Election Betting with Crypto: The Rise of Decentralized Prediction Markets

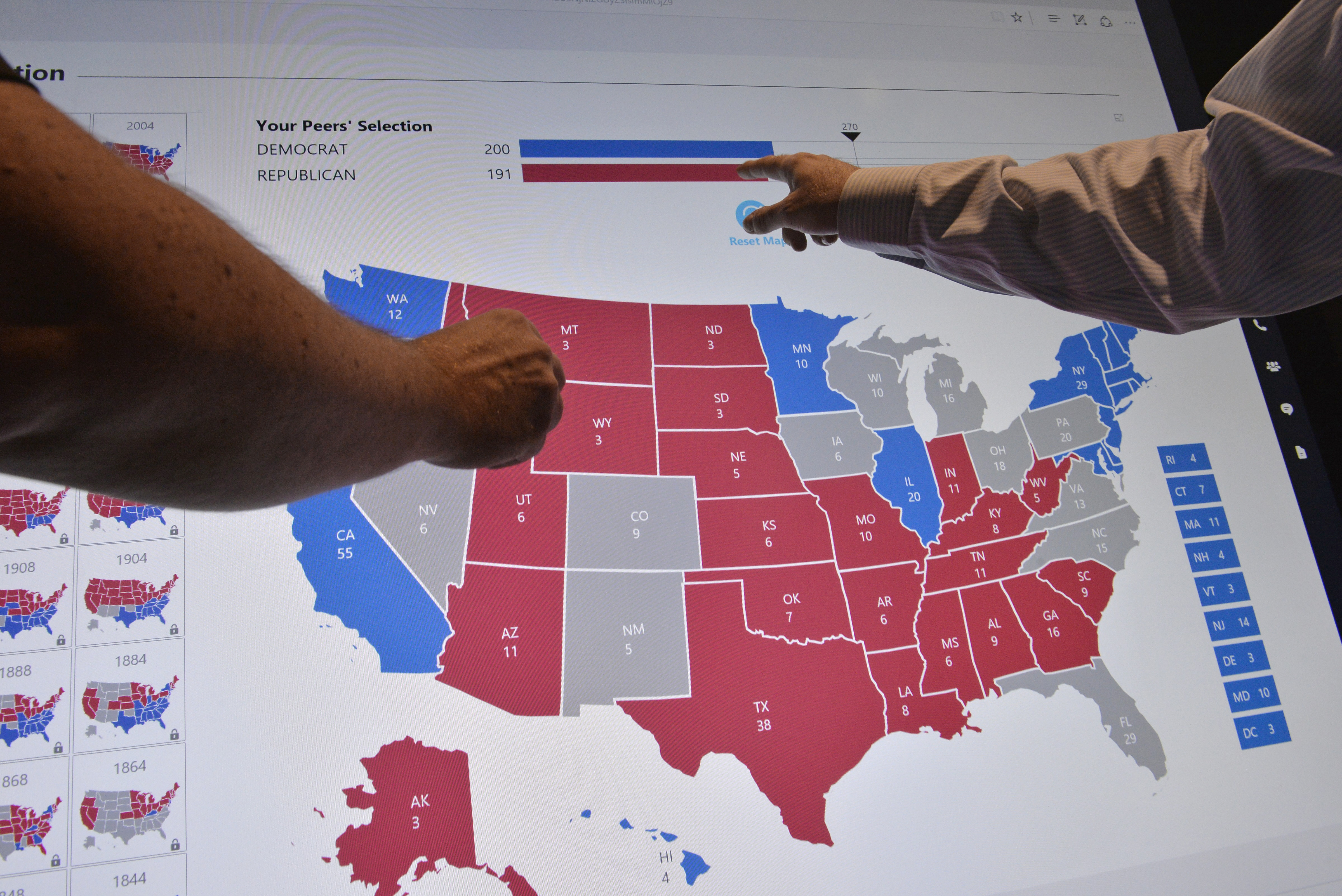

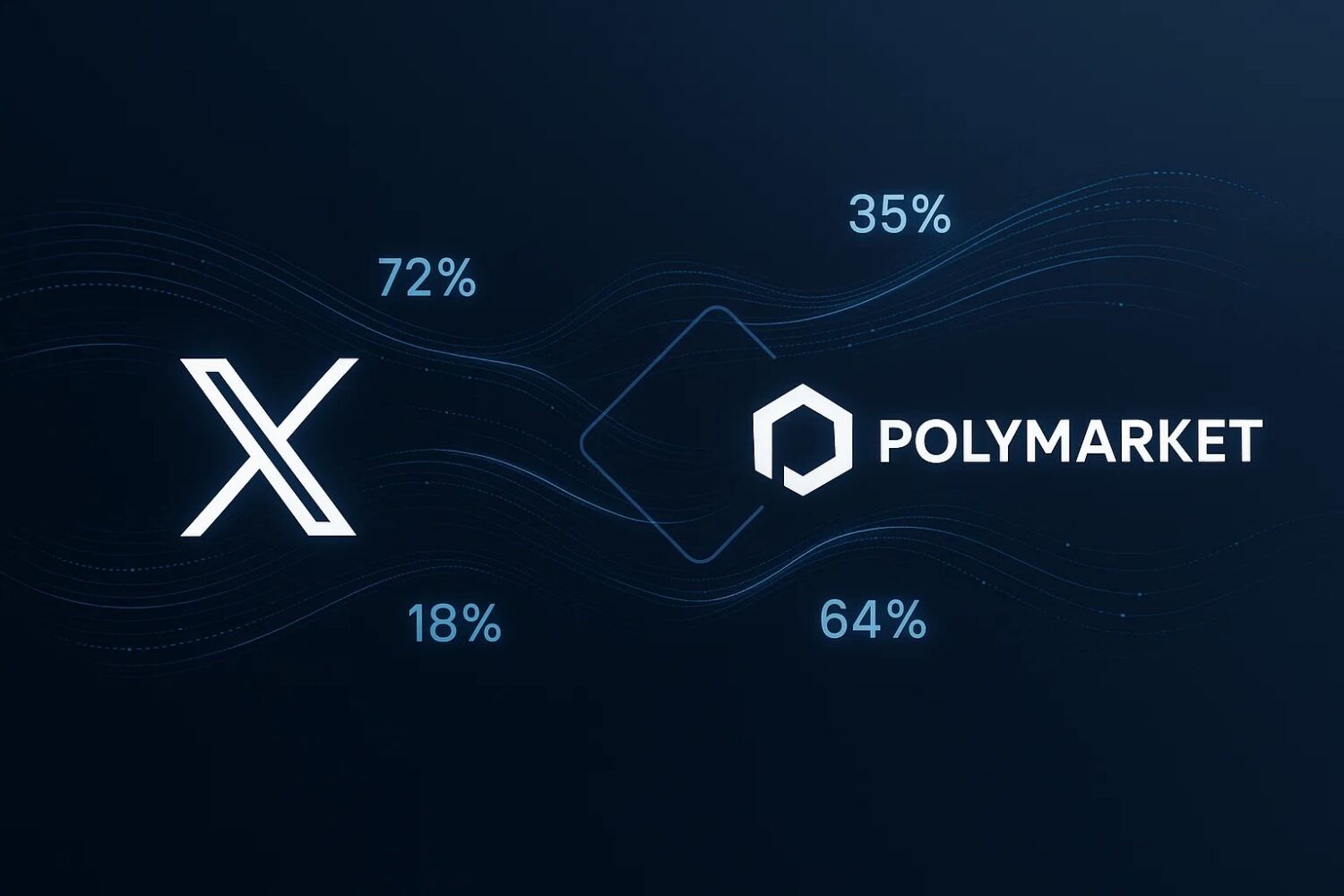

Election betting has entered a new era. The rise of decentralized prediction markets, powered by blockchain, is transforming how individuals speculate on political outcomes, offering transparency and accessibility that traditional bookmakers and pollsters can’t match. As we approach pivotal global elections, platforms like Polymarket and Kalshi are not just attracting crypto enthusiasts, they’re drawing the attention of mainstream traders, venture capitalists, and regulators alike.

Polymarket’s $3.2 Billion Surge: A New Standard for Crypto Election Betting

Polymarket’s explosive growth has become the headline story in crypto election betting. In October 2024 alone, Polymarket reported a record-breaking $2.5 billion in trading volume. By early November, that figure had soared to $3.2 billion as political speculation intensified ahead of the U. S. presidential election (Forbes). This represents an astonishing 47-fold increase since the 2020 cycle, with monthly active traders ballooning from just 2,000 to over 214,000, a clear indicator of surging demand for decentralized election prediction markets.

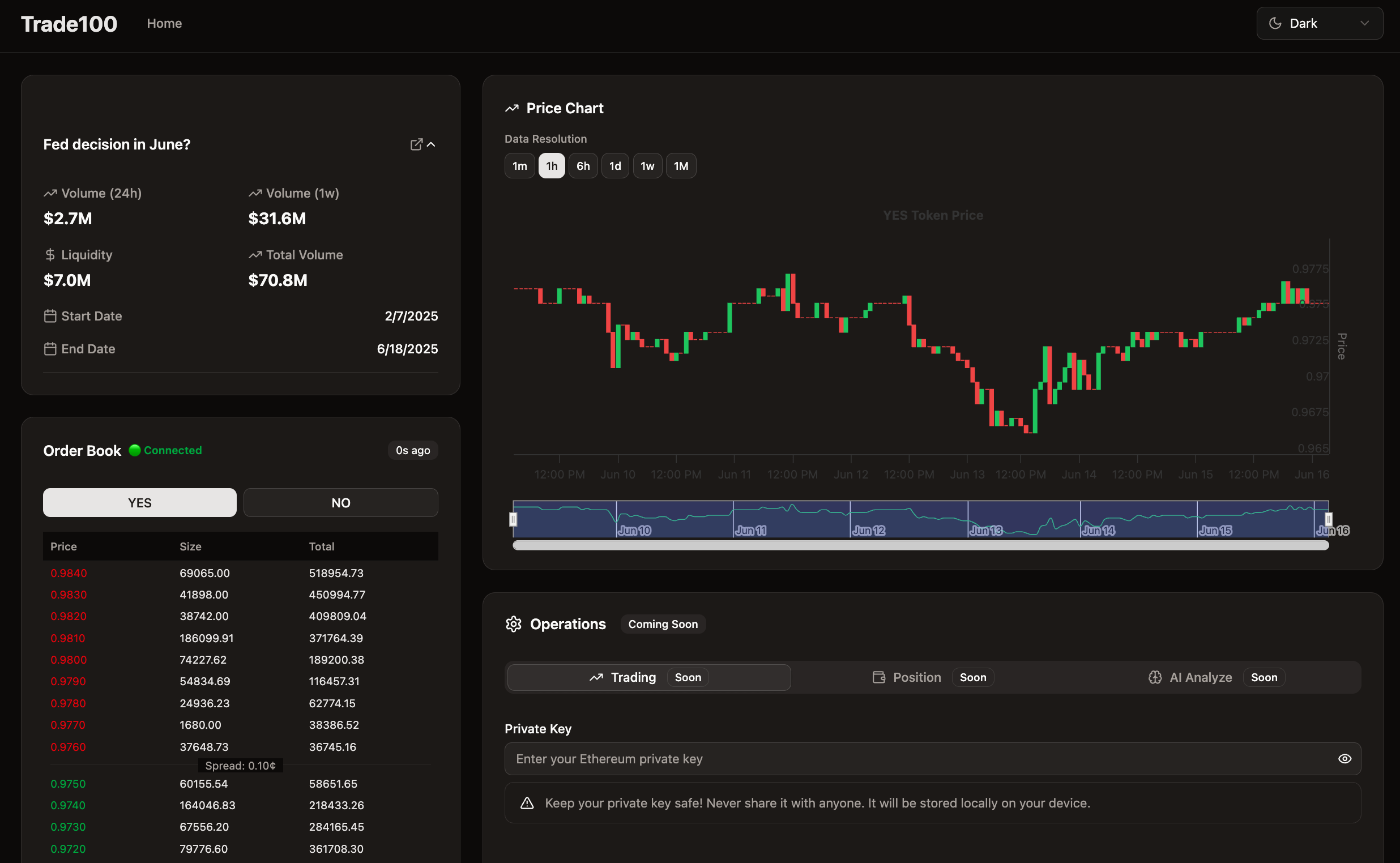

What sets Polymarket apart? The platform leverages Ethereum and Polygon blockchains to facilitate self-custodial betting, users retain control over their funds at all times. Smart contracts automate settlements and ensure every transaction is recorded transparently on-chain (Decrypt). This structure appeals not only to seasoned crypto traders but also to political analysts seeking data-driven insights into public sentiment.

Regulatory Milestones: Kalshi and Polymarket Secure US Access

The rapid ascent of decentralized prediction markets has not gone unnoticed by regulators. Kalshi made headlines when it secured provisional approval from the U. S. Court of Appeals in October 2024 to offer markets on congressional control, an important milestone after a lengthy dispute with the CFTC (Axios). By June 2025, Kalshi had raised $185 million in fresh funding at a $2 billion valuation (Reuters), cementing its position as a regulated gateway for event-based trading.

Meanwhile, Polymarket achieved its own regulatory breakthrough in September 2025 after acquiring QCEX, a CFTC-licensed derivatives exchange, enabling it to relaunch compliant operations in the United States (Reuters). These developments signal growing acceptance of blockchain election markets, even as oversight remains tight and concerns persist around market manipulation or foreign interference.

Key Advantages of Decentralized Prediction Markets

-

Transparency and Trust: Platforms like Polymarket operate on public blockchains (Ethereum and Polygon), utilizing smart contracts to automate settlements and provide auditable records, ensuring that all bets and outcomes are visible and tamper-resistant.

-

Enhanced Accessibility: Decentralized markets allow users worldwide to participate in election betting using self-custodial crypto wallets, bypassing traditional banking restrictions and enabling 24/7 access without geographic limitations.

-

Rapid Growth and Liquidity: The surge in trading volume—Polymarket processed approximately $3.2 billion in crypto bets during the 2024 U.S. election—demonstrates increased liquidity, making it easier for users to enter and exit positions at fair market prices.

-

Regulatory Progress: Platforms such as Kalshi and Polymarket have made significant regulatory strides, with Kalshi provisionally cleared to offer Congressional control markets and Polymarket receiving CFTC approval to relaunch in the U.S., enhancing legitimacy and user protection.

-

Accurate Market Forecasting: Studies, including those by the University of Cincinnati, have shown that prediction markets can outperform traditional polls in forecasting election outcomes, leveraging the collective wisdom and incentives of informed participants.

The Accuracy Debate: Prediction Markets vs Polls and Pundits

Academic research is increasingly validating what crypto insiders have long suspected: election prediction markets often outperform traditional polls. A University of Cincinnati study found that decentralized platforms were more accurate than both polling averages and expert forecasts during the 2024 presidential race. This efficiency stems from their ability to aggregate diverse information sources, including real-time news events and grassroots sentiment, into actionable prices.

However, critics highlight potential pitfalls such as low liquidity in certain contracts or susceptibility to coordinated manipulation if governance standards slip (Time). Regulatory scrutiny remains high as authorities weigh whether these new tools truly democratize forecasting, or simply introduce novel risks into highly charged political environments.

The debate over the reliability of decentralized election prediction markets is far from settled. While advocates point to their track record of accuracy and transparency, skeptics caution that these platforms are still evolving, with market depth and regulatory frameworks playing a critical role in determining their long-term credibility. The surge in trading volume, Polymarket’s $3.2 billion milestone during the 2024 U. S. presidential election, demonstrates both the appetite for crypto election betting and the need for robust oversight.

Importantly, the self-custodial nature of platforms like Polymarket means users hold their own keys and funds, reducing counterparty risk compared to centralized bookmakers. Automated smart contracts further eliminate settlement delays and ensure outcomes are based on verifiable public data. These features are not just technical upgrades; they represent a philosophical shift toward greater user empowerment in political forecasting.

Investor Momentum: Venture Capital and Mainstream Adoption

The influx of venture capital into this sector underscores its mainstream potential. Kalshi’s $185 million raise at a $2 billion valuation is just one example of how institutional investors are betting on event-based trading as a new asset class (Reuters). Meanwhile, Polymarket’s regulatory green light to re-enter the U. S. market after acquiring QCEX has set a precedent for how decentralized platforms can navigate compliance without sacrificing core blockchain principles (Reuters).

This momentum is also visible in user demographics: once dominated by crypto-native traders, prediction markets now attract political analysts, journalists, and traditional investors seeking alternative data sources to supplement polling and punditry.

Risks, Governance and Future Trajectory

No innovation comes without risks. Liquidity remains uneven across smaller or less-publicized contracts, making some markets vulnerable to outsized influence by deep-pocketed players or coordinated groups. Governance models, how disputes are resolved, how rules evolve, are still being tested in real time. As Time points out, vigilance around manipulation and foreign interference will be crucial as these platforms scale globally.

Despite these challenges, decentralized prediction markets continue to push boundaries in transparency and user participation. The regulatory advances by Polymarket and Kalshi show that collaboration between innovators and authorities is possible, and perhaps necessary, for long-term legitimacy.

The Bottom Line for Crypto Election Bettors

The rise of decentralized election betting isn’t just a passing trend, it’s reshaping how society gauges political probabilities in real time. Whether you’re an investor seeking alternative alpha or a voter looking for unbiased sentiment signals, blockchain-powered prediction markets offer unique advantages over legacy systems.

As the landscape matures, with billions traded ($3.2 billion on Polymarket alone), increasing regulatory clarity, and growing academic validation, the role of election prediction markets will only become more central to both financial speculation and democratic discourse.

Essential Tips for Safe Decentralized Election Betting

-

Use Reputable Platforms Like Polymarket and KalshiStick to established, well-regulated prediction markets such as Polymarket and Kalshi. Both platforms have achieved major regulatory milestones in 2024-2025, with Polymarket receiving CFTC approval and Kalshi securing provisional clearance for election contracts.

-

Secure Your Crypto WalletsAlways use self-custodial wallets and enable two-factor authentication. Decentralized platforms like Polymarket require users to control their private keys, which enhances fund security but also means you are solely responsible for safeguarding access.

-

Understand Regulatory Status and RestrictionsCheck the legal status of election betting in your jurisdiction. For example, Polymarket recently received CFTC approval to operate in the US, but regulations may vary by state or country. Kalshi’s offerings are also subject to ongoing regulatory review.

-

Verify Smart Contract TransparencyEnsure the platform operates on reputable blockchains like Ethereum or Polygon, and that their smart contracts are publicly auditable. This transparency is key to fair bet settlement and reduces the risk of manipulation.

-

Be Aware of Market Manipulation RisksWhile prediction markets aggregate public knowledge, they are not immune to manipulation, especially with low trading volumes or coordinated activity. Analyze market depth and trade volume—Polymarket, for example, reported $3.2 billion in bets for the 2024 US election, indicating high liquidity.

-

Protect Your Privacy and Personal DataDecentralized platforms typically require minimal personal information, but always review privacy policies and avoid oversharing. Use privacy-focused browsers and consider VPNs when accessing platforms.

-

Stay Informed About Platform Updates and SecurityFollow official announcements from platforms like Polymarket and Kalshi for news on upgrades, regulatory changes, or potential vulnerabilities. Staying updated helps you react quickly to emerging risks.