Fantasy Sports Meets Blockchain: Tokenized Athlete Performance Markets

Fantasy sports has always thrived on the intersection of data, fandom, and strategy. But with the rise of blockchain technology and tokenization, we are witnessing a fundamental shift: tokenized fantasy sports platforms now allow fans to own, trade, and invest in digital representations of athletes with real-world value. This evolution is not simply cosmetic; it’s transforming how fans engage with sports, how value flows within fantasy ecosystems, and even how athlete performance is speculated on as an asset class.

How Blockchain Is Reshaping Fantasy Sports

Traditional fantasy leagues have long relied on centralized operators to manage rosters and scoring. Blockchain disrupts this model by introducing transparent smart contracts and decentralized ownership. Platforms like LeagueDAO have pioneered NFT-based leagues, where players are represented by unique digital tokens, for example, Nomo Player Tokens in their Nomo League. These tokens can be bought, sold, or staked just like crypto assets.

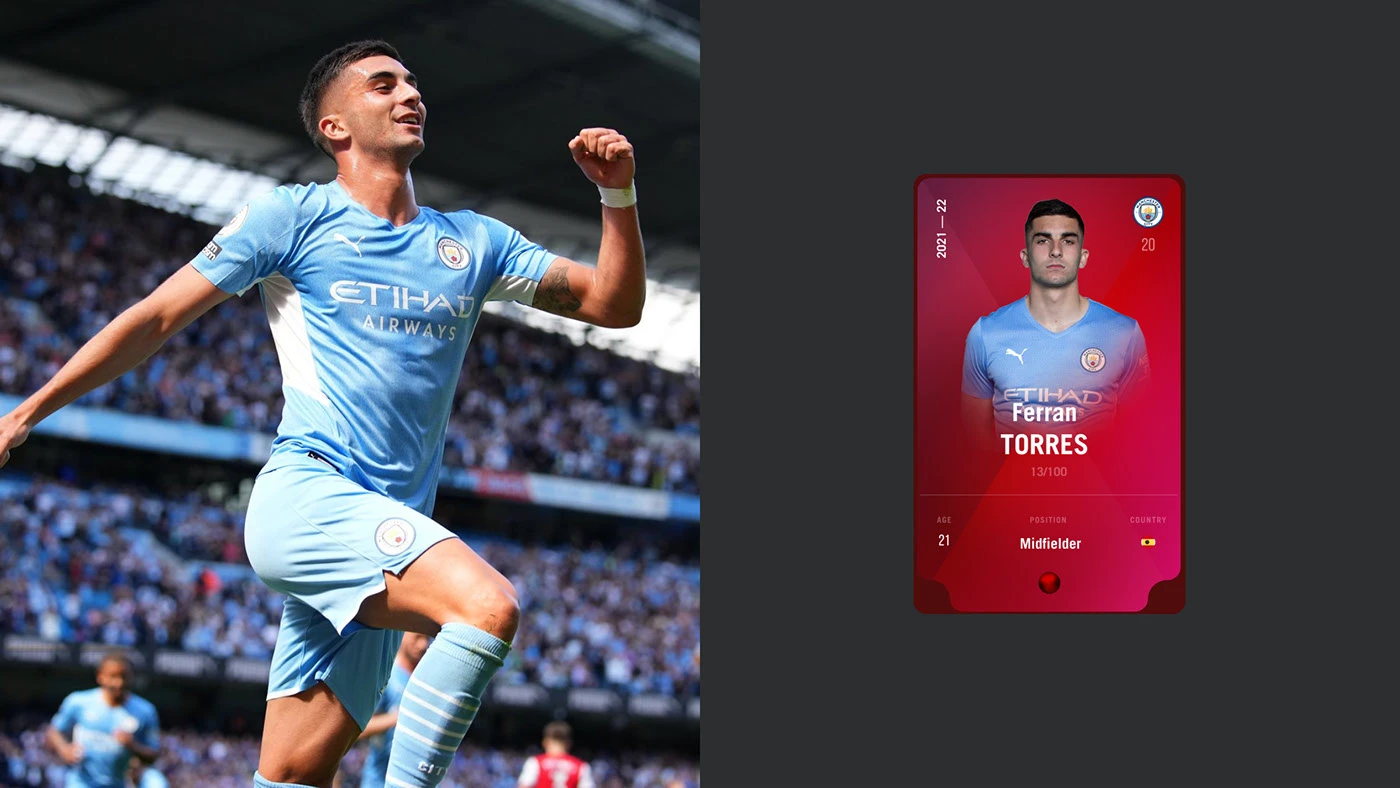

This tokenization extends far beyond collectibles. On platforms such as Sorare, NFTs representing real athletes are actively traded based on actual performance stats. TradeStars goes a step further by offering fractional NFTs tied directly to player metrics, users can own a percentage of an athlete’s season-long output. These innovations create blockchain athlete markets, where speculation meets fandom in a regulated environment.

The Mechanics of Tokenized Athlete Performance Markets

The core innovation behind these platforms is the ability to tokenize both athletes and rewards:

[list: The top features that set tokenized fantasy sports apart from traditional leagues]

NFTs or tokens represent player rights or performance shares. As games unfold in the real world, smart contracts automatically update token values based on official statistics, goals scored, assists made, yards gained. This creates a dynamic marketplace where prices fluctuate in real time according to player form and fan sentiment.

Tokenized rewards further enhance engagement: instead of generic prizes or bragging rights, participants earn crypto payouts or rare digital collectibles directly linked to their knowledge and success within the league. The result is a more transparent, liquid market for sports performance prediction, one that blurs the line between investing and playing.

Navigating Regulation and Security in Crypto Fantasy Leagues

The rapid growth of these markets has caught regulatory attention. In July 2024, a U. S. District Judge ruled that DraftKings’ digital trading cards qualified as securities (source). This landmark decision underscores the importance of compliance for any platform launching blockchain athlete markets or crypto fantasy leagues.

For users and builders alike, security remains paramount. Leading platforms leverage audited smart contracts and robust KYC protocols while maintaining low fees and fast settlements via decentralized infrastructure. As adoption accelerates, driven by both technological maturity and surging user interest, expect further clarity around legal frameworks governing tokenized fantasy sports.

As the landscape continues to evolve, the convergence of sports fandom and blockchain innovation is generating unprecedented opportunities for both fans and investors. The ability to own a stake in an athlete’s performance, whether through a full NFT or fractional shares, creates a new dynamic where sports knowledge can be directly monetized. This is not just about digital collectibles; it’s about building liquid, tradable markets around real-world outcomes.

Platforms are increasingly focused on community-driven governance, with some leagues allowing token holders to vote on rule changes or platform upgrades. This participatory model fosters deeper engagement and aligns incentives between users and developers. At the same time, platforms like Football. fun have demonstrated that robust liquidity is possible, with recent surges in total value locked (TVL) reflecting growing trust in crypto fantasy leagues as an asset class.

What Sets Tokenized Fantasy Sports Platforms Apart?

Top Advantages of Blockchain-Powered Sports Prediction Markets

-

Transparent and Trustless Gameplay: Blockchain ensures all transactions and scoring are recorded on an immutable ledger, reducing fraud and increasing confidence for crypto-savvy players. TradeStars exemplifies this with on-chain tracking of fractional athlete NFTs.

-

Tokenized Rewards and Real-World Value: Crypto enthusiasts can earn tokenized rewards that hold real value, as seen with platforms like Football.fun and SportyCo, where platform tokens can be traded or used across DeFi ecosystems.

-

Fractional Investment in Athlete Performance: Platforms such as TradeStars enable users to invest in fractions of athlete performance tokens, democratizing access and allowing for diversified strategies based on real-time stats.

-

Enhanced Fan Engagement and New Revenue Streams: Blockchain-powered platforms like Globaltalent.com and Sorare offer innovative ways for fans to engage with their favorite athletes and teams, while also opening up new monetization opportunities through digital collectibles and token economies.

Beyond speculation, these systems introduce innovative funding models for athletes and clubs themselves. Through tokenization, up-and-coming players can raise capital by issuing performance-linked tokens to fans, a model already explored by platforms such as SportyCo and Globaltalent. com. This democratizes access to investment in sports talent while offering clubs new revenue streams outside traditional sponsorships.

For those eager to participate, the entry barriers are dropping rapidly. User-friendly wallets, seamless onboarding flows, and transparent smart contract logic make it easier than ever for newcomers to join crypto fantasy leagues or prediction markets without deep technical expertise.

Risks and Responsible Participation

While the potential rewards are significant, it’s essential for participants to recognize the risks inherent in speculative markets. Prices for athlete tokens can be highly volatile, driven by injuries, transfers, or sudden changes in form, and regulatory frameworks may continue to shift as authorities adapt to new models. Always do your due diligence before investing significant sums into any blockchain athlete market.

Looking ahead, expect further integration between prediction markets and tokenized fantasy sports platforms. As macroeconomic trends shape both the crypto sector and global sporting events, savvy participants will find themselves at the intersection of entertainment, investment opportunity, and technological progress.