Conditional Prediction Markets: Linking Sports, Elections, and Crypto Outcomes

Conditional prediction markets are rapidly transforming the landscape of event forecasting, allowing participants to bet on outcomes that are interlinked across sports, elections, and crypto markets. Unlike traditional single-event betting, these blockchain-powered platforms enable nuanced speculation on how one event’s result might impact another, creating a sophisticated ecosystem for both traders and enthusiasts.

How Conditional Prediction Markets Work

At their core, conditional prediction markets allow users to place bets on outcomes that depend on specific scenarios. For example, rather than simply wagering on who will win an election or a sports match independently, users can create or join markets like: “Will Party X win the presidential election if Team Y wins the World Cup?” or “Will Bitcoin break $100,000 if Candidate Z secures victory?” This approach unlocks a new dimension of market intelligence and price discovery by aggregating crowd insights across multiple domains.

The technical backbone for these markets often involves frameworks like the Gnosis Conditional Token Framework, which tokenizes potential outcomes and ensures transparent settlement via smart contracts. Platforms such as Polymarket and Omen have popularized this model at scale by making it easy for users to trade event-linked tokens with real-time pricing. PlotX has also emerged as a leader in cross-chain prediction protocols, offering hourly to weekly timeframes for crypto-asset price predictions.

The Rise of Multi-Event Betting in Crypto

The intersection of sports, politics, and cryptocurrency is no longer theoretical. Recent developments highlight how conditional prediction markets are being used to forecast complex real-world scenarios:

Top Conditional Prediction Markets Linking Sports, Elections, and Crypto

-

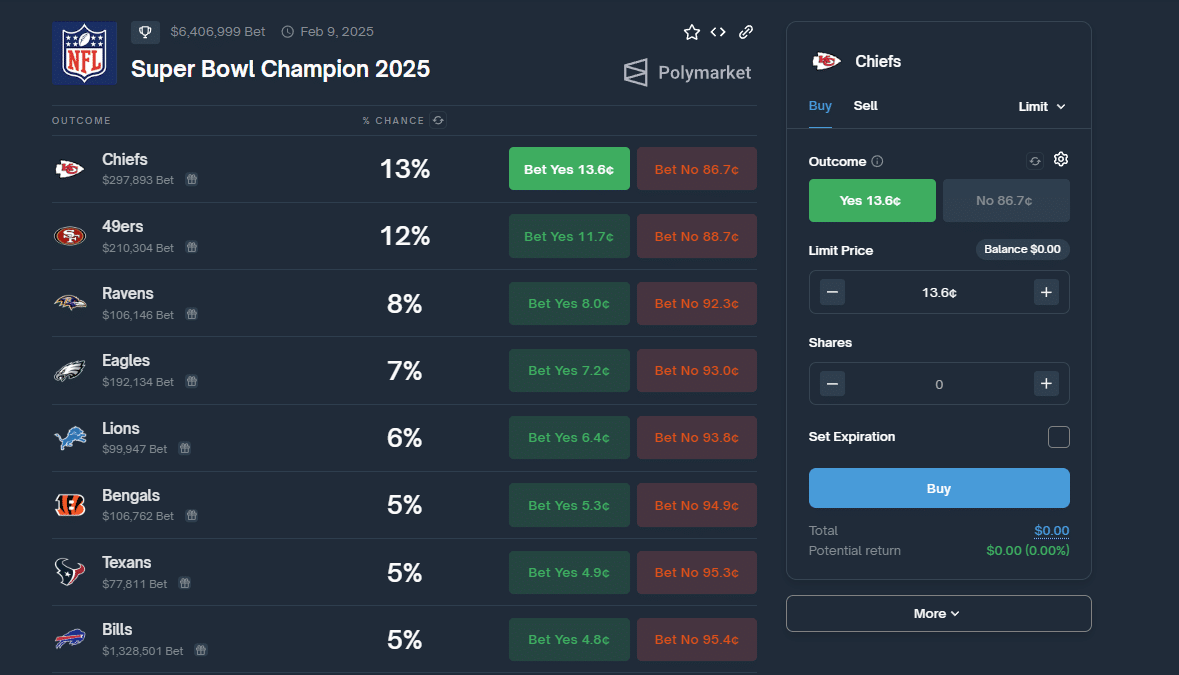

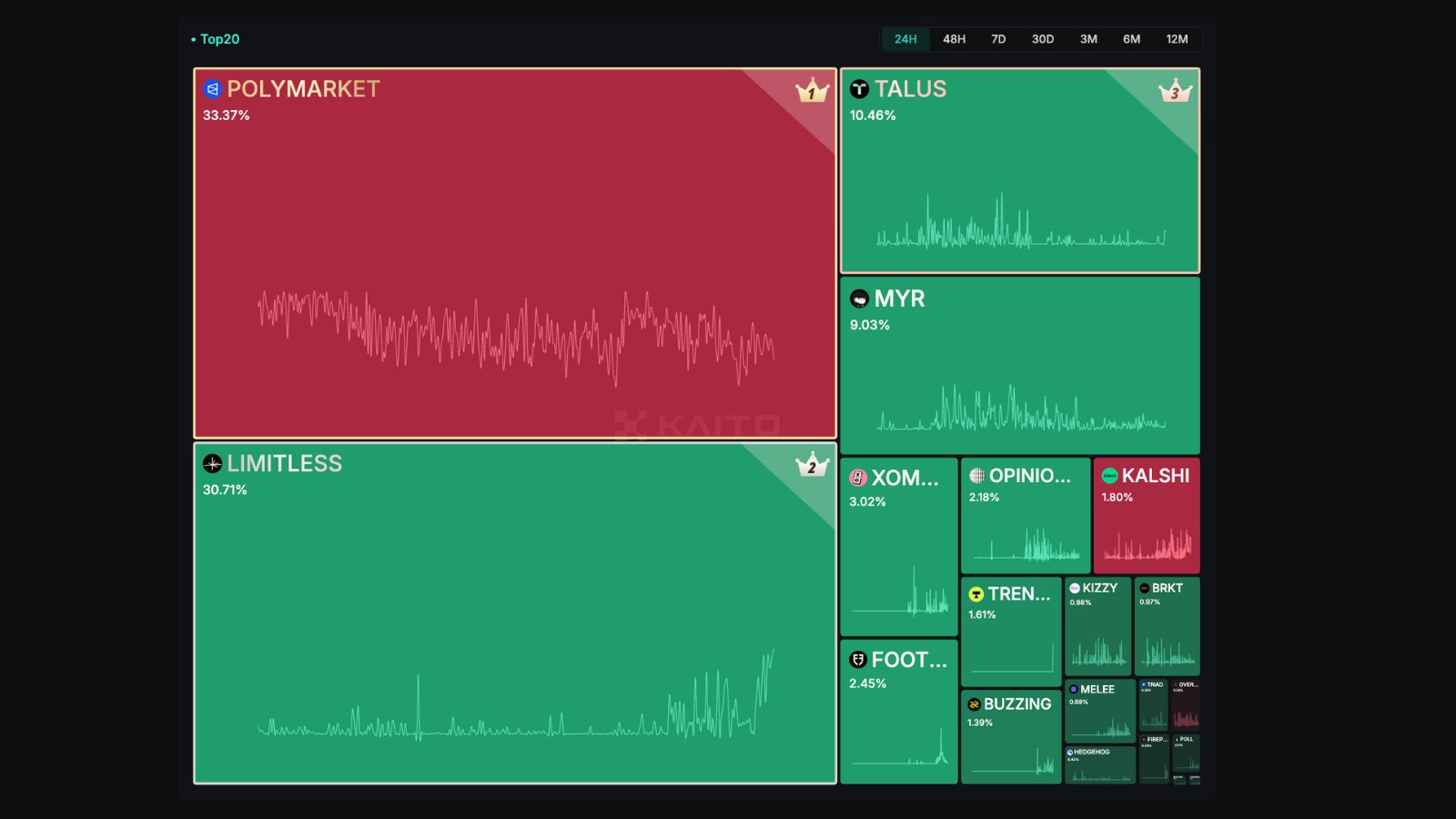

Polymarket: Polymarket is a leading crypto-based prediction market platform that enables users to create and trade on conditional markets, such as forecasting Bitcoin’s price trajectory if a particular U.S. presidential candidate wins the 2024 election. Following its September 2025 CFTC approval, Polymarket now operates legally in the U.S., expanding access to conditional markets that interlink sports results, election outcomes, and cryptocurrency prices.

-

Kalshi: Kalshi is a CFTC-regulated event contract exchange that allows users to trade on a wide range of outcomes, including political and sports events. Kalshi’s platform supports conditional markets, such as predicting the outcome of an election based on the performance of a national sports team, or forecasting cryptocurrency price movements contingent on specific legislative results.

-

Robinhood Prediction Markets (via Kalshi): In March 2025, Robinhood integrated a prediction markets hub powered by Kalshi, enabling users to access regulated contracts on sports, elections, and financial policy outcomes. This integration facilitates conditional predictions, such as the impact of a major sports event on subsequent election results or crypto market reactions.

-

Gnosis Conditional Token Framework: Gnosis offers a conditional token framework that allows for the creation of tokens tied to specific outcomes, making it possible to structure markets where payouts depend on both sports and election results or crypto price triggers. This framework has been adopted by decentralized platforms to build complex, multi-event prediction markets.

-

Omen: Omen is a decentralized prediction market platform built on the Gnosis protocol, supporting conditional markets that link sports, political, and cryptocurrency outcomes. Users can participate in markets such as predicting Ethereum’s price movement if a specific team wins the Super Bowl, leveraging Omen’s open and transparent infrastructure.

This multi-event approach is particularly appealing to seasoned bettors who understand that global events rarely occur in isolation. For instance:

- Sports and Elections: Predicting whether a national team’s championship win could boost voter optimism and sway an upcoming election.

- Elections and Crypto: Speculating on whether a pro-crypto candidate’s victory will trigger a rally in digital asset prices.

- Sports and Crypto: Betting on whether Ethereum’s price will jump if a major league underdog secures an upset victory.

This interdependency is not just theoretical; it’s being actively traded on platforms like Polymarket, now operating under full CFTC compliance after acquiring QCEX (Reuters). Meanwhile, Kalshi’s regulated exchange has become integral to Robinhood’s new prediction market hub (Axios), further cementing mainstream acceptance of these innovative tools.

Navigating Challenges: Regulation and Liquidity

The promise of blockchain conditional markets comes with unique hurdles. Regulatory uncertainty remains front-and-center, Polymarket’s journey from regulatory shutdown to CFTC approval underscores the importance of compliance in building sustainable platforms. Without clear legal frameworks, even the most advanced protocols face existential risks.

Market liquidity is another critical factor. For prices to reflect true probabilities in linked outcome betting, there must be enough active participation across all conditional branches. This requires robust user bases and incentive structures, a challenge that decentralized finance (DeFi) innovators are tackling through tokenomics and liquidity mining incentives.

Equally important is the complexity of modeling event interdependencies. Conditional prediction markets must accurately encode the relationship between triggers and outcomes, such as how a sports upset might ripple through voter sentiment or crypto volatility. Platforms leveraging frameworks like Gnosis Conditional Tokens are making strides, but analytical rigor and transparent methodologies remain essential for user trust and effective price discovery.

Transparency is a key selling point for blockchain conditional markets. Every trade, outcome, and payout is recorded on-chain, enabling participants to audit market integrity in real time. This openness stands in stark contrast to legacy bookmakers, where odds-setting can be opaque and settlement processes slow or disputed.

Emerging Use Cases and Future Potential

Conditional prediction markets are already influencing capital allocation and governance decisions within decentralized organizations. For example, Butter’s Conditional Funding Markets aim to let Uniswap Governance allocate resources based on the outcome of community-driven prediction markets, directly tying funding to verifiable event results (Mirror.xyz). This approach could soon extend into mainstream finance, imagine ETFs that rebalance based on conditional predictions about elections or macroeconomic shifts.

- Decentralized Sportsbooks: Blockchain-based platforms allow users to create custom multi-event bets with settlement guarantees.

- Crypto-Election Hedging: Traders hedge exposure by betting on crypto prices contingent on election results.

- Governance-Linked Funding: DAOs use conditional markets to trigger funding only if certain milestones or events are achieved.

The growing regulatory clarity around platforms like Polymarket (Reuters) signals a maturing market with increasing institutional interest. As more traditional exchanges integrate conditional contracts, Robinhood’s partnership with Kalshi being a prime example (Axios): expect liquidity, product diversity, and mainstream adoption to accelerate rapidly.

Best Practices for Traders Entering Multi-Event Betting Crypto Markets

Best Practices Checklist for Blockchain Conditional Markets

-

Verify Regulatory Compliance: Always ensure the platform (e.g., Kalshi, Polymarket) is legally authorized to operate in your jurisdiction. Regulatory status can change; recent approvals (like Polymarket’s CFTC license in 2025) are crucial for U.S. users.

-

Understand Market Mechanics: Study how conditional prediction markets function, including the use of conditional tokens (as with the Gnosis Conditional Token Framework). Know how outcomes, event dependencies, and payouts are structured.

-

Assess Market Liquidity: Choose platforms with active participation and deep liquidity (e.g., Polymarket, PlotX) to ensure efficient pricing and the ability to enter or exit positions easily.

-

Evaluate Event Interdependencies: Carefully review how markets link outcomes across sports, elections, and crypto. Analyze how one event’s result may impact another, and use available analytical tools to model these relationships.

-

Secure Your Assets: Use reputable wallets and enable two-factor authentication when interacting with blockchain-based markets. Double-check contract addresses and avoid phishing links, especially when trading on decentralized platforms.

-

Stay Informed on Platform Updates: Monitor official announcements from platforms like Kalshi, Polymarket, and Robinhood for changes in market offerings, regulatory status, or technical upgrades.

-

Review Fee Structures: Understand trading, settlement, and withdrawal fees on each platform. Compare costs on established markets (e.g., Kalshi, Polymarket, PlotX) before making significant trades.

-

Practice Responsible Risk Management: Only commit funds you can afford to lose. Diversify predictions across unrelated events to mitigate risk and avoid overexposure to any single outcome.

If you’re considering participating in these innovative markets, disciplined risk management is paramount. Start by understanding the underlying logic of each linked event, scrutinize platform compliance status, and monitor liquidity before committing significant capital. As always in event-driven speculation: preparation trumps prediction.