Collective Intelligence: How Prediction Markets Beat Polls in Elections

Prediction markets have quietly become a force in election forecasting, outpacing traditional polls and pundit analysis in accuracy. In the 2024 presidential election, a University of Cincinnati study found that a prediction market beat both major pollsters and expert commentators when it came to calling the outcome. This isn’t just a one-off result – it’s part of a broader trend where crypto-powered, decentralized election forecasting is proving more reliable than legacy approaches.

Why Prediction Markets Outperform Polls

The core advantage of prediction markets vs polls comes down to incentive and collective intelligence. When participants put real money on the line, they’re motivated to seek out accurate information and adjust their positions as new data emerges. Unlike poll respondents, who may answer carelessly or be influenced by question wording, market traders are financially invested in getting it right.

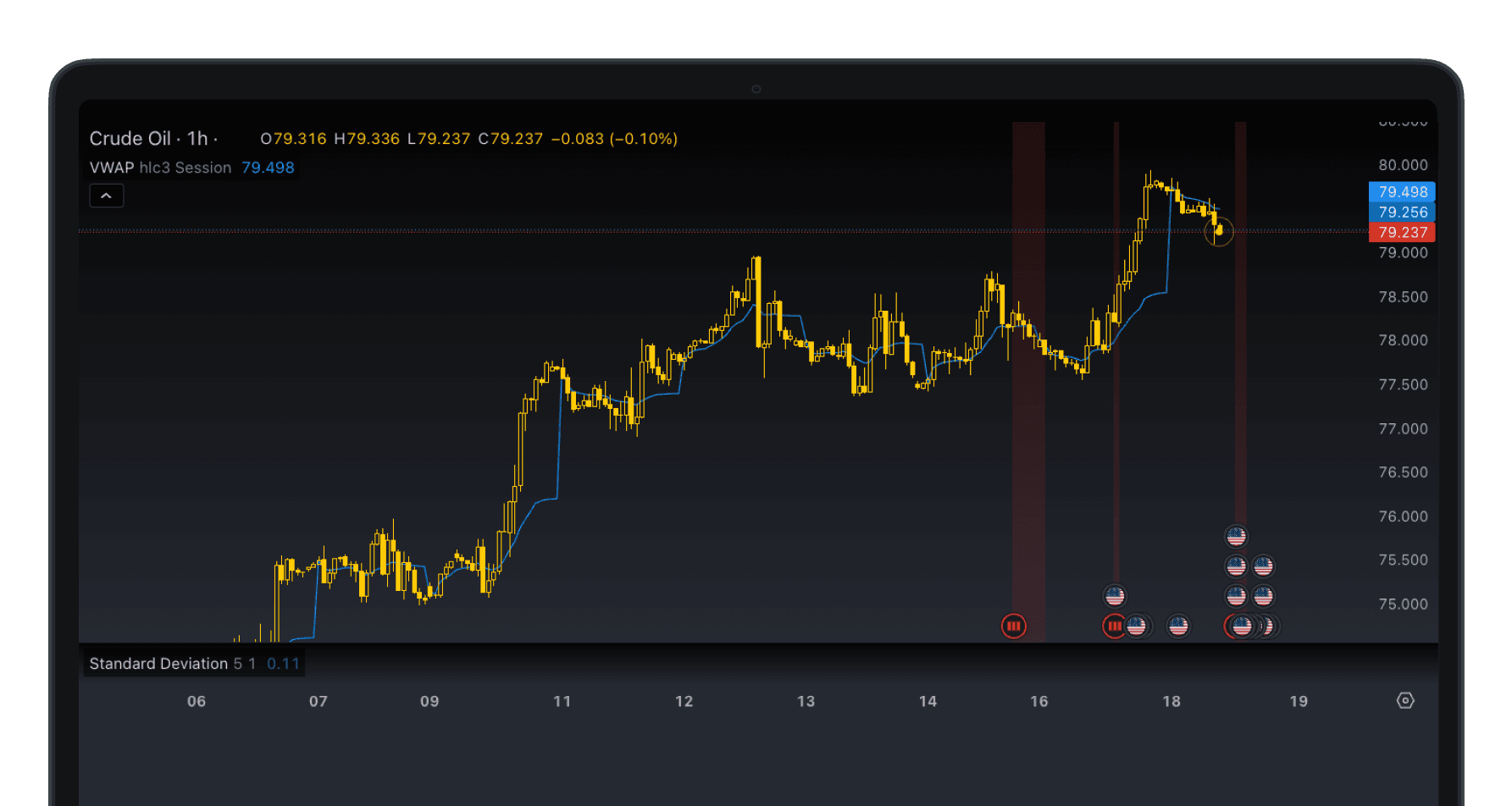

This creates a dynamic environment where prices update in real time as news breaks or narratives shift. For example, crypto-based markets like Polymarket reflected a sharp move when rumors about President Biden’s campaign future circulated – showing a 70% chance he would drop out as early as July 4 (source). Compare this with static polling snapshots that often lag behind events.

The Mechanics: Harnessing Crypto Collective Intelligence

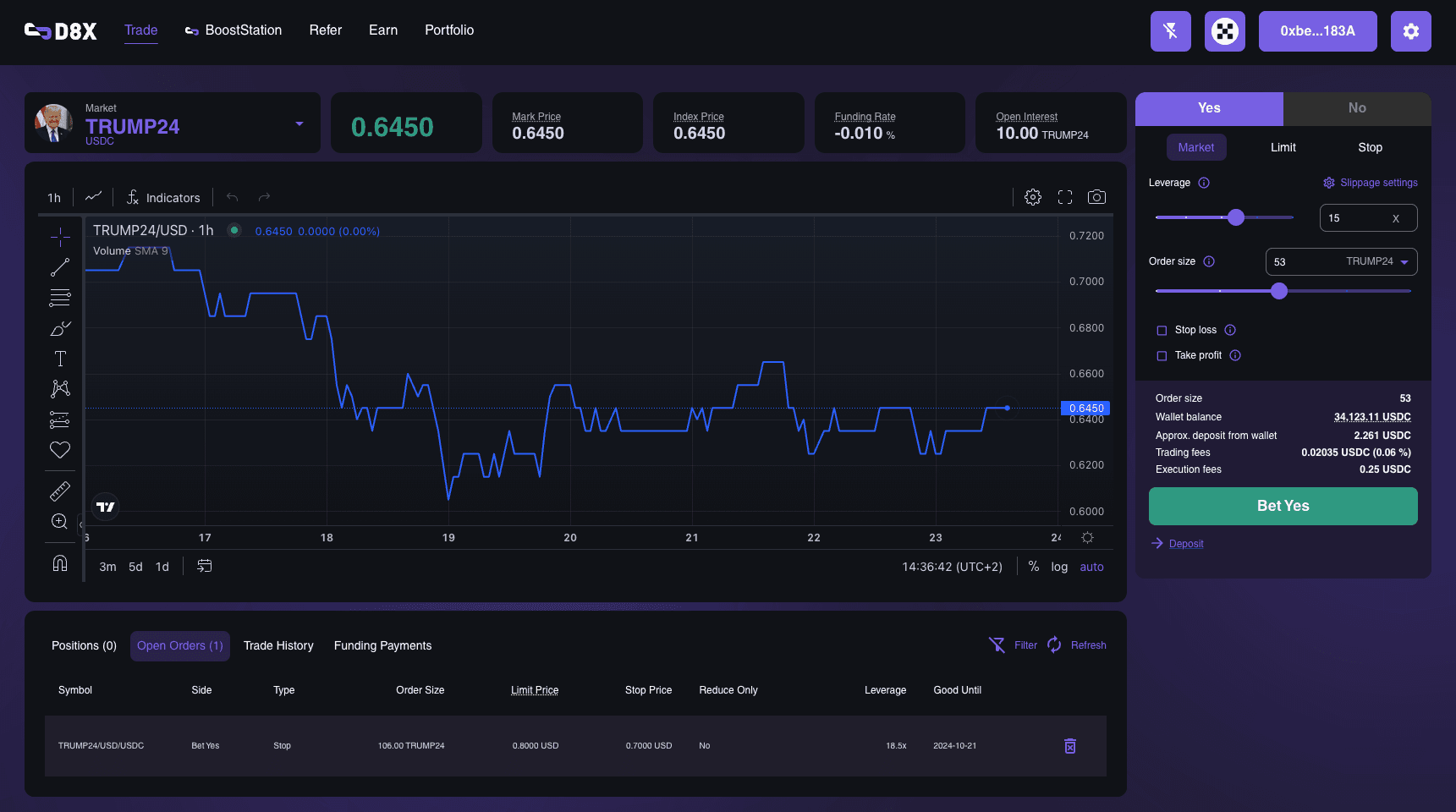

At their core, prediction markets let users buy and sell contracts based on event outcomes – for instance, “Will Trump win the presidency?” The current price reflects the crowd’s consensus probability. As more participants join and trade based on new information or sentiment, these probabilities adjust fluidly.

How Prediction Markets Aggregate Diverse Opinions

-

Financial Incentives Drive Informed Participation: Unlike traditional polls, prediction markets like Polymarket and PredictIt require participants to put real money on the line. This financial stake motivates users to seek out accurate, up-to-date information and make careful forecasts, leading to more reliable aggregated predictions.

-

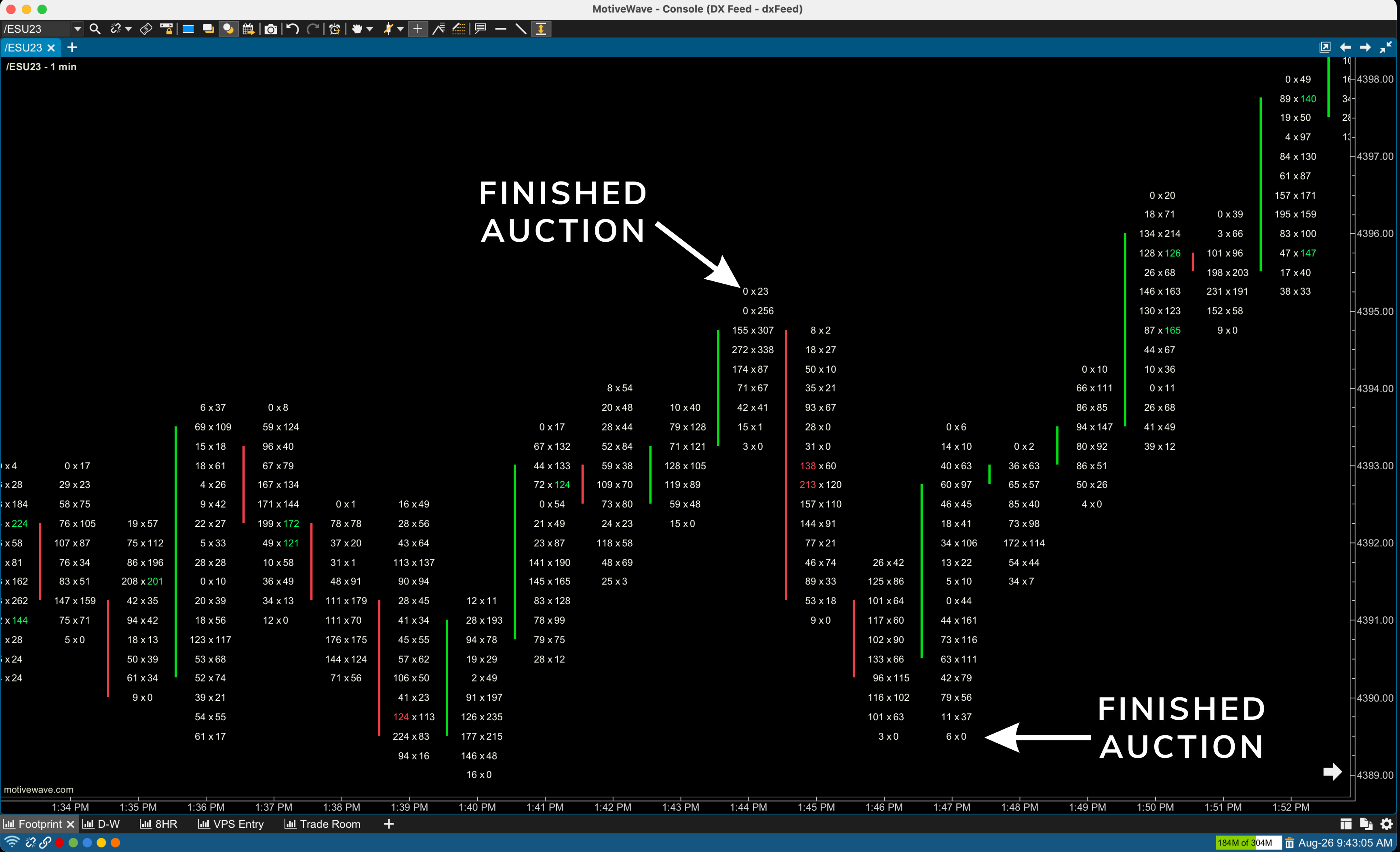

Continuous Real-Time Updates: Prediction markets are dynamic—prices adjust instantly as new information emerges. This allows markets to reflect breaking news, debates, or sudden shifts in public opinion far more quickly than traditional polling methods.

-

Diverse Crowd Participation Reduces Bias: With thousands of participants from varied backgrounds, prediction markets tap into a broad spectrum of knowledge and perspectives. This diversity helps balance out individual biases, resulting in forecasts that better represent collective intelligence.

-

Market Prices Reflect Collective Belief: The price of a contract in a prediction market directly represents the crowd’s consensus probability for an event, such as a candidate winning an election. This single, actionable number distills the wisdom of the crowd into an easily understood forecast.

-

Empirical Evidence of Superior Accuracy: Studies of major events, including the 2024 U.S. presidential election, consistently show that prediction markets outperform traditional polls in forecasting outcomes, thanks to their aggregation of diverse, incentivized opinions.

Empirical evidence backs up this theory-driven edge:

- A study of the 2008 and 2012 U. S. elections found that prediction markets consistently outperformed major polling averages (source).

- Taiwanese elections from 2006-2008 saw markets deliver forecasts that were up to 10% more accurate than opinion polls (source).

This isn’t just academic: traders and political operatives are increasingly relying on decentralized election forecasting tools to gauge momentum shifts ahead of critical votes.

Challenges: Manipulation, Regulation, and Edge Cases

No system is perfect. Thin liquidity can make smaller markets vulnerable to manipulation by well-funded actors aiming to sway perception or profit from price moves. However, as participation grows – especially with blockchain-based platforms lowering entry barriers – these risks tend to diminish due to greater diversity among traders.

Regulatory hurdles also limit access for many U. S. -based users, reducing market depth and potentially skewing results toward international sentiment (source). And while rare, edge cases do occur where markets assign unrealistic probabilities to unlikely events – an important caveat for interpreting extreme odds.

Still, the long-term trend is clear: decentralized election forecasting models are gaining traction for their ability to synthesize vast information streams into actionable probabilities. Unlike polls that can be skewed by sampling errors or low response rates, prediction markets reward accuracy and penalize noise. This self-correcting mechanism helps filter out hype and herd mentality, especially as more sophisticated traders enter the space.

For campaign strategists and political bettors alike, these platforms offer an edge. The market’s real-time pricing acts as a sentiment barometer, flagging shifts in public perception before they show up in headlines or polling averages. When a major candidate stumbles in a debate or a policy bombshell lands, you’ll often see the odds move instantly, well ahead of mainstream coverage.

Key Takeaways for Traders and Observers

Whether you’re an active trader on crypto prediction markets or just tracking election prediction accuracy for research, there are actionable lessons here:

Practical Tips for Tracking Political Momentum with Prediction Markets

-

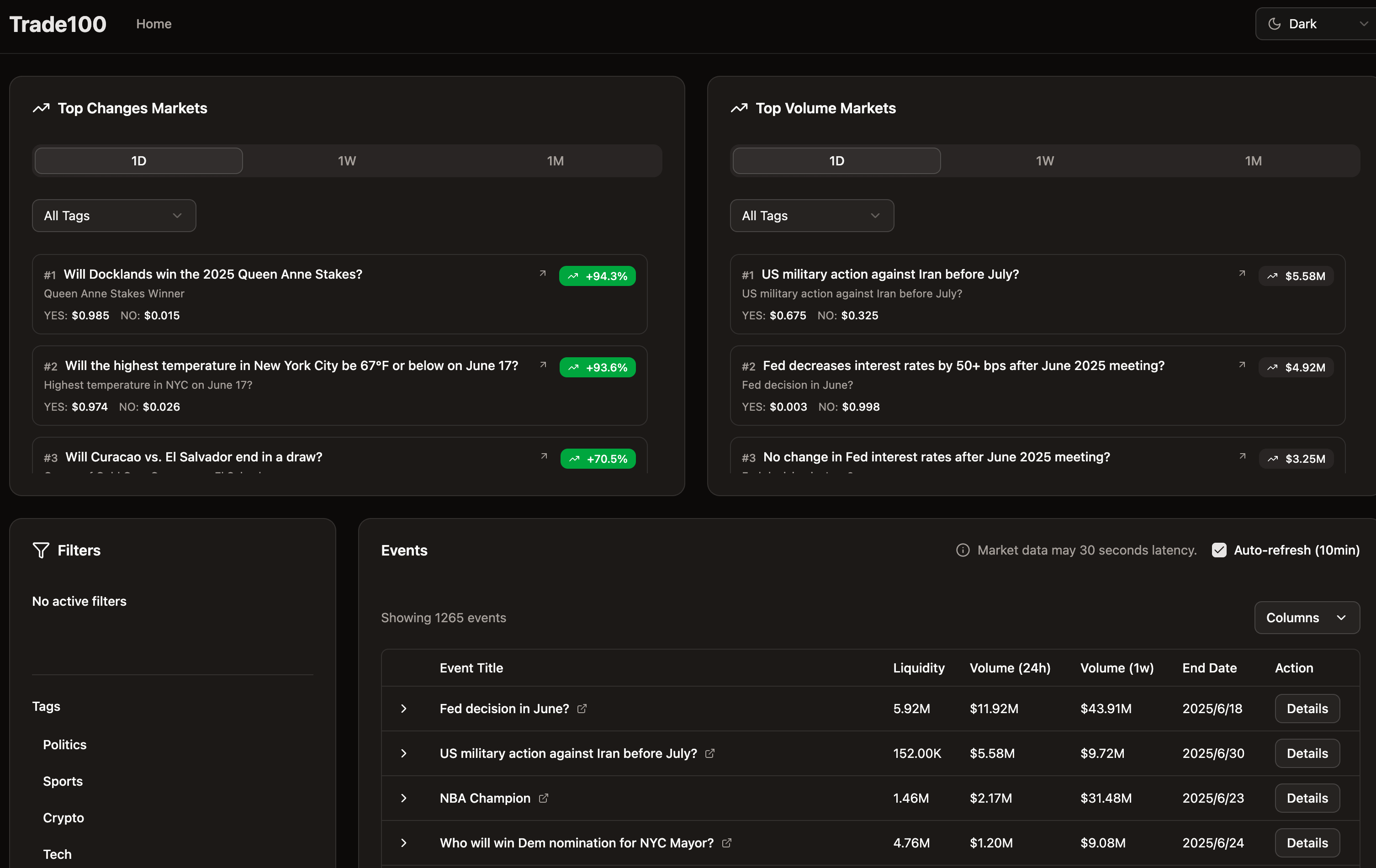

Monitor Leading Platforms Like Polymarket and PredictItTrack real-time contract prices on established prediction markets such as Polymarket and PredictIt to gauge collective sentiment shifts before they’re reflected in polls.

-

Watch for Sudden Price Swings After News EventsSignificant news—debates, scandals, or endorsements—often triggers immediate price changes in prediction markets, signaling early shifts in political momentum.

-

Compare Market Odds to Polling AveragesRegularly contrast market-implied probabilities with reputable polling averages (e.g., FiveThirtyEight, RealClearPolitics) to spot divergences that may indicate emerging trends.

-

Track Volume and Liquidity for Signal StrengthFocus on markets with higher trading volume and liquidity, as these attract more informed participants and reduce the risk of price manipulation.

-

Set Alerts for Key ContractsUse alert features on platforms like Polymarket to get notified of major price moves or volatility in contracts related to specific candidates or outcomes.

-

Be Aware of Regulatory and Participation LimitsUnderstand U.S. regulatory restrictions on platforms like PredictIt, which may affect market diversity and accuracy, and consider this context when interpreting data.

-

Interpret Edge Cases with CautionMarkets sometimes assign unrealistic probabilities to unlikely outcomes; always scrutinize extreme odds and cross-reference with credible news sources.

- Watch liquidity: Higher volume markets are less prone to manipulation and provide more reliable signals.

- Monitor price swings around news events: Sudden changes can indicate insider information or rapid shifts in voter sentiment.

- Diversify your sources: Use both market data and traditional polls for a fuller picture, especially in tightly contested races.

The bottom line? Prediction markets aren’t just another betting tool, they’re a window into the crowd’s evolving consensus, powered by financial incentives that drive participants toward truth-seeking behavior. As regulatory clarity improves and market participation deepens, expect decentralized forecasting to play an even bigger role in shaping how we understand, and bet on, elections worldwide.