How Blockchain Prediction Markets Are Changing Election Betting in 2024

Blockchain prediction markets are rapidly reshaping the landscape of election betting, bringing a new era of transparency, accessibility, and data-driven forecasting to one of the world’s most closely watched events: the 2024 U. S. presidential election. As traditional polling faces growing skepticism, crypto prediction markets like Polymarket and Kalshi have surged in popularity, offering tech-savvy bettors and political enthusiasts an alternative way to wager on, and interpret, the political future.

Decentralized Election Betting Goes Mainstream

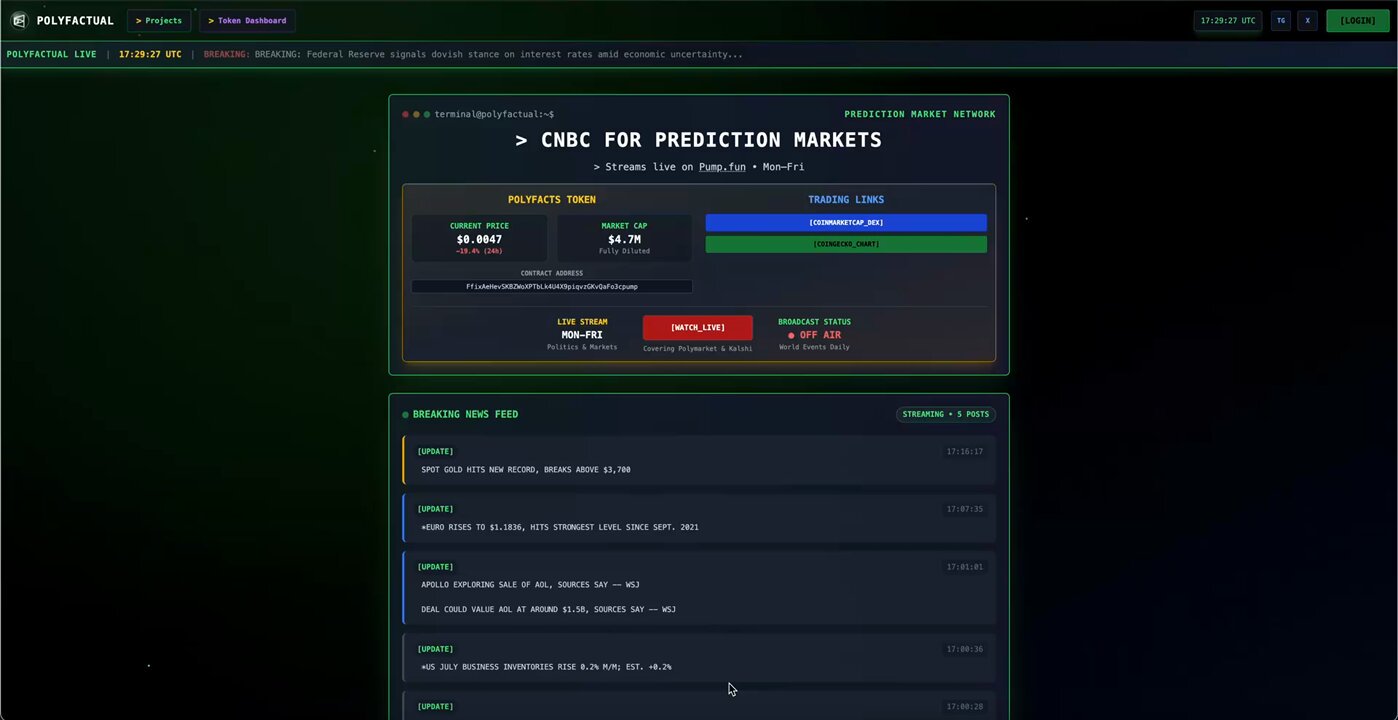

The 2024 race has been a watershed moment for decentralized election betting. Platforms such as Polymarket are leading the charge, leveraging Ethereum-Polygon blockchain infrastructure to host the world’s largest election prediction market. By July 2024, Polymarket had recorded over $200 million in bets on the U. S. presidential outcome alone, an unprecedented figure that signals mainstream adoption among both retail and institutional participants.

This surge is not limited to just one platform. The entire sector ballooned in Q3 2024, with prediction market activity up 565% to hit $3.1 billion across major platforms (source). The driving force? Intense public interest in the Trump vs Biden rematch, and a growing belief that blockchain-based markets can offer more accurate forecasts than polling aggregators or pundit-driven analysis.

Why Blockchain Markets Outperform Traditional Polls

The accuracy of these markets isn’t just hype. Academic studies and real-world results back up their predictive power: a University of Cincinnati study found that a prediction market outperformed both polls and pundits in forecasting the 2024 election result (see also arXiv analysis). In swing states especially, Polymarket’s pricing was more closely aligned with eventual outcomes than mainstream polling averages.

“Overall, findings suggest that Polymarket was superior to polling in predicting the outcome of the 2024 presidential election, particularly in swing states. ” – arXiv preprint (May 2024)

This edge comes from two key advantages:

Why Blockchain Prediction Markets Outperform Traditional Polls

-

Real-Time, Crowd-Sourced Forecasts: Blockchain prediction markets like Polymarket aggregate the insights and incentives of thousands of participants, reflecting collective expectations in real time—unlike polls, which may lag behind shifting public sentiment.

-

Financial Incentives Drive Accuracy: Participants in markets such as Kalshi have real money at stake, motivating them to research and act on the most accurate information available, rather than simply expressing opinions as in traditional polls.

-

Transparency and Tamper-Resistance: Blockchain technology ensures that all bets and outcomes are recorded immutably and publicly, reducing the risk of manipulation or hidden bias that can affect poll results.

-

Higher Predictive Performance in 2024 Elections: Studies, including from the University of Cincinnati and arXiv, found that blockchain-based markets like Polymarket outperformed major polls in forecasting the 2024 U.S. presidential election, especially in swing states.

-

Global Participation and Diverse Perspectives: Decentralized platforms allow users from around the world to participate, incorporating a wider range of viewpoints than geographically limited polling samples.

-

Reduced Susceptibility to Social Desirability Bias: Because market participants are financially motivated and often anonymous, they are less likely to misrepresent their true beliefs compared to respondents in traditional opinion polls.

The Legalization Wave: Kalshi’s Breakthrough and Regulatory Tensions

The regulatory front saw major developments as well. In October 2024, Kalshi won a pivotal court ruling allowing Americans to legally bet on federal elections, a first for regulated U. S. -based platforms (Reuters coverage). This opened doors for new types of contracts on everything from Senate control to state-level races (Cointelegraph report), further legitimizing crypto-powered political wagering as a financial product.

Yet this rapid growth has not come without friction. In November 2024, an FBI raid on Polymarket’s CEO raised fresh concerns about compliance risks and legal ambiguity for decentralized operators (Axios report). Critics warn that while crypto prediction markets offer transparency at the protocol level, they remain vulnerable to manipulation attempts or regulatory crackdowns, a tension likely to define their evolution going forward.

Ultimately, the 2024 cycle has underscored both the promise and the perils of blockchain election betting. On one hand, platforms like Polymarket and Kalshi have democratized access to political forecasting, letting anyone with crypto participate in markets that were once the preserve of offshore bookmakers or high-net-worth insiders. The sheer scale provides $3.1 billion in Q3 2024 prediction market volume, reflects not just speculative fervor but a collective search for more trustworthy signals in an era of poll fatigue and media distrust.

For many, these decentralized markets have become a real-time barometer of public sentiment. When Polymarket showed Donald Trump with a 63% chance to win and Joe Biden lagging at 18%, it wasn’t just a bet, it was a distilled snapshot of global expectations, constantly updated as new information flowed into the market. This liquidity and dynamism are what make crypto prediction markets so compelling for both traders and political analysts.

Risks, Manipulation, and the Road Ahead

Still, the sector’s rapid ascent has brought challenges that can’t be ignored. Regulatory uncertainty remains high: while Kalshi’s legal breakthrough is significant for U. S. -based election betting, decentralized platforms face persistent scrutiny from authorities. The November 2024 FBI raid on Polymarket’s CEO sent shockwaves through the industry, sparking debate over whether these platforms can ever achieve full legitimacy under current laws (Axios report).

Critics also highlight potential vulnerabilities unique to blockchain-based systems. Although transparency is built into smart contracts and transaction ledgers, market manipulation remains a risk, particularly in thinly traded contracts or when large actors attempt to sway odds for narrative or financial gain. As TIME notes, skepticism persists about whether these markets are truly immune to coordinated influence.

What’s Next for Crypto Prediction Markets?

The trajectory for crypto prediction markets looks robust but uncertain. Venture capital interest is accelerating as firms bet on blockchain-based forecasting becoming a mainstream financial tool (The Block). With continued innovation, such as faster settlement times, improved user interfaces, and new types of event contracts, the sector is poised to expand beyond politics into sports, economics, and even climate outcomes.

If regulators can strike a balance between consumer protection and open innovation, decentralized election betting could become an enduring fixture in both financial markets and civic life. For now, users should approach these platforms with informed caution: while they offer unprecedented transparency and accuracy (as demonstrated by outperforming traditional polls), legal risks and operational uncertainties persist.

The story of blockchain election betting in 2024 is far from over. As technology matures and regulatory frameworks evolve, crypto-powered prediction markets may redefine how we gauge, and wager on, the future of democracy itself.