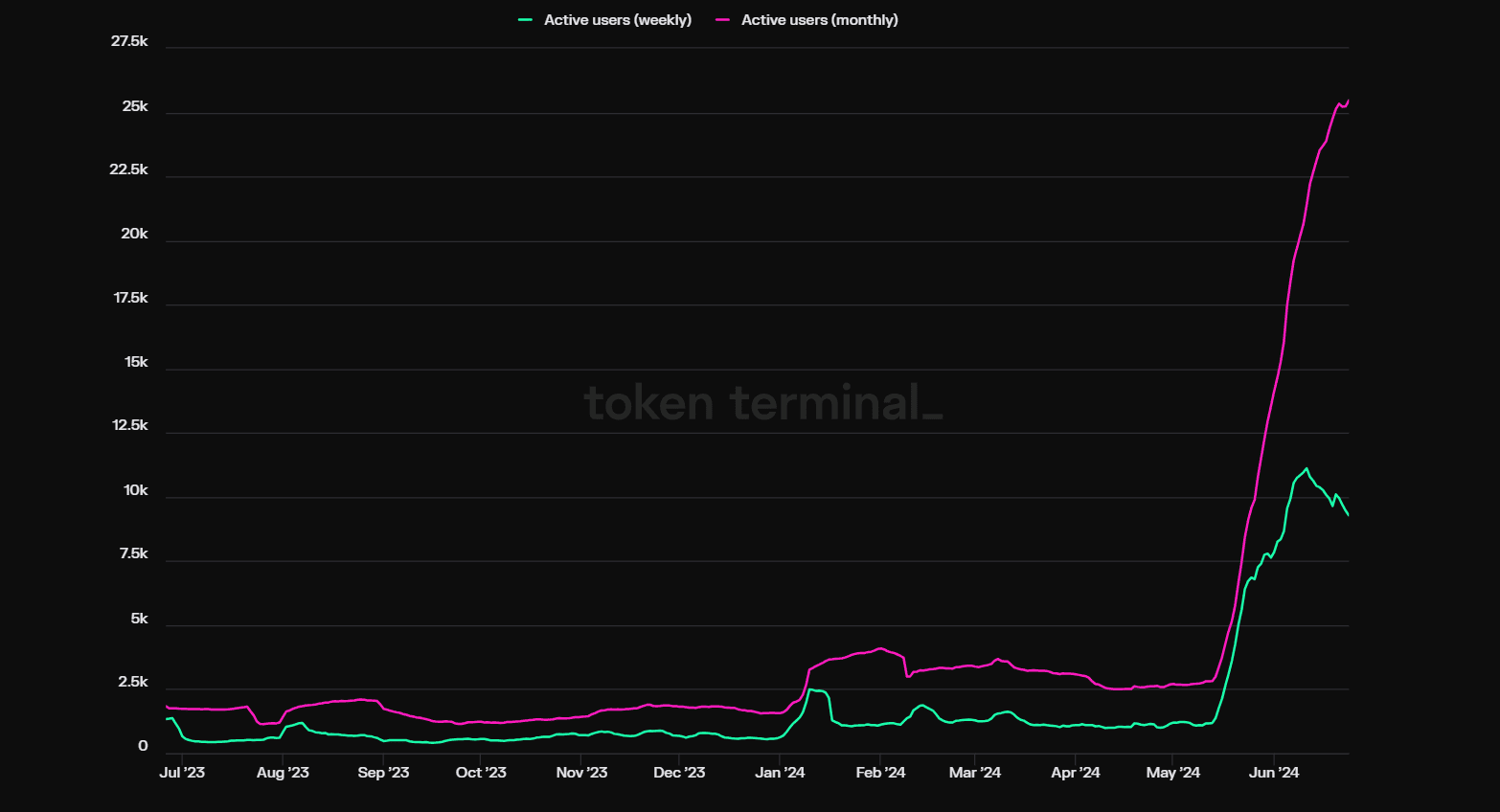

The explosion in popularity of platforms like Polymarket, now recognized as the world’s largest election prediction market, demonstrates the mainstreaming of decentralized election forecasting. By July 2024, Polymarket had attracted over $200 million in bets on the U. S. presidential outcome alone. Odds traded on-chain indicated a 63% probability for Donald Trump’s victory, compared to just 18% for Joe Biden. These precise odds reflected the aggregation of millions of independent data points from a global user base, often outperforming traditional polls and pundit predictions.

This growth wasn’t isolated to a single platform. In Q3 2024, total prediction market volumes across major blockchain-based platforms surged by 565%, reaching an unprecedented $3.1 billion. Such figures underscore how quickly crypto-powered political event prediction has moved from fringe experiment to a core tool for traders, analysts, and political enthusiasts alike.

Why Blockchain? Transparency, Liquidity, and Trust

The advantages of blockchain technology for political event prediction are clear:

Top Benefits of Blockchain Election Betting Platforms

-

Enhanced Transparency and Trust: Blockchain-based platforms like Polymarket record every transaction and bet outcome on a public ledger, ensuring results are verifiable and tamper-proof.

-

Superior Forecast Accuracy: In 2024, prediction markets outperformed traditional polls in forecasting the U.S. presidential election, demonstrating the collective intelligence and efficiency of decentralized markets.

-

Increased Market Liquidity: Platforms such as Polymarket experienced a 565% surge in trading volumes during the 2024 election cycle, reaching $3.1 billion, which enabled faster, more efficient price discovery.

-

Global Accessibility and Inclusion: Blockchain removes geographical and financial barriers, allowing users worldwide to participate in election prediction markets with just an internet connection and a crypto wallet.

-

Immutable Record-Keeping: All bets and outcomes are permanently recorded on the blockchain, providing an auditable trail that enhances accountability and reduces disputes.

-

Reduced Centralized Control: Decentralized platforms minimize the influence of single entities, fostering a more open and resilient prediction market ecosystem.

Transparency is paramount. Every wager is recorded immutably on-chain, making it impossible for operators to manipulate outcomes or withhold funds. Settlement occurs nearly instantly after results are confirmed, bypassing traditional delays and opaque accounting practices found in legacy betting systems.

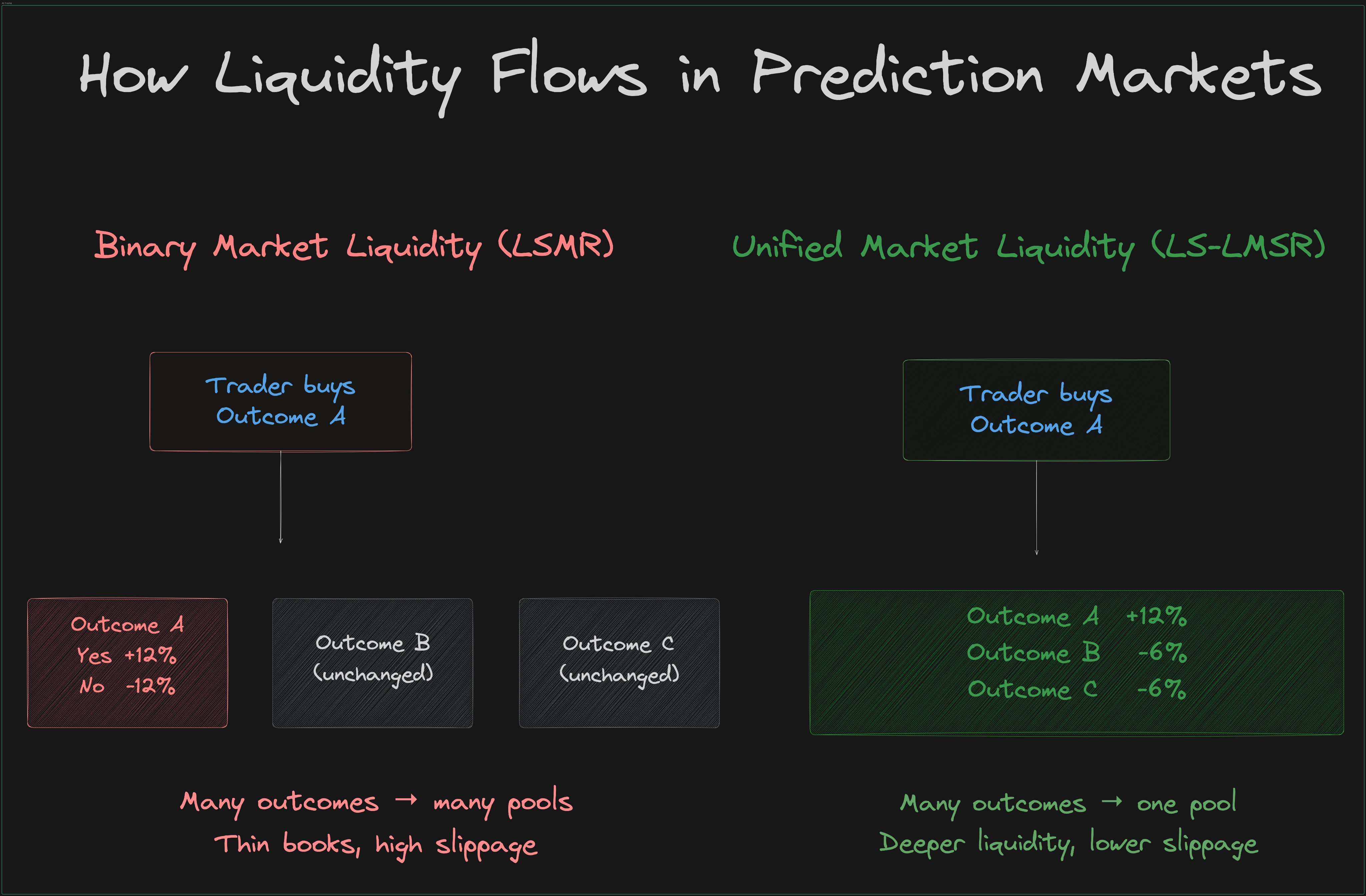

This transparency also drives liquidity. With no centralized intermediaries or geographic restrictions, participants from around the world can trade their opinions freely. As a result, markets become deeper and more efficient, allowing prices (odds) to reflect collective wisdom more accurately than small-sample polling or expert commentary ever could.

The Data-Driven Edge: Are Prediction Markets More Accurate Than Polls?

The evidence from 2024 suggests so. According to research by the University of Cincinnati and independent analysis across the crypto space, blockchain-based prediction markets delivered more accurate forecasts than most established polling models. While national polls struggled with sampling errors and late swings in voter sentiment, decentralized markets continuously adjusted odds in response to new information, offering a real-time pulse on public expectations.

This isn’t just theory; it’s quantifiable performance. When compared side-by-side with polling averages and pundit forecasts during the final weeks before Election Day, platforms like Polymarket consistently provided probabilities that closely matched eventual outcomes. For those seeking actionable insights, or simply looking for an edge, these platforms have become indispensable tools.

Yet the rapid ascent of crypto election betting 2024 was not without challenges. As prediction markets gained visibility, regulatory scrutiny intensified. In November 2024, the FBI’s raid on Polymarket CEO Shayne Coplan’s home signaled a new phase of legal uncertainty for decentralized election forecasting. While these interventions raised questions about compliance and jurisdiction, they also underscored the disruptive potential of blockchain transparency in elections, a technology now too significant to ignore.

Navigating Regulatory Hurdles and Market Integrity

The intersection of blockchain and political event prediction crypto is complex. U. S. authorities, for example, have historically restricted election betting due to concerns over manipulation and legality. However, as platforms like Polymarket operate on public blockchains with immutable records, some experts argue that these systems inherently reduce risks associated with opaque or unregulated markets.

For users, this means increased confidence in market integrity, each trade is traceable, every settlement verifiable. Still, participants must be mindful of evolving legal landscapes and platform-specific terms. The future growth of decentralized election forecasting will likely depend on how regulators adapt to the unique characteristics of blockchain-based systems.

“Blockchain brings radical transparency to election betting, but it also challenges outdated regulations that weren’t designed for open global networks. “

The Broader Impact: Data Liquidity and Real-World Influence

The influence of blockchain election prediction markets now extends beyond traders and political junkies. In 2024, spikes in prediction market odds frequently made headlines, shaping narratives in mainstream media and even influencing campaign strategies. As research from ScienceDirect notes, narrative political signals during the U. S. presidential race had measurable effects on cryptocurrency prices and crypto-linked equities.

This feedback loop between real-world events and digital asset markets is a defining feature of the new era. When millions place bets on a candidate’s chances using transparent protocols, it becomes harder for misinformation or isolated polling errors to distort perceptions. Instead, market-driven probabilities emerge as a more reliable indicator for both investors and citizens tracking high-stakes elections.

How Blockchain Prediction Markets Shaped the 2024 Election

-

Polymarket’s Odds Became a Media Reference Point: In July 2024, Polymarket odds—showing Donald Trump with a 63% chance and Joe Biden with 18%—were widely cited by major news outlets as a real-time barometer of the race, often contrasted with traditional polling data.

-

Prediction Market Accuracy Outperformed Polls: A University of Cincinnati study found that blockchain-based prediction markets were more accurate in forecasting the 2024 presidential outcome than established polls, influencing how media and analysts framed the election narrative.

-

Campaigns Adjusted Strategies Based on Market Signals: Both major party campaigns reportedly monitored Polymarket and similar platforms, adjusting messaging and resource allocation in response to real-time shifts in market sentiment, as reported by Cointelegraph and other outlets.

-

Media Coverage Highlighted Market Volatility: The surge to $3.1 billion in election-related prediction market volume during Q3 2024 was covered by financial and political media, emphasizing blockchain markets as leading indicators of public sentiment and campaign momentum.

-

Regulatory Scrutiny Became a News Story: The FBI’s November 2024 raid of Polymarket CEO Shayne Coplan’s home was widely reported, sparking discussions in the media about the legal status and future of decentralized election prediction markets.

Looking Ahead: The Future of Decentralized Election Forecasting

The surge to $3.1 billion in Q3 2024 prediction market volumes marks only the beginning for this sector. As user experience improves, abstracting away blockchain complexity, mainstream adoption is poised to accelerate further. Key questions remain around regulation and cross-border participation, but one thing is clear: decentralized platforms are redefining trust in political event forecasting.

For those seeking a deeper dive into how these innovations are reshaping global betting ecosystems, and what might come next, see our analysis at How Blockchain Prediction Markets Are Changing 2024 Election Betting.